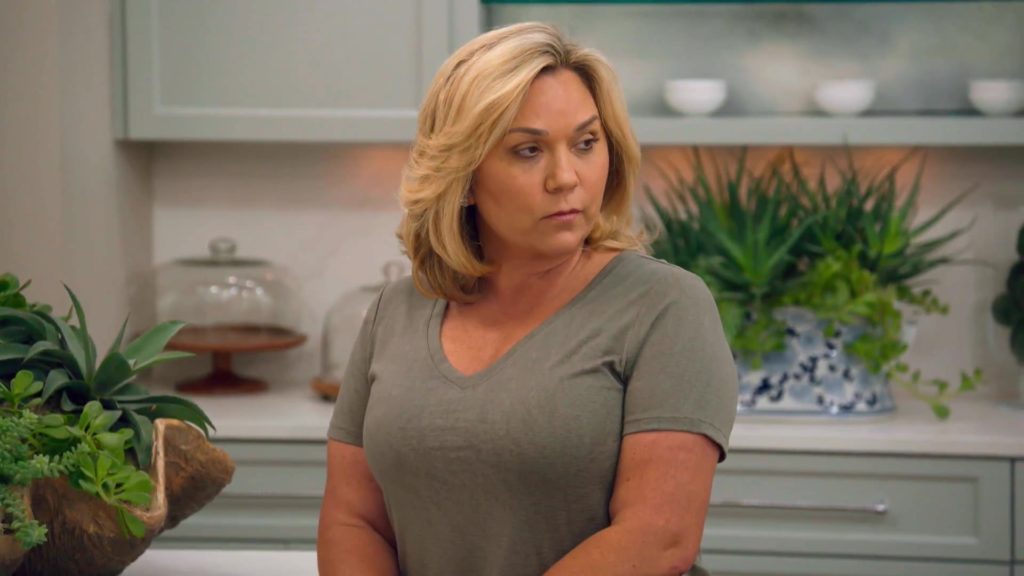

Julie Chrisley's 2024 Net Worth: Revealed!

Estimating a public figure's financial standing can be complex. A precise figure for Julie Chrisley's 2024 net worth is not publicly available.

The concept of "net worth" represents the total value of an individual's assets (like property, investments, and cash) minus their liabilities (like debts and loans). Determining this figure for any person requires access to detailed financial records, a task often difficult for public figures given privacy concerns and potential complexities in reporting. While various online sources may attempt to estimate net worth, these estimates are often approximations rather than definitive figures.

Understanding a celebrity's financial position can be of interest for various reasons. The information might relate to assessing their lifestyle choices, the success of their endeavors, or the impact of past legal proceedings and business ventures. However, it is crucial to distinguish between readily available estimations and precise, verified values. Public perception of wealth can significantly affect a person's reputation and influence within their field. Reliable financial data is often essential for evaluating the economic impact of a celebrity's activities.

| Category | Data |

|---|---|

| Name | Julie Chrisley |

| Profession | Reality TV personality, businesswoman |

| Known For | "Chrisley Knows Best" |

| Relevant Legal Proceedings (Note: This is not exhaustive.) | Possible impact on financial standing. |

Further exploration into Julie Chrisley's financial history, including her various ventures and legal matters, might provide a more thorough understanding of her economic position. This context will be relevant for articles discussing the overall state of the celebrity economy.

Julie Chrisley's Net Worth 2024

Accurate financial figures for public figures are often elusive. Estimating a celebrity's net worth, particularly one undergoing legal or business transitions, can be complex. These key aspects provide insight into the challenges of determining a definitive figure for Julie Chrisley in 2024.

- Financial Records

- Legal Proceedings

- Business Ventures

- Asset Valuation

- Liability Assessment

- Public Perception

- Estimation Complexity

Determining Julie Chrisley's 2024 net worth requires examining her financial records, considering the impact of legal proceedings and business ventures. Asset valuation and liability assessment are crucial components. Public perception of her wealth, and the inherent complexity of estimations for public figures, add further layers of difficulty. For example, a business downturn or legal settlements can drastically affect a person's financial standing. Connections between these aspects reveal the multifaceted nature of assessing a celebrity's financial position, highlighting the need for comprehensive research and clear definitions when discussing such estimations.

1. Financial Records

Accurate financial records are fundamental to determining net worth, particularly for public figures like Julie Chrisley. These records provide a verifiable history of assets, income, and expenditures, crucial for establishing a complete financial picture. Their absence or inaccessibility significantly complicates efforts to calculate a precise net worth figure for any individual.

- Asset Valuation

Financial records document the various assets held by an individual, including real estate, investments, and personal property. Proper valuation of these assets is essential. Accurate appraisals for real estate, stock portfolios, and other holdings are crucial for an accurate net worth calculation. Inadequate or outdated documentation can lead to significant inaccuracies in the final figure.

- Income and Expense Statements

Detailed income and expense statements provide a clear picture of an individual's financial inflows and outflows. These records track sources of income (salary, investments, business profits) and expenditures (taxes, personal expenses, debt repayments). Discrepancies or missing entries in these statements hinder a comprehensive understanding of financial health and net worth.

- Tax Returns

Tax returns, often a public record for businesses or individuals, provide valuable insights into an individual's income and deductions. These documents serve as a vital source for verifying declared earnings and liabilities, crucial for calculating net worth. Inconsistencies or missing tax documents can complicate or obscure the process of determining a precise net worth.

- Liability Documentation

A comprehensive assessment of net worth requires identifying and documenting all outstanding liabilities. This includes loans, mortgages, credit card debt, and any other financial obligations. A thorough accounting of these liabilities is essential for calculating the net worth figure accurately. Unreported liabilities lead to a misrepresentation of the actual financial position.

In the case of Julie Chrisley, the availability and accessibility of these financial records are likely central to determining a precise net worth. Without comprehensive records, estimates remain approximations, rather than accurate reflections of her financial standing. The reliability of publicly available information, or potentially court-mandated disclosures, becomes pivotal for any comprehensive analysis of her net worth. These crucial records provide the framework for a complete financial narrative that helps determine her current financial situation, thereby linking it to the overall topic of her net worth.

2. Legal Proceedings

Legal proceedings can significantly impact a person's net worth. Cases involving lawsuits, settlements, or judgments can directly affect assets, income, and liabilities. For public figures like Julie Chrisley, legal proceedings can be highly consequential, potentially altering the perception of their financial standing and impacting the calculation of their net worth in a given year. The outcomes of these legal processes may involve financial penalties, asset forfeitures, or court-ordered settlements, all of which would influence the calculation of net worth. For instance, a substantial judgment against an individual can drastically reduce their net worth, while favorable settlements or the successful resolution of legal disputes could have a positive effect.

The interplay between legal proceedings and net worth is not merely a theoretical concept. Real-world examples demonstrate the direct correlation. A significant judgment against a business owner or individual can reduce the value of their assets, especially if assets are seized or encumbered as part of the court order. Conversely, a favourable settlement or the resolution of a legal challenge could free up financial resources, positively impacting net worth. Such court-mandated actions would invariably be reflected in the calculation and reporting of a person's net worth during the relevant period. The impact of legal proceedings is not limited to the immediate financial consequences; it extends to perceptions, influencing public and professional opinions and potentially affecting future business or investment opportunities.

Understanding the connection between legal proceedings and net worth is critical for accurate assessment and analysis. For individuals like Julie Chrisley, where legal matters have been publicly documented, examining the financial implications of these proceedings is crucial to a comprehensive understanding of their net worth for a specific year. The potential for court-ordered financial repercussions, asset dispositions, or settlements must be factored in when interpreting and contextualizing estimations of net worth. This perspective offers a more holistic understanding of the dynamics involved in financial reporting for public figures, particularly when legal challenges or controversies are present. Such nuances are often necessary when considering figures related to net worth.

3. Business Ventures

Business ventures directly impact a person's net worth. Success in these endeavors generates income and increases assets, positively influencing the calculation. Conversely, unsuccessful ventures or mismanagement can lead to losses and a reduction in net worth. For individuals like Julie Chrisley, whose career includes business ventures, the financial health of these activities plays a substantial role in determining her net worth in any given year.

The types of business ventures undertaken, and their performance, are crucial factors. A profitable business generates income and increases assets. This income can be reinvested to grow the business further or used to purchase additional assets, leading to an overall increase in net worth. Conversely, if a venture incurs significant losses, it reduces the value of assets and can lead to a decline in net worth. The specific financial performance of these ventures, including revenue, expenses, and profits, directly impacts the net worth calculation. For example, successful investments yield returns, contributing to the overall asset value. Conversely, if a business venture suffers from financial mismanagement, operational problems, or unfavorable market conditions, the potential for a negative impact on net worth becomes apparent. The overall health and success of the ventures undertaken during 2024, along with the specific financial performance of each, become central to the assessment of Julie Chrisley's net worth for that year.

The significance of business ventures lies in their ability to influence asset growth and liability management. Success leads to increased assets and income, thus positively impacting net worth, while failures, mismanagement, or unforeseen challenges can negatively affect it. Understanding this connection is crucial for analyzing and evaluating the factors impacting Julie Chrisley's net worth in 2024. The results of these ventures are fundamental to the overall net worth figure and provide crucial insights into the overall financial health and trajectory of the person.

4. Asset Valuation

Accurate asset valuation is fundamental to determining Julie Chrisley's net worth in 2024. The total value of assets, subtracted from liabilities, determines net worth. Precise valuation of assets is critical for a reliable assessment. Various factors, including market conditions, condition of assets, and potential future use, influence this valuation.

- Real Estate Valuation

Appraisals of real estate holdingshomes, land, or commercial propertiesare essential. Factors such as location, size, condition, comparable sales, and local market trends are crucial to arriving at a fair market value. Changes in property value, especially if related to any legal proceedings, should be documented and reflected in the net worth calculation. Fluctuations in real estate markets can affect the assessed worth of property owned by Julie Chrisley in the year 2024.

- Investment Portfolio Valuation

Determining the value of investment holdings, including stocks, bonds, and other financial instruments, requires careful analysis. Market fluctuations, current market conditions, and the overall performance of the portfolio significantly impact the total value. An accurate valuation of investments in 2024 is necessary for a precise determination of her net worth.

- Personal Property Valuation

Valuations of personal property, including vehicles, artwork, or collectibles, require specialized assessments. Factors such as condition, rarity, and market demand for similar items influence their valuation. Accurate assessment of personal possessions is important for a comprehensive calculation of Julie Chrisley's total assets.

- Business Valuation (if applicable)

If Julie Chrisley owns businesses, professional valuations are necessary. These assessments consider factors such as revenue, profit margins, market share, and projected future growth. Assessing the value of businesses is often more complex than assessing other assets, demanding expertise in accounting and business analysis.

Accurate valuation of all relevant assets is a prerequisite for determining Julie Chrisley's net worth in 2024. Failure to appropriately assess assets, either due to inaccurate appraisals or neglect of key elements, will result in an incomplete and potentially misleading net worth figure. Thorough and reliable valuation procedures ensure the accuracy and reliability of the calculated net worth. Careful consideration of all relevant factors and utilization of expert evaluations ensures an accurate financial picture, which is essential for a comprehensive understanding of the financial state of individuals like Julie Chrisley.

5. Liability Assessment

Assessing liabilities is integral to calculating Julie Chrisley's net worth in 2024. Liabilities represent financial obligations, such as debts, loans, and outstanding payments. Accurate accounting for these obligations is critical for a precise net worth determination. Omitting or misrepresenting liabilities leads to a distorted picture of her financial health. Subtracting liabilities from assets yields the net worth figure, reflecting her financial standing.

- Outstanding Debts

This category encompasses various forms of debt, including credit card balances, mortgages, and personal loans. A comprehensive list of outstanding debts, along with their associated interest rates and repayment schedules, is necessary. High levels of outstanding debt negatively impact net worth. Delinquent payments or substantial loan amounts impact the final net worth calculation directly.

- Tax Obligations

Unpaid or underpaid taxes, including income taxes, property taxes, and sales taxes, constitute significant liabilities. The amount owed in taxes influences the ultimate net worth calculation. Accurate assessment necessitates an examination of tax returns and any outstanding tax liabilities during 2024.

- Legal Judgments and Settlements

Court-ordered payments resulting from judgments or settlements represent substantial liabilities. Failure to accurately account for these obligations distorts the net worth calculation. The terms of legal settlements and judgments, including amounts and repayment schedules, are vital to an accurate liability assessment in 2024.

- Unpaid Bills and Accounts Payable

Unpaid bills, such as utility bills, vendor invoices, and outstanding accounts payable, represent short-term and potentially long-term financial obligations. A complete assessment requires identifying and quantifying these debts to ensure the final net worth accurately reflects all existing financial commitments.

Accurate liability assessment is essential in the calculation of Julie Chrisley's net worth in 2024. Ignoring or underestimating any form of debt leads to an inaccurate representation of her financial health. A complete and precise assessment of all relevant liabilities during this specific period is crucial for a clear and comprehensive picture of her overall financial position. This approach ensures a more complete and realistic portrayal of Julie Chrisley's financial standing.

6. Public Perception

Public perception plays a significant role in shaping the perceived net worth of individuals like Julie Chrisley. While precise net worth figures remain elusive, the public's understanding and image of a person's financial standing can significantly influence estimations and, potentially, the actual market valuation of assets. Favorable public opinion can enhance the perceived value of a person's assets, while negative sentiment can depress it, even in the absence of tangible changes in financial standing. This connection between perception and valuation underscores the importance of understanding how the public views a figure's financial health.

Factors contributing to public perception of financial status are multifaceted. Media portrayals, legal proceedings, and business ventures all contribute. A celebrity's lifestyle choices, high-profile purchases, and perceived lavishness can fuel public speculation about their wealth. Conversely, negative publicity, particularly legal issues or business failures, can lead to a decline in the perceived net worth, even if the reality remains unchanged. Public perception is not always a direct reflection of reality, but it nonetheless exerts a strong influence on how Julie Chrisley's financial standing is perceived.

Understanding the connection between public perception and perceived net worth is crucial for a nuanced perspective. Public opinion does not replace precise financial reporting, but it represents a critical component of the broader context surrounding a figure like Julie Chrisley. Public perception often interacts with actual financial details in complex ways. This necessitates a careful consideration of the interplay between reported financial information, legal proceedings, media portrayals, and public opinion to develop a comprehensive view of a person's financial situation. A critical evaluation of the available information, including the potential for biases and inconsistencies in public perception, is essential to avoid misinterpretations and ensure a thorough understanding.

7. Estimation Complexity

Estimating the net worth of a public figure like Julie Chrisley in 2024 presents significant complexity. This stems from multiple interwoven factors. Access to complete and accurate financial records is often limited, particularly when dealing with individuals whose business dealings are intertwined with ongoing legal proceedings. Complex financial structures, including multiple business entities and intricate investment portfolios, add layers of difficulty. Furthermore, fluctuations in market values of assetsreal estate, investments, and personal property necessitate ongoing appraisal and valuation. These factors create significant challenges for anyone attempting to determine a precise net worth figure.

The estimation process is further complicated by potential biases in publicly available information. Media portrayals and public perception can significantly influence estimations, even in the absence of documented financial changes. Furthermore, the dynamic nature of financial situations necessitates frequent updates and re-evaluations. Changes in market conditions, legal outcomes, or business performance significantly impact an individual's financial position. This inherent dynamism requires regular monitoring and adjustment of estimations to reflect the most current and accurate picture. For example, if a business venture experiences a downturn, or a significant judgment is levied, the net worth estimation must account for those changes.

Understanding the inherent complexity of net worth estimation is crucial. It emphasizes the limitations of readily available information and highlights the need for cautious interpretation of publicly reported figures. Accurate estimation requires access to comprehensive financial records, expert valuation of assets, and a nuanced understanding of related legal and business issues. Without these foundational components, estimations of Julie Chrisley's 2024 net worth are subject to significant inherent uncertainties. This understanding allows for a more realistic and balanced perspective on reported financial figures, especially for individuals involved in complex business dealings, legal proceedings, or volatile financial markets.

Frequently Asked Questions about Julie Chrisley's Net Worth in 2024

Determining the precise net worth of public figures like Julie Chrisley in a specific year presents challenges due to the complexity of financial information and the potential for inaccuracies in reported figures. This FAQ section addresses common questions regarding Julie Chrisley's financial standing in 2024, providing clarity on the available information and the limitations of estimation.

Question 1: What is the precise net worth of Julie Chrisley in 2024?

A definitive figure for Julie Chrisley's 2024 net worth is not publicly available. Publicly accessible financial records for individuals are often incomplete or inaccessible. Public figures often manage their finances through multiple accounts and business entities, further complicating the calculation of a precise net worth. Estimates are frequently approximations based on available information rather than verified financial statements.

Question 2: How do legal proceedings affect net worth estimations?

Legal proceedings, including lawsuits and settlements, can significantly impact a person's financial standing. These proceedings might involve asset seizures, judgments, or settlements. Outcomes of such processes directly affect the calculation of net worth by altering asset values, liabilities, and potential income streams. Analysis of the financial implications of legal proceedings is essential for an accurate estimation.

Question 3: How are business ventures reflected in net worth calculations?

Business ventures impact net worth calculations through their financial performance. Successful ventures increase assets and income, while unsuccessful ventures or mismanagement can lead to losses, thereby decreasing net worth. Financial details associated with these endeavorsrevenue, expenses, profits, and lossesare critical for accurately representing the overall financial position.

Question 4: Why are valuations of assets important to net worth estimation?

Asset valuation is essential for calculating net worth, as it determines the total value of assets held. Accurate valuations of assets like real estate, investments, and personal property are fundamental for a precise calculation. Market fluctuations, current market conditions, and the overall performance of assets directly influence their values. Incorrect or outdated valuations significantly affect the overall net worth calculation.

Question 5: How does public perception influence the perceived net worth?

Public perception of a person's financial status often differs from the actual financial standing. Media portrayals and lifestyle choices can significantly impact public perception of wealth. Favorable or unfavorable publicity can influence estimations, even if the actual financial situation remains unchanged. Public perception is not a substitute for verifiable financial data.

Understanding these factors highlights the complexity and potential for uncertainty in estimating a public figure's net worth. Precise figures are often unattainable without complete and verified financial records.

Moving forward, we will delve into the specifics of Julie Chrisley's career, legal proceedings, and business ventures to gain a deeper understanding of the factors influencing her financial situation.

Conclusion

Determining a precise net worth for Julie Chrisley in 2024 proves challenging. The process necessitates access to comprehensive financial records, including meticulous documentation of assets, liabilities, and income streams. Complex business ventures, legal proceedings, and fluctuating market conditions further complicate the calculation. Public perception, though influential, cannot substitute for verifiable financial data. Consequently, estimations remain approximations rather than definitive figures. Key factors such as asset valuations, liability assessments, and the impact of legal settlements heavily influence the outcome. Accurate reporting requires detailed documentation, expert valuations, and transparency in financial disclosures, aspects often absent in public figures' financial affairs.

The complexities inherent in calculating a precise net worth highlight the limitations of publicly available information. The absence of readily accessible financial data underscores the necessity for critical analysis and awareness of potential biases. While estimates may offer a general understanding, a precise calculation demands thorough, transparent financial reporting. Future exploration into Julie Chrisley's financial dealings should focus on reliable sources that provide greater clarity on her financial situation in 2024, offering a more nuanced and accurate representation of her financial standing.

Detail Author:

- Name : Candido Abbott

- Username : dcollier

- Email : alvis.hilpert@hotmail.com

- Birthdate : 1975-11-30

- Address : 9428 Bayer Mill Suite 969 Port Maeview, OH 70657

- Phone : +1-704-649-3782

- Company : Carroll-Sanford

- Job : Biologist

- Bio : Ut enim amet ut qui. Dolor quibusdam dicta suscipit totam explicabo et deserunt doloribus. Quis libero doloribus vero occaecati voluptatum qui. Voluptas et unde magnam voluptas deserunt sunt est.

Socials

instagram:

- url : https://instagram.com/stantonm

- username : stantonm

- bio : Delectus in mollitia expedita deleniti. Molestiae officia omnis earum mollitia a vero saepe.

- followers : 6388

- following : 1892

tiktok:

- url : https://tiktok.com/@stanton2021

- username : stanton2021

- bio : Cupiditate ut molestiae unde inventore dolorem.

- followers : 430

- following : 1491

facebook:

- url : https://facebook.com/maximillianstanton

- username : maximillianstanton

- bio : Iusto ut magnam repudiandae consequatur quas sit.

- followers : 3072

- following : 1026