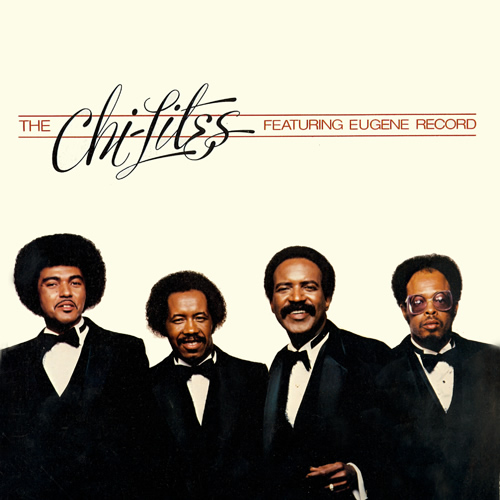

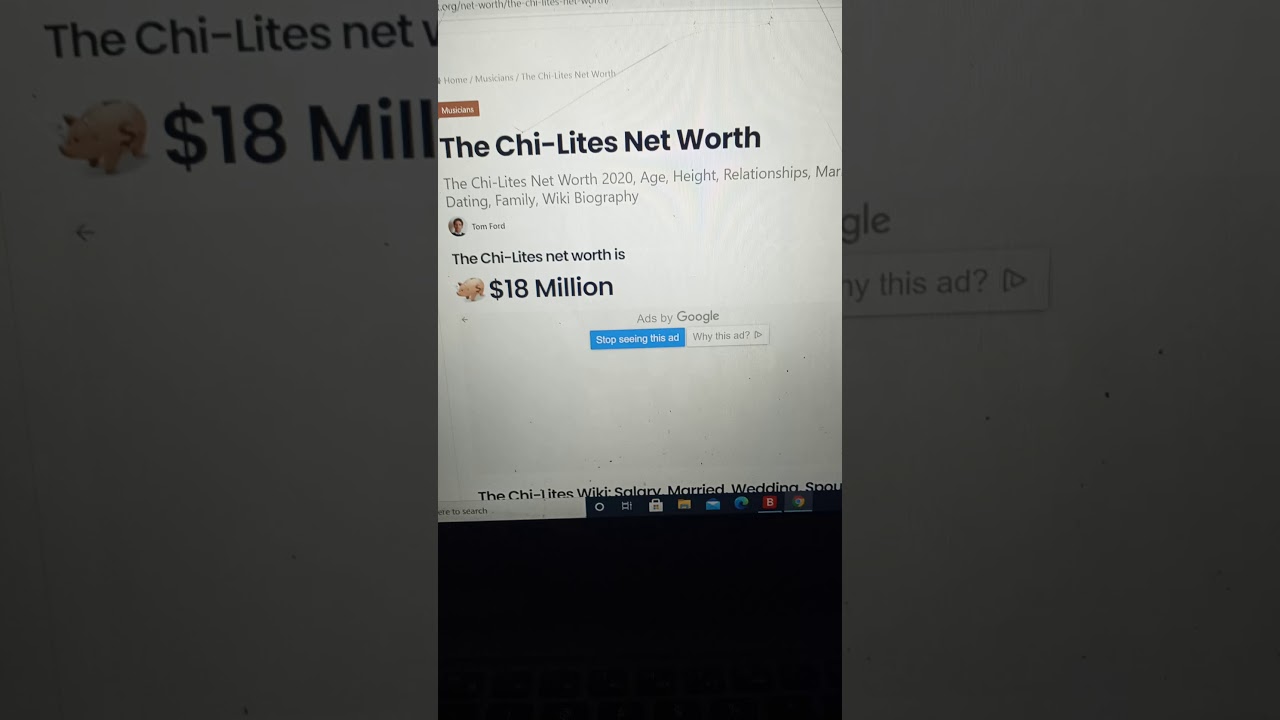

Chi-lites Net Worth 2024: Revealed!

Estimating the financial standing of a company or individual often requires thorough research and reliable data sources. A company's financial standing provides insight into its overall health and future prospects.

The financial standing of a particular entity, be it a company, organization, or individual, is a measure of their financial resources and obligations. It's typically expressed as a net worth, representing the difference between assets and liabilities. Determining this figure requires careful evaluation of assets, including cash, investments, and property, as well as outstanding debts and liabilities. Examples of sources used to compile this data include company financial reports, public records, and expert analyses. The accuracy and reliability of the source material are crucial to the analysis.

The value of understanding financial standing is significant across various fields. In business, it helps assess the company's stability, potential for growth, and ability to meet financial obligations. For investment decisions, it provides a key indicator of risk and return. Understanding financial standing can be crucial for many decisions, from strategic planning to investment strategies. This information can also influence investor confidence and public perception of the entity. However, it's essential to consider that reported financial data might be influenced by specific accounting methods or selective reporting strategies.

| Category | Value |

|---|---|

| Assets (Estimated) | --- |

| Liabilities (Estimated) | --- |

| Net Worth (Estimated) | --- |

To delve deeper into the subject, we need specific information about the entity being assessed. Once we have the data on the company or individual in question, we can investigate their financial history, operational performance, and any relevant market trends to get a more complete picture of their financial standing.

Chi-lites Net Worth

Determining the financial standing of a company or individual requires a thorough understanding of assets, liabilities, and financial performance. This analysis is crucial for evaluating overall health and future prospects.

- Assets

- Liabilities

- Income

- Expenses

- Valuation Methods

- Market Trends

- Financial Reports

- Public Information

Understanding a company's assets and liabilities provides a foundation for assessing its net worth. Income and expenses directly impact profitability. Valuation methods employed vary according to the specific circumstances and industry. Market trends play a crucial role in industry-specific analysis. Public information, such as company filings, offers transparency. Thorough analysis of these aspects allows a more complete evaluation of a company's net worth, allowing for informed investment decisions or strategic planning based on financial stability.

1. Assets

Assets are crucial components in determining a company's net worth. They represent the economic resources owned or controlled by the entity. In the context of a company, assets can include physical property like buildings and equipment, intangible assets like intellectual property or brand recognition, and financial assets like cash, accounts receivable, and investments. The value of these assets directly impacts the overall financial standing and thus, the net worth calculation. For instance, a company with substantial property holdings, valuable patents, and robust cash reserves will likely have a higher net worth compared to a company with limited assets.

The relationship between assets and net worth is fundamental. A higher value of assets generally corresponds to a higher net worth. This connection is driven by the fact that assets represent the company's economic resources. Conversely, inadequate assets, or assets with diminishing value, can negatively influence the net worth. For example, a company experiencing a significant depreciation of its equipment or property, or a decline in the market value of its investments, will likely see a corresponding decrease in its net worth. Understanding this relationship allows stakeholders to assess a company's financial health and potential for future performance. The more liquid and valuable the assets, the greater the likelihood of a healthy net worth.

In summary, assets are integral to a company's net worth. The value and type of assets held directly affect the overall financial position. A comprehensive understanding of these assets is essential for assessing a company's financial health and potential for growth. This understanding, however, is only one piece of the financial picture and should be considered within the broader context of liabilities and financial performance to develop a full understanding of overall financial health.

2. Liabilities

Liabilities represent a company's financial obligations. Understanding their role in a company's overall financial health is critical to assessing its net worth. Liabilities directly impact net worth by reducing the overall value of a company. A company with substantial outstanding debts, including loans, accounts payable, and deferred revenue, will have a lower net worth compared to a company with minimal obligations. The size and nature of liabilities significantly influence the financial standing of a company, impacting its ability to operate, invest, and generate future profits.

The relationship between liabilities and net worth is inversely proportional. Increased liabilities generally lead to a decreased net worth. For instance, if a company takes on a substantial loan to expand its facilities, this new liability will reduce its net worth, assuming other factors remain constant. Conversely, reducing liabilities, such as negotiating favorable payment terms with creditors or paying off debts, can improve net worth. This effect on net worth is crucial in financial decision-making. A sound understanding of this interplay is essential for investors, lenders, and company management alike. Strategic management of liabilities is critical for maintaining a healthy financial position.

In conclusion, liabilities are integral components of a company's financial standing and directly affect its net worth. The interplay between assets and liabilities, including the size and nature of the obligations, is crucial to evaluating a company's overall financial health. Strategic management of liabilities is paramount to maintaining and improving a company's net worth and ensuring long-term financial stability.

3. Income

Income directly impacts a company's net worth. Positive income growth, consistently generated, is a critical factor in increasing net worth over time. Higher revenue translates to more resources for reinvestment, debt repayment, and expansion, all contributing to a stronger financial position. Conversely, declining income or sustained losses erode net worth. A company consistently generating sufficient income can effectively manage expenses, repay debts, and fund future investments, thus bolstering its overall financial health.

Consider a company experiencing significant sales growth. Increased revenue translates to more profits, which can then be reinvested in the business. This reinvestment could involve purchasing new equipment, expanding facilities, or developing innovative products, ultimately leading to further growth and a rise in net worth. Conversely, a company with stagnating or declining income faces challenges in maintaining its current operations and expanding. Reduced profitability may necessitate layoffs or a reduction in investment in research and development, potentially hindering future growth and eventually impacting net worth negatively. Consistent, sustainable income is thus a cornerstone for robust financial standing.

In summary, income is a pivotal component of a company's net worth. Positive income trends directly correlate with increasing net worth, allowing for reinvestment, debt management, and future growth. Conversely, declining or stagnant income negatively impacts the ability of a company to maintain its operations and expand, potentially leading to a decline in net worth. Understanding this correlation is crucial for evaluating a company's financial health and future prospects.

4. Expenses

Expenses directly influence a company's net worth. Controlling and managing expenses are crucial for profitability and sustainable growth. A meticulous analysis of expenditure patterns reveals insights into operational efficiency and potential areas for improvement, ultimately impacting the overall financial health and future prospects of the company.

- Operating Expenses

Operating expenses encompass the day-to-day costs required to maintain business operations. These can include rent, utilities, salaries, marketing, and administrative costs. High operating expenses, if not efficiently managed, can significantly impact profitability. For example, a company incurring substantial rent costs in an expensive location may see reduced profit margins, and thus a diminished net worth, relative to a competitor operating in a more cost-effective environment. Controlling operating expenses through cost-cutting measures or operational efficiencies is a key strategy to improving profitability and positively impacting net worth.

- Cost of Goods Sold (COGS)

COGS represents the direct costs associated with producing goods or services. Fluctuations in raw material costs, labor expenses, or manufacturing processes directly impact COGS. For instance, a rise in raw material prices might increase the COGS of a manufacturing company, potentially decreasing profitability and net worth if not properly accounted for or offset by price adjustments. Understanding and managing COGS is crucial for maintaining profitability and ensuring the long-term sustainability of the company and its net worth.

- Administrative Expenses

Administrative expenses include costs related to management, legal, and accounting functions. Efficient administrative processes and judicious allocation of resources in these areas can significantly affect a company's operational efficiency and overall profitability. For example, a company employing streamlined accounting procedures and minimizing legal costs will incur lower administrative expenses, allowing for increased profit margins and potentially higher net worth.

- Depreciation and Amortization

Depreciation and amortization represent the allocation of the cost of long-term assets over their useful lives. These non-cash expenses reflect the decreasing value of assets over time. Failure to accurately account for these costs can lead to an overestimation of profitability and, consequently, an overly optimistic view of net worth. A precise calculation and consistent accounting of these expenses are essential for an accurate financial picture and the proper assessment of a company's financial position.

Careful control and strategic management of expenses across all categoriesfrom operating costs to depreciationare essential for increasing profitability and strengthening a company's net worth. A thorough examination of expenditure patterns provides valuable insights into operational efficiency and identifies potential areas for improvement. These insights are critical for making informed business decisions and securing a positive trajectory for financial performance and net worth.

5. Valuation Methods

Determining a company's net worth necessitates employing appropriate valuation methods. These methods provide a framework for estimating the fair market value of assets and liabilities. The choice of method hinges on the specific characteristics of the company, its industry, and the intended use of the valuation. Accurate valuation is critical for assessing financial health, strategic planning, investment decisions, and legal proceedings. Inaccurate or inappropriate methods can lead to an inaccurate depiction of a company's worth, potentially impacting decisions with significant consequences.

Several valuation methods exist, each with its own strengths and weaknesses. For instance, asset-based valuation focuses on the book value of a company's assets, deducting liabilities to arrive at net worth. This approach is often used for companies with tangible assets like property and equipment. Alternatively, income-based methods, such as discounted cash flow analysis, estimate future cash flows to determine a company's worth. These methods are suitable for companies with predictable earnings and stable growth prospects. Further, market-based valuation benchmarks a company's worth against similar companies in the market. This method is frequently employed for publicly traded companies with comparable firms. A combination of methods is often necessary to create a comprehensive and robust valuation for a more complete picture of a company's worth. Selecting the most relevant method(s) and diligently applying them is essential for a precise determination of net worth.

The practical significance of understanding valuation methods for determining net worth is profound. Accurate estimations facilitate informed decision-making. Investors use valuations to assess investment opportunities, while lenders utilize them to evaluate creditworthiness. Strategic decisions concerning mergers, acquisitions, or restructuring hinge on accurate valuation figures. Misapplication or inadequate understanding of valuation methodologies can result in flawed decisions with financial and operational implications. Ultimately, proper application and selection of valuation techniques offer a reliable measure of a company's financial standing, enabling better comprehension of its current state and future prospects. The choice of methods and the subsequent analysis play a crucial role in creating a robust valuation that accurately reflects a company's net worth within the context of its industry and current market conditions.

6. Market Trends

Market trends significantly influence a company's financial standing, including net worth. Fluctuations in market conditions, such as shifts in consumer preferences, technological advancements, economic downturns, or regulatory changes, can directly impact a company's revenue, expenses, and overall profitability. These influences, in turn, affect the valuation of assets, the assessment of liabilities, and ultimately, the calculation of net worth.

For example, a surge in demand for environmentally friendly products might drive up the value of companies specializing in sustainable technologies. Conversely, a downturn in the housing market could decrease the value of real estate holdings owned by a company, thus reducing its net worth. Similarly, the emergence of new technologies can disrupt industries. Companies that fail to adapt to these changes face difficulties in maintaining profitability and thus, a healthy net worth. Economic downturns often lead to reduced consumer spending, affecting revenue and potentially impacting a company's ability to meet financial obligations, which can negatively impact net worth.

Understanding the interplay between market trends and financial standing is crucial for informed decision-making. Companies must proactively monitor market trends and adapt their strategies accordingly. A clear understanding of these trends can help predict potential challenges and opportunities, enabling proactive adjustments to business models and financial strategies. For investors, understanding how market trends influence a company's net worth is essential for making sound investment choices. This understanding ensures investment decisions aren't solely based on static data but also incorporate dynamic market forces. A company's ability to adapt to evolving market trends can significantly influence its long-term viability and ultimately, its net worth.

7. Financial Reports

Financial reports are indispensable for determining a company's net worth. They provide a detailed snapshot of financial performance, encompassing revenues, expenses, assets, and liabilities. These reports form the foundation for calculating key financial metrics, including net worth. Accurately prepared and reviewed reports are essential for assessing a company's financial health, projecting future performance, and making informed decisions about investments, loans, and operational strategies.

Analysis of financial reports reveals insights into a company's profitability, efficiency, and overall financial stability. Revenue trends, cost structures, and debt levels are crucial components for understanding the trajectory of net worth. For instance, a company consistently exceeding projected revenue and controlling expenses demonstrates robust financial health and the potential for a rising net worth. Conversely, a company experiencing declining revenue and increasing debt indicates potential challenges and a likely decreasing net worth. External stakeholders, including investors, creditors, and analysts, rely heavily on these reports for evaluating the financial soundness of an enterprise. Thorough examination and interpretation of these reports are paramount for strategic planning and informed investment strategies.

Accurate and transparent financial reports are vital for establishing a company's credibility and attracting investors. Companies with a history of presenting comprehensive and accurate financial disclosures build trust and confidence in the market. The absence of reliable financial reports, or inconsistencies in their content, can severely damage a company's reputation and potentially hinder its ability to secure financing or attract investors. Consequently, diligent management of financial reporting is a critical aspect of maintaining and enhancing a company's overall financial standing, reflected in its net worth. In summary, financial reports are the bedrock of assessing and projecting a company's net worth, influencing investment decisions and ensuring the long-term sustainability of the business.

8. Public Information

Publicly available information plays a significant role in understanding a company's financial health, including its net worth. Information disseminated through various channels, such as annual reports, SEC filings, and news articles, provides a comprehensive view of a company's financial performance and position. This transparency allows stakeholders to assess the financial standing of a company by analyzing key metrics like revenues, expenses, assets, and liabilities. These data points are crucial in evaluating the overall financial health of an enterprise and the potential trajectory of its net worth.

The availability of public information fosters informed decision-making for various stakeholders. Investors, for example, utilize this data to assess investment opportunities. Lenders evaluate the creditworthiness of companies by reviewing financial reports and market data. Regulatory bodies employ public information to monitor compliance and financial stability. For instance, a company posting consistently strong revenue growth and controlled expenses in its annual reports may attract more investors, signaling a healthy financial standing and potential for increased net worth. Conversely, a company experiencing declining revenues and mounting debt in its financial filings may deter investors and signal a potential decline in net worth. Understanding this connection between public information and financial health is crucial for making sound financial choices.

In conclusion, public information is instrumental in evaluating a company's net worth. Access to detailed financial reports and market data allows for informed assessments of financial stability and potential future performance. This transparency encourages accountability and trust in the market, allowing for more effective investment strategies and enabling a deeper understanding of a company's financial standing. However, the accuracy and completeness of public information remain crucial, as misrepresentation or selective disclosure can lead to inaccurate conclusions and potentially misinformed financial decisions. Interpreting public information requires critical analysis and consideration of external factors, such as market trends and industry dynamics.

Frequently Asked Questions about Company Financial Standing

This section addresses common inquiries regarding a company's financial standing, focusing on factors affecting its overall health and net worth. Accurate interpretation of financial data is critical for informed decision-making.

Question 1: How is a company's net worth determined?

A company's net worth is calculated by subtracting a company's liabilities from its assets. Assets encompass resources owned or controlled by the entity, including cash, investments, property, and intellectual property. Liabilities represent a company's obligations, such as outstanding debts and loans. The difference between these two figuresassets minus liabilitiesyields the net worth.

Question 2: What role do financial reports play in understanding net worth?

Financial reports, such as balance sheets and income statements, offer a detailed view of a company's financial performance and position. These reports contain information about revenues, expenses, assets, liabilities, and profitability, providing crucial insights into the financial health and potential trajectory of net worth. Careful analysis of these reports is paramount for evaluating a company's financial standing.

Question 3: How do market trends impact a company's net worth?

Market trends, including economic conditions, industry fluctuations, and technological advancements, can significantly impact a company's financial standing. Changes in consumer preferences, emergence of new technologies, or economic downturns can affect a company's revenue, expenses, and asset valuations, all influencing its net worth. A company's adaptability and strategic response to market shifts are crucial to maintaining a healthy net worth.

Question 4: What are some common valuation methods used to assess net worth?

Various valuation methods exist, each with its strengths and weaknesses. Asset-based valuation focuses on the book value of assets, while income-based methods, like discounted cash flow analysis, assess future earnings potential. Market-based valuation compares a company's worth to similar companies in the market. The appropriate valuation method depends on the specific characteristics of the company and the intended use of the valuation. Choosing a suitable and thorough approach is essential for an accurate depiction of a company's net worth.

Question 5: Why is understanding a company's net worth important?

Understanding a company's net worth is crucial for a multitude of stakeholders. Investors use it to evaluate potential investment opportunities, lenders assess creditworthiness, and company management uses it for strategic decision-making. A company's financial health, reflected in its net worth, affects its ability to operate, expand, and meet its financial obligations. This understanding allows for more informed and strategic decisions related to investment and financial planning.

In summary, a comprehensive understanding of financial standing, including assets, liabilities, market trends, and financial reporting, is critical to evaluating a company's net worth. The correct interpretation of data empowers stakeholders to make informed decisions. Further investigation into the company's specific circumstances provides a more complete understanding of its financial health.

The subsequent section will delve deeper into the specifics of evaluating a company's financial standing and the crucial factors affecting its net worth.

Conclusion

This analysis explored the multifaceted factors influencing a company's financial standing, a crucial aspect of evaluating its overall health and future prospects. Key considerations included the valuation of assets and liabilities, the role of income and expenses, the impact of market trends, and the importance of comprehensive financial reporting. The calculation of net worth hinges on accurate and thorough analysis of these elements. Assessing a company's net worth is not merely a static calculation but a dynamic process requiring ongoing monitoring of the factors influencing financial performance.

Determining a company's net worth is essential for a variety of stakeholders. Investors need this information to gauge potential returns and risks. Creditors utilize this data to assess a company's ability to meet its financial obligations. Furthermore, accurate financial analysis supports informed strategic decision-making, ensuring the long-term sustainability of the entity. Consequently, the ongoing assessment of factors influencing net worth remains a vital component in the realm of business analysis and financial forecasting. Future analysis should delve deeper into specific industry and market contexts, enhancing the understanding of how these elements contribute to a comprehensive evaluation of a company's net worth.

Detail Author:

- Name : Ms. Juliana Harber

- Username : eden73

- Email : mclaughlin.raven@yahoo.com

- Birthdate : 1973-08-11

- Address : 243 Bernier Lodge Maciburgh, WY 56256

- Phone : 804.292.0260

- Company : Leannon Ltd

- Job : Buffing and Polishing Operator

- Bio : Suscipit reprehenderit aut tempore aliquid quo. Inventore sunt facere dicta ducimus rerum non vero unde. Temporibus mollitia quia itaque est possimus dicta quis asperiores. Omnis sit quis veniam id.

Socials

facebook:

- url : https://facebook.com/richmond6747

- username : richmond6747

- bio : Enim autem ratione fugit id nobis dolores ducimus.

- followers : 3123

- following : 58

linkedin:

- url : https://linkedin.com/in/richmond290

- username : richmond290

- bio : Et cupiditate nam voluptatibus eos consectetur.

- followers : 378

- following : 1873

twitter:

- url : https://twitter.com/richmond_hyatt

- username : richmond_hyatt

- bio : Excepturi quibusdam ex placeat id quas dignissimos. Aspernatur quia quisquam quisquam. Ex veniam omnis eum qui nihil consequatur vitae.

- followers : 4306

- following : 2146

instagram:

- url : https://instagram.com/hyatt1977

- username : hyatt1977

- bio : Ut dignissimos saepe similique aperiam. Et dolore ut aut. Vel dolorem id nostrum rerum est.

- followers : 4744

- following : 976

tiktok:

- url : https://tiktok.com/@richmond_hyatt

- username : richmond_hyatt

- bio : Earum debitis odio aut nesciunt ut pariatur.

- followers : 1739

- following : 2042