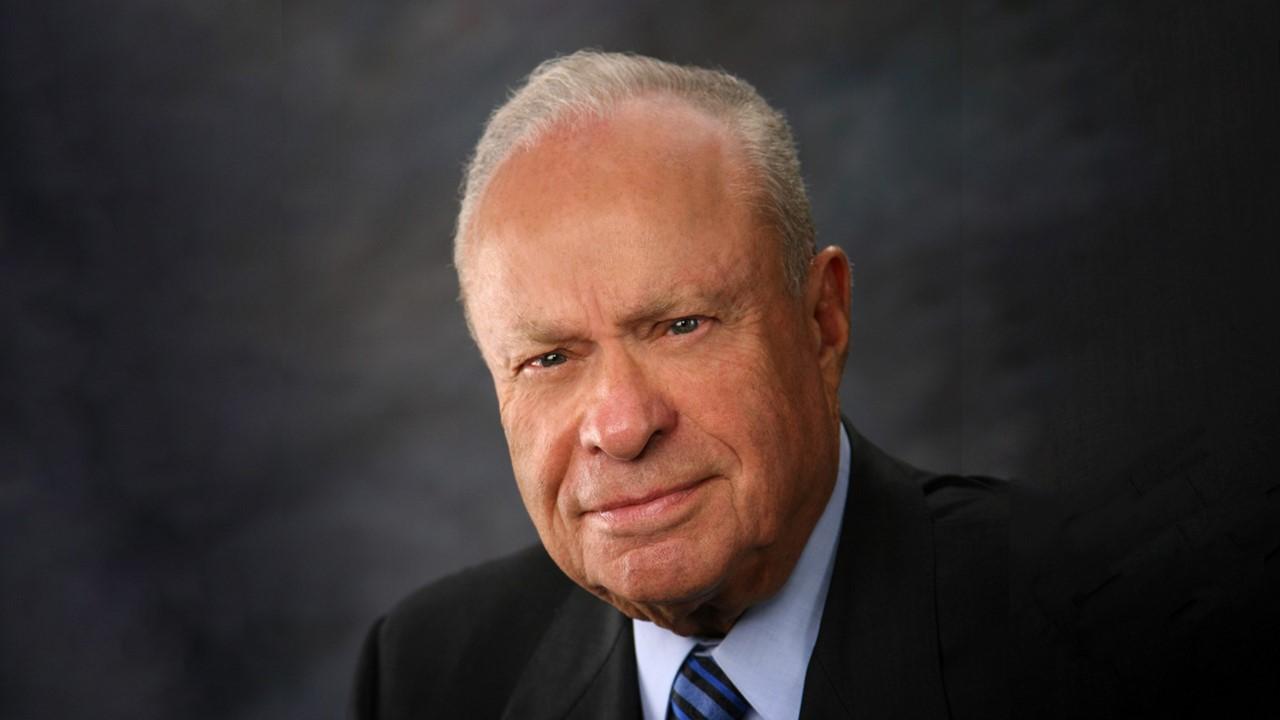

Ted Virtue Net Worth: 2023 Update & Details

Estimating an individual's financial standing can be complex, but understanding wealth is crucial. This profile provides insight into the financial status of a particular individual.

The financial standing of an individual, often discussed in terms of net worth, refers to the total value of assets minus liabilities. This calculation encompasses various holdings, including investments, property, and other assets. The value of these assets, fluctuating with market conditions, plays a role in determining the overall net worth. In simple terms, it's a snapshot of someone's financial position at a given time.

Understanding an individual's net worth can offer insight into their financial success and the scale of their business interests or investments. This information can contextualize their influence in a variety of fields, whether within a business, a public forum, or the media. Public interest in this information often stems from curiosity, but an understanding of this financial picture can sometimes illuminate motivations and actions in various contexts.

- Chef Christina Wilson Salary How Much Does She Earn

- Lil Meech Net Worth 2023 Latest Estimates Details

While a complete financial profile of a specific individual is not provided, the underlying principles discussed here regarding net worth can be applied to numerous other individuals and scenarios.

Ted Virtue Net Worth

Assessing an individual's financial standing, often represented by net worth, is a complex process involving various factors. This overview highlights key considerations related to such estimations.

- Financial Assets

- Investment Portfolio

- Income Sources

- Liabilities

- Business Interests

- Market Fluctuations

- Public Information

Estimating net worth requires careful consideration of financial assets, including investments and property. Income sources, such as salary or business revenue, significantly impact the overall picture. Liabilities, such as debt, need to be factored in for an accurate assessment. Business ventures, if applicable, may have a substantial impact on the overall net worth. Market conditions influence investment values. Public information on individuals, often through reports or news, plays a role in forming an understanding of potential wealth. While specific details are frequently unavailable due to privacy or lack of disclosure, these elements collectively inform the understanding of an individual's financial standing.

1. Financial Assets

Financial assets, encompassing a wide range of holdings, are a crucial component of net worth. They represent an individual's accumulated wealth, derived from investments, property, and other holdings. The value of these assets fluctuates based on market conditions, affecting the overall net worth calculation. For example, a substantial portfolio of stocks or real estate can significantly contribute to a high net worth, whereas minimal holdings in these areas may result in a relatively low net worth.

The significance of financial assets extends beyond their numerical value. They represent the potential for future income generation. Stocks, for instance, can appreciate in value, while real estate can produce rental income. The diverse nature of assets further influences the structure and stability of a person's financial standing. Understanding the composition of these assets their types, values, and associated risks is essential to grasping the full picture of an individual's financial position. Furthermore, the acquisition, management, and disposition of these assets directly impacts the net worth over time.

In conclusion, financial assets are fundamental to understanding net worth. Fluctuations in asset values directly correlate with changes in net worth, emphasizing the importance of prudent asset management. A comprehensive evaluation of these assets provides a substantial insight into an individual's financial standing and influences factors such as investment strategy, income diversification, and the overall financial health.

2. Investment Portfolio

An individual's investment portfolio is a critical component in assessing net worth. The value and performance of investments directly impact the overall financial standing. A diversified and well-managed portfolio, with assets potentially appreciating over time, can contribute significantly to a higher net worth. Conversely, poor investment choices or market downturns can erode the value of assets and thus reduce net worth.

Consideration of various investment vehicles, such as stocks, bonds, real estate, and other assets, is essential. The specific composition of a portfolio, reflecting risk tolerance and financial goals, plays a decisive role. For instance, a portfolio emphasizing growth-oriented stocks might yield higher returns but also face greater volatility. A portfolio designed for stability might offer lower returns, but with decreased risk. The performance of these investments, whether through capital appreciation or dividends, will materially affect the overall net worth. Strategic investment choices, often informed by financial advice and market analysis, are key to building and sustaining a healthy portfolio and, consequently, a substantial net worth.

In summary, an investment portfolio's role in determining net worth cannot be overstated. The performance of investments, both positive and negative, directly affects the overall financial position. A well-structured and managed portfolio, with informed investment choices aligned with financial objectives, is a crucial factor in achieving and maintaining a healthy net worth. Understanding the intricate relationship between investment portfolios and net worth is fundamental for individuals and institutions aiming to build and manage wealth effectively.

3. Income Sources

Income sources are fundamental to understanding an individual's net worth. The totality of income streams directly impacts the accumulation of wealth and the resulting financial standing. A higher volume of income, from various reliable sources, generally correlates with a greater potential to build substantial net worth. Consistent high income provides a base for savings, investments, and the eventual accumulation of assets, all contributing to a larger net worth figure.

Different income sources vary in their contribution to net worth. Salaries, business profits, and investment returns all play a role. Salaries represent a stable income stream but may not offer the same growth potential as business profits. Business profits, if substantial and sustained, can lead to significant wealth accumulation over time. Investment returns, contingent on successful investments, offer a potential for wealth growth but also come with inherent risk. The relative importance of each income stream can differ considerably depending on an individual's financial situation and goals. For instance, an entrepreneur might derive a significant portion of their net worth from business income, while a professional might rely primarily on salary. The diversity and stability of these sources, therefore, strongly influence the potential for building and maintaining a substantial net worth.

In conclusion, income sources are a critical element in assessing and projecting an individual's net worth. The volume, stability, and growth potential of income streams are key factors that influence the accumulation and maintenance of wealth. A diversified income portfolio, with multiple streams contributing to overall financial stability, demonstrates greater potential for a high net worth. This underlines the importance of income diversity and prudent financial management as critical components of wealth building.

4. Liabilities

Liabilities represent financial obligations or debts owed by an individual. Understanding these obligations is crucial in assessing net worth. A significant amount of debt can diminish net worth, while a low level of liabilities can indicate a stronger financial position. The nature and size of these financial responsibilities directly impact the overall financial health of an individual, as well as their potential for building wealth.

- Debt Obligations

Debt obligations, such as loans, mortgages, credit card balances, and outstanding invoices, represent financial liabilities. These obligations require repayment of principal and interest over time. High levels of debt reduce available funds for investments and savings, thus potentially impacting the growth of net worth. For example, large mortgage payments decrease disposable income, reducing the ability to invest in stocks or other assets, which could contribute to a lower net worth.

- Outstanding Taxes

Unpaid taxes are significant liabilities. Tax liabilities, whether for income, property, or other taxes, can accumulate and negatively affect net worth. Failure to fulfill tax obligations can result in penalties and further financial strain, hindering the accumulation of assets and the increase of net worth.

- Guarantees and Commitments

Guarantees and commitments, such as personal guarantees on loans or commitments to other entities, represent potential future liabilities. While not always immediately evident as cash outflow, they carry the risk of financial obligations arising in the future. These obligations can potentially significantly affect an individual's net worth should the guaranteed party default on their own financial obligations.

- Operational Expenses

Certain operational expenses may be treated as liabilities in certain contexts. For example, if an individual's business incurs significant outstanding vendor payments, these outstanding amounts represent financial liabilities that reduce the net worth of the business.

In summary, liabilities are an essential, often overlooked, component of assessing an individual's net worth. The existence and magnitude of debt obligations, outstanding taxes, guarantees, and other potential commitments directly affect the amount of available funds for investment and savings. A careful examination of liabilities provides a complete financial picture, essential for evaluating an individual's financial standing and potential for future wealth accumulation.

5. Business Interests

Business interests play a substantial role in determining an individual's net worth. The success and profitability of ventures directly impact the overall financial standing. Exploring various aspects of business involvement reveals how these activities contribute to, or detract from, an individual's wealth.

- Revenue Generation

Business ventures are significant sources of income. Profits generated from operations, sales, and investments within these ventures directly contribute to an individual's overall net worth. The scale and consistency of revenue streams significantly affect the financial profile. For example, a thriving company producing substantial profits will elevate the net worth, whereas struggling enterprises will likely show a decrease.

- Asset Ownership

Business interests often involve the ownership of substantial assets, such as real estate, equipment, intellectual property, and other valuable resources. The value of these assets, and their potential for appreciation or depreciation, directly correlates with the net worth. For example, owning a building or a patent portfolio can bolster net worth, while extensive equipment or inventory might not appreciate in value as significantly.

- Market Value and Valuation

The market value assigned to a business interest, reflecting its perceived worth in the marketplace, directly influences net worth calculations. Factors such as profitability, growth potential, and industry standing shape market valuation. An enterprise deemed high-growth or leading within its sector may command a significantly higher market value, thus affecting the overall net worth. For example, a business with a recognizable brand or strong market share will typically have a higher market value compared to a smaller, less established company.

- Debt and Liabilities

Business ventures often involve liabilities, such as loans, outstanding debts, or operational expenses. High levels of business debt can reduce net worth, whereas effectively managing debt can maintain or enhance it. The impact of business debts on overall net worth depends on the ability of the enterprise to generate sufficient income to service its obligations.

In conclusion, an individual's business interests, encompassing income generation, asset ownership, market valuation, and debt management, substantially influence their net worth. The complexity of these factors, alongside the variability in profitability and market dynamics, underscores the need for comprehensive analysis to understand the specific contribution of these interests to the overall financial position.

6. Market Fluctuations

Market fluctuations, encompassing shifts in asset values and economic conditions, directly impact an individual's net worth. These fluctuations, whether related to stock market trends, commodity prices, or broader economic climates, exert a considerable influence on the value of investments and holdings. Understanding this connection is essential for comprehending how external market forces shape financial standing.

- Stock Market Volatility

Significant changes in stock market indices can dramatically affect the value of investments held by an individual. Declines in market performance can lead to substantial reductions in the value of stock portfolios, potentially lowering net worth. Conversely, favorable market conditions can increase the value of stocks, thereby boosting net worth. These fluctuations are often unpredictable, making long-term wealth management challenging and requiring prudent strategies.

- Commodity Price Swings

Fluctuations in commodity prices, such as oil, gold, or agricultural products, can directly influence net worth. Rising commodity prices may increase the value of related investments, positively impacting net worth. Conversely, a downturn in commodity markets can negatively impact holdings, affecting the overall financial position. The impact is particularly pertinent for individuals invested in commodity-related ventures or holding significant commodity assets.

- Economic Downturns and Recessions

Broad economic downturns or recessions often lead to decreased investment values across various asset classes. Reduced consumer spending, business closures, and job losses generally impact the overall market, resulting in a decline in many investments. This can cause a significant reduction in net worth for individuals reliant on investment returns or holding substantial assets. The correlation between economic cycles and net worth is a critical aspect in long-term wealth management.

- Interest Rate Changes

Changes in interest rates, whether rises or declines, affect the cost of borrowing and investment returns. Increased interest rates can make borrowing more expensive, potentially reducing investment capacity. Conversely, lower rates might stimulate investment and increase the value of certain holdings. Such fluctuations influence the overall investment strategy and impact an individual's ability to accumulate or maintain net worth. This connection extends to various investment vehicles, including mortgages, bonds, and savings accounts.

In conclusion, market fluctuations exert a considerable influence on an individual's net worth. The interplay of factors, including stock market volatility, commodity price swings, economic cycles, and interest rate changes, significantly affects the value of assets and holdings. For an accurate assessment of net worth, these external influences must be considered alongside internal factors such as income, expenses, and investment strategies.

7. Public Information

Public information plays a crucial role in understanding, though not definitively determining, an individual's net worth. News reports, financial disclosures, and public statements can offer insights into an individual's financial activities and assets. However, this information is often incomplete or indirectly related to the precise calculation of net worth. Direct financial statements or valuations are rarely publicly available. Estimates of net worth, based on publicly accessible data, are often approximations, influenced by various interpretations and potential biases.

For instance, news articles might report on significant investments or philanthropic activities. These reports can suggest an individual possesses substantial wealth, providing a general context but not a precise measure. Similarly, publicly available information about real estate holdings, business ventures, or investment portfolios might contribute to an informed estimate, yet remain incomplete without access to full financial records. The availability and reliability of such public data varies considerably, and often are influenced by factors like media reporting practices or regulatory policies.

In summary, while public information can provide contextual clues about an individual's potential wealth, it rarely provides a definitive or complete picture of net worth. Estimates based on public information are inherently limited. The presence or absence of detailed financial disclosures significantly affects the accuracy and usefulness of these estimations. Understanding the limitations of public data is crucial for avoiding inaccurate or incomplete conclusions about financial standing.

Frequently Asked Questions about Ted Virtue's Net Worth

Estimating an individual's net worth is a complex process. Publicly available information is often limited, making precise figures challenging to ascertain. This FAQ section addresses common inquiries about Ted Virtue's financial standing.

Question 1: What is net worth, and why is it important to understand this concept?

Net worth represents the difference between an individual's total assets and liabilities. Understanding net worth offers insight into an individual's financial position. It considers the value of assets like investments, property, and other holdings, contrasted with debts, loans, and other financial obligations. This provides context for understanding an individual's financial standing, influence, and overall financial situation.

Question 2: Where can I find accurate information on Ted Virtue's net worth?

Precise figures for Ted Virtue's net worth are not consistently publicly available. Reliable financial reporting often requires access to private financial documents. Statements or news reports mentioning potential wealth levels should be approached with caution, as estimates based on limited information may not reflect the complete financial picture.

Question 3: How do market fluctuations impact net worth estimations?

Market fluctuations, including stock market movements, commodity prices, and economic trends, influence the value of assets. These changes directly affect the overall net worth calculation, which can lead to variations in estimates over time. For example, if the value of investments decreases, the estimated net worth will likely also decrease.

Question 4: Are there any potential biases in public estimates of net worth?

Public estimates are often influenced by media coverage or other sources. Selective reporting or incomplete information can lead to biases in estimates. The public perception of an individual's wealth may not accurately reflect their true net worth. Consequently, relying solely on public statements or estimates may lead to an inaccurate understanding of the individual's financial position.

Question 5: How does the calculation of net worth consider business interests?

Business interests often significantly impact net worth. Factors like revenue generation, asset valuation, and debt levels are considered. Complex calculations, including projections and appraisals of business assets, are often necessary for accurate assessments of the business's contribution to overall net worth. Accurate estimations necessitate careful examination of financial statements and business operations, not just general news reports.

In conclusion, acquiring precise details regarding an individual's net worth often requires access to private financial information. Public statements or estimates should be interpreted cautiously, considering the limitations of publicly available data. Understanding the methodologies behind calculating net worth enhances interpretation of the information encountered.

Moving forward, the focus will shift to examining the key considerations underpinning estimations of net worth, while acknowledging the inherent limitations of publicly available information.

Conclusion

Assessing an individual's net worth, a critical metric reflecting financial standing, necessitates a multifaceted approach. This analysis reveals the intricate interplay of financial assets, investment portfolios, income sources, liabilities, business interests, market fluctuations, and the limitations of publicly available information. While precise figures for Ted Virtue's net worth remain elusive due to the nature of such estimations, this exploration illuminates the key components influencing such calculations. The value of assets, the impact of investment decisions, the significance of income streams, and the burdens of liabilities all contribute to the overall financial picture.

Ultimately, a complete understanding of any individual's financial situation requires a comprehensive review of their holdings and responsibilities, extending beyond publicly available data. The complexity of these elements underscores the need for careful analysis and, often, access to private financial information. The factors analyzed in this study, including market volatility and the inherent limitations of public information, highlight the challenges and nuances in evaluating net worth. This conclusion underscores the need for critical thinking and careful consideration when assessing financial standing, particularly in the absence of comprehensive disclosure.

Detail Author:

- Name : Cory Effertz

- Username : jakubowski.santiago

- Email : mcglynn.yoshiko@kirlin.com

- Birthdate : 2003-01-31

- Address : 957 Wehner River Suite 658 Hansenborough, CT 05593

- Phone : +1.754.385.7325

- Company : Sanford-O'Reilly

- Job : Loan Officer

- Bio : Quod perspiciatis consequatur possimus vitae. Aut excepturi error voluptatem. Iure magnam qui ducimus eaque consequatur aut saepe. Blanditiis deserunt aut nihil voluptates cumque.

Socials

linkedin:

- url : https://linkedin.com/in/emmaleewiza

- username : emmaleewiza

- bio : Asperiores nisi nihil tenetur quia.

- followers : 3741

- following : 568

tiktok:

- url : https://tiktok.com/@emmaleewiza

- username : emmaleewiza

- bio : Neque sit neque doloremque. Ab rerum magnam ex sunt nostrum accusantium.

- followers : 6193

- following : 1432

facebook:

- url : https://facebook.com/wizae

- username : wizae

- bio : Quos rerum neque est ratione dolorem.

- followers : 4783

- following : 247

twitter:

- url : https://twitter.com/emmalee_wiza

- username : emmalee_wiza

- bio : Qui atque voluptatem ipsum qui. Quo unde ut et. Sapiente molestias optio et alias recusandae et. Ad et veritatis unde in.

- followers : 2514

- following : 364