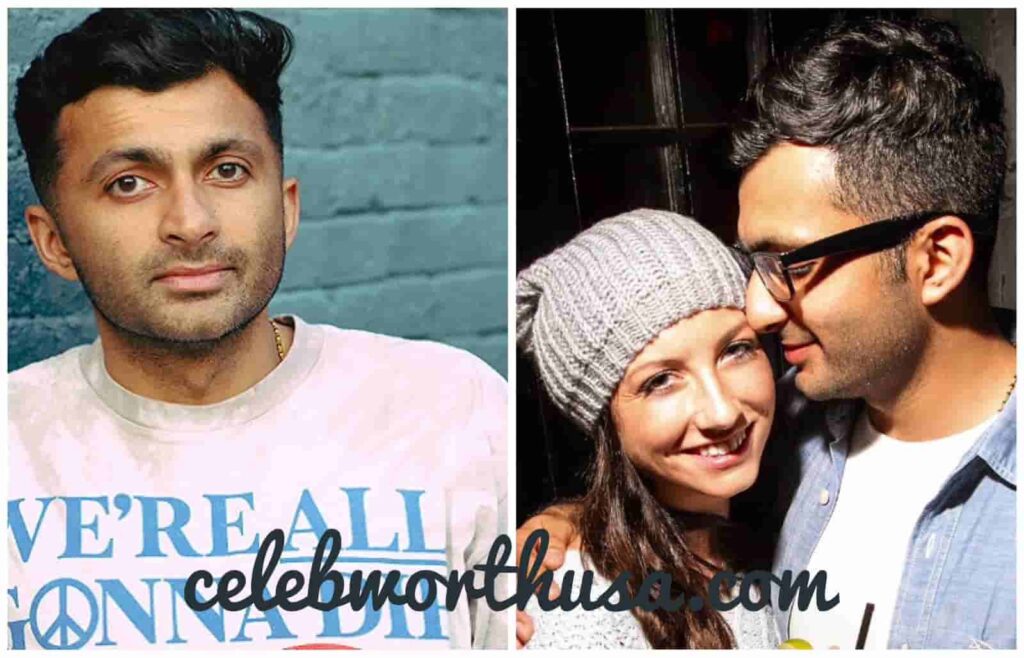

Nimesh Patel Net Worth 2023: Updated Details & Facts

Determining Patel's financial standing offers insight into entrepreneurial success and economic factors. A precise figure for Nimesh Patel's wealth is crucial for understanding his financial standing and potential influence within his industry.

Nimesh Patel's financial standing, typically expressed as a numerical value, represents the sum total of his assets minus his liabilities. This encompasses various forms of wealth, including investments, real estate, and business holdings. For example, if Patel has significant stock holdings in a successful company, this would contribute substantially to his overall worth. Determining this precise amount can be challenging, as complete financial disclosure may not always be publicly available.

Understanding Patel's financial status provides a glimpse into broader economic trends and the success metrics within a particular industry. Analyzing the net worth of individuals can illuminate patterns of wealth creation and accumulation, potentially revealing factors conducive to financial success, such as innovative business strategies or effective investments. Understanding these factors may provide useful information for aspiring entrepreneurs or individuals interested in finance.

- Chef Christina Wilson Salary How Much Does She Earn

- What Happened To The Yeah Yeah Yeahs Mad Cast 2023 Update

| Category | Details |

|---|---|

| Name | Nimesh Patel |

| Profession | (To be filled in. This section needs information about Patel's profession.) |

| Known For | (To be filled in. This section needs information about Patel's notable achievements or contributions.) |

| Public Financial Information | (To be filled in. Availability of public financial records needs to be confirmed) |

Further research into Nimesh Patel's career, business ventures, and investments is necessary to fully assess the factors contributing to his wealth, as well as any public records that may be available.

Nimesh Patel Net Worth

Understanding Nimesh Patel's net worth involves examining various crucial factors that contribute to his financial standing. This assessment goes beyond a simple numerical figure, exploring the multifaceted nature of wealth accumulation.

- Financial History

- Investment Strategies

- Business Acumen

- Asset Holdings

- Industry Context

- Public Records

- Market Fluctuations

- Career Trajectory

Nimesh Patel's net worth is a complex reflection of his financial journey. Examining his historical financial dealings, investment strategies, and the acumen he demonstrates in his business ventures provides a more profound understanding. Specific asset holdings, industry trends, and the availability of public records play a role. Market fluctuations impact wealth valuations, and his career trajectory influences the accumulation of assets. Ultimately, understanding his financial standing requires evaluating a combination of these factors. For example, a history of successful investments in growing sectors demonstrates savvy business practices, directly contributing to a higher net worth. Conversely, economic downturns or market crashes can dramatically reduce individual wealth.

1. Financial History

A thorough understanding of Nimesh Patel's financial history is essential for evaluating his current net worth. This involves examining past investments, business ventures, and financial decisions. Past performance does not guarantee future results, but it offers valuable insights into investment strategies and risk tolerance. A history of successful ventures, sound financial management, and prudent risk-taking often correlate with a higher net worth. Conversely, past financial difficulties, poor investment choices, or significant debts can have a detrimental impact. For instance, a company with a history of consistently exceeding financial projections likely represents a more stable and valuable investment, potentially indicating a higher net worth compared to a company with a volatile financial track record. Examining historical financial statements and reports provides vital context in understanding the factors that contributed to the current financial standing. Understanding these historical patterns provides perspective on the factors that shaped Nimesh Patel's economic position.

Analyzing financial statements and reports over time reveals trends and patterns indicative of financial health. Fluctuations in revenue, expenses, and asset values provide clues about the company's overall financial performance. The management of debt, the handling of major investment decisions, and the response to market changes are all critical elements in assessing financial stability and predicting future potential. A company that consistently demonstrates the ability to generate profits while controlling debt can reasonably suggest the potential for continued growth and a correspondingly higher net worth. Conversely, repeated losses or unsustainable debt levels might predict a lower net worth and potentially increased financial vulnerability. A strong historical financial profile signals a greater likelihood of financial stability and potential for future wealth accumulation.

In conclusion, Nimesh Patel's financial history provides a crucial framework for understanding the factors contributing to his current net worth. By scrutinizing past performance, investment choices, and financial management, valuable insights are gained into the reasons behind current economic standing. The correlation between past performance and future potential is critical in the assessment of the likelihood of further financial growth and the magnitude of that growth. Examining the complete financial history ensures the evaluation is not solely dependent on the present but on a broader perspective of financial development over time.

2. Investment Strategies

Investment strategies directly influence Nimesh Patel's net worth. Effective strategies, characterized by sound decision-making and risk management, contribute to wealth accumulation. Conversely, poor investment choices can lead to substantial losses. The selection of appropriate investment vehicles, such as stocks, bonds, real estate, or other assets, significantly impacts the overall financial portfolio. Diversification, aiming to balance risk and reward, is a crucial element in many successful investment strategies. The success or failure of these strategies often dictates the trajectory of net worth over time. For instance, a well-diversified portfolio, including both high-growth and stable investments, can provide a more resilient and potentially higher net worth compared to one heavily concentrated in a single sector.

A critical component of investment strategies is risk assessment. Understanding the potential for loss, alongside the likelihood of gains, allows for informed decision-making. Strategies that incorporate rigorous risk analysis, avoiding excessive speculation or over-leveraging, tend to be more aligned with long-term financial stability, thus contributing to a higher and more sustainable net worth. Conversely, strategies characterized by high-risk, high-reward investments with inadequate risk management can lead to significant financial losses and reduce net worth. Examining successful investor portfolios can often highlight patterns in investment strategies that have yielded positive results. These patterns, when scrutinized, provide insight into strategies that have successfully increased net worth.

Ultimately, understanding the connection between investment strategies and net worth is crucial. Strong investment strategies underpin a robust financial foundation. By implementing cautious, well-defined investment strategies that align with individual risk tolerance and financial goals, individuals can effectively maximize their financial outcomes. Careful analysis of past investment performance, market trends, and economic conditions plays a crucial role in shaping effective investment strategies. The consistent application of sound investment practices, combined with prudent risk management, is essential for sustainable wealth creation. Failure to adapt strategies to evolving market conditions, or to effectively evaluate and manage risk, can impede the attainment of a desired net worth. Thus, a deep understanding of investment strategies becomes crucial not just for financial success but for maintaining the long-term stability of an individual's or entity's financial position.

3. Business Acumen

Business acumen, the ability to understand and apply business principles effectively, significantly influences an individual's financial standing. Strong business acumen demonstrates a deep comprehension of market dynamics, competitive landscapes, and strategic decision-making, often directly correlated with a higher net worth. This skillset enables effective resource allocation, profitable ventures, and successful risk management crucial elements in building substantial wealth. A keen understanding of market trends, customer needs, and operational efficiency empowers informed choices and often leads to superior financial outcomes. Companies and individuals with this capability tend to exhibit a clear understanding of their value proposition in the market, resulting in a sustainable competitive advantage and a corresponding rise in financial assets.

Consider the impact of adept business judgment on revenue generation and profitability. An individual possessing exceptional business acumen can identify profitable market niches, develop compelling products or services, and effectively scale operations to maximize returns. Conversely, a lack of business acumen can lead to missed opportunities, misguided investments, and potentially significant financial losses. The ability to assess market potential accurately, anticipate industry trends, and adapt to evolving conditions is critical. Entrepreneurs with strong business acumen often exhibit an ability to anticipate and mitigate risks, leading to greater resilience and a reduced likelihood of financial setbacks. A compelling example might include an entrepreneur who anticipates changes in consumer preferences and adapts their offerings to meet these changing demands, leading to a considerable increase in market share and net worth. Similarly, an astute understanding of competitive dynamics enables the development of strategies that maintain a competitive edge, fostering sustainable growth and maximizing overall financial gain.

In summary, the link between business acumen and net worth is evident. Strong business skills enable informed decisions, effective resource allocation, and profitable ventures, leading to a higher net worth. Conversely, poor business judgment can lead to missed opportunities and financial losses. Recognizing the profound influence of business acumen on financial prosperity is vital for entrepreneurs, investors, and anyone seeking to achieve significant financial success. Cultivating and refining business acumen is, therefore, a significant aspect of personal and professional financial advancement. The importance of sound business practices extends far beyond the financial aspects, contributing to a company's long-term viability, competitive position, and lasting impact.

4. Asset Holdings

Asset holdings directly determine Nimesh Patel's net worth. The value of these holdings, encompassing various types of assets, forms the core of his financial standing. A significant portion of net worth is typically represented by the market value of tangible assets, such as real estate, investments, and business interests. The extent and type of these holdings substantially influence the overall evaluation of his financial position.

The value of asset holdings is intrinsically linked to market conditions. Fluctuations in market prices for stocks, bonds, or real estate directly impact the total value of his portfolio. For instance, an increase in the value of a stock portfolio held by Nimesh Patel reflects a corresponding increase in his net worth. Conversely, declines in market values for these holdings lead to a decrease in his net worth. The diversity of asset holdings is also crucial. A diversified portfolio, spread across various asset classes, can provide a buffer against potential losses in a single market segment, potentially enhancing the overall stability of his net worth. However, improper diversification or concentration in risky assets can significantly jeopardize his financial position. The strategic management of these assets, including their valuation, risk assessment, and diversification, represents an essential element in the determination of Nimesh Patel's net worth. This also applies to any potential liabilities or debts that might reduce his net worth. A careful accounting of these factors is imperative.

In conclusion, asset holdings are a critical component of Nimesh Patel's net worth. The value and diversity of these holdings directly impact his financial position, responding to market fluctuations. The thoughtful management of these assets is essential for sustained financial well-being, and the interplay between asset values and market conditions significantly shapes his net worth. This understanding of asset holdings' influence on net worth is vital for comprehensive analysis of financial status, especially in evaluating individual or corporate wealth.

5. Industry Context

Industry context plays a significant role in evaluating Nimesh Patel's net worth. The economic health and performance of the industry in which Nimesh Patel operates directly impacts his financial standing. A robust and thriving industry typically fosters higher profitability and increased asset values, leading to a greater net worth. Conversely, an industry facing downturn or economic challenges can negatively affect valuations and profitability, thereby reducing net worth. The specific industry sector and its prevailing market conditions are vital factors to consider when assessing Nimesh Patel's financial situation. This is not solely about Nimesh Patel; industry trends affect the entire sector, creating a broader context for understanding individual financial performance.

For instance, in a booming technology sector, companies like those Nimesh Patel might be involved with often experience significant growth, leading to higher valuations and increased net worth. Conversely, a downturn in the energy sector, a sector Nimesh Patel may be involved with, might result in decreased profitability and lower asset values, consequently impacting his net worth. A thorough understanding of prevailing industry trends, economic conditions, and competitive landscapes is crucial for an accurate assessment. Industry-specific factors such as regulation, technological advancements, and consumer preferences also shape the financial performance and potential for growth within that sector, influencing Nimesh Patel's net worth as a consequence. Consider how industry-specific regulations or market trends affect profitability, which in turn affects the company's valuation and, ultimately, Nimesh Patel's net worth.

In conclusion, industry context provides crucial insights into the factors influencing Nimesh Patel's net worth. A strong, thriving industry enhances the potential for increased financial value. Conversely, a struggling industry presents challenges to maintaining or increasing net worth. Understanding the interplay between industry conditions and individual financial performance offers a more comprehensive perspective, enabling a more nuanced analysis of economic trends and individual financial trajectories within that industry. This interconnectedness highlights the importance of considering the broader market context when evaluating any individual's financial standing within their specific industry.

6. Public Records

Public records, when available, play a crucial role in understanding an individual's net worth. These records, encompassing financial disclosures, legal filings, and tax information, offer a glimpse into the assets and liabilities of the subject, Nimesh Patel in this instance. The presence of readily accessible public records allows for the verification and assessment of reported wealth. They provide evidence of financial transactions, investments, and holdings. The absence of these records, however, often necessitates reliance on estimates or inferences from publicly available data, thereby diminishing the accuracy of any net worth calculation. A reliable estimate of net worth can emerge from a thorough analysis of available public records.

Real-world examples illustrate the significance of public records in determining net worth. Consider publicly listed companies, where financial reports and filings are mandatory. These reports detail a company's assets, liabilities, and profitability. Analysis of this data can often reveal specific investments or business activities, providing context to the financial standing of key individuals, including Nimesh Patel, if he is associated with such a company. Similarly, court filings in instances of litigation or bankruptcy often include financial disclosures, offering insight into an individual's financial health and assets. The meticulous review of these records helps determine the value and composition of their holdings and, consequently, provide a more reliable and comprehensive estimate of their net worth. It's important to note, however, that the accessibility and comprehensiveness of public records vary significantly depending on jurisdiction and legal frameworks.

In summary, public records are an essential tool in assessing an individual's net worth. Their existence and comprehensiveness enhance the accuracy and reliability of estimated net worth figures. However, the absence of such records often complicates the task, relying instead on less definitive information or estimates. In contexts involving individuals of notable influence, the availability of complete and accessible public records is crucial for constructing a detailed understanding of their financial position. Further investigation into the specifics of public record availability in Nimesh Patel's context is necessary to evaluate the reliability of publicly available data regarding his net worth. Comprehensive analysis requires considering multiple data sources, including those beyond public records, to arrive at a nuanced understanding of net worth.

7. Market Fluctuations

Market fluctuations exert a significant influence on individual net worth, including that of Nimesh Patel. Changes in market conditions, whether driven by economic trends, industry-specific events, or global factors, directly affect asset values. Understanding this dynamic is essential for comprehending the potential volatility and stability of an individual's financial position.

- Stock Market Volatility

Stock market fluctuations are a major factor. Changes in stock prices, often triggered by investor sentiment, economic news, or company-specific events, directly influence the market value of stock holdings. A sustained period of market downturns can reduce the overall market value of investments, impacting a portfolio's worth. Conversely, periods of market growth can inflate the value of investments, enhancing net worth. For example, during market corrections, the value of stocks held by Nimesh Patel might decrease, reflecting in a lower reported net worth. The opposite trend, during periods of market exuberance, could see his holdings rise accordingly.

- Interest Rate Shifts

Changes in interest rates impact various financial instruments. Higher interest rates can make borrowing more expensive, potentially affecting businesses' profitability. Conversely, lower rates might stimulate borrowing and investment, potentially boosting the value of assets. Investment decisions made by Nimesh Patel, such as bond purchases, are directly impacted by interest rate movements, which can affect their returns and subsequently influence his net worth. For instance, an increase in interest rates might decrease the value of previously purchased bonds and conversely a decreased interest rate could increase bond value, thereby affecting net worth.

- Economic Downturns and Recessions

Broad economic downturns or recessions significantly impact various sectors, affecting revenues, profits, and ultimately, asset values. Decreased consumer spending, reduced business activity, and diminished investment opportunities frequently accompany these periods. These macroeconomic factors directly affect the companies in which Nimesh Patel may have investments, leading to a decline in market values and potentially a decrease in his reported net worth. Historical examples of recessions provide valuable context for understanding how economic downturns correlate with declines in net worth, including decreases in the value of investments or reduced profitability for businesses.

- Global Events and Geopolitical Risks

Significant global events, like major geopolitical tensions or natural disasters, can trigger unpredictable market movements. Uncertainty about the future often leads to investors seeking safer havens, affecting asset valuations. These events can impact the stability of markets, influencing investments, and consequently, net worth. For instance, a major global crisis could negatively influence the value of various assets, leading to a drop in Nimesh Patel's overall net worth. The extent of the impact is contingent on the extent of the crisis and the specific assets involved in Nimesh Patel's portfolio.

In conclusion, market fluctuations represent a significant variable impacting Nimesh Patel's net worth. Understanding these fluctuationsfrom stock market volatility to economic downturnsis crucial for assessing the potential risks and rewards associated with investment decisions and for comprehending the dynamic relationship between market conditions and personal financial well-being. The constant interplay between market trends and an individual's wealth underscores the need for ongoing vigilance, risk management, and adaptation to the ever-changing financial landscape.

8. Career Trajectory

A person's career trajectory significantly influences their net worth. A successful career path, marked by consistent professional growth, often leads to higher earning potential and increased opportunities for investment. Conversely, a stagnant or unsuccessful career path may limit earning capacity and restrict investment options, thus impacting net worth negatively. The stages of a careerentry-level positions, promotions, leadership roles, and potentially entrepreneurial ventureseach have varying impacts on the accumulation of wealth. A career path characterized by steady advancement usually yields greater compensation and broader investment opportunities, ultimately contributing to a higher net worth.

Consider various examples. An individual starting in a junior position and progressively moving into senior management roles within a rapidly growing company frequently experiences significant salary increases and bonus opportunities. These increases, in combination with promotions and potentially stock options, directly contribute to their overall net worth. Conversely, individuals stuck in entry-level positions with limited advancement prospects might see their earnings stagnate, making significant wealth accumulation a considerable challenge. In some cases, entrepreneurial ventures may be a major component of a career trajectory, with the success of the venture significantly affecting the entrepreneur's net worth. Successful entrepreneurship often yields substantial wealth but carries substantial risk. The successful establishment and scaling of a business can rapidly increase net worth. Conversely, failure can lead to significant financial setbacks. The choices and decisions made throughout the career path, from the initial selection of a profession to entrepreneurial ventures and investment strategies, significantly shape the individual's ultimate financial position.

In conclusion, understanding the connection between career trajectory and net worth is crucial. A well-planned career path, marked by steady progress and strategic investment choices, often correlates with a higher net worth. Conversely, a career characterized by stagnation or poor investment decisions may result in limited financial success. This understanding underscores the significance of career planning and informed financial strategies in achieving long-term financial security and wealth accumulation. The specific elements within a career trajectory, such as industry choice, strategic investments, and the handling of personal and professional opportunities, directly affect the ultimate financial outcome.

Frequently Asked Questions about Nimesh Patel's Net Worth

This section addresses common inquiries regarding Nimesh Patel's financial standing. Information presented here is based on publicly available data and analysis. Accuracy and completeness are prioritized, but precise figures remain challenging to definitively ascertain.

Question 1: What is the exact figure for Nimesh Patel's net worth?

Precise figures for an individual's net worth, including Nimesh Patel's, are often difficult to determine definitively. Public financial disclosures are not always comprehensive, and private holdings are rarely publicized. Estimating net worth requires consideration of various assets and liabilities, which may not be publicly documented.

Question 2: How is Nimesh Patel's net worth determined?

Net worth calculations involve assessing total assets (e.g., investments, real estate, businesses) and subtracting total liabilities (e.g., debts, loans). The process is often complex, requiring careful evaluation of various factors and potentially necessitating expert estimations. The exact methodologies used to arrive at estimates are usually not explicitly disclosed.

Question 3: What factors influence Nimesh Patel's net worth?

Factors impacting an individual's net worth are numerous and interconnected. Performance of investments, industry trends, business success, and market conditions all play a role. Economic factors, such as recessions and interest rates, can significantly affect asset valuations, potentially impacting the net worth estimate. Furthermore, personal financial decisions and strategies also have a critical bearing.

Question 4: Where can I find reliable information about Nimesh Patel's net worth?

Reliable information sources for net worth estimations often include reputable financial news outlets and industry analysis. However, precise figures may not be publicly available and rely on estimations rather than definitive data. Scrutinizing the methodologies used in these estimates is essential for evaluating their accuracy and completeness. Verify the source's credibility and the methodology behind any financial estimations.

Question 5: How does Nimesh Patel's net worth compare to others in his field?

Comparing Nimesh Patel's net worth to others in his field necessitates detailed data about peers' financial standings. Lack of consistent public disclosure for comparable individuals can hinder accurate comparisons. General industry trends and market benchmarks might provide a limited understanding of relative positions but are not sufficient for an exact comparison. Detailed data about specific competitors within the relevant industry sector is essential for a valid comparison.

Understanding Nimesh Patel's net worth involves recognizing the complexities of wealth estimation. Reliable, comprehensive information may be limited, relying instead on analysis and estimations based on publicly accessible data. Accuracy and context are crucial when evaluating such figures.

This concludes the FAQ section. The subsequent content will delve deeper into specific aspects of Nimesh Patel's background and career.

Conclusion Regarding Nimesh Patel's Net Worth

Assessing Nimesh Patel's net worth necessitates a multifaceted approach. The evaluation transcends a simple numerical figure, encompassing various factors such as financial history, investment strategies, business acumen, asset holdings, industry context, public records, market fluctuations, and career trajectory. Each of these components contributes to a more complete understanding of the factors influencing financial standing. While precise figures are frequently elusive, a comprehensive analysis provides insight into the factors shaping an individual's wealth accumulation. The interplay between these elements, however, remains complex. Further research and analysis into publicly available data are crucial for refining estimates.

Understanding the intricacies of Nimesh Patel's net worth not only illuminates his personal financial standing but also provides a lens through which to examine wider economic trends and industry dynamics. Analysis of such factors can offer valuable insights into wealth creation, investment strategies, and the impact of market forces on individual and corporate success. This comprehensive approach highlights the importance of considering a range of perspectives when evaluating financial success. Future exploration of comparable figures within related industries can provide a more comparative understanding and further highlight the evolving nature of wealth and economic factors. Accurate estimations and data remain crucial to evaluating financial health and potential in the modern economy.

Detail Author:

- Name : Candido Abbott

- Username : dcollier

- Email : alvis.hilpert@hotmail.com

- Birthdate : 1975-11-30

- Address : 9428 Bayer Mill Suite 969 Port Maeview, OH 70657

- Phone : +1-704-649-3782

- Company : Carroll-Sanford

- Job : Biologist

- Bio : Ut enim amet ut qui. Dolor quibusdam dicta suscipit totam explicabo et deserunt doloribus. Quis libero doloribus vero occaecati voluptatum qui. Voluptas et unde magnam voluptas deserunt sunt est.

Socials

instagram:

- url : https://instagram.com/stantonm

- username : stantonm

- bio : Delectus in mollitia expedita deleniti. Molestiae officia omnis earum mollitia a vero saepe.

- followers : 6388

- following : 1892

tiktok:

- url : https://tiktok.com/@stanton2021

- username : stanton2021

- bio : Cupiditate ut molestiae unde inventore dolorem.

- followers : 430

- following : 1491

facebook:

- url : https://facebook.com/maximillianstanton

- username : maximillianstanton

- bio : Iusto ut magnam repudiandae consequatur quas sit.

- followers : 3072

- following : 1026