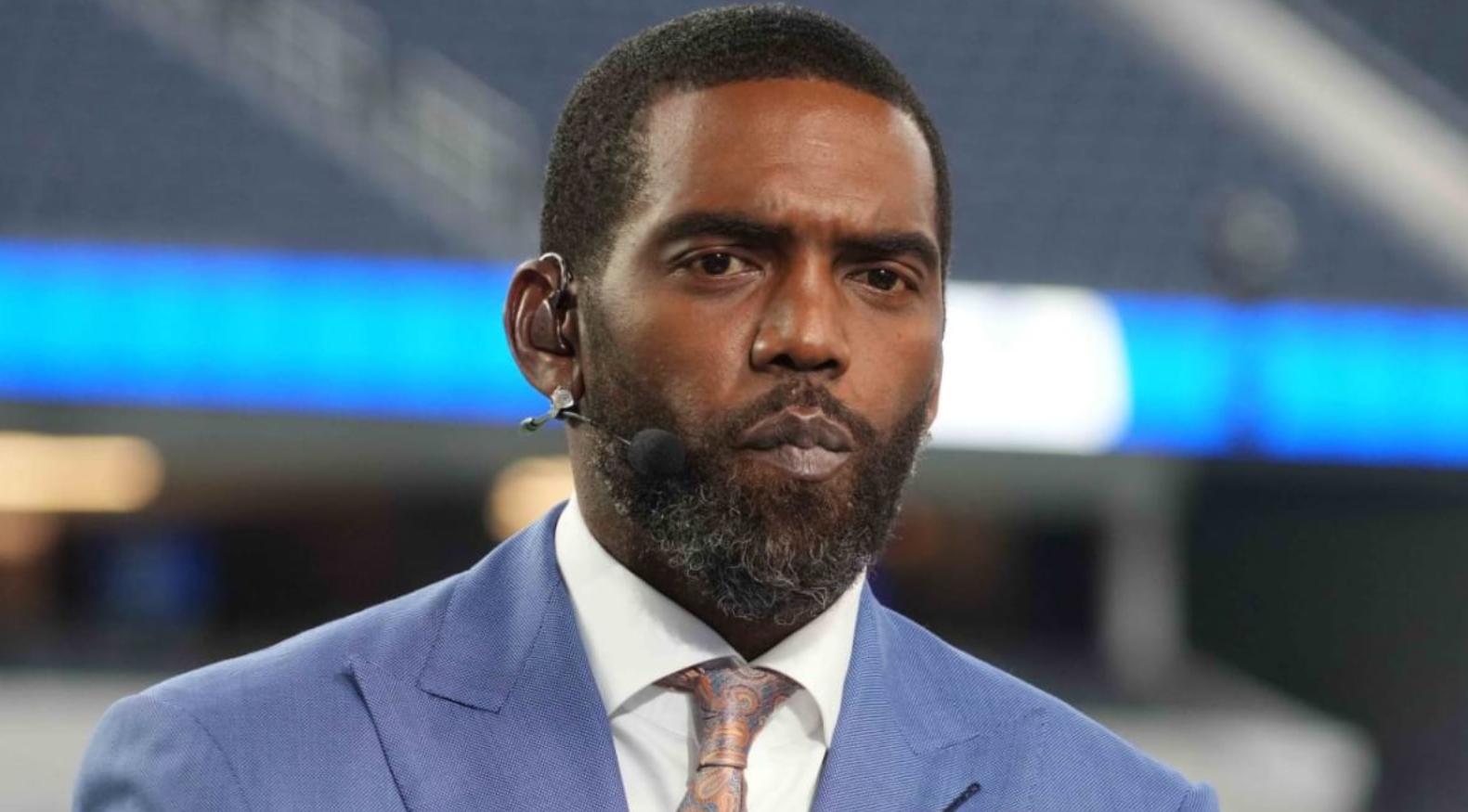

Randy Moss Net Worth 2024: Updated Figures & Insights

Estimating the financial standing of a public figure like Randy Moss in a specific year, such as 2024, requires accessing reliable financial data. A precise figure, however, is often elusive.

Determining an individual's net worth involves compiling assets (like real estate, investments, and personal possessions) and subtracting liabilities (debts). Public figures' financial data is sometimes reported in annual financial disclosures or by reputable financial news sources. However, precise, up-to-the-minute valuations for wealthy individuals are frequently unavailable. The estimation process is complex and can be subject to fluctuations in market values. Information gleaned from various sources is often necessary to form a comprehensive picture.

Understanding a professional athlete's financial situation in a particular year offers insights into their career earnings and financial choices. This information can be used to evaluate their career success, investment strategies, and overall wealth management. The financial data of athletes, like that of any public figure, can also serve as a benchmark to assess the rewards and risks involved in a specific field. The data about the wealth of athletes can also illuminate the relationship between professional achievements and financial prosperity.

| Category | Description |

|---|---|

| Full Name | Randy Moss |

| Profession | Former NFL Wide Receiver |

| Years Active | 1998-2012 |

| Notable Achievements | Multiple Pro Bowl selections, NFL records |

To fully explore this topic, more in-depth analysis of Randy Moss's career earnings, investment decisions, and spending habits would be necessary. Sources such as financial records, publicly available financial disclosures, or reputable financial reporting may provide more detail. This information could offer valuable insights into the complexities of wealth management and financial success, especially in a high-stakes profession like professional football.

Randy Moss Net Worth 2024

Assessing Randy Moss's 2024 net worth involves examining various financial factors. The precise figure remains uncertain, requiring a careful consideration of his income sources and financial obligations.

- Career earnings

- Investment returns

- Business ventures

- Asset valuation

- Tax implications

- Debts and liabilities

- Public information access

- Estimated figures

Precise net worth calculations for public figures like Randy Moss are complex and often involve estimated figures. Career earnings, including salary and endorsements, form a major component. Investment returns and potential business ventures significantly impact the overall wealth. Valuation of assets such as real estate, cars, or other investments also plays a role. Understanding tax implications is vital, since these reduce net worth figures. Debt and liabilities must be subtracted. Reliable sources, like financial reports or estimates, are essential. The accessibility of public information about the financial aspects influences our ability to estimate the net worth. Estimated figures, however, are not definitive and should be interpreted with caution, as they may not reflect the full picture of Randy Moss's financial standing.

1. Career Earnings

Career earnings are a substantial component of Randy Moss's overall net worth. Salary from professional football, along with endorsements and potentially other income streams, constitute a significant portion of his accumulated wealth. The magnitude of these earnings directly influences the overall financial picture. Historically, high-performing athletes often accrue substantial wealth through their careers.

The correlation between career earnings and net worth is direct: higher career earnings generally translate to a greater net worth. This is particularly true for athletes like Randy Moss, whose career spanned significant earning periods and included lucrative endorsements. However, factors like investment strategies, expenses, and tax implications influence the net outcome. While career earnings lay the foundation, other economic factors can either bolster or diminish a final net worth figure. Examining past professional athletes reveals a similar pattern: substantial earnings often correspond with a substantial net worth, but the precise relationship is not straightforward.

Understanding the role of career earnings in determining net worth provides valuable context. Analyzing a figure like Randy Moss's career highlights how income from professional sport, combined with other financial endeavors, can significantly impact overall wealth. This connection illuminates the complex interplay between professional success and financial accumulation. However, the specific interplay of career earnings and ultimate net worth requires a complete financial picture, including investment strategies and personal spending patterns. The importance of career earnings remains crucial in evaluating the economic outcomes of professional athletes.

2. Investment Returns

Investment returns play a significant role in shaping an individual's net worth, including that of Randy Moss. The success of investment strategies directly influences the overall financial standing. Profitable investments increase assets, contributing positively to the net worth. Conversely, poor investment choices or losses diminish assets, thereby affecting the net worth figure. The influence of investment returns is a crucial component in calculating total net worth, especially for individuals with substantial wealth.

Successful investment strategies, particularly those aligning with risk tolerance and financial goals, can substantially boost a figure like Randy Moss's net worth. Diversification across various investment typesstocks, bonds, real estate, or other assetsreduces risk and maximizes potential returns. The success of these investment strategies can be demonstrated through examples of high-net-worth individuals who have significantly enhanced their financial positions through astute investment decisions. The historical performance of investments offers insights into their potential impact on net worth. However, it's crucial to note that past performance is not indicative of future results, and careful consideration of risk factors is always necessary. Factors like market fluctuations and economic conditions are important to consider in investment strategy, and the individual's risk tolerance plays a critical role in determining a suitable investment strategy.

Understanding the correlation between investment returns and net worth is crucial for financial planning and decision-making. This understanding, particularly in the case of high-profile individuals, highlights the vital role that investment choices play in overall financial prosperity. While career earnings provide a foundation, investment returns often serve as a primary driver of net worth growth. For those with substantial wealth, investment performance can substantially impact their overall financial standing. This highlights the importance of a sound investment strategy in achieving and maintaining financial security and long-term wealth accumulation.

3. Business Ventures

Business ventures undertaken by individuals like Randy Moss can significantly impact their net worth. Successful ventures add to accumulated assets, positively affecting the overall financial picture. Conversely, unsuccessful ventures can lead to financial losses, reducing net worth. The nature and success of these ventures are crucial factors in determining overall wealth. The impact of business ventures, both positive and negative, is a relevant component in analyzing net worth. Understanding this connection provides a fuller perspective on the factors contributing to an individual's financial standing.

The extent to which business ventures contribute to a figure like Randy Moss's net worth depends on various factors, including the nature of the venture, market conditions, and management effectiveness. Successful ventures can generate substantial income, increasing assets and influencing overall financial prosperity. Examples of athletes diversifying into business endeavors illustrate this effect. These ventures can encompass investments in various industries, including sports-related businesses, ventures in entertainment or other fields, or brand endorsements. The success of such ventures can significantly contribute to a substantial increase in net worth. Conversely, unsuccessful ventures can lead to substantial losses, diminishing accumulated wealth. Careful consideration and due diligence in any business pursuit are crucial, as highlighted by examples of athletes who entered ventures with limited success. Evaluating the risk-reward ratio of different business opportunities is important. Thorough planning, market analysis, and strong management are critical elements for success in such endeavors.

In summary, business ventures represent a multifaceted aspect influencing Randy Moss's, or any high-profile individual's, net worth. The potential for substantial gains or losses is significant, making meticulous planning and evaluation essential. Understanding the link between business ventures and overall wealth highlights the importance of careful consideration of potential ventures and the assessment of potential risks and rewards. Analyzing successful and unsuccessful examples provides crucial insights into the complexities of accumulating wealth. The connection between business ventures and an individual's financial health is an essential part of the bigger picture when assessing net worth.

4. Asset Valuation

Determining Randy Moss's net worth in 2024 hinges on accurately valuing various assets. This process involves assessing the current market worth of possessions, from tangible items like real estate and vehicles to intangible assets like investments and intellectual property. Precise valuation is crucial for a complete picture of financial standing. Fluctuations in market values can significantly impact the overall calculation.

- Real Estate Valuation

Evaluating the value of real estate holdings is a critical component. Factors influencing this include location, size, condition, and current market trends. Appraisals, conducted by qualified professionals, provide a reasoned estimation of market value. For high-profile individuals, complex legal and ownership structures can complicate this assessment. Accurate valuation of real estate is a cornerstone of evaluating an individual's financial position. Variations in property values across different regions or economic climates can cause significant fluctuations in net worth estimates.

- Investment Portfolio Valuation

The value of investment holdings, including stocks, bonds, and other financial instruments, is dynamic and affected by market fluctuations. Portfolio valuations require ongoing monitoring. Professional financial advisors are often employed to manage and evaluate such portfolios. The market value of these investments directly correlates with an individual's financial standing, and changes can lead to fluctuations in estimated net worth.

- Personal Property Valuation

Valuing personal property, such as vehicles, collectibles, and other possessions, requires an appraisal or market research. The value of these assets can vary greatly depending on condition, rarity, and current demand. The methods for valuation may include auction records, historical sale prices, and expert opinions. Inclusion of personal property in the assessment provides a more comprehensive view of the individual's assets. Fluctuations in market desirability for collectibles or vehicles significantly affect the overall asset value calculation.

- Intellectual Property Valuation (if applicable)

For individuals with brand endorsements or other intellectual property, a valuation of these assets is essential. Such valuations may involve legal consultation, market research, and analysis of past performance. Assessing the potential future earnings generated from intellectual property, like brand name recognition, adds another dimension to the asset valuation. Accurate evaluation of intangible assets is challenging due to the subjective nature and market dynamics.

Accurate asset valuation is fundamental in determining Randy Moss's net worth. The various types of assets, from real estate to intellectual property, need meticulous assessment. Market fluctuations, economic conditions, and legal intricacies all play a role in determining these values. This process provides a comprehensive and accurate picture of the individual's financial standing. The importance of this valuation in understanding Randy Moss's overall financial status cannot be overstated. Subsequent changes in market conditions or individual circumstances can cause significant adjustments to calculated net worth.

5. Tax Implications

Accurate determination of Randy Moss's net worth in 2024 requires careful consideration of tax implications. Taxes levied on income, investments, and assets directly impact the final figure representing net worth. Understanding these implications is essential for a comprehensive assessment of his financial standing.

- Income Tax Considerations

Income taxes significantly affect net worth calculations. Sources of income, including salary, endorsements, and investment returns, are subject to varying tax rates and regulations. Deductions and exemptions, if applicable, reduce taxable income. Thorough accounting for these deductions is critical to determining the actual net income, a core element for calculating net worth. For high-earning individuals, the complexity of tax laws and strategies becomes more pronounced, requiring expertise in tax planning and compliance.

- Capital Gains Taxes

Capital gains taxes are levied on the profits realized from the sale of assets, such as investments or real estate. The sale of assets, like stocks or property, may trigger capital gains taxes. These taxes directly reduce the net proceeds from the asset sale, which, in turn, affects net worth. Tax rates and regulations vary by jurisdiction. Individuals must carefully manage and plan for these taxes, as they can have a substantial impact on the eventual net worth figure.

- Estate and Inheritance Taxes

These taxes apply when assets are transferred through inheritance or estate settlement. Individuals may structure their financial affairs to minimize the impact of these taxes, particularly those with substantial wealth. Understanding these potential tax liabilities is critical when estimating the amount of wealth that is ultimately transferred or remains after taxes are paid. Estate planning plays a significant role in minimizing the impact of estate and inheritance taxes on net worth.

- Other Tax Obligations

Other tax obligations, like property taxes, payroll deductions, or business taxes, if applicable, also affect the final calculation of net worth. The inclusion of various taxes across different income streams and asset holdings provides a more accurate overall picture of an individual's financial situation. This is particularly important for high-profile individuals like Randy Moss, who may be subject to various and sometimes complex tax regulations.

In conclusion, tax implications are an essential facet of determining Randy Moss's net worth. Taxes on income, capital gains, estates, and other obligations are all important elements to factor into the overall calculation. Accountants and tax professionals with specialized knowledge can be instrumental in ensuring these tax obligations are accurately reflected when assessing net worth figures. The significance of taxes in determining net worth underscores the necessity of a thorough understanding of applicable tax laws and regulations. A precise figure requires consideration of the full range of tax liabilities and related strategies to minimize tax burdens on his assets.

6. Debts and Liabilities

Accurate determination of Randy Moss's net worth in 2024 necessitates careful consideration of debts and liabilities. These financial obligations directly reduce the overall value of assets, thereby impacting the final net worth figure. A comprehensive analysis must account for outstanding loans, outstanding credit card balances, or other financial commitments. Failing to account for these obligations produces an inaccurate portrayal of true financial standing.

- Outstanding Loans

Loans, including mortgages, car loans, and personal loans, represent significant liabilities. The principal amount, interest accrued, and any penalties associated with these loans must be subtracted from the total assets. The effect of outstanding loans on net worth is significant, particularly for high-net-worth individuals. Examples include outstanding mortgage payments on multiple properties or extensive financing for personal investments.

- Credit Card Debt

Credit card balances represent ongoing financial obligations. The outstanding debt on credit cards, including interest charges, directly contributes to a reduction in net worth. High credit card balances can materially decrease the net worth figure, requiring a detailed assessment of outstanding amounts. Examples include accumulated interest from excessive spending or failure to manage credit card payments effectively.

- Unpaid Taxes and Legal Obligations

Unpaid taxes or pending legal settlements constitute liabilities that directly impact net worth. Unpaid taxes or penalties for income, property, or other tax obligations can be substantial. The inclusion of these pending liabilities is vital for accurate net worth calculation. Examples could include tax liabilities from prior years or court-ordered payments.

- Financial Guarantees and Obligations

Financial guarantees or commitments to other parties, while not always immediately apparent liabilities, can impact future financial outcomes. Potential future financial obligations are equally important in assessing overall financial standing. Examples include personal guarantees on loans or business ventures, which may create future debt obligations. Recognizing these future obligations requires careful judgment and foresight.

In summary, debts and liabilities represent substantial deductions from Randy Moss's overall net worth. Careful consideration of outstanding loans, credit card debt, unpaid taxes, and any potential future obligations is essential for a precise and accurate assessment. Accurate accounting for these financial commitments offers a more comprehensive picture of his financial standing, revealing a more complete view of his financial health than an analysis neglecting these details. Omitting these crucial details may significantly underestimate his financial position and provide a misleading representation of his net worth in 2024. The effect of debts and liabilities is a critical component of a fair and accurate evaluation.

7. Public Information Access

Publicly accessible information plays a significant role in understanding a figure like Randy Moss's financial status. The availability and reliability of such data directly influence attempts to determine net worth in a specific year. Limited or unreliable publicly available information creates obstacles in accurately estimating Randy Moss's net worth in 2024. News reports, financial disclosures, or public records, when accessible, provide a foundation for understanding income streams, assets, and liabilities, thereby forming the basis for calculating net worth. However, the absence or inadequacy of this information hinders a precise estimation. Access to such data varies depending on the jurisdiction, privacy laws, and reporting requirements. Public records can include real estate transactions, tax filings (when available), and sometimes details on investment activities. Information pertaining to business ventures, if any, is another potential source of financial data, but its availability is often limited or private.

Access to this data is crucial because it allows for a more comprehensive financial analysis. Reliable financial news sources, which often compile financial data, are important for forming a comprehensive understanding of an individual's financial history and current standing. This transparency supports the public's understanding of wealth accumulation and distribution within different professions and industries. For athletes like Randy Moss, public access to their financial information underscores the relationship between professional achievements and financial success. The visibility into their earnings and investments enables informed discussions about potential wealth disparities and the impact of economic factors on their career path and subsequent financial choices. For example, reliable financial publications provide insights into historical salary figures, endorsement deals, and investment trends, enabling a more informed estimate of the net worth. A lack of transparency hampers the process and often leads to speculation and potentially inaccurate estimations.

In conclusion, public information access is a critical component in attempting to estimate Randy Moss's net worth. The availability, reliability, and comprehensiveness of publicly available data significantly influence the accuracy of these estimates. Limited transparency in financial matters can create challenges in reaching a precise figure. Moreover, the presence or absence of publicly accessible information affects the wider discussion around wealth, professional success, and economic trends. Understanding the limitations of publicly accessible financial data is essential for interpreting available information and reaching a more nuanced understanding of an individual's financial standing. Ultimately, a broader availability of transparent financial reporting would foster a more insightful public understanding of wealth dynamics.

8. Estimated Figures

Estimating Randy Moss's net worth in 2024, due to the complexities and privacy surrounding such valuations, necessitates the use of estimated figures. These estimates represent approximations based on available information and often serve as a placeholder until more definitive data emerges. The accuracy of these estimates is inherently limited by the inherent difficulty in compiling comprehensive financial data for high-profile individuals. The limited access to private financial records and the dynamic nature of investment markets further complicate precise calculations.

The use of estimated figures as a component of net worth assessments is commonplace, particularly when dealing with figures like Randy Moss. Public figures often enjoy a degree of privacy concerning their financial matters, which makes direct access to definitive figures difficult. Furthermore, the valuations of various assets, such as real estate and investment portfolios, are subject to market fluctuations. These factors contribute to the uncertainty often associated with precise net worth estimations. Consequently, estimated figures provide a necessary alternative for gaining an understanding of financial standing when definitive data is unavailable. For instance, media reports often rely on estimates to provide readers with an initial understanding of a celebrity's wealth. These estimates, while not definitive, offer a framework for understanding a person's financial status. Historical data, combined with available information on income sources and asset valuations, forms the basis for these estimations. However, the lack of verifiable, detailed information, like precise financial disclosures or tax returns, inevitably introduces a degree of uncertainty.

Understanding the nature of estimated figures in net worth assessments provides a framework for interpreting the available information. While these estimations are not definitive, they offer an essential starting point for analysis. Recognizing that estimated figures are approximations rather than precise values enables a more realistic and less judgmental view of such reports. This understanding prevents the misinterpretation of an estimated figure as an absolute and unchangeable financial value. The inherent limitations of estimated figures should guide the interpretation and application of such information when analyzing public figures' financial positions.

Frequently Asked Questions

This section addresses common inquiries regarding the estimated net worth of Randy Moss in 2024. Accurate financial figures for public figures often remain private. The information provided here represents a compilation of publicly available data and expert estimations. Interpretations should be considered within the context of available data.

Question 1: What is the precise net worth of Randy Moss in 2024?

A precise figure for Randy Moss's 2024 net worth is not publicly available. Estimating net worth necessitates compiling assets, subtracting liabilities, and considering fluctuating market values. Due to the private nature of financial information for many individuals, a definitive figure is often elusive.

Question 2: How are estimates of net worth calculated?

Estimates rely on available public information, such as reported income, asset valuations (real estate, investments), and known debts or liabilities. Reliable financial news sources, financial analysts, and estimates based on previous performance often inform these calculations. Estimating methodologies vary, leading to potential differences in calculated figures.

Question 3: What factors influence the fluctuation of net worth estimates?

Market conditions, investment returns, and potential business ventures influence estimations. Changes in asset values, including real estate and investment portfolios, impact the overall net worth. Additionally, tax implications and any outstanding debts or liabilities directly affect the calculation.

Question 4: Are these estimates reliable indicators of Randy Moss's true financial status?

Estimated net worth figures should be approached with caution. The absence of complete financial disclosures renders them approximations rather than precise representations. Market fluctuations and evolving financial situations contribute to the dynamic nature of these estimations.

Question 5: Where can I find reliable information regarding net worth estimates?

Reliable sources often include reputable financial news organizations that compile financial data. These may contain estimates or analyses of professional athletes' financial status. However, seeking multiple perspectives and considering the limitations of estimated figures is advisable.

In summary, understanding the nuances of estimating net worth for public figures like Randy Moss involves recognizing that precise values are rarely publicly available. Estimating methodologies often rely on available data and expert opinions. Consequently, careful consideration of the limitations inherent in such estimations is paramount.

This concludes the FAQ section. The next section will delve deeper into the factors impacting Randy Moss's potential career earnings and professional history.

Conclusion

Determining Randy Moss's precise net worth in 2024 proves challenging. The process requires a multifaceted approach, encompassing career earnings, investment returns, business ventures, asset valuation, tax implications, and outstanding debts. Publicly available data is often incomplete or inaccessible. Consequently, estimated figures are frequently employed, acknowledging the inherent limitations in such approximations. The dynamic nature of financial markets and the private financial information of high-profile individuals further complicates the calculation. While career earnings form a significant component, other factorsincluding investment decisions and personal spendingare crucial elements in calculating a complete picture of financial standing.

The pursuit of a definitive net worth figure underscores the complexities inherent in evaluating the financial status of public figures. The interplay of various economic factors and the inherent limitations of available data highlight the challenges in accurately assessing wealth. Accurate financial reporting for high-profile individuals remains an ongoing endeavor, impacting the broader understanding of wealth accumulation and distribution across various professions. Further research, particularly with more transparent financial disclosures becoming available, could provide more precise future estimates.

Detail Author:

- Name : Miller Hermiston

- Username : gromaguera

- Email : broderick61@hotmail.com

- Birthdate : 1985-10-14

- Address : 4125 Bednar Crossing Lednerton, WA 71771

- Phone : +19476234311

- Company : Kertzmann Ltd

- Job : Information Systems Manager

- Bio : Ratione illum vero eos rerum expedita dolor delectus voluptas. Autem neque omnis sequi debitis debitis. Mollitia aperiam et odio et at qui.

Socials

facebook:

- url : https://facebook.com/ahauck

- username : ahauck

- bio : Sed repellendus et qui harum.

- followers : 5926

- following : 2902

linkedin:

- url : https://linkedin.com/in/abagail_hauck

- username : abagail_hauck

- bio : Aspernatur et expedita fugiat et aut.

- followers : 6410

- following : 2661