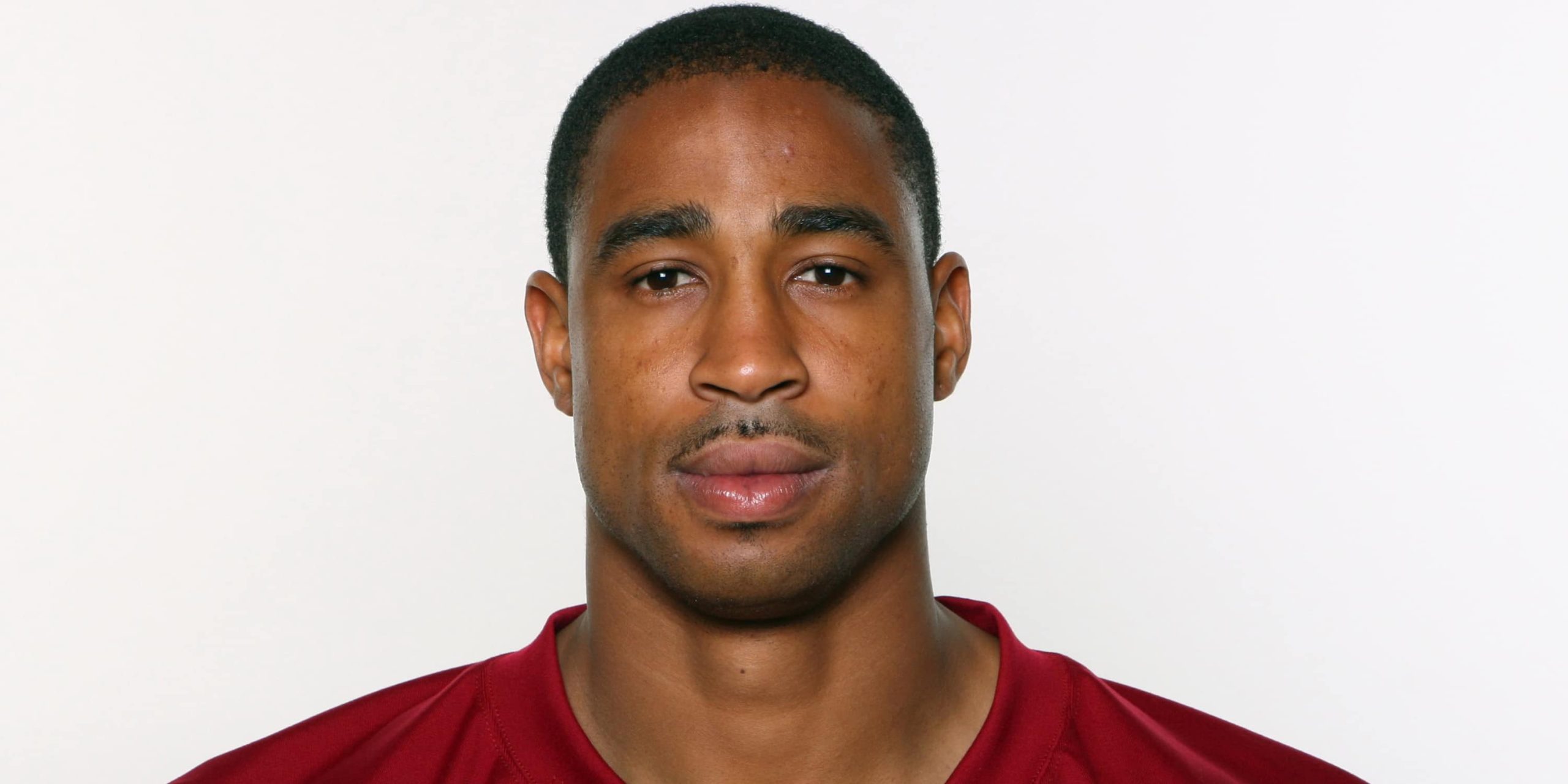

Fred Smoot Net Worth: 2024 Update & Facts

How much is Fred Smoot worth? Understanding a Public Figure's Financial Standing.

Fred Smoot's financial standing, like that of any public figure, reflects a combination of income sources, investment strategies, and personal spending habits. This information, while not always publicly available in detail, can provide insights into a person's overall economic position. Analyzing such data requires careful consideration of available resources, recognizing that these figures are often estimates, and not definitive statements.

The significance of an individual's net worth extends beyond mere curiosity. In the context of a public figure, it can illuminate the success and impact of their endeavors. For instance, the financial trajectory of a businessman or entrepreneur can reflect their business acumen and strategic decision-making. In the case of a celebrity, net worth can be a factor in evaluating their influence and overall standing within society. However, it is critical to remember that net worth is only one aspect of a person's life and should not be the sole measure of their value or contribution.

Moving forward, this article will delve into the factors that shape an individual's financial position, examining case studies and analyzing the impact of various industries and career paths on accumulating wealth. It will offer insights into the complexities of determining net worth in a comprehensive manner, encompassing the influence of investments, income, and lifestyle expenses.

Fred Smoot Net Worth

Assessing an individual's net worth involves examining various contributing factors. This analysis considers essential elements that shape a person's financial standing. Understanding these aspects provides a more complete picture.

- Income Sources

- Investment Returns

- Asset Valuation

- Debt Burden

- Expenses

- Industry Impact

- Career Progression

Income sources, including salary, investments, and business ventures, are fundamental components. Investment returns and asset valuation (e.g., real estate or stocks) heavily influence a person's overall financial standing. Debt burden significantly affects net worth, while expenses (living, business) impact disposable income. The specific industry and career progression play a vital role; certain professions or industries often correlate with higher earning potential. For example, high-income earners in lucrative sectors often accumulate considerable wealth, particularly when investments yield strong returns. Conversely, individuals facing substantial debt or high expenses experience a different trajectory.

1. Income Sources

Income sources are critical determinants of an individual's financial standing. Understanding the nature and volume of income streams is essential for assessing overall financial health and, in the case of public figures, for contextualizing their overall financial profile. This analysis considers the various avenues through which income is generated.

- Salaries and Wages

A significant portion of income often stems from employment-related compensation. This encompasses salaries, wages, and other related benefits. The specific amount varies greatly depending on factors such as position, experience, and industry. High-demand professions often command higher compensation, affecting overall net worth.

- Investment Income

Capital investments, such as stocks, bonds, real estate, or other ventures, can generate substantial income. The return on these investments plays a crucial role in accumulating wealth. Fluctuations in market conditions can considerably influence investment income and, consequently, an individual's financial standing.

- Business Profits

For individuals involved in business ventures, profits derived from operations are a key income source. Profits are directly tied to business performance, market conditions, and operational efficiency. Business owners and entrepreneurs often experience fluctuating income levels tied to their enterprise's success.

- Passive Income Streams

Passive income streams represent earnings generated from activities requiring minimal ongoing involvement. Examples include royalties from intellectual property, rental income from property, or income from established online ventures. These sources can be crucial in building long-term financial security.

Ultimately, the variety and volume of income sources significantly impact a person's net worth. A diverse income portfolio often contributes to financial stability and resilience in fluctuating economic environments. Analyzing these different income sources provides a nuanced understanding of how they contribute to overall wealth accumulation.

2. Investment Returns

Investment returns play a significant role in shaping an individual's overall financial standing. The performance of investments directly correlates with wealth accumulation. Successful investment strategies can contribute substantially to a higher net worth, while poor choices can negatively impact financial standing. Understanding the dynamics of investment returns is crucial in evaluating the potential and realized value of assets held by an individual.

- Stock Market Performance

Fluctuations in the stock market are a major factor in determining the value of investments. Positive returns from stock market investments can substantially enhance an individual's net worth. Conversely, market downturns can decrease the value of investments, impacting net worth negatively.

- Real Estate Appreciation

Real estate investments can be a crucial component of a diversified portfolio. Appreciation in property values can contribute significantly to a higher net worth, while market downturns can affect the value of real estate holdings. Rental income from property also factors into the overall financial picture.

- Diversification Strategies

Diversification across various asset classes (stocks, bonds, real estate, etc.) can mitigate the impact of market volatility. A well-diversified portfolio generally exhibits more stable performance and can provide a more secure path toward wealth accumulation. This stability is crucial, especially when evaluating net worth over time.

- Investment Timing and Horizon

The timing of investments and the investment horizon significantly affect returns. Long-term investments may yield higher returns but involve greater risk. Short-term investments typically carry lower risk but lower potential returns. Understanding an investor's time horizon is essential for evaluating the long-term implications for their net worth.

In conclusion, the returns generated from investments are key contributors to an individual's financial status. Successful investment strategies, coupled with risk management and informed decision-making, are crucial elements for building and maintaining a strong financial position, which is directly reflected in net worth. Careful analysis of past investment performance and the potential for future returns are necessary for any comprehensive evaluation of financial standing.

3. Asset Valuation

Asset valuation is a critical component in determining net worth. The fair market value assigned to an individual's assets directly impacts the overall calculation. The accuracy of asset valuation is essential for a precise representation of an individual's financial position. Subjectivity in valuation, especially with complex assets, can lead to significant discrepancies in reported net worth figures. For example, a business's valuation can fluctuate significantly based on market conditions, industry trends, and the projected future earnings of the company. Similarly, the appraised value of a piece of real estate is influenced by location, market conditions, and comparable property sales. Understanding these inherent complexities is crucial for interpreting reported net worth figures, recognizing that these valuations are estimates, not absolute certainties.

The practical significance of accurate asset valuation is evident in various contexts. For financial reporting, precise valuations are essential for transparent and reliable financial statements. In estate planning, accurate asset valuation is crucial for the equitable distribution of assets among beneficiaries. A precise valuation process helps maintain the fairness and integrity of the entire process. Furthermore, asset valuations inform investment decisions, as potential investors consider the fair market value of assets before committing capital. A thorough analysis of an asset's value enables a more informed and balanced perspective when determining its suitability for investment. Errors or inconsistencies in asset valuations can have considerable consequences, ranging from misrepresentation of financial status to difficulties in estate administration or investment decisions.

In summary, accurate asset valuation is a fundamental aspect in understanding net worth. Variations in valuation methodologies can create significant discrepancies in reported figures. The practical applications of asset valuation extend to financial reporting, estate planning, and investment decisions. Consequently, a thorough understanding of valuation principles and the methodologies used is indispensable for accurately interpreting and utilizing net worth figures, particularly when assessing the overall financial position of an individual or entity.

4. Debt Burden

Debt burden significantly impacts an individual's net worth. High levels of debt act as a counterpoint to assets, reducing the overall net worth figure. Debt obligations, whether personal loans, mortgages, or credit card balances, represent financial commitments that directly diminish available resources. These obligations consume a portion of income, impacting the amount available for savings, investment, or other financial objectives. The magnitude of this impact is substantial, reducing the net worth calculation directly and illustrating the counterbalancing effect of debt against assets. For instance, a large mortgage payment regularly reduces the net worth of a homeowner, as the debt obligation is subtracted from the appraised value of the property.

The importance of considering debt burden in assessing net worth cannot be overstated. High levels of debt can negatively influence an individual's ability to accumulate wealth and achieve financial security. The impact of debt is not merely quantitative; it can affect an individual's financial flexibility and decision-making capabilities. For example, excessive debt repayments can limit investment opportunities, impacting future earning potential and hindering overall financial growth. A significant outstanding debt load can lead to a perception of reduced financial stability and can impact creditworthiness, potentially affecting future borrowing opportunities. Ultimately, this financial strain can lead to a cyclical effect, negatively influencing the trajectory of net worth growth.

In conclusion, debt burden is a crucial component in understanding net worth. High debt levels directly diminish net worth, impacting an individual's financial flexibility and future prospects. Understanding this relationship provides crucial insights into an individual's overall financial health and the potential for long-term financial success. It is essential to recognize that debt burden is not simply a financial metric; it reflects a key aspect of an individual's financial management practices and their overall financial well-being. Failure to adequately address debt can lead to further financial strain and impede the accumulation of future wealth, emphasizing the critical significance of responsible financial planning and debt management strategies.

5. Expenses

Expenses directly influence an individual's net worth. A significant portion of income, after taxes and before investment or savings, is allocated to everyday living costs and obligations. The nature and extent of these expenses exert a powerful influence on the accumulation or depletion of wealth. High spending on essential goods and services can diminish available funds for savings, investments, or other financial pursuits. Conversely, responsible expense management can release funds for investment, ultimately contributing to higher net worth.

Analyzing expense patterns provides valuable insights into financial behavior. Factors such as lifestyle choices, geographic location, and family size significantly affect spending habits. For instance, individuals residing in high-cost-of-living areas generally experience higher expenses for housing, transportation, and everyday necessities. Likewise, individuals with families often see increased expenses related to childcare, education, and healthcare. These factors must be considered when evaluating the relationship between spending and net worth. The difference between income and expenses ultimately determines the net amount available for investment or saving. Consistent awareness and management of expenses are crucial to positive net worth growth.

In conclusion, expenses directly affect the trajectory of net worth. Understanding the influence of various expense categories and lifestyle factors is crucial for effective financial planning. Careful budgeting, prioritizing financial goals, and making informed spending decisions are essential elements in optimizing the relationship between expenses and net worth. A comprehensive understanding of personal expenses empowers individuals to effectively manage finances, which directly impacts their overall financial well-being.

6. Industry Impact

Industry dynamics play a critical role in shaping an individual's financial standing. The sector in which an individual operates, whether through employment, entrepreneurship, or investment, directly influences the potential for income generation and wealth accumulation. The success and trajectory of industries are often linked to macro-economic trends, market conditions, and competitive pressures. These factors, in turn, impact the earnings potential and investment opportunities available to individuals within those industries, significantly affecting their net worth.

- Earnings Potential and Compensation Structures

Industries vary considerably in the compensation structures and earning potential they offer. Highly specialized or in-demand skills within a particular sector often command higher salaries. For example, professionals in technology, finance, or healthcare frequently earn more than those in less developed industries. These salary disparities directly translate into differences in potential wealth accumulation for individuals in those professions.

- Investment Opportunities and Asset Classes

Industries often create specific investment opportunities. The success of a particular industry can drive the value of its related asset classes. For example, individuals investing in technology companies during periods of rapid growth in that sector have the potential for significant returns. Conversely, investments in industries facing decline or downturn can lead to loss of capital.

- Market Demand and Economic Fluctuations

Economic conditions and market demand significantly affect an industry's overall performance. Industries experiencing strong demand and economic growth often offer increased earning potential and investment opportunities. Industries facing recessionary pressures or declining demand may experience reduced income and potential negative impacts on investment returns.

- Competitive Landscape and Industry Consolidation

The competitive landscape within an industry influences an individual's earnings potential. In highly competitive industries, innovation and efficiency are essential for success. Consolidation within an industry can affect business practices and investment opportunities. Industries with low barriers to entry may see a wider dispersion of financial outcomes among participants, while industries dominated by a few large companies may lead to greater compensation disparities.

In conclusion, the industry in which an individual operates significantly influences their earnings potential and investment opportunities. The prosperity of an industry can correlate with increased earning potential, driving wealth accumulation. Understanding the economic climate and competitive dynamics within an industry allows for more informed financial decision-making and provides insight into the possible trajectory of an individual's financial standing.

7. Career Progression

Career progression significantly influences an individual's net worth. The trajectory of a careerfrom entry-level roles to senior positionsoften correlates with increasing earning potential. This relationship stems from the accumulation of skills, experience, and knowledge that typically accompany career advancement. Promotions, specialized expertise, and leadership roles frequently translate to higher salaries and expanded opportunities for income generation beyond direct employment, such as investment returns or business ownership. For example, an engineer advancing from junior to senior engineer, acquiring expertise in specialized design software or project management, may see significant salary increases and expanded opportunities to lead larger projects, which in turn affect net worth.

The importance of career progression as a component of net worth is multifaceted. A well-structured career path with planned progression usually results in consistent income growth and accumulated savings. This sustained growth can be reinvested, leading to further asset appreciation. Furthermore, career progression often broadens investment opportunities. Increased earning potential allows individuals to diversify investment portfolios or pursue higher-risk, potentially higher-reward investments. Consider a successful entrepreneur, whose business acumen and increased earnings through career progression allowed for investments in various ventures, significantly contributing to the net worth.

In conclusion, career progression is a vital factor contributing to overall net worth. A proactive approach to career development, including continuous learning and skill enhancement, often correlates with increased earning potential and expanded investment opportunities. This underscores the importance of long-term career planning and development. Individuals recognizing the linkage between career advancement and financial success are better positioned to build and maintain a robust financial position reflected in their net worth.

Frequently Asked Questions about Fred Smoot's Net Worth

This section addresses common inquiries regarding Fred Smoot's financial standing. Understanding the complexities surrounding public figures' financial information requires careful consideration of the available data and the limitations inherent in such estimations.

Question 1: What is the precise figure for Fred Smoot's net worth?

Publicly available, definitive figures for Fred Smoot's net worth are often scarce. Estimates vary, and the lack of readily accessible, official information necessitates caution when considering any single reported figure. The absence of comprehensive, transparent disclosures complicates the accuracy of any particular net worth estimation.

Question 2: How is Fred Smoot's net worth determined?

Determining an individual's net worth involves evaluating various elements, including income sources (salaries, investments, and business ventures), asset valuation (real estate, stocks, and other holdings), and outstanding debts. Sophisticated methodologies and financial analysis tools are employed to estimate these figures. However, the absence of detailed public information limits the precision of such assessments.

Question 3: What factors influence fluctuations in Fred Smoot's net worth?

Fred Smoot's net worth, like any individual's, is susceptible to market forces and personal decisions. Changes in investment performance, business fluctuations, and personal spending habits contribute to adjustments in overall financial standing. Market conditions, industry trends, and personal choices directly impact estimations of net worth.

Question 4: Why is it important to understand estimates of Fred Smoot's net worth?

Estimating Fred Smoot's net worth, while not definitive, can offer insights into various aspects of his professional life and public profile. Understanding the trends in reported figures may potentially reveal economic success, investment strategies, or financial stability within his industry.

Question 5: Where can reliable information on Fred Smoot's net worth be found?

Reliable information on public figures' net worth is typically limited. Official financial disclosures, industry-specific reporting, or authoritative financial resources might sometimes contain pertinent data. However, the lack of consistent, readily accessible information often necessitates caution when interpreting estimates of net worth.

In summary, accessing precise net worth figures for individuals like Fred Smoot often involves interpreting estimates rather than precise declarations. Understanding the methodology behind such estimations, considering potential inaccuracies, and recognizing the impact of various factors on financial standing are crucial for a well-rounded perspective.

Moving forward, this article will explore the broader implications of net worth in the context of individual achievement and overall economic trends.

Conclusion

This article explored the multifaceted concept of Fred Smoot's net worth, examining the contributing factors that shape an individual's financial standing. Key considerations included income sources, investment returns, asset valuation, the burden of debt, expense management, industry impact, and career progression. The analysis underscored the complexities involved in determining and interpreting net worth figures, highlighting the limitations of publicly available data and the inherent subjectivity in valuation processes. Fluctuations in market conditions, industry trends, and personal choices all play significant roles in shaping a person's financial position, emphasizing the dynamic nature of net worth over time. The article highlighted that net worth, while a valuable indicator, should not be considered the sole measure of an individual's success or overall well-being.

Ultimately, understanding the elements contributing to Fred Smoot's net worth, or any public figure, requires acknowledging the intricate interplay of economic factors and individual choices. Accurate assessment necessitates a nuanced perspective that goes beyond simple numerical figures to encompass the diverse influences shaping financial trajectories. The absence of comprehensive public information necessitates careful interpretation of available data and the recognition of potential limitations. Further research, especially with more publicly available data, could potentially offer a more complete and reliable picture of this financial aspect of Fred Smoot's life.

Detail Author:

- Name : Prof. Tremayne Hessel IV

- Username : devyn.russel

- Email : allan27@stokes.info

- Birthdate : 1972-06-07

- Address : 695 Marcia Cliff Ricofurt, NC 06576-7516

- Phone : (737) 369-1944

- Company : Gottlieb Inc

- Job : Market Research Analyst

- Bio : Tenetur officiis sit ea sit est excepturi inventore possimus. Ipsa optio cum nisi nostrum sunt. Illum qui nulla incidunt nulla doloribus eos tenetur. Mollitia alias est et eum placeat.

Socials

instagram:

- url : https://instagram.com/rutherfordh

- username : rutherfordh

- bio : Nisi dicta consequuntur atque. Non dolores sequi minus et aut. A totam ea facere.

- followers : 2959

- following : 13

linkedin:

- url : https://linkedin.com/in/hilda136

- username : hilda136

- bio : Et voluptas tempore ipsum iusto quia.

- followers : 3365

- following : 2043

facebook:

- url : https://facebook.com/rutherfordh

- username : rutherfordh

- bio : Iste rerum et sit sapiente reiciendis qui.

- followers : 2499

- following : 2248

tiktok:

- url : https://tiktok.com/@rutherfordh

- username : rutherfordh

- bio : Rerum quae voluptas et magni. Enim eaque culpa ipsum assumenda provident.

- followers : 3883

- following : 1113