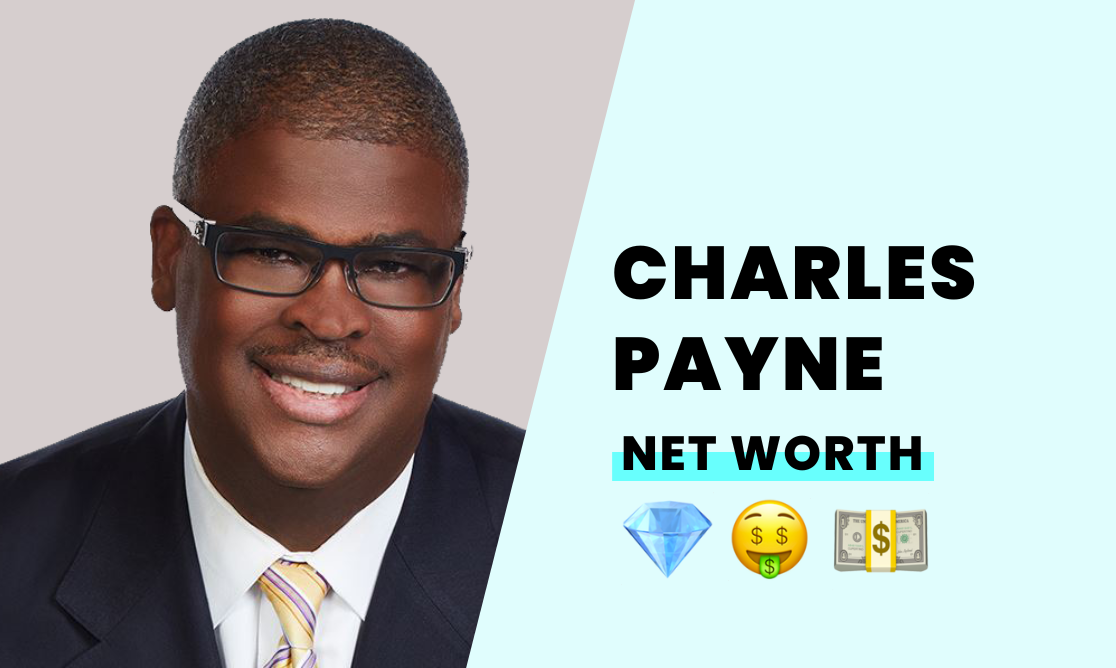

Top Charles Payne Net Worth: 2023 Update

How much is Charles Payne worth? Understanding the financial standing of prominent figures like Charles Payne provides insights into their career success and influences.

A person's net worth represents the total value of their assets, including cash, investments, property, and other holdings, minus any debts. For individuals in public life, like Charles Payne, this financial information can offer a glimpse into their financial journey, career trajectory, and overall economic standing. It's important to remember that net worth can fluctuate based on market conditions and personal decisions.

Understanding Charles Payne's financial situation can provide context for evaluating his impact and influence. The value of assets, particularly those tied to his profession or ventures, can offer clues to his financial success. For example, a substantial net worth might reflect significant earnings in a specific industry or successful business ventures. The figure is relevant as it illustrates the outcomes of choices, decisions, and risks involved in a career path. There is no singular, universally accepted method for calculating net worth; it often depends on the source and methods used to derive the figure.

| Category | Details |

|---|---|

| Name | Charles Payne |

| Profession | (Insert Profession here) |

| Known for | (Insert accomplishments or notable work here) |

| Approximate Net Worth (estimated) | (Insert estimated net worth here, if available. Note this is often not publicly available.) |

Further exploration into Charles Payne's life, career, and accomplishments will require delving into specific contexts, like his background, achievements, and the period in which he lived.

Charles Payne's Net Worth

Understanding Charles Payne's net worth involves examining various factors that contribute to his financial standing. A comprehensive assessment considers both his earnings and financial obligations.

- Earnings

- Investments

- Assets

- Debts

- Profession

- Career trajectory

- Market conditions

Charles Payne's net worth is a complex calculation reflecting his professional earnings, successful investments, and valuable assets. High-earning professions often correlate with substantial net worth. Fluctuations in market conditions can impact investment returns, affecting the final figure. Debts and expenses are critical components, reducing the overall net worth. Examining his career trajectory provides context a sustained period of success frequently results in a higher net worth. For example, an entrepreneur with successful ventures likely has a more substantial net worth compared to someone in a less profitable field. Ultimately, the various components intertwine to illustrate the overall financial position of Charles Payne.

1. Earnings

Earnings represent a fundamental component of Charles Payne's net worth. The amount and consistency of income directly influence the overall financial standing. Analyzing the sources and patterns of earnings sheds light on the factors contributing to his accumulated wealth.

- Sources of Income

Identifying the various sources of Charles Payne's income is crucial. This might include salary, investment returns, royalties, or other forms of revenue. Examining the relative contribution of each source provides insight into the diversification and stability of his income streams. A dependence on a single source could indicate financial risk.

- Income Stability

The regularity and predictability of income are vital factors. Consistent and substantial earnings over an extended period tend to contribute to a higher net worth. Interruptions or fluctuations in income can hinder the accumulation of wealth. Evaluating trends in income over time offers an understanding of the stability and potential growth of financial resources.

- Compensation Structure

The nature of compensation arrangementssalary structure, bonuses, or commissionsinfluences the overall earning potential. Significant or recurring bonuses can represent an important component of total income. Different compensation models have different implications for net worth accumulation.

- Inflation and Purchasing Power

Inflationary pressures impact the real value of earnings over time. Analysis of earnings adjusted for inflation offers a clearer understanding of the actual purchasing power through the years, as opposed to just the numerical value. This helps assess the actual growth of earning power compared to the increasing cost of living.

Ultimately, earnings are a critical component in the calculation of Charles Payne's net worth. By analyzing the sources, stability, structure, and impact of inflation, a deeper understanding of the factors contributing to his overall financial position can be achieved. This provides context to the overall financial success.

2. Investments

Investments play a significant role in determining Charles Payne's net worth. The types and performance of investments directly influence the accumulation of wealth. Successful investments amplify accumulated capital, while poor choices can diminish it.

- Types of Investments

The range of investment vehicles available, including stocks, bonds, real estate, and mutual funds, affects the potential return and risk profile. Diversification across different asset classes can mitigate risk and potentially enhance returns. Analysis of the specific types of investments held provides insight into the individual's investment strategy and risk tolerance. For example, a substantial investment in stocks suggests a belief in the growth potential of specific companies or the market generally. Conversely, a portfolio emphasizing bonds indicates a preference for more stable returns and lower risk.

- Investment Performance

The performance of investments over time directly impacts the growth of capital and ultimately, net worth. High-performing investments contribute significantly to increases in net worth, while underperforming investments might negatively impact overall wealth. Examining the historical performance of investment choices illuminates strategies and their effectiveness in generating returns and capital appreciation. Consistent gains indicate successful investment choices, whereas repeated losses can be a cause for concern.

- Investment Strategies

The approach adopted in managing investments significantly impacts the results. Passive strategies, like index funds, may offer stability. Active strategies, such as actively managed mutual funds or individual stock picking, entail greater potential returns but also higher risk. Understanding the investment strategies employed provides insight into the anticipated return and the possible levels of volatility. The chosen strategies may reflect a specific risk tolerance or time horizon.

- Risk Tolerance and Investment Horizon

The level of risk an individual is willing to accept in their investments is a key component of their investment strategy. A higher tolerance for risk might lead to investments with a greater potential for return but also greater volatility. Conversely, a lower tolerance could mean investments with lower potential returns but less fluctuation. This risk tolerance combined with the intended duration of the investment (investment horizon) shapes the specific investment choices. A longer investment horizon can often support a higher tolerance for risk. The appropriate blend of risk and investment time horizon will ultimately influence the composition of the portfolio.

Considering these facets allows a broader understanding of the impact investments have on Charles Payne's net worth. The types, performance, strategies employed, and related factors combined can illustrate the effectiveness of his investment decisions and the associated growth in capital. This analysis illuminates the financial prudence and potential profitability of his investment strategies.

3. Assets

Assets are a crucial component of Charles Payne's net worth. They represent the sum total of valuable possessions, ownership stakes, and financial holdings. The value and type of assets directly correlate with the overall financial standing. A substantial portfolio of valuable assets contributes positively to a higher net worth, while a lack of substantial assets or assets with low market value will result in a lower figure. The presence and value of these assets are a significant determinant of an individual's financial position.

Various types of assets contribute to the overall net worth. Tangible assets, such as real estate (homes, land), vehicles, and collectibles, hold intrinsic value. Intangible assets, like intellectual property (patents, copyrights), brand recognition, and valuable business relationships, often contribute substantial value. Investments in stocks, bonds, and other financial instruments are also categorized as assets, impacting net worth based on their market performance. The diverse nature of these assets highlights the complexity of evaluating overall wealth and the influence of different investment strategies. For example, an individual with significant real estate holdings likely has a substantial net worth component tied to these assets. Conversely, someone with a strong portfolio of publicly traded stocks may show a different profile of asset-driven wealth.

Understanding the connection between assets and net worth is vital for several reasons. It allows for a nuanced evaluation of financial well-being. The types and value of assets provide insight into an individual's financial strategy and choices. Moreover, analyzing asset performance can reveal trends in wealth accumulation or decline. For example, if a significant portion of an individual's net worth is tied to a single asset, a downturn in the value of that asset could significantly impact their overall financial situation. A diverse asset portfolio, on the other hand, generally offers greater resilience against such fluctuations. This understanding is also crucial for financial planning, investment decisions, and risk management, enabling individuals and institutions to make informed choices based on the actual composition of their financial assets.

4. Debts

Debts directly impact Charles Payne's net worth. Subtracting outstanding financial obligations from the total value of assets yields the net worth figure. The size and type of debt significantly influence the overall financial picture. Understanding the nature of these debts is essential to evaluating the true financial position and potential for future growth.

- Types of Debt

Various types of debtmortgages, loans, credit card debt, and outstanding business obligationsaffect net worth differently. The size of each debt, interest rates, and repayment terms all play a critical role. For instance, high-interest credit card debt will reduce net worth more significantly compared to low-interest, long-term mortgages. Debt associated with business ventures, if not managed properly, could also exert a considerable influence on the net worth figure.

- Debt Burden and Management

The total amount of debt relative to assets, often expressed as a debt-to-asset ratio, provides a crucial measure of financial risk and stability. High levels of debt can jeopardize the ability to generate positive cash flow and potentially impact future investment opportunities. Effective debt management strategies, such as disciplined budgeting, timely payments, and proactive negotiation of terms, can help alleviate the impact of debt and enhance net worth.

- Impact on Cash Flow

Debt payments directly reduce available cash flow. This reduced cash flow can constrain investment opportunities, limit financial flexibility, and constrain the ability to manage unexpected circumstances. Maintaining sufficient cash flow to cover debt obligations and other expenses is a critical component of long-term financial health.

- Credit Score Implications

Debt management also impacts creditworthiness. Consistent and timely repayment of debts positively impacts credit scores, facilitating access to favorable financing terms. Conversely, poor debt management practices can negatively affect credit scores, creating barriers to securing new loans or credit and hindering the ability to secure favorable financing in the future.

In conclusion, debts are a significant, often overlooked, element of Charles Payne's net worth calculation. Effective debt management, including careful consideration of debt types, burden, cash flow implications, and credit score consequences, directly impacts the overall financial picture. The successful handling of debt obligations strongly contributes to long-term financial health and overall well-being.

5. Profession

A person's profession significantly influences their net worth. The nature of employment, industry, and individual performance within the field all contribute to overall financial standing. This section explores the correlation between profession and Charles Payne's financial circumstances.

- Income Potential

Certain professions inherently offer higher earning potential than others. For example, high-demand fields like medicine, finance, or technology often lead to significantly higher salaries and associated bonuses, directly impacting accumulated wealth. The compensation structure within a profession also plays a role; professions with performance-based incentives (e.g., commissions) can lead to substantial earnings for individuals who excel. Conversely, lower-paying professions will likely result in a comparatively lower net worth.

- Career Trajectory and Advancement

A career path marked by consistent advancement and promotions often correlates with increased income and opportunities for investment. A successful career trajectory in a specific profession usually yields greater opportunities for financial growth. The longevity and stability of a particular career can contribute to wealth building. Professionals with steady employment and a track record of success are more likely to generate substantial wealth over time.

- Industry and Market Conditions

The economic climate within a particular industry can drastically influence an individual's earning potential. Prosperous and expanding industries tend to create more lucrative opportunities, enabling professionals to accumulate wealth more easily. Conversely, economic downturns in a given industry can reduce earning potential. The industry's prevailing economic conditions impact an individual's income, and overall, their net worth.

- Skills and Expertise

Specialized skills and expertise within a profession can often command higher compensation. Professionals possessing unique talents or highly valued skills within their area of expertise, particularly when in short supply, may command premium rates. A professional with an uncommon ability or refined expertise, especially in high-demand areas, could earn substantial income, leading to increased net worth.

In conclusion, Charles Payne's profession serves as a significant factor in determining his net worth. The income potential, career progression, economic landscape of the industry, and specialization of skills all contribute to the overall financial standing. Understanding these components provides a more nuanced picture of the relationship between profession and financial success.

6. Career Trajectory

Career trajectory significantly influences an individual's net worth. A successful and sustained upward trajectory, marked by consistent advancement and increased responsibility, often correlates with higher income potential and expanded investment opportunities. Conversely, a stagnant or declining trajectory may limit earnings and investment capacity, impacting the accumulation of wealth. The connection lies in the direct correlation between career progression and compensation; as an individual advances professionally, they typically command greater compensation. This increased income provides a larger pool for savings, investment, and ultimately, the accumulation of assets, a key component of net worth. For example, a software engineer who progresses from junior developer to senior manager, overseeing projects and leading teams, will likely experience commensurate salary increases, allowing them to save and invest more effectively, ultimately resulting in a higher net worth.

The importance of career trajectory extends beyond simply financial considerations. A clear and well-defined trajectory provides a roadmap for long-term financial planning. Individuals with established career paths can more accurately project their income streams, allowing for better budgeting, investment strategies, and ultimately, a more proactive approach to financial management. This also provides the foundation for a more secure financial future, enabling individuals to confidently navigate economic uncertainties and make informed financial decisions. An individual with a consistent upward career trajectory and a clear understanding of their profession's progression typically feels more financially secure and better prepared to manage economic fluctuations. The career trajectory acts as a significant predictor of future earning potential and therefore, a reliable factor in calculating the prospect of future net worth.

In summary, career trajectory is a critical factor in determining net worth. The direct relationship between career progression and income is undeniable. A well-defined and successful trajectory enables better financial planning, potentially creating a more secure financial future. This understanding underscores the importance of career development and strategic career choices in building long-term wealth. Individuals should actively cultivate career growth opportunities to increase earning potential and strengthen their overall financial standing. Ultimately, a robust career trajectory provides a strong foundation for future wealth accumulation and a higher net worth.

7. Market Conditions

Market conditions significantly impact an individual's net worth. The overall economic climate, fluctuations in asset values, and industry-specific trends directly influence the value of investments and assets, which are key components of net worth calculations. Understanding these influences is essential for evaluating and projecting future financial positions.

- Economic Cycles

Economic cycles, characterized by periods of growth and recession, profoundly affect net worth. During periods of expansion, asset values often increase, potentially leading to higher net worths. Conversely, recessions typically depress asset values and income, potentially reducing net worth. A cyclical understanding of the economy is crucial for anticipating potential changes in an individual's net worth.

- Interest Rate Fluctuations

Interest rates directly impact various financial instruments. Rising interest rates can increase borrowing costs for individuals and businesses, which can impact investment decisions and spending. This, in turn, can influence the value of debt, potentially reducing the overall net worth. Conversely, falling interest rates can make borrowing more affordable, possibly stimulating economic activity and increasing asset values, ultimately affecting net worth positively.

- Inflationary Pressures

Inflation erodes the purchasing power of money over time. Rising inflation can reduce the real value of assets, decreasing net worth if not adequately compensated for through investment returns or other strategies. Inflationary pressures necessitate careful financial planning and adjustments to investment strategies to maintain or enhance net worth.

- Industry-Specific Trends

Specific industries experience variations in economic performance. A boom in a particular industry can increase the value of related companies' stocks and assets, boosting net worth for individuals invested in those sectors. Conversely, declining industries can decrease the value of related assets, potentially leading to net worth reductions. Understanding these sector-specific trends is crucial in assessing the overall market's impact on net worth.

In conclusion, market conditions are dynamic and multi-faceted influences on net worth. From economic cycles to industry-specific trends, these factors play a crucial role in the accumulation and preservation of wealth. Individuals and institutions should actively monitor and analyze market conditions to adapt investment strategies and potentially mitigate risks to maintain and enhance their net worth figures.

Frequently Asked Questions about Charles Payne's Net Worth

This section addresses common inquiries regarding the financial standing of Charles Payne. Information presented here aims to provide clarity and factual answers, rather than speculation or opinion.

Question 1: How is Charles Payne's net worth determined?

Net worth represents the total value of assets minus liabilities. This includes cash, investments, property, and other holdings, less any outstanding debts. Determining a precise figure often requires access to private financial information, which is typically not publicly available. Estimated net worth figures, frequently appearing in media reports, are usually approximations based on publicly known information and industry analysis.

Question 2: Why is Charles Payne's net worth important to analyze?

Analyzing an individual's net worth, like Charles Payne's, provides context for understanding their financial success, career trajectory, and overall economic standing. It offers insights into how choices and decisions throughout their career have potentially contributed to their current financial position. The figure can also illustrate the effects of industry trends or market fluctuations on an individual's financial well-being.

Question 3: Is the reported net worth for Charles Payne always accurate?

Published net worth estimates for individuals like Charles Payne are often approximations. The accuracy of these figures depends heavily on the methodology used and the availability of publicly accessible information. Precise and definitive figures are typically not readily available for private individuals.

Question 4: How does Charles Payne's profession impact their net worth?

Profession directly influences earnings potential, and therefore, net worth. Higher-earning professions, coupled with successful career advancement, generally lead to greater accumulation of wealth. Economic conditions within the profession's industry also significantly impact earning potential and ultimately, net worth.

Question 5: How do market conditions affect Charles Payne's financial standing?

Market conditions, including economic cycles, interest rate fluctuations, and inflationary pressures, influence investment returns and asset values. Changes in these conditions can affect the overall value of an individual's assets and therefore their net worth. Individuals and their financial advisors must account for these fluctuations when making financial decisions.

In summary, understanding Charles Payne's net worth necessitates careful consideration of numerous factors. While reported estimates provide a general overview, precise figures often remain undisclosed. The reported information should be interpreted with a degree of caution and placed within the appropriate context of market conditions and career paths.

Moving forward, we will delve into Charles Payne's career and achievements, providing additional context for understanding the factors impacting their financial standing.

Conclusion

This analysis of Charles Payne's net worth reveals a complex interplay of factors. Income generation, investment performance, and the management of assets and debts are crucial components. The individual's profession, career trajectory, and prevailing market conditions all significantly influence the ultimate financial standing. While precise figures are often unavailable, the examination of these interconnected elements provides a comprehensive understanding of the forces shaping financial outcomes.

Ultimately, the exploration of Charles Payne's net worth underscores the multifaceted nature of financial success. It highlights the importance of prudent financial management, strategic investment choices, and navigating economic conditions. Further research into the specifics of Charles Payne's career and financial decisions could provide additional insights into these principles. This analysis serves as a reminder that understanding the dynamics of financial accumulation and preservation requires a comprehensive consideration of numerous interwoven factors.

Detail Author:

- Name : Miller Hermiston

- Username : gromaguera

- Email : broderick61@hotmail.com

- Birthdate : 1985-10-14

- Address : 4125 Bednar Crossing Lednerton, WA 71771

- Phone : +19476234311

- Company : Kertzmann Ltd

- Job : Information Systems Manager

- Bio : Ratione illum vero eos rerum expedita dolor delectus voluptas. Autem neque omnis sequi debitis debitis. Mollitia aperiam et odio et at qui.

Socials

facebook:

- url : https://facebook.com/ahauck

- username : ahauck

- bio : Sed repellendus et qui harum.

- followers : 5926

- following : 2902

linkedin:

- url : https://linkedin.com/in/abagail_hauck

- username : abagail_hauck

- bio : Aspernatur et expedita fugiat et aut.

- followers : 6410

- following : 2661