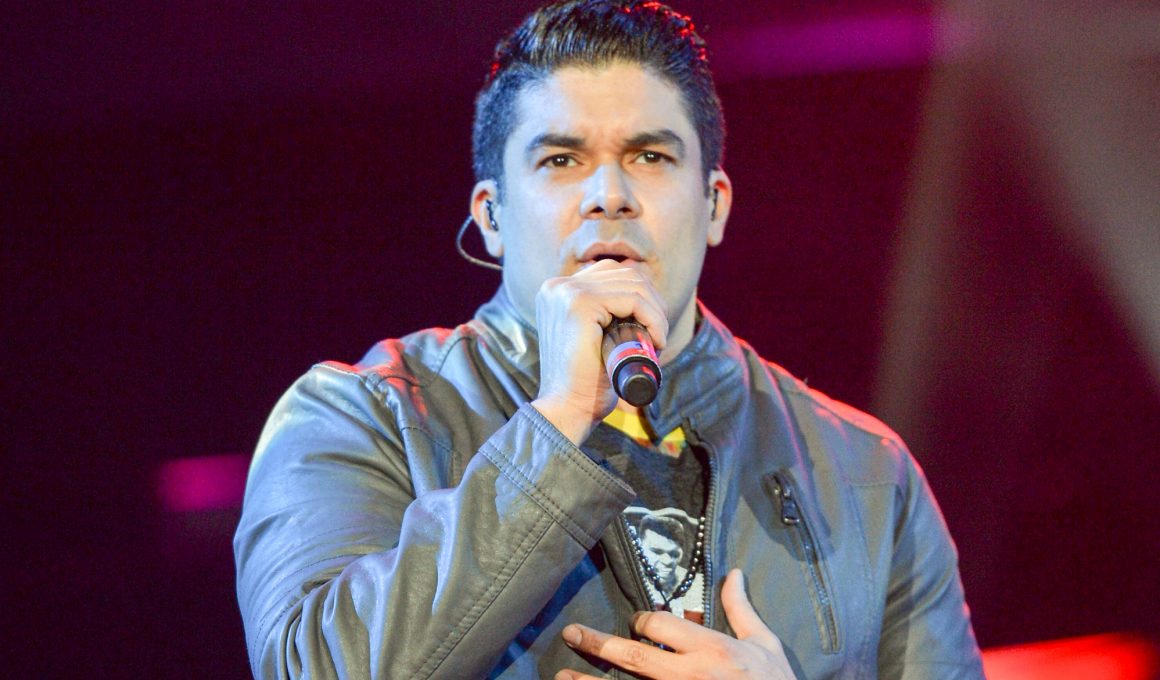

Jerry Rivera Net Worth 2023: Updated Figures & Details

What is the financial standing of the individual known as Jerry Rivera? Understanding an individual's financial position can offer insights into their career trajectory and lifestyle.

An individual's net worth represents the total value of their assets (such as property, investments, and other holdings) minus their liabilities (debts and obligations). Jerry Rivera's net worth, like that of any individual, is a complex calculation reflecting a variety of financial factors throughout their life. It doesn't necessarily reflect current income or earnings potential. Furthermore, publicly available information about net worth is often a snapshot in time and may not be precisely accurate.

Understanding someone's financial standing can provide a window into their career trajectory and success. It can highlight the financial benefits of various professional choices and demonstrate the impact of various life decisions. This information is relevant to understanding the broader context of professional success in the entertainment industry or other fields. However, it is crucial to remember that net worth is not a sole indicator of success, happiness, or well-being.

While this exploration focuses on financial details, a comprehensive understanding of Jerry Rivera requires delving into their career, personal life, and contributions. Further information about their career, accomplishments, philanthropic efforts, and other aspects of their life can offer a richer picture. To understand the factors affecting their financial situation, exploring their profession and relevant economic trends in that sector can provide a broader perspective.

Jerry Rivera Net Worth

Assessing Jerry Rivera's net worth necessitates careful consideration of various financial factors. This includes evaluating assets, liabilities, and the overall financial situation. This comprehensive approach offers valuable insight into the individual's financial standing.

- Assets

- Income

- Investments

- Debts

- Expenses

- Profession

- Market Value

Jerry Rivera's net worth is a reflection of his financial life, influenced by income streams from his profession, investment returns, and overall financial management. For example, substantial investment portfolios can significantly impact net worth. Professionally, a higher income generally correlates to a greater potential net worth. Factors like market conditions and debt levels further shape the overall picture. This data provides a snapshot of his financial situation at a specific point in time. Furthermore, this analysis highlights the multifaceted nature of financial standing, emphasizing the complex interplay of various factors.

1. Assets

Assets are crucial components in determining net worth. Understanding the nature and value of assets held by Jerry Rivera is essential for a comprehensive assessment of his financial position. Different types of assets contribute varying amounts to overall wealth, and their valuation plays a key role in calculations.

- Real Estate Holdings

Property ownership, including homes, land, and commercial buildings, represents a significant asset category. The value of these properties fluctuates based on market conditions, location, and condition. For example, a prime location property may command a higher value compared to a similar property in a less desirable area. The value of real estate holdings is a critical factor in calculating net worth, and the market value of these properties directly affects the overall valuation.

- Investment Portfolios

Investments in stocks, bonds, mutual funds, and other securities can be substantial assets. Their value depends on market performance, individual investment choices, and diversification strategies. For instance, diversified portfolios can provide more stability compared to those heavily concentrated in single stocks. Investment returns or losses directly influence net worth over time.

- Personal Assets

Personal possessions like vehicles, jewelry, and art collections also constitute assets. Determining their precise value can vary significantly, relying on current market appraisals or estimates. The value of personal assets is usually less substantial compared to major holdings like real estate and investments but still contributes to the total picture.

- Intellectual Property

If Jerry Rivera holds intellectual property rights, such as patents or copyrights, their value can be substantial and directly contribute to net worth. These assets may have inherent intangible value and present unique challenges in valuation. For example, a highly regarded or unique piece of intellectual property would command a higher market valuation.

The diverse range of assets held by an individual, like Jerry Rivera, significantly impacts their overall net worth. Proper valuation and categorization of these assets are essential for a clear understanding of their financial standing. The varying types of assets and the nuances in their valuation strategies help paint a complete picture of financial situation.

2. Income

Income represents a fundamental element in the calculation of net worth. The amount and stability of income directly influence an individual's accumulated wealth. For Jerry Rivera, as for anyone, the sources and levels of income significantly impact their overall financial situation and the potential for increasing or decreasing net worth.

- Sources of Income

Understanding the various income streams contributes to a comprehensive picture. A diversified income portfolio, encompassing multiple sources like salary, investments, and potential business ventures, provides greater financial stability. For example, a performer like Jerry Rivera may have income from various sources, including concert fees, record sales, merchandise, endorsements, or potentially other ventures. The consistent nature of these income sources plays a critical role in building long-term wealth.

- Income Stability and Growth

Income stability over time is crucial. A steady stream of revenue allows for the accumulation of assets and the management of expenses. Irregular or volatile income can hinder the consistent building of wealth. The fluctuation and predictability of income streams affect long-term financial stability. The consistency or variability of Jerry Rivera's income, therefore, influences the trajectory of his net worth. For instance, successful performances in high-demand periods lead to consistent income, while periods of lower demand might impact revenue.

- Income and Expenses Relationship

Income and expenses must be carefully managed. A balanced budget is critical for wealth creation. Overspending or failure to manage expenses effectively can diminish the potential for accumulating assets. Proper expense management allows for reinvestment or savings to support long-term financial growth. The relative levels of income and expenses are crucial to the overall success of wealth accumulation. The relationship between the two in Jerry Rivera's case demonstrates the financial choices and strategies influencing his overall financial picture.

- Impact on Investment Decisions

Income availability directly impacts investment decisions. A higher income generally provides more capital for investing in assets or businesses, potentially increasing overall wealth. The amount of available capital for investments influences strategic decision-making. Furthermore, the ability to weather economic downturns depends partially on the stability of income streams. Income plays a critical role in the capacity to manage economic downturns, which ultimately affects net worth over time.

The various facets of income, from diverse sources and stability to its relationship with expenses and investment opportunities, collectively shape an individual's net worth. These relationships demonstrate the dynamic nature of an individual's financial profile and ultimately provide insight into the factors influencing Jerry Rivera's wealth-building trajectory. Understanding these dynamic interrelationships is essential to any analysis of net worth.

3. Investments

Investments play a significant role in determining net worth. The nature and performance of investments directly impact an individual's financial standing. For someone like Jerry Rivera, whose career likely generates income, investment decisions become crucial for long-term wealth accumulation. Successful investments can lead to substantial growth in overall net worth, while poor or poorly timed investments can diminish it. This connection is crucial for understanding the factors influencing net worth.

Consider the potential impact of diversified investment strategies. A portfolio encompassing various asset classesstocks, bonds, real estate, or other opportunitiescan offer stability and potentially higher returns compared to a portfolio concentrated in a single area. Diversification mitigates risk, which is particularly important during market fluctuations or economic downturns. Specific investment choices and market conditions heavily influence the outcome. For example, investments in rapidly growing sectors or well-managed companies can lead to substantial gains. Conversely, investments in declining sectors or poorly managed entities can lead to losses. The returns from these choices affect the overall net worth in the long term.

Understanding the connection between investments and net worth is crucial for individuals seeking to build and maintain wealth. Appropriate diversification and careful evaluation of potential investments, alongside risk tolerance and financial goals, are essential components of informed financial decision-making. For Jerry Rivera, or anyone in a similar position, strategic investment choices can play a substantial role in maximizing the potential for wealth accumulation and growth over time. Careful analysis of market trends and appropriate risk management are integral parts of effective investment strategies.

4. Debts

Debts directly affect an individual's net worth. They represent financial obligations that reduce the overall value of assets. For any individual, including Jerry Rivera, the level and type of debt significantly influence their net worth calculation. A thorough understanding of debt is vital for assessing their financial standing.

- Types of Debt

Various forms of debt exist, each with different implications. Mortgage debt, representing loans secured by real estate, is a common example. Credit card debt, characterized by revolving credit lines, can accumulate rapidly. Other types include personal loans, student loans, and business debts. The nature of the debt, from mortgages to smaller personal loans, affects the impact on net worth. Recognizing the diverse categories of debt provides a more nuanced understanding of the financial picture.

- Debt Burden and Net Worth

The quantity and cost of debt directly influence net worth. High levels of debt can substantially reduce an individual's net worth, potentially creating a negative net worth if liabilities outweigh assets. Conversely, manageable debt levels can still impact net worth, but the impact is less significant. The relationship between debt levels and overall financial standing is crucial for evaluating an individual's financial health. For example, a large mortgage payment may represent a substantial portion of income, making it harder to save for other assets or investments. Similarly, high credit card debt can lead to increasing interest expenses and negative cash flow.

- Impact on Cash Flow

Debt obligations tie up significant portions of an individual's cash flow. Repayments and interest payments reduce available funds for savings, investments, or other financial goals. Managing debt effectively is vital for maintaining a positive cash flow, enabling investment in assets and potentially growing net worth. The impact of debt on cash flow illustrates how crucial debt management is. Debt service eats into discretionary income, hindering savings or growth.

- Debt Management Strategies

Strategies for managing debt are crucial for maintaining a healthy financial position. Debt consolidation, aiming to reduce multiple debts into a single, manageable loan, can lower interest payments. Budgeting effectively to prioritize debt repayment is another key strategy. These strategies, such as negotiating lower interest rates, emphasize responsible financial planning. For example, a proactive approach to debt consolidation can significantly reduce the overall financial burden and potentially improve net worth. Similarly, a well-defined budget prioritizes debt repayment, reducing the impact on overall net worth.

In conclusion, the presence and management of debt significantly influence net worth. Understanding the various types of debt, their impact on cash flow, and effective management strategies are essential for anyone seeking a clear financial picture. The interplay between debts and net worth is a critical component of financial planning and decision-making, highlighting the need for responsible debt management practices. For Jerry Rivera, or any individual, a comprehensive understanding of their debt situation is essential for a realistic and thorough financial assessment.

5. Expenses

Expenses directly influence Jerry Rivera's net worth. The relationship between expenditures and income is fundamental to any individual's financial health and ultimately shapes their accumulated wealth. Understanding how expenses are managed provides crucial insight into the factors affecting overall financial standing.

- Lifestyle Choices and Spending Habits

Discretionary spending and lifestyle choices directly impact an individual's expenses. Varied spending habits can significantly affect the ability to accumulate and maintain wealth. Factors like housing costs, transportation, entertainment, and dining habits are all part of this category. For example, an individual who prioritizes luxury goods and experiences will have higher expenses, possibly impacting investment opportunities or savings. In contrast, someone who prioritizes cost-effective living choices might dedicate more funds to investments and savings.

- Essential Expenses and Obligations

Necessary expenses, such as housing, utilities, groceries, and healthcare, are unavoidable. The proportion of income devoted to these essentials affects the amount available for other financial goals. The stability and predictability of these expenditures are crucial. Unforeseen medical issues or substantial property taxes, for instance, can severely impact the overall financial picture. Adequate budgeting and contingency planning are essential to manage these.

- Debt Repayments and Interest Expenses

Debt repayment represents a substantial portion of expenses for many individuals. The amount of debt, interest rates, and repayment schedules profoundly impact the remaining funds for other purposes. Effective debt management strategies can significantly impact available resources for investments and savings. High debt levels leave little room for accumulating wealth or responding to unforeseen expenses. Debt reduction strategies and prudent financial decisions can help mitigate the effects of high debt levels.

- Investment Management and Allocation

Allocating resources toward investments can be viewed as an expense in the short term but can yield significant returns in the long run. Investing in diverse assets can generate higher returns and potentially offset some of the more predictable expenses. This can be considered a longer-term expense to pursue wealth building. Strategic investment decisions directly affect the return on investment, influencing the overall financial health of an individual.

In summary, expenses and their various categories directly correlate with the overall net worth of Jerry Rivera, or anyone else. Effective expense management, including mindful spending habits, prioritization of necessary expenses, responsible debt management, and strategic investment allocation, are all crucial for a positive financial outcome. The interplay between these factors is key to understanding and managing an individual's financial position.

6. Profession

An individual's profession is a critical factor in determining their net worth. The nature of the work, income levels associated with the profession, and career longevity all contribute to the accumulation or depletion of wealth. Understanding the correlation between profession and financial standing is essential for evaluating the complexity of financial situations like Jerry Rivera's.

- Income Levels and Stability

Certain professions inherently command higher earnings than others. Specialized skills, high demand, or executive roles often correlate with substantial income potential. The stability of income streams is equally important. A consistent salary or predictable project-based income allows for more reliable financial planning and investment opportunities. Fluctuations in income, common in certain freelance or project-based professions, can impact the ability to build and maintain wealth. In contrast, secure, steady employment typically promotes more stable financial growth.

- Career Longevity and Experience

The length of a career and the accumulation of experience often correlate with increased earnings potential and opportunities for advancement. Established professionals, especially those in high-demand fields, typically earn more and have greater opportunities for investment and wealth building. Building experience in a specific field typically leads to higher compensation and greater influence over financial decisions. Conversely, the earlier stages of a career might feature lower income levels as experience and skills develop. Early career transitions can also affect the consistency of income and stability of financial planning.

- Industry Performance and Economic Conditions

The overall performance of an industry plays a critical role. Economic downturns, industry-specific challenges, or changes in demand for a particular skill directly affect income levels and job stability. For instance, a significant drop in consumer demand for certain products might impact sales revenue and employment within related professions. Conversely, robust economic conditions often support higher salaries and greater investment opportunities. The impact of economic conditions and industry trends on professional income is crucial for understanding potential fluctuations in an individual's financial situation.

- Perquisites and Benefits

Certain professions offer additional benefits like retirement plans, health insurance, and paid time off, impacting an individual's overall financial well-being. These extras contribute to a more comprehensive evaluation of financial standing. Such benefits can offset a portion of living expenses and provide enhanced security against unforeseen circumstances. The value of these perks in relation to income is crucial to consider. For example, comprehensive benefits packages in some professions can significantly influence the financial structure of the individual.

In conclusion, evaluating Jerry Rivera's net worth requires a profound understanding of the relationship between his profession and financial factors. The type of work, income stability, career length, industry conditions, and accompanying benefits all interact to shape the overall financial picture. These factors highlight the intricate interplay between a career path and accumulated wealth. These factors are essential for any meaningful assessment of an individual's financial standing and longevity.

7. Market Value

Market value, a crucial component in evaluating net worth, represents the estimated worth of assets based on current market conditions. For an individual like Jerry Rivera, assessing market value is essential in determining the true worth of holdings. Fluctuations in market values directly impact the overall financial picture.

- Real Estate Valuation

Real estate holdings constitute a significant portion of net worth for many individuals. The current market value of properties, influenced by factors such as location, size, and condition, is crucial for calculating overall financial standing. A property's market value can fluctuate based on local economic trends, construction costs, and competing properties in the area. Decreases in market value can impact net worth negatively, while increases can enhance it. The market value of properties owned by Jerry Rivera, or any individual, is a key component in their overall financial evaluation.

- Investment Portfolio Assessment

Investments, including stocks, bonds, and other securities, are evaluated based on current market prices. Fluctuations in market value directly affect the total worth of the investment portfolio. Factors like market trends, economic indicators, and company performance significantly impact the market value of investments. The estimated worth of Jerry Rivera's investments, for example, is influenced by market-determined values of the securities held. This highlights the sensitivity of an investment portfolio to market volatility. Understanding market trends is essential for assessing investment value.

- Impact of Economic Conditions

Economic conditions, including inflation and interest rates, influence market values. Periods of inflation often see rising market values, while recessions typically cause declines. The specific economic climate plays a direct role in the overall value of assets. Economic downturns may decrease the market value of assets held by Jerry Rivera, or any individual, highlighting the connection between broader economic conditions and personal finances.

- Valuation Methodologies

Various methodologies exist for determining market value. Appraisals, often conducted by licensed professionals, assess the worth of properties and other assets. Market comparisons, considering similar properties or assets in the area, provide insights. The accuracy of the methodology employed directly impacts the reliability of the market value assessment. Understanding the methodology behind valuation ensures a realistic evaluation of assets like those held by Jerry Rivera.

In conclusion, market value is an integral element in determining Jerry Rivera's net worth. Fluctuations in asset values based on current market conditions influence the overall assessment of wealth. Economic indicators, investment performance, and valuation methodologies all contribute to the intricate relationship between market value and an individual's financial standing. A clear understanding of market value principles ensures a more accurate reflection of the true financial picture.

Frequently Asked Questions about Jerry Rivera's Net Worth

This section addresses common inquiries regarding the financial standing of Jerry Rivera. Information presented is based on publicly available data and analysis. Exact figures are often unavailable or subject to interpretation.

Question 1: How is net worth determined for Jerry Rivera, or any individual?

Net worth represents the total value of assets minus liabilities. Assets include tangible items (real estate, vehicles, art) and intangible assets (intellectual property, investments). Liabilities encompass debts (loans, mortgages). Calculating net worth requires careful valuation of all assets and liabilities at a specific point in time.

Question 2: What are the key factors influencing Jerry Rivera's net worth?

Various factors influence an individual's net worth. These include income sources (salary, investments, royalties), expense management, investment performance, debt levels, and market conditions. Career longevity and industry trends also play crucial roles.

Question 3: Is Jerry Rivera's net worth publicly available?

Publicly available information about an individual's net worth is often limited. Precise figures are rarely released, and estimations rely on diverse, often indirect, data points.

Question 4: How reliable are estimations of net worth for celebrities?

Estimates of celebrity net worth often rely on reported income, public records, and market analyses. These estimates may not always be perfectly accurate. Discrepancies may exist between reported figures and true financial positions due to the complexities of private investment portfolios, and the reliance on third-party reporting.

Question 5: Why is understanding net worth important?

Understanding net worth provides a snapshot of an individual's financial position. It offers insights into career success and the potential impact of life choices on wealth accumulation. This can also provide context for their public image and potential investments.

In conclusion, while precise figures for Jerry Rivera's net worth may not be publicly available, understanding the underlying principles of net worth calculation and the influential factors offers a more comprehensive perspective. Precise figures aren't always accessible; reliable estimations and publicly available information help provide a nuanced view of the individual's financial standing.

The next section will delve into the broader career trajectory of Jerry Rivera.

Conclusion

This exploration of Jerry Rivera's financial standing has highlighted the multifaceted nature of assessing net worth. Factors such as income sources, investment performance, expense management, debt levels, and market conditions all play significant roles. The analysis demonstrates that precise figures are often unavailable or subject to interpretation, and estimations rely on a combination of reported data, public records, and market analyses. The complexity of calculating and understanding net worth, even for public figures, underscores the importance of reliable data sources and accurate methodologies. The various facets of income, expense management, and debt burden presented in this examination, combined with the influence of investment choices and market factors, offer a comprehensive view of the financial realities surrounding individuals in similar professional contexts.

While precise figures may remain elusive, this investigation serves as a case study in evaluating the dynamic relationship between career, personal choices, and financial outcomes. The exploration encourages critical thinking about the diverse factors shaping individual financial situations. A clear understanding of these factors is crucial for anyone seeking to assess, plan, or understand financial realities, whether for personal or professional purposes. Future investigations into similar financial situations will benefit from a comprehensive understanding of the interconnectedness of various factors, including industry trends, market volatility, and individual financial strategies. The pursuit of deeper, more nuanced understandings of such complexities will inform more responsible and ethical financial dealings.

Detail Author:

- Name : Ms. Jeanne Heathcote DDS

- Username : larson.fidel

- Email : gconnelly@gmail.com

- Birthdate : 2006-07-14

- Address : 64282 Hirthe Glen Suite 523 Lake Jedidiah, MD 59200

- Phone : 540.327.3891

- Company : Bode-Schuster

- Job : Telemarketer

- Bio : Iusto quam laudantium est sapiente nostrum doloribus sit. Itaque dolore quasi eos odio labore labore. Quia distinctio perferendis neque aut consequatur.

Socials

twitter:

- url : https://twitter.com/camryn_lubowitz

- username : camryn_lubowitz

- bio : Impedit mollitia aliquam est. Rerum consequatur cum rerum. Quos quia delectus earum voluptas totam sit impedit.

- followers : 2124

- following : 1206

linkedin:

- url : https://linkedin.com/in/camryn_real

- username : camryn_real

- bio : Distinctio quis qui fugiat ducimus ea molestias.

- followers : 6200

- following : 1137

tiktok:

- url : https://tiktok.com/@camryn6951

- username : camryn6951

- bio : Sint quis commodi molestias ut rerum delectus omnis.

- followers : 4782

- following : 1679