Justin Leonard Net Worth 2024: Updated Figures & Earnings

How much is Justin Leonard worth? A Look at the Professional Golfer's Financial Standing.

Justin Leonard's financial standing reflects his successful career in professional golf. It encompasses all assets, including but not limited to, accumulated earnings from prize money, endorsements, and investments. Quantifying this precise figure requires access to detailed financial records, which are typically not publicly available.

Understanding an athlete's net worth provides insight into their financial success. Such information is valuable for appreciating the economic impact of a professional career. Successful athletes frequently leverage their fame for endorsement deals and investments, contributing to their overall wealth. A notable factor is the duration and consistency of a career in a high-demand field like professional golf. High performance yields significant reward, including prize money, appearance fees, and lucrative endorsement deals over an extended career span.

- Real World Skeletons Season 30 Premieres Unseen Secrets Revealed

- Quavo Net Worth 2024 Updated Earnings Amp Lifestyle

| Category | Details |

|---|---|

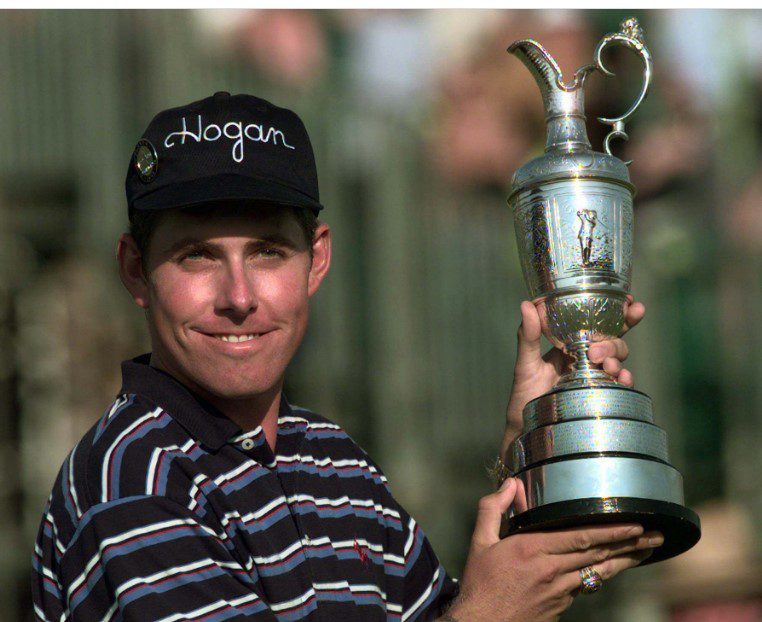

| Full Name | Justin Leonard |

| Profession | Professional Golfer |

| Notable Achievements | Multiple PGA Tour victories, including the 1997 PGA Championship |

| Years Active | 1990s to 2000s and sporadically beyond |

This information serves as a springboard for further exploration into the intricacies of professional athlete financial management. A detailed analysis of the factors influencing a player's financial success, from performance to endorsements, would offer a deeper understanding. Examining the fluctuations in earnings over time, the impact of endorsements on net worth, and the role of investment strategies could provide more specific and valuable conclusions.

Justin Leonard Net Worth

Understanding Justin Leonard's net worth requires examining various financial elements of his career, including earnings from tournaments, endorsements, and investments. This comprehensive overview highlights key aspects that contribute to his overall financial standing.

- Prize Money

- Endorsements

- Investments

- Real Estate

- Management

- Career Length

- Performance Fluctuation

- Tax Implications

Justin Leonard's substantial prize money from numerous PGA Tour victories is a significant contributor to his net worth. Endorsement deals with various companies add to his financial standing. His potential investments in real estate or other ventures could further augment his wealth. The long-term management of financial assets plays a role, as does the impact of peaks and valleys in his performance on tournament earnings. Tax implications, always present, impact any substantial income and investment strategy, influencing the true measure of financial success. A prolonged career in professional golf often translates to a high overall financial standing.

1. Prize Money

Prize money constitutes a substantial component of professional athletes' overall financial standing. For figures like Justin Leonard, tournament winnings form a crucial element in the calculation of overall net worth. This section explores the significance of prize money in the context of his career and financial profile.

- Direct Correlation with Performance

Prize money directly reflects tournament performance. Successful finishes in major championships and other high-profile events yield significant rewards. This direct link between on-course success and financial gain is fundamental to understanding how prize money impacts overall net worth.

- Frequency and Magnitude of Winnings

The frequency and magnitude of tournament winnings vary depending on factors like tournament strength, field quality, and the golfer's form. Consistent strong performances generate substantial prize money over time, contributing significantly to a player's accumulated wealth. Conversely, periods of lesser performance lead to smaller winnings.

- Impact on Career Longevity

High prize money often attracts sponsors and endorsements, which, in turn, can extend a professional career beyond a purely performance-based model. The potential for financial security, derived from prize money, enables athletes to focus on consistent performance throughout their careers. A significant prize-winning track record, like that of prominent figures, also often attracts investment opportunities.

- Comparison with Other Income Streams

Prize money should be considered alongside other income streams, such as endorsements and investments. Evaluating the relative contributions of different revenue sources to an athlete's total earnings provides a more comprehensive understanding of their financial situation. The proportion of prize money to total earnings varies considerably between athletes.

In summary, prize money is a primary driver of Justin Leonard's financial success. Its direct correlation with on-course performance, combined with the potential for long-term income, underscores its importance in his overall financial picture. However, a comprehensive evaluation of his net worth must incorporate other income sources as well.

2. Endorsements

Endorsement agreements represent a significant component of professional athletes' financial portfolios. For individuals like Justin Leonard, who achieved prominent success in professional golf, endorsement deals played a pivotal role in shaping their overall net worth. These agreements often result from recognition and popularity, translating into lucrative contracts with various companies. The value of these endorsements is directly linked to the athlete's public image, visibility, and the perceived value they bring to a brand.

The value of an endorsement deal is contingent on multiple factors. These include the athlete's visibility, their perceived influence over target demographics, and the alignment between the athlete's persona and the values represented by the endorsing brand. Strong endorsements frequently involve a mix of financial considerations, marketing benefits, and strategic partnerships. A successful endorsement deal provides the athlete with immediate financial returns in addition to long-term value. The successful endorsements of prominent figures illustrate the practical impact of public recognition on financial standings. Analysis of past and present agreements reveals a strong correlation between market appeal and financial gain.

In summary, endorsement deals are a critical factor in the financial success of prominent figures in professional sports. The value of these deals, driven by factors including public visibility and brand alignment, can significantly augment an athlete's net worth. The complex interplay between an athlete's reputation and the marketplace can produce substantial financial returns. Understanding the mechanics of endorsement agreements offers valuable insights into the strategies employed by successful professionals to maximize their earning potential beyond prize money.

3. Investments

Investments play a significant role in augmenting an athlete's overall net worth. For figures like Justin Leonard, investments, if made astutely, can provide a substantial supplementary income stream, independent of tournament winnings or endorsements. This section examines the crucial link between investment strategies and long-term financial security for professional athletes. Successful investment decisions, often built upon careful planning and market analysis, can significantly contribute to a substantial increase in net worth over time.

The practical significance of investment strategies becomes clear when considering the fluctuating nature of an athlete's income. Tournament winnings, while substantial in high-performance periods, can experience fluctuations. Investments can act as a stabilizing force, generating consistent returns, and smoothing out potential income disparities. Diversification across various investment vehicles, like stocks, bonds, or real estate, can mitigate risk and potentially increase overall returns. Professional financial advisors specializing in athlete wealth management often assist in these decisions.

In conclusion, investments are not merely an ancillary aspect of an athlete's financial success but a critical component. By understanding and employing prudent investment strategies, individuals like Justin Leonard can potentially create a robust financial foundation that extends beyond their active career. While no investment guarantees success, thoughtful financial planning, often with the guidance of qualified professionals, can significantly enhance the long-term sustainability of their net worth.

4. Real Estate

Real estate investments can significantly contribute to an athlete's overall net worth. For individuals like Justin Leonard, with substantial income streams from professional golf, the acquisition and management of real estate holdings can represent a substantial portion of their total assets. This often translates into a diversification of income, providing a steady source of returns beyond prize money and endorsements. The value of real estate holdings is typically influenced by market conditions and the location of the property. Property appreciation or rental income can generate revenue independent of other income sources.

The acquisition of real estate involves several key considerations for athletes. Liquidity, or the ability to quickly convert an asset to cash, can be a critical factor. The potential for long-term appreciation and consistent income from rentals presents a significant appeal. However, factors such as property taxes, maintenance costs, and potential market fluctuations all need careful consideration. The geographical location and local economic climate play a crucial role in a property's potential appreciation. Professional financial advisors can provide valuable insights in evaluating these factors and navigating the complexities of real estate transactions. Strategic property management plays a critical role in maximizing returns and minimizing risk. Examples of successful athletes who have strategically incorporated real estate into their portfolios demonstrate the potential benefits and complexities of such investments.

In conclusion, real estate can be a substantial component of an athlete's net worth. While risk factors exist, the potential for long-term appreciation and steady income streams makes this an important asset class to consider. Understanding the nuances of real estate investments, along with the advice of qualified professionals, is crucial for individuals seeking to effectively incorporate this strategy into their overall financial planning. Careful consideration of factors such as market conditions, property location, and potential financial burdens is essential for maximizing the benefits and mitigating potential risks associated with real estate holdings.

5. Management

Effective management is crucial in maximizing an athlete's financial potential, significantly impacting a figure like Justin Leonard's net worth. Sound management encompasses a range of strategies, from financial planning and negotiation to risk mitigation and asset protection. The role of a skilled management team extends beyond day-to-day operations, influencing both short-term gains and long-term financial security.

Strategic financial planning, often facilitated by experienced financial advisors, is paramount. This involves developing and executing a comprehensive budget, optimizing tax strategies, and diversifying investments to mitigate risk. The management of endorsements, a critical component of an athlete's income, requires skillful negotiation and contract evaluation to ensure maximum return. The management of a high-profile individual like Leonard necessitates careful handling of public image and brand representation, crucial elements impacting endorsement opportunities and long-term value. A well-structured management team ensures these elements are considered and leveraged effectively. Examples of athletes with successful management teams demonstrate the correlation between effective leadership and improved financial outcomes. Analysis of financial records often reveals a direct connection between competent management and an athlete's accumulated wealth.

Ultimately, effective management is a fundamental aspect of building and safeguarding substantial net worth for athletes. Without careful planning, negotiation, and risk mitigation, the full potential of earnings and asset growth can be lost. This underscores the importance of well-structured teams and the strategic approach needed for maximizing returns within the complex financial landscape of professional sports. The successful management of financial resources can significantly enhance and secure long-term financial stability. The management process should be adapted to reflect the changing priorities and needs of an athlete throughout their career, ensuring financial security and well-being.

6. Career Length

The duration of a professional athlete's career is intrinsically linked to their accumulated wealth. Career length directly impacts the opportunity for sustained income generation, influencing factors such as prize money, endorsements, and investments. A longer career often equates to greater earning potential, but factors beyond longevity also contribute to overall financial success.

- Sustained Income Generation

A longer career provides more opportunities to earn from prize money, especially in high-profile tournaments. The consistency of income over a longer period allows for investment strategies that compound returns and enhance long-term financial security. In contrast, a shorter career may limit the scope for substantial prize money accumulation.

- Increased Endorsement Opportunities

Athletes with extended careers generally have more opportunities for endorsement deals. Established reputations and consistent high-profile performance often translate into more lucrative and sustained endorsement contracts. Furthermore, prolonged exposure to a wider audience often leads to a greater range of potential partners, potentially maximizing earning potential through endorsements.

- Investment Portfolio Diversification

The extended earning potential from a lengthy career allows for greater investment diversification. Athletes with longer careers have more time to establish significant investment portfolios, which can yield returns that contribute significantly to overall net worth. Consistent income streams, derived from a long career, facilitate the growth and maturity of well-structured investment plans.

- Risk Mitigation through Time

A longer career allows time to mitigate potential financial risks. Sustained high performance over a longer period minimizes the financial impact of short-term downturns in performance or injury, factors that might severely hamper the income generation of athletes with shorter careers. The accumulation of substantial financial assets throughout a long career acts as a buffer, enhancing long-term security.

In summary, career length is a critical component in shaping an athlete's financial standing. The accumulated income over time, whether from prize money, endorsements, or investments, directly correlates with the overall net worth of professional figures like Justin Leonard. A longer career not only offers more opportunities for income but also allows for strategic financial planning and risk mitigation, ultimately contributing to a more substantial financial legacy. However, exceptional performance and sound financial management are critical regardless of career duration. Consequently, a successful athlete with a shorter career might still achieve substantial wealth through focused performance and shrewd financial decisions, illustrating the complex interplay of factors.

7. Performance Fluctuation

Performance fluctuations are a significant factor influencing the financial trajectory of professional athletes. For an athlete like Justin Leonard, whose income is heavily tied to tournament results, variations in performance directly correlate with fluctuations in earnings. Understanding this relationship is essential to a comprehensive analysis of his financial standing.

- Impact on Prize Money

Consistently high performance translates to larger prize pools and higher earnings. Conversely, periods of lower performance result in reduced tournament winnings. The magnitude of these fluctuations can be substantial, impacting the overall income generated during a given year or even a career phase. Exceptional performances in major championships dramatically boost earnings, while periods of inconsistent form can significantly reduce income streams.

- Influence on Endorsement Deals

An athlete's public image and perceived value are closely tied to performance. Sustained high performance often leads to more lucrative and extended endorsement agreements. Conversely, a decline in performance may impact an athlete's desirability as an endorser. This dynamic illustrates how performance directly affects a player's market value and the potential for lucrative contracts. Loss of endorsement opportunities can negatively affect overall financial returns.

- Effect on Investment Opportunities

Investment decisions are influenced by the perceived financial stability of an athlete. A consistently successful athlete may command higher valuations for potential investment opportunities or attract greater interest from investors. Conversely, significant performance drops could deter investors or reduce the valuation of existing investments. Therefore, performance fluctuation influences the perception of financial risk, affecting both the accessibility and attractiveness of various investment options.

- Role in Overall Financial Planning

Athletes must plan for periods of reduced earnings during career transitions or performance dips. Understanding the potential for performance fluctuations allows for the development of more resilient financial strategies, such as diversification of income streams and appropriate budgeting. Sound financial management becomes even more crucial when dealing with inconsistent performance, mitigating potential financial hardships. An athlete's ability to adapt financial plans to potential performance fluctuations directly impacts long-term financial stability.

In conclusion, performance fluctuation is a critical element to consider when evaluating Justin Leonard's net worth. The interconnectedness of performance with prize money, endorsements, and investment opportunities underscores the dynamic nature of an athlete's financial journey. Planning for these fluctuations, through strategic financial management, is a critical component in building sustained financial security and ultimately influencing the overall net worth of athletes with careers subject to such variability. The extent of the impact depends on the extent and duration of any performance dip, as well as the mitigation strategies in place.

8. Tax Implications

Taxation significantly impacts an athlete's net worth. For a figure like Justin Leonard, understanding the various tax implications associated with his income, endorsements, and investments is crucial to accurately evaluating his total financial standing. Taxes on earned income, capital gains, and various deductions influence the actual amount of wealth available for personal use or reinvestment.

- Income Tax on Prize Money

Tournament winnings constitute a substantial portion of a professional golfer's income. These earnings are subject to federal and potentially state income taxes. The specific tax rate depends on various factors, including the athlete's income level and applicable tax brackets. Accurate record-keeping of all earnings is essential to calculate the correct tax liability and ensure compliance with tax regulations. Failure to accurately report income can lead to penalties and interest charges.

- Taxation of Endorsements and Other Income Streams

Income from endorsements, sponsorships, and other forms of compensation is also subject to taxation. The nature of these agreements often dictates specific tax classifications and associated regulations. Advising with tax professionals specializing in athlete finances is crucial for navigating the complex tax implications associated with diverse income streams. Properly categorizing and reporting these revenues is essential for tax compliance.

- Capital Gains Tax on Investments

Any realized capital gains from investments, such as the sale of assets or property, are typically subject to capital gains tax. These gains are calculated by comparing the sale price to the original purchase price. Understanding the tax rate schedule applicable to capital gains is essential for effective financial planning. The type of investment and the holding period can affect the applicable tax rate. Strategic financial planning can minimize tax liabilities in situations involving capital gains.

- Deductions and Exemptions

Specific deductions and exemptions may be applicable to an athlete's tax situation. Items like professional expenses (equipment, travel, or training), charitable contributions, and business expenses can be significant in reducing tax obligations. Consultations with qualified tax professionals are essential for understanding applicable deductions and their impact on the final tax liability. These deductions play a vital role in optimizing a comprehensive tax strategy for the athlete's financial circumstances.

In conclusion, the intricate web of tax implications associated with professional sports careers like Justin Leonard's significantly affects the actual net worth. Understanding and managing these tax obligations effectively is vital for optimizing wealth accumulation and ensuring compliance with relevant tax regulations. Tax planning, executed by skilled professionals, plays a crucial role in maximizing an athlete's financial outcome, ensuring compliance, and minimizing potential liabilities.

Frequently Asked Questions about Justin Leonard's Net Worth

This section addresses common inquiries regarding Justin Leonard's financial standing. Information presented is based on publicly available data and common financial principles, not definitive estimations of private wealth.

Question 1: What is the precise figure for Justin Leonard's net worth?

Precise figures for an athlete's net worth are rarely publicly available. Publicly accessible information typically encompasses earnings from prize money, endorsements, and investments but often excludes personal assets. Many factors, including private investment decisions and tax liabilities, influence a complete calculation, making a precise figure difficult to ascertain.

Question 2: How does prize money contribute to Justin Leonard's overall financial position?

Prize money from tournaments is a substantial component. Significant victories in major championships contribute significantly to a golfer's accumulated prize earnings. However, consistent performance across a career is crucial in building a substantial prize money total that contributes significantly to the overall financial picture.

Question 3: What role do endorsements play in his net worth?

Endorsement deals are crucial, extending beyond prize winnings. The value of endorsement agreements reflects the athlete's visibility, market appeal, and alignment with a brand's image. These agreements often represent substantial income streams beyond the compensation received from tournaments.

Question 4: How do investments affect his financial standing?

Investments often diversify an athlete's income streams, providing potential for sustained returns beyond immediate earnings. Investment strategies, including diversification and risk management, play a vital role in building long-term financial security. Sound investment choices are crucial for long-term growth in net worth.

Question 5: Are there any public records available regarding his assets?

Publicly accessible records may be limited to official tournament winnings and documented endorsements. Precise details about private investments, personal property, or other assets are often not part of publicly accessible information. Information concerning an athlete's financial holdings often remains private and unavailable to the general public.

Understanding an athlete's financial situation involves recognizing the limitations of publicly available data. Factors such as private investment choices, tax strategies, and personal asset valuations significantly affect the complete picture. This information should be understood in the context of limited public record availability.

This concludes the Frequently Asked Questions section. The following section will now delve into the broader aspects of financial management strategies employed by successful athletes.

Conclusion

Analyzing Justin Leonard's financial standing reveals a complex interplay of factors. Tournament winnings, a substantial component, are directly tied to performance levels. Endorsement agreements, often lucrative, reflect market appeal and brand alignment. Investments, critical for long-term security, can significantly augment overall wealth. Real estate, if strategically acquired and managed, can provide steady income streams. Effective financial management, including sound tax strategies, is crucial for maximizing returns and preserving wealth. Fluctuations in performance, a characteristic of professional sports careers, require adaptive financial strategies. Ultimately, the calculation of Justin Leonard's net worth requires careful consideration of all these elements. Notably, precise figures often remain private, given the inherent complexities and confidentiality surrounding personal finances.

Understanding the factors contributing to an athlete's net worth offers valuable insights into the multifaceted nature of financial success in professional sports. The intricate interplay of performance, endorsements, investments, and effective management strategies underscores the importance of thoughtful planning and execution. Careful consideration of tax implications is fundamental to maximizing financial outcomes and preserving wealth. Furthermore, the dynamic nature of performance fluctuations underscores the need for adaptable and resilient financial planning. This analysis highlights the crucial connection between on-field success and long-term financial stability for individuals navigating the professional sports landscape.

Detail Author:

- Name : Prof. Tremayne Hessel IV

- Username : devyn.russel

- Email : allan27@stokes.info

- Birthdate : 1972-06-07

- Address : 695 Marcia Cliff Ricofurt, NC 06576-7516

- Phone : (737) 369-1944

- Company : Gottlieb Inc

- Job : Market Research Analyst

- Bio : Tenetur officiis sit ea sit est excepturi inventore possimus. Ipsa optio cum nisi nostrum sunt. Illum qui nulla incidunt nulla doloribus eos tenetur. Mollitia alias est et eum placeat.

Socials

instagram:

- url : https://instagram.com/rutherfordh

- username : rutherfordh

- bio : Nisi dicta consequuntur atque. Non dolores sequi minus et aut. A totam ea facere.

- followers : 2959

- following : 13

linkedin:

- url : https://linkedin.com/in/hilda136

- username : hilda136

- bio : Et voluptas tempore ipsum iusto quia.

- followers : 3365

- following : 2043

facebook:

- url : https://facebook.com/rutherfordh

- username : rutherfordh

- bio : Iste rerum et sit sapiente reiciendis qui.

- followers : 2499

- following : 2248

tiktok:

- url : https://tiktok.com/@rutherfordh

- username : rutherfordh

- bio : Rerum quae voluptas et magni. Enim eaque culpa ipsum assumenda provident.

- followers : 3883

- following : 1113