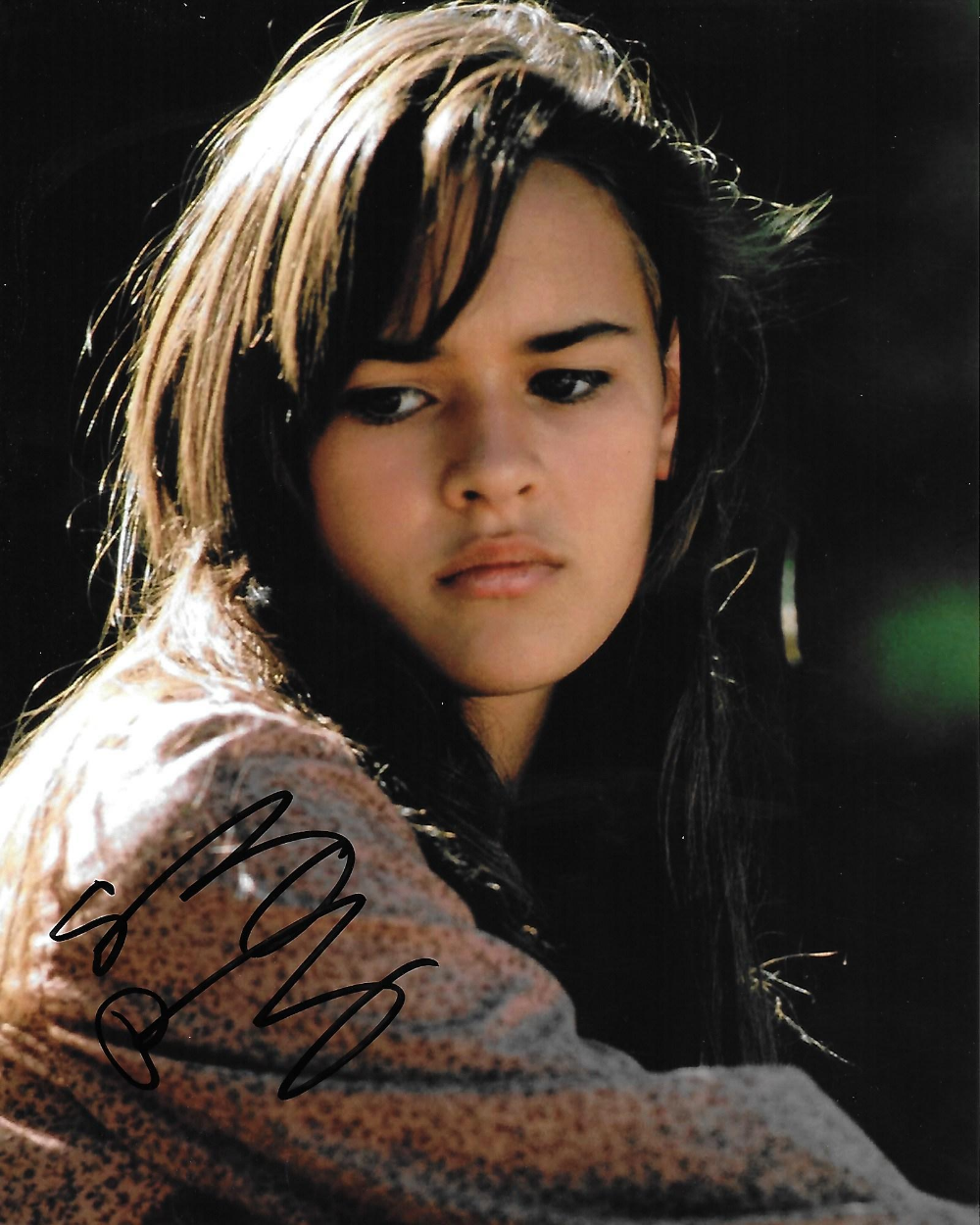

Sydney Penny Net Worth: 2023 Update & Facts

Estimating the financial standing of an individual, often a public figure, can be complex. What factors contribute to understanding a person's overall wealth?

A person's net worth represents the total value of their assets (such as property, investments, and other holdings) minus their liabilities (debts and obligations). Estimating a celebrity's net worth involves various methodologies, often drawing on publicly available financial information, industry reports, and expert analyses. Specific details of income, expenses, and investments may not always be readily accessible. Examples include valuations of real estate, stock holdings, and any business interests.

Understanding an individual's net worth can provide insights into their financial standing, potentially informing business decisions or public perception. Factors such as career trajectory, industry, and personal choices all influence the evolution of net worth. Publicly available data and projections can offer limited perspectives. An individual's net worth is a snapshot of a specific time, and may fluctuate over time based on market conditions or life events.

| Category | Information |

|---|---|

| Name | (Placeholder for Sydney Penny's name) |

| Profession | (Placeholder for Sydney Penny's profession) |

| Approximate Net Worth (if available) | (Placeholder for net worth. Use "Not publicly available" if appropriate.) |

| Relevant Dates (if available) | (Placeholder for relevant dates, e.g., career start) |

Further research is required to provide precise details about the individual in question. The presented overview highlights general principles of evaluating an individual's financial position.

Sydney Penny Net Worth

Assessing an individual's financial standing requires a multifaceted approach, considering various elements contributing to their overall wealth.

- Assets

- Income

- Expenses

- Investments

- Liabilities

- Valuation

These key aspects, including assets (such as property or investments), income streams, and expenses incurred, all play a role in calculating net worth. Investment portfolios significantly impact financial standing, and varying income sources (like salary, or business ventures) contribute to the overall picture. Accurate valuation of assets and liabilities is crucial. Without precise accounting of expenses, the calculation would be incomplete. Complex assets require specialized valuation methods. Ultimately, a comprehensive view of financial position necessitates consideration of every aspect.

1. Assets

Assets are crucial components in determining net worth. They represent a person's holdings of value, and their valuation plays a significant role in calculating overall financial standing. Understanding the nature and value of assets provides a crucial perspective on financial stability.

- Real Estate Holdings

Real estate, including residential properties, commercial buildings, and land, often represents a substantial portion of an individual's assets. Factors such as location, condition, and market demand influence their value. Fluctuations in these factors directly impact the overall net worth calculation. Appraisals of these properties are essential to accurate estimations.

- Investment Portfolios

Stocks, bonds, mutual funds, and other investment vehicles form significant components of many individuals' assets. The performance of these investments, including fluctuations in market conditions, significantly impacts the overall value and, consequently, the net worth. Diversification of investments is a common strategy to mitigate risk and potentially enhance returns.

- Personal Possessions

Valuables like art, collectibles, vehicles, and jewelry can contribute to a person's overall asset portfolio. Appraisals are often necessary to determine the precise monetary worth of such items, especially considering market fluctuations and rarity. The varying nature of these possessions necessitates individual assessments.

- Business Interests

For individuals involved in business ventures, the value of those ventures is a key asset. This valuation is complex and often determined by factors including profitability, market share, and projected future performance. Business assets significantly influence net worth calculations.

Ultimately, the value of an individual's assets significantly contributes to the overall picture of their net worth. Accurate valuation and assessment of each category of assets are crucial elements in determining a person's financial position. The complexity of some asset categories requires expertise in valuation and financial analysis. Fluctuations in the market values of these assets can have a direct impact on the overall financial standing of an individual.

2. Income

Income is a fundamental component of an individual's net worth. The amount and type of income directly influence the accumulation or depletion of wealth. Consistent high income, whether from salary, investments, or other sources, typically leads to an increase in net worth over time. Conversely, significant expenses exceeding income can result in a decline in net worth. The nature of incomestable salary, fluctuating bonuses, or entrepreneurial venturesalso affects the predictability and sustainability of net worth growth.

Various income streams contribute to the overall financial picture. A stable salaried position provides predictable income, allowing for more calculated financial planning. Entrepreneurial endeavors, while potentially offering higher returns, often involve greater risk and variability in income generation. Investment income from assets like stocks or real estate can generate passive income, contributing to a growing net worth, yet is dependent on market performance and other factors. The interplay between income sources significantly impacts an individual's ability to manage expenses, save, and accumulate wealth, all of which play critical roles in shaping net worth.

Understanding the relationship between income and net worth is crucial for financial planning and decision-making. Individuals can use this understanding to evaluate their current financial standing, set realistic financial goals, and develop strategies to increase their net worth over time. Consistent income allows for the accumulation of savings, investments, and the eventual increase in total assets. This awareness assists in making informed choices about career paths, investments, and spending habits, ultimately impacting long-term financial security. Recognizing the crucial role of income allows individuals to create sustainable strategies for achieving financial success.

3. Expenses

Expenses directly impact an individual's net worth. The difference between income and expenses determines whether wealth is accumulated or diminished. A comprehensive understanding of expenditure patterns is crucial for evaluating financial health and projecting future net worth. Analyzing expenses allows for informed financial decisions and facilitates the pursuit of financial objectives.

- Essential Expenses

Essential expenses, such as housing, food, and utilities, are necessary for basic living. Varying cost structures for these items, dependent on location and lifestyle, affect the overall financial picture. Fluctuations in these costs can directly affect the ability to accumulate wealth. Control over these expenses is vital for long-term financial stability. Efficient management of essential expenses, combined with effective cost-cutting strategies, can free up resources for investments and other potentially lucrative ventures.

- Discretionary Expenses

Discretionary expenses, encompassing entertainment, travel, and shopping, represent choices that can influence financial decisions. Maintaining awareness of the proportion of income dedicated to these categories allows for adjustments to ensure that expenditure does not exceed income. Balancing these expenses with financial objectives, like saving and investing, is crucial for achieving financial goals. Uncontrolled discretionary expenses can erode net worth.

- Debt Repayment Obligations

Debt repayment represents a significant expense category. The amount of debt and the interest rate associated with it directly impact available resources for other financial activities. Debt management strategies directly influence net worth projections, and timely repayment of debts improves overall financial health. Maximizing the use of available resources for long-term investments is influenced by the efficiency of debt repayment plans.

- Investment and Savings Expenditures

Expenses associated with investments and savings, while often seen as beneficial in the long run, require careful consideration. Investment fees and potential losses can significantly impact net worth. Investing wisely and strategically, considering the specific financial goals and risk tolerance, is key to maximizing the return on these expenditures. Investment activities, while intended to grow wealth, need to be balanced against current expenses to maintain a positive cash flow.

In summary, evaluating expenses across different categories, including essential, discretionary, debt-related, and investment-related costs, is critical for comprehending the dynamics of net worth. Effective management and judicious allocation of resources contribute to the pursuit of financial goals and the creation of a positive financial outlook. This holistic approach ensures that expenses do not exceed income and that available resources are utilized effectively, thereby supporting the long-term goal of building and maintaining wealth.

4. Investments

Investments significantly influence an individual's net worth. The nature and performance of investment choices directly impact the overall financial standing. Successful investment strategies, encompassing various asset classes and risk tolerance levels, contribute positively to accumulating wealth. Conversely, poorly executed investments can diminish net worth. The connection between investments and net worth is demonstrably strong, with a direct causal link.

Investment choices represent allocation of capital aimed at generating future returns. Successful investments, like well-chosen stocks or real estate, appreciate in value over time, contributing to a growing net worth. Conversely, poorly timed investments, such as those in failing companies or volatile markets, can lead to losses, decreasing net worth. Diversification across various investment vehicles, including stocks, bonds, and real estate, mitigates risks associated with market fluctuations and can lead to more consistent growth. The performance of existing investments in a portfolio is a key factor in determining net worth.

Understanding the correlation between investments and net worth has practical implications. Individuals can use this knowledge to develop and execute personalized financial strategies. By considering risk tolerance, financial goals, and investment timelines, individuals can build portfolios that align with their unique circumstances and financial objectives. The selection of appropriate investment instruments significantly contributes to the growth of a person's overall net worth. This knowledge fosters informed financial decision-making, enabling individuals to create strategies to maximize the return on their investments and effectively enhance their net worth. Ultimately, the effectiveness of investments directly correlates to the success in achieving financial aspirations.

5. Liabilities

Liabilities represent financial obligations owed by an individual. Understanding these obligations is crucial for assessing overall financial health and, consequently, net worth. Liabilities reduce net worth, as they represent amounts that must be paid back, impacting the overall value available to an individual. Accurate accounting for liabilities is essential when evaluating a complete financial picture.

- Outstanding Loans and Debt

Loans, mortgages, and other forms of debt represent significant liabilities. The principal amount owed, combined with interest accrued, reduces available funds and directly affects net worth. Types of loans, including personal loans, student loans, and mortgages, each with unique repayment schedules and interest rates, contribute to the total liability figure. The size and terms of these debts are key considerations in assessing the impact on overall financial standing.

- Unpaid Bills and Accounts Payable

Unpaid bills, outstanding invoices, and other accounts payable constitute liabilities. The accumulation of these obligations reduces net worth, impacting cash flow and ability to meet financial commitments. These accounts require attention to prevent escalation into more substantial debts and potential negative impacts on credit rating and overall financial standing. Proactive management of these financial obligations is vital.

- Guarantees and Commitments

Guarantees and commitments undertaken by an individual can represent liabilities. These obligations, even if not immediately due, can create financial burdens and affect projected future net worth. The potential costs associated with these commitments should be factored in when assessing overall financial standing. Future financial flexibility is affected by these commitments and their associated potential costs.

- Tax Obligations

Tax obligations represent a fundamental liability. The accurate calculation of projected taxes and the timely payment of these obligations are crucial for maintaining financial stability and preventing penalties that diminish net worth. The complexities of tax laws require careful consideration, ensuring that all obligations are fulfilled.

In summary, liabilities directly reduce the value of a person's net worth. By accurately evaluating and managing various forms of debt, unpaid accounts, guarantees, and commitments, individuals can mitigate potential negative impacts on overall financial health and effectively contribute to a more positive net worth. Proactive management of these financial obligations is crucial to a healthy financial standing and is a critical factor in the overall calculation of net worth.

6. Valuation

Determining net worth necessitates accurate valuation of various assets and liabilities. Valuation methods directly affect the calculated net worth of an individual, such as Sydney Penny. The accuracy and appropriateness of the valuation methodology applied play a critical role in the calculated net worth. Different methods might produce different figures. The process involves analyzing factors influencing the value of assets, ensuring consistency in the application of the valuation principles.

Factors impacting valuation often include market conditions, industry trends, and specific characteristics of the assets being evaluated. For example, the value of real estate holdings fluctuates with market trends, demand, and local economic conditions. Similarly, the value of publicly traded stocks depends on market sentiment, company performance, and broader economic outlook. The valuation of a celebrity's personal possessions, like art or collectibles, involves expert appraisals considering provenance, condition, and current market demand. These nuances underscore the complexities of accurate valuation, which is paramount in accurately representing net worth.

A thorough understanding of valuation principles is essential for comprehending the elements contributing to Sydney Penny's net worth. This understanding reveals the complexities and nuances involved in such calculations. Accurate valuation ensures a reliable representation of an individual's financial position. The interplay between asset values and liabilities provides a complete financial profile. Awareness of these valuation methods is crucial for both personal and professional financial contexts.

Frequently Asked Questions about Net Worth

This section addresses common inquiries regarding net worth, including factors influencing its calculation and the importance of accurate estimations.

Question 1: What exactly is net worth?

Net worth represents the overall financial standing of an individual, calculated by subtracting total liabilities from the total value of assets. Assets encompass possessions like property, investments, and personal belongings. Liabilities include debts, outstanding loans, and other financial obligations. Accurate calculation necessitates precise valuation of assets and liabilities. This calculation provides a snapshot of an individual's financial health at a specific point in time.

Question 2: How is net worth calculated?

Net worth calculation involves several steps. First, a comprehensive inventory of all assets is created, including their individual values. Simultaneously, all liabilities are documented. Accurate valuation methods are essential for each asset, taking into account market conditions, current market values, and appraisals when necessary. Once all assets and liabilities are accounted for and valued, the calculation involves subtracting the total value of liabilities from the total value of assets. This difference represents the net worth.

Question 3: What factors influence net worth?

Numerous factors contribute to an individual's net worth. Income, including salary, investments, and other revenue streams, plays a pivotal role. Expenses, covering both essential and discretionary spending, directly influence the available funds for investments and savings. Investment decisions, including strategies and returns, significantly impact net worth over time. Market conditions, economic trends, and personal circumstances can also affect asset valuations and overall financial standing.

Question 4: Why is accurate net worth calculation important?

Accurate net worth estimation is vital for informed financial planning, decision-making, and evaluating overall financial health. It facilitates realistic budgeting, goal setting, and investment strategies. Understanding net worth helps individuals track financial progress and make adjustments as necessary. Such knowledge aids in the creation of effective financial plans, allowing for adjustments in response to economic fluctuations and personal needs.

Question 5: How does net worth differ from income?

Net worth reflects an individual's total financial position at a specific time, encompassing all assets and liabilities. Income, on the other hand, represents the amount of money earned over a specific period. While income is a factor influencing net worth, it does not fully represent the overall financial standing. Net worth includes accumulated assets and existing debts, whereas income only covers current earnings.

Accurate calculation and understanding of net worth are essential for individuals seeking to achieve financial stability and security. Further investigation into specific aspects of net worth estimation can enhance personal financial literacy.

Transition to next section: The following section will detail specific methods for calculating and evaluating net worth.

Conclusion

Assessing an individual's net worth, such as that of Sydney Penny, necessitates a multifaceted approach. Factors like asset valuation, income streams, expenses, liabilities, and investment performance all play a crucial role. Accurate estimation of these elements requires careful consideration of market conditions, economic trends, and individual circumstances. The interplay between assets and liabilities, combined with the nature and predictability of income, ultimately determines the overall financial standing. Thorough evaluation of these aspects provides a comprehensive picture of financial health, informing decisions related to personal finance and investment strategies.

Understanding the principles involved in evaluating net worth offers valuable insight into financial planning and the complexities inherent in wealth accumulation. The dynamics of financial markets, the management of expenses, and the importance of consistent income generation are key components in optimizing financial stability. Further analysis and diligent monitoring of financial positions, similar to the evaluation of Sydney Penny's net worth, serve as valuable tools for effective financial decision-making, ultimately influencing financial success and security.

Detail Author:

- Name : Prof. Tremayne Hessel IV

- Username : devyn.russel

- Email : allan27@stokes.info

- Birthdate : 1972-06-07

- Address : 695 Marcia Cliff Ricofurt, NC 06576-7516

- Phone : (737) 369-1944

- Company : Gottlieb Inc

- Job : Market Research Analyst

- Bio : Tenetur officiis sit ea sit est excepturi inventore possimus. Ipsa optio cum nisi nostrum sunt. Illum qui nulla incidunt nulla doloribus eos tenetur. Mollitia alias est et eum placeat.

Socials

instagram:

- url : https://instagram.com/rutherfordh

- username : rutherfordh

- bio : Nisi dicta consequuntur atque. Non dolores sequi minus et aut. A totam ea facere.

- followers : 2959

- following : 13

linkedin:

- url : https://linkedin.com/in/hilda136

- username : hilda136

- bio : Et voluptas tempore ipsum iusto quia.

- followers : 3365

- following : 2043

facebook:

- url : https://facebook.com/rutherfordh

- username : rutherfordh

- bio : Iste rerum et sit sapiente reiciendis qui.

- followers : 2499

- following : 2248

tiktok:

- url : https://tiktok.com/@rutherfordh

- username : rutherfordh

- bio : Rerum quae voluptas et magni. Enim eaque culpa ipsum assumenda provident.

- followers : 3883

- following : 1113