Mark Rypien Net Worth 2023: A Deep Dive

How much is Mark Rypien's fortune? Understanding a notable NFL quarterback's financial standing.

A figure representing an individual's total assets, including investments, real estate, and other holdings, is often crucial for understanding their overall financial position. This figure, for a prominent athlete like Mark Rypien, is a reflection of career earnings and subsequent investments. The exact value fluctuates based on market conditions and financial decisions.

Understanding an athlete's financial standing offers insights into the potential rewards and risks of professional sports careers. It contextualizes the compensation structure for prominent positions like quarterback, highlighting the income disparity and variations within the industry. Rypien's financial situation, like that of any public figure, can be a subject of speculation and analysis. This financial information may affect potential business endorsements, public perception, and career transitions. Additionally, such an evaluation of financial stability in high-profile individuals can provide a tangible example of how personal wealth can be accumulated and managed over time.

| Category | Details |

|---|---|

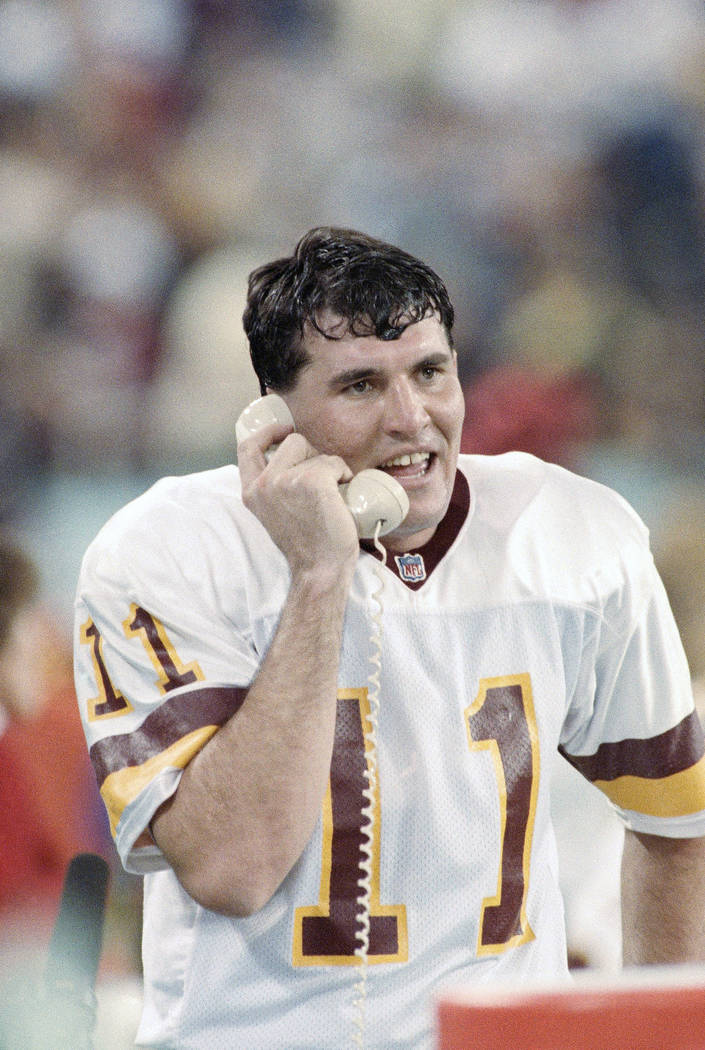

| Full Name | Mark Rypien |

| Profession | Former NFL Quarterback |

| Years Active | 1987-2000 |

| Teams Played For | Washington Commanders (and others) |

Further exploration into athletes' compensation and financial strategies can delve deeper into the intricacies of career trajectories and the complex relationship between athletic talent and financial success. Such analysis could offer a unique lens through which to observe the factors shaping wealth accumulation in professional sports.

Mark Rypien Net Worth

Understanding Mark Rypien's financial standing provides insight into the potential rewards and risks of a professional sports career. This assessment is crucial for evaluating the overall financial success and career trajectory of a prominent athlete.

- Earnings

- Investments

- Real Estate

- Endorsements

- Business Ventures

- Management

Mark Rypien's net worth reflects a combination of his NFL salary, lucrative endorsement deals, shrewd investments, and potentially savvy business decisions. Evaluating these aspects paints a comprehensive picture of his financial situation. For instance, significant earnings from successful football seasons contribute to the overall sum. Investments in real estate or stocks provide avenues for long-term growth, showcasing the importance of financial planning for a career that often ends quickly. Ultimately, a thorough analysis considers not only direct sources of income, but the accumulated value from diverse ventures within his portfolio, highlighting the comprehensive nature of financial success.

- Tex Ritter Net Worth A Deep Dive Into His Earnings

- Lance Armstrongs Net Worth Today A Look At His Legacy

1. Earnings

Earnings represent a substantial component of Mark Rypien's overall net worth. NFL quarterback salaries, particularly during a successful career, directly impact financial accumulation. High-earning seasons, combined with potentially lucrative endorsement deals and other income streams, contribute significantly to the total value of assets. The impact of earnings is multifaceted, influencing the acquisition of assets such as real estate and investments. For instance, substantial earnings from consistent and high-performance seasons provide capital for investment and accumulation, ultimately bolstering the overall net worth. This relationship between earnings and net worth is crucial in understanding the financial trajectory of a professional athlete like Rypien.

Factors beyond immediate earnings also contribute. Proactive financial management, including wise investment strategies, can significantly amplify the impact of earnings. Successful investment choices leverage initial earnings, promoting long-term financial growth beyond direct salary income. The importance of managing these earnings effectively cannot be overstated, as this directly affects the sustained growth and preservation of accumulated wealth. Furthermore, a prudent approach to managing earnings, including taxes and expenses, is essential for preserving and growing the eventual net worth. A career ending prematurely, due to injury or other factors, requires a well-defined plan to protect the capital accumulated during active earnings. Therefore, planning for both the earning years and the post-career phase is crucial to ensuring financial security.

In conclusion, earnings are a primary driver of Mark Rypien's net worth. These earnings, combined with proactive financial planning and investment strategies, directly impact the total accumulation of assets and long-term financial security. This highlights the importance of consistent high-performance for sustained financial growth in professional sports and emphasizes the critical role of diligent management for a prosperous future.

2. Investments

Investments play a crucial role in augmenting and preserving Mark Rypien's net worth. Beyond direct earnings, investments provide avenues for capital growth and financial security, especially during and after a professional career. This aspect of his financial portfolio deserves careful consideration.

- Diversification Strategies

A successful investment strategy frequently involves diversification. This approach spreads risk across various asset classes, including stocks, bonds, real estate, and potentially other instruments. By not concentrating all investments in a single area, potential losses are mitigated. Mark Rypien, like many high-net-worth individuals, likely utilizes diverse investment strategies, which lessen exposure to any single market downturn, offering a crucial hedge against financial volatility.

- Long-Term Growth Potential

Long-term investments, particularly in assets demonstrating consistent growth potential over time, align with the long-term financial goals of a high-profile athlete like Rypien. Investments in stocks, real estate or other such vehicles, can generate significant returns over extended periods, contributing substantially to an increased net worth. The appreciation in value, when coupled with income generation through dividends or rental income, directly impacts the financial standing.

- Asset Protection and Management

Effective management of accumulated assets is critical in preserving wealth. Investment strategies should incorporate mechanisms for tax optimization, risk mitigation, and estate planning considerations. Proper structuring of investment vehicles and adhering to sound financial advice help safeguard the assets from unnecessary taxation or other impediments. This component is crucial for sustaining long-term financial well-being.

- Timing and Market Analysis

Successful investment strategy requires astute timing and market analysis, crucial for identifying favorable investment opportunities. A skilled approach to assessing market conditions and anticipating future trends are essential parts of the investment process. These abilities allow high-profile individuals to take advantage of suitable market cycles and make informed decisions to maximize investment returns.

Investments are not merely a means to generate short-term gains; they are vital tools for preserving and increasing Mark Rypien's net worth. Successful financial management, encompassing diversification, long-term growth, risk mitigation, and timely market insights, form the basis of a robust investment portfolio. The complexity of his financial strategy highlights the importance of professional financial guidance. These aspects, as illustrated by Rypien's example, are vital in converting his earnings into a lasting, sustainable financial foundation.

3. Real Estate

Real estate investments frequently contribute significantly to a high-net-worth individual's overall financial portfolio. For a figure like Mark Rypien, successful real estate holdings can be a substantial component of their accumulated wealth. Such investments often represent a tangible asset, offering potential for both capital appreciation and income generation. This can be a critical factor in long-term financial security, especially for individuals whose primary source of income is tied to a finite professional career.

The importance of real estate in accumulating wealth is multifaceted. Strategic property acquisition can lead to appreciation in value over time, increasing the overall net worth. Furthermore, income-generating properties, such as rental units, produce passive income streams that contribute to a continuous flow of revenue. This passive income can be particularly valuable as a source of supplementary financial stability beyond primary income streams, providing a degree of financial independence and flexibility. The diversification of investment portfolios through real estate holdings can reduce dependence on a single income source or market sector and lessen overall financial vulnerability. Such diversification can prove especially crucial during transitions between professional phases. For athletes, real estate investments can serve as a crucial element in transitioning from active playing careers to future financial independence.

Understanding the role of real estate in Mark Rypien's net worth provides a practical understanding of wealth accumulation strategies. Analysis of real estate holdings reveals the potential long-term financial value and security that can be derived from strategic investments in property. The presence of real estate within a high-net-worth individual's financial portfolio emphasizes the importance of diversification and strategic planning for sustainable financial health, particularly for individuals with careers that have a definite end date. A thorough understanding of this aspect extends beyond the specific case of Mark Rypien, offering insights into common wealth accumulation strategies applicable to a wider context.

4. Endorsements

Endorsements represent a significant avenue for supplemental income for athletes like Mark Rypien. The value of these endorsements directly correlates with public recognition, brand appeal, and the athlete's perceived image. Successful endorsements can significantly augment and diversify an athlete's overall financial portfolio, playing a critical role in the accumulation and preservation of wealth, and thus contributing to a robust net worth.

- Brand Recognition and Appeal

Successful endorsements hinge on the athlete's ability to effectively connect with a brand. A favorable public image and reputation create a bridge between the athlete and the consumer, enhancing the brand's appeal. An endorsement becomes more valuable if the athlete's characteristics align seamlessly with the brand's image and target audience. This alignment establishes trust and credibility, ultimately influencing consumer perception and increasing demand for the associated products or services.

- Negotiation and Contract Value

The financial value of an endorsement contract is contingent upon several factors. These include market conditions, the athlete's level of recognition and influence, and the perceived value of the products or services being endorsed. Experienced negotiation strategies and understanding of the market dynamics can significantly impact the contract's profitability and its contribution to the overall financial well-being. Successful endorsements are not merely about signing a deal; they are about the calculated return on investment.

- Diversification of Income Streams

Endorsements offer a critical diversification strategy. By securing multiple endorsement deals, the athlete reduces dependence on a single income source, like salary, creating a more secure and resilient financial portfolio. This diversification is particularly valuable for athletes who have a career with a predictable end date, as it provides alternate income streams to supplement post-career planning.

- Impact on Public Perception

Endorsements significantly affect public perception of an athlete. The association with reputable brands projects a positive image, impacting both personal and professional standing. Conversely, endorsements with inappropriate brands can damage an athlete's reputation, negatively impacting future opportunities and potentially their net worth.

In summary, endorsements are critical components of an athlete's financial portfolio. The ability to leverage endorsements effectively, through brand alignment, skilled negotiation, and diversification, can yield substantial financial rewards. Successful endorsement strategies can significantly enhance an athlete's net worth, bolstering long-term financial stability, and providing crucial financial resilience beyond their playing career. The careful selection of endorsement partners is an important strategy to ensure positive impact on public perception and maximize financial returns for the athlete.

5. Business Ventures

Business ventures, if successful, can significantly impact an individual's net worth. For athletes like Mark Rypien, leveraging entrepreneurial skills and knowledge gained through their professional careers can create substantial supplementary income streams. Analyzing these ventures provides a more comprehensive understanding of the elements contributing to overall financial success.

- Investment Portfolio Diversification

A common approach is to diversify investments beyond the initial source of income. Successful ventures often involve leveraging knowledge gained during sports careers. These ventures can encompass various sectors aligned with market trends and offer potential avenues for substantial long-term capital growth. This diversification strategy reduces risk associated with relying solely on a professional athlete's career, enhancing financial stability. Rypien's investment activities, if any, would likely represent an expansion of the asset portfolio beyond direct endorsements or traditional investment vehicles, contributing to the overall picture of accumulated wealth. Examples of successful ventures might include investments in real estate, businesses related to sports, or emerging tech ventures. These various investments would be documented in a way that reflects the diversification strategy and its role in the total net worth.

- Strategic Partnerships and Franchises

Strategic partnerships and franchising arrangements can provide avenues for substantial returns. These ventures can establish enduring revenue streams over the long term, supplementing and potentially surpassing other avenues for income generation. Understanding the structures of these ventures helps determine their contributions to overall wealth. For example, an athlete with a robust brand could create and franchise a sports-themed product line or establish partnerships with complementary businesses.

- Entrepreneurial Ventures

Individual entrepreneurial initiatives, particularly those related to a specialized field or aligned with the athlete's background, offer avenues for substantial growth and diversification. These initiatives can build on established networks, industry knowledge, and recognized credibility, allowing an athlete to leverage their expertise and reputation to generate revenue beyond traditional avenues. Identifying ventures that involve an athlete's personal involvement or a specialized skill set provides a significant insight into the potential for growth and the risk/reward calculus.

- Impact on Overall Wealth Accumulation

The success of these business ventures profoundly impacts the overall accumulation of wealth. Positive returns from ventures add to the net worth, reflecting the value of the investment and the entrepreneurial acumen. Conversely, unsuccessful ventures could diminish the net worth. An analysis should clarify the contributions of successful and unsuccessful initiatives to the total accumulated wealth. The value attributed to these ventures needs to reflect the extent to which they have impacted the individual's overall financial standing.

Examining business ventures provides a richer understanding of an athlete's complete financial strategy. Beyond simply listing sources of income, an analysis highlights the diversification potential and risk mitigation offered by these ventures. The impact on Mark Rypien's overall net worth depends critically on the success of these ventures and the degree to which they augment or diminish his overall financial portfolio. Ultimately, understanding such ventures is crucial in formulating a complete picture of how an athlete's career extends to influence and contribute to accumulating financial wealth.

6. Management

Effective management is a critical component in the accumulation and preservation of wealth, especially for individuals with high-profile careers like Mark Rypien's. Sound financial management, encompassing investment strategies, tax planning, and asset protection, directly impacts the size and sustainability of an athlete's net worth. Neglecting or mismanaging these areas can lead to significant financial losses, even with substantial initial earnings. The strategic allocation of resources, both during and after a career, is essential for maximizing returns and minimizing risk.

The connection between management and net worth is undeniable. Consideration of factors like tax implications on high earnings, the optimal timing for investments, and careful evaluation of risk versus reward are all facets of strategic management. These factors, when handled effectively, can significantly enhance the growth and long-term viability of an athlete's financial portfolio. Conversely, poor financial management practices, such as a lack of diversification, excessive risk-taking, or a failure to understand tax liabilities, can erode accumulated wealth. The value of professional financial advice, including guidance on estate planning and asset protection, cannot be overstated, particularly for individuals with careers as concentrated as professional athletics. A comprehensive management strategy, encompassing both active and post-career phases, safeguards future financial stability.

In conclusion, effective management practices are integral to achieving and sustaining a substantial net worth. Professional financial guidance and thoughtful planning are crucial elements in achieving financial success, and their importance is amplified for high-earning individuals with careers potentially ending sooner rather than later. Careful consideration of financial management, encompassing proactive planning, risk assessment, and informed decision-making, is key to ensuring the long-term preservation and growth of wealth, not just for athletes like Mark Rypien but for anyone seeking financial security and sustainability. This approach ensures that the potential rewards of a successful career translate into enduring financial well-being.

Frequently Asked Questions about Mark Rypien's Net Worth

This section addresses common inquiries regarding Mark Rypien's financial situation. Accurate and comprehensive information about an individual's net worth requires careful consideration of various factors and is often subject to public scrutiny and varying estimations.

Question 1: What are the primary components of Mark Rypien's net worth?

Mark Rypien's net worth is a culmination of multiple income streams and assets. Key components include his career earnings in the NFL, endorsement deals, investments, and potentially real estate holdings. The precise breakdown of these elements remains difficult to definitively ascertain publicly.

Question 2: How do NFL salaries contribute to an athlete's overall net worth?

NFL salaries, particularly during a successful career, can be a significant contributor to an athlete's accumulated wealth. However, factors like financial management strategies and long-term investment choices also significantly impact the overall financial position. Salary alone does not fully represent the total net worth; it is a crucial but not the sole determinant.

Question 3: What role do endorsements play in determining net worth?

Endorsements offer substantial supplemental income for athletes. The value of these partnerships is closely tied to the athlete's public image and brand appeal. Successful endorsement deals can significantly bolster the overall financial portfolio.

Question 4: How significant are investments in building an athlete's net worth?

Investments, including diversified portfolios across various assets, play a crucial role in enhancing and preserving net worth. Successful investment strategies can maximize returns and ensure financial stability beyond a professional career's duration.

Question 5: Why is accurate data on an athlete's net worth sometimes elusive?

Public access to detailed financial information for high-profile individuals is often limited. Data on investments, real estate holdings, and other assets are not always publicly accessible, making a precise determination of net worth challenging. Estimates may fluctuate based on market conditions and reported financial activities.

Understanding net worth requires a holistic approach, encompassing earnings, investments, and management strategies. Precise figures are often unavailable publicly, and estimations may vary. A full evaluation considers the diverse elements contributing to overall financial strength and stability.

This concludes the FAQ section. The following section will provide a more detailed overview of athlete financial planning strategies.

Conclusion

Mark Rypien's net worth, like that of any prominent athlete, reflects a complex interplay of factors. Career earnings from the NFL, coupled with strategic investment decisions, endorsement deals, and potentially other business ventures, contribute to the overall financial picture. Analysis of these elements reveals the importance of diversification, long-term planning, and sound financial management in securing a robust and sustainable financial future, particularly for athletes with careers of limited duration. Factors such as successful investments, shrewd negotiation of endorsement contracts, and effective management strategies all contribute significantly to the accumulation of wealth. A comprehensive understanding of these components, rather than focusing solely on any single element, is crucial to fully grasping the nature and significance of his financial standing.

Ultimately, assessing Mark Rypien's financial standing provides valuable insight into the potential rewards and challenges of a professional athletic career. The strategies employed in building and managing wealth offer lessons relevant to individuals across various fields seeking financial security. Careful consideration of diverse income streams, prudent investment choices, and proactive management are all essential to maximizing the financial returns and ensuring long-term stability for athletes and professionals alike. The dynamic interplay of various factors, not simply the initial income, shapes the final financial trajectory.

Detail Author:

- Name : Ms. Jeanne Heathcote DDS

- Username : larson.fidel

- Email : gconnelly@gmail.com

- Birthdate : 2006-07-14

- Address : 64282 Hirthe Glen Suite 523 Lake Jedidiah, MD 59200

- Phone : 540.327.3891

- Company : Bode-Schuster

- Job : Telemarketer

- Bio : Iusto quam laudantium est sapiente nostrum doloribus sit. Itaque dolore quasi eos odio labore labore. Quia distinctio perferendis neque aut consequatur.

Socials

twitter:

- url : https://twitter.com/camryn_lubowitz

- username : camryn_lubowitz

- bio : Impedit mollitia aliquam est. Rerum consequatur cum rerum. Quos quia delectus earum voluptas totam sit impedit.

- followers : 2124

- following : 1206

linkedin:

- url : https://linkedin.com/in/camryn_real

- username : camryn_real

- bio : Distinctio quis qui fugiat ducimus ea molestias.

- followers : 6200

- following : 1137

tiktok:

- url : https://tiktok.com/@camryn6951

- username : camryn6951

- bio : Sint quis commodi molestias ut rerum delectus omnis.

- followers : 4782

- following : 1679