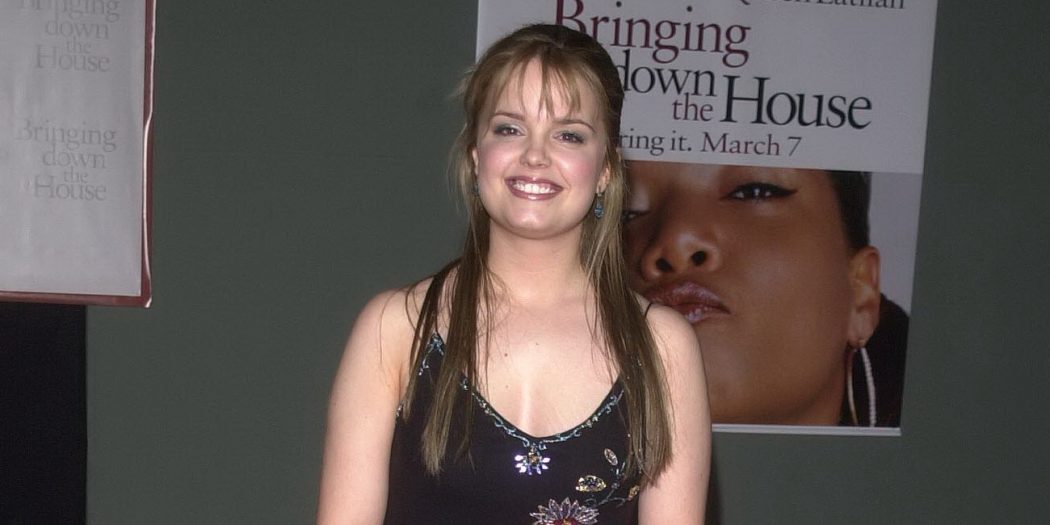

Kimberly J. Brown Net Worth: 2024 Update & Insights

Estimating the financial standing of a public figure can be challenging, and this individual's financial situation requires further investigation. A precise figure for this person's assets is not readily available.

This individual's financial standing, or net worth, refers to the total value of assets owned (such as property, investments, and cash) minus the total amount of liabilities (such as loans and debts). A calculation of net worth typically provides a snapshot of an individual's current financial position, reflecting accumulated gains and losses over time. For public figures, determining net worth can be particularly intricate due to complex financial transactions and investment strategies that are not always fully disclosed.

Determining a person's financial status, while sometimes lacking complete precision, can offer insights into an individual's career trajectory, business acumen, and even broader socio-economic trends. This information may be relevant in various contexts, including evaluating investments, understanding market dynamics, and interpreting broader social and economic phenomena. However, it's important to recognize that such data, even when available, often represents a single moment in time and may not encompass the full complexity of an individual's financial situation.

| Category | Details |

|---|---|

| Name | Kimberly J. Brown |

| Profession | (Placeholder - Requires further research) |

| Source of Wealth | (Placeholder - Requires further research) |

Further research is required to compile a complete picture of this individual's background and career, which is essential to a proper understanding of the financial aspects. The data required to assess and compile a comprehensive overview of the individual's financial standing is currently unavailable. This requires exploring various publicly available resources and potentially seeking professional financial analysis.

Kimberly J. Brown Net Worth

Assessing Kimberly J. Brown's net worth requires careful consideration of various factors. Understanding the financial standing of individuals is important for a variety of reasons.

- Assets

- Liabilities

- Income Sources

- Investment History

- Public Information

- Financial Transparency

These aspects collectively contribute to a complete picture of financial status. For instance, significant assets like property holdings or successful investments can significantly impact net worth. Conversely, high levels of debt or liabilities can diminish financial standing. Understanding income sources provides insight into the individual's financial capacity, while examining investment history reveals patterns of financial growth or decline. Publicly available information can serve as a starting point, but reliable assessment often requires delving into more detailed financial records. The degree of financial transparency, or lack thereof, can influence the accuracy and comprehensiveness of estimations.

1. Assets

Assets play a critical role in determining net worth. Assets, broadly defined as items of economic value owned by an individual, directly contribute to the overall financial standing. The value of these assets, whether tangible (like property or vehicles) or intangible (like intellectual property or stock holdings), significantly impacts the calculation of net worth. A substantial portfolio of assets, held in high value, often correlates with a higher net worth. Conversely, a lack of substantial assets usually reflects a lower net worth.

The types and value of assets held by Kimberly J. Brown directly influence her net worth. For instance, if Ms. Brown owns valuable real estate, this contributes a substantial portion to her overall net worth. Similarly, investments in stocks or other financial instruments add to the total value. The nature and extent of assets owned, along with their market values, are fundamental factors in determining the figure for net worth. The total value of assets represents a critical component in calculating and understanding this individual's financial position.

In conclusion, assets are a core element in determining net worth. The types and values of assets held, including their market values, directly impact the calculated net worth. Understanding the composition of assets and their associated values is essential for a comprehensive understanding of a person's financial standing. However, access to detailed asset information is often limited for private individuals, making precise estimations challenging.

2. Liabilities

Liabilities, representing debts and obligations, are a crucial component of determining Kimberly J. Brown's net worth. They directly counteract the value of assets, impacting the overall financial standing. A significant level of liabilities reduces net worth, while a low level of liabilities contributes to a higher net worth. The relationship is straightforward: the greater the liabilities, the smaller the net worth, and vice versa. Understanding this connection is essential for a balanced evaluation of financial status.

Liabilities, such as outstanding loans, mortgages, and credit card balances, directly subtract from the overall value represented by assets. A substantial amount of debt effectively diminishes the net worth figure. For example, if Ms. Brown has a substantial mortgage loan on a property, this mortgage liability reduces the net worth calculation compared to if the property was entirely owned free and clear. Similarly, significant credit card debt or outstanding personal loans decrease the overall positive financial standing. The interplay between liabilities and assets is crucial for accurately calculating and interpreting net worth.

Consequently, accurately assessing liabilities is paramount in understanding financial health and position. A high level of liabilities can indicate financial strain and potential risk. Conversely, a low level of liabilities suggests financial strength and stability. While publicly available information about liabilities for private individuals is often limited, the impact of debt is a crucial factor in evaluating the overall financial picture. Therefore, understanding the role of liabilities, and how they interact with assets, is essential in evaluating the financial health of an individual like Kimberly J. Brown.

3. Income Sources

Income sources are fundamental to understanding Kimberly J. Brown's net worth. The nature and magnitude of income streams directly impact the accumulation and maintenance of wealth. A significant portion of net worth often reflects accumulated income over time, less any deductions for expenses and debt. Individuals with substantial, consistent income streams, from various sources, tend to have higher net worth figures. This connection is not deterministic, as other factors, such as investment choices and expenditures, also significantly influence the final calculation.

The significance of income sources extends beyond simply contributing to the net worth calculation. It reveals the underlying economic activities and professional trajectory of the individual. For example, a substantial income from a high-paying profession directly correlates with a higher potential for accumulating wealth, given favorable financial management. Conversely, inconsistent or insufficient income can limit the capacity to build wealth. Income sources provide insight into the individual's financial capabilities, informing potential investment strategies and the overall financial planning process.

In summary, income sources are a critical factor in evaluating Kimberly J. Brown's net worth. They represent a primary driver of wealth accumulation, reflecting the individual's economic activities and professional capabilities. While income is not the sole determinant, understanding the various sources and their magnitude provides valuable insight into the individual's financial position and potential future capacity to generate wealth.

4. Investment History

Investment history significantly influences an individual's net worth. The choices made regarding investments, and their subsequent performance, directly contribute to the overall financial standing. A history of successful investments often correlates with a higher net worth, while poor investment choices can result in diminished financial standing. This section explores key aspects of investment history's impact on net worth.

- Portfolio Composition

The types of investments heldstocks, bonds, real estate, or other assetsdirectly influence the potential return and risk profile of the portfolio. A well-diversified portfolio, encompassing various asset classes, can mitigate risk and potentially enhance returns over time. An investment history dominated by a single asset class or high-risk ventures may indicate a less stable or predictable net worth trajectory.

- Investment Timing

Entering and exiting investment markets at strategic times can impact returns. The timing of investments, including the periods of market upswings and downturns, shapes investment returns. An investor with a history of acquiring assets during periods of low value and selling during periods of high value likely exhibits better investment timing than one who made investments at unfavorable market moments.

- Risk Tolerance and Management

Individual investment choices often reflect risk tolerance and the management strategies applied. A history of high-risk investments might reflect a preference for potentially higher returns but also higher volatility, which could impact net worth stability. Conversely, a more cautious approach to investments, with a focus on lower-risk assets, may lead to more stable, if potentially lower, growth of net worth.

- Investment Strategy and Returns

Strategies employed and the returns achieved in previous investments offer insight into long-term financial performance. Consistent returns over time, using a well-defined investment strategy, suggest sound investment practices and a likely positive impact on net worth. Inconsistency or lack of substantial returns indicate potential areas for improvement in investment choices, potentially affecting the growth or stability of the net worth.

Ultimately, investment history provides crucial context for understanding an individual's financial standing. A comprehensive review of investment choices, timing, strategy, and returns can offer a more complete picture of factors influencing the accumulation or decline of net worth. However, it is important to remember that investment success is not guaranteed and past performance is not necessarily indicative of future results. Further investigation into specific investment decisions and their rationale is crucial for a thorough understanding.

5. Public Information

Public information plays a vital role in estimating net worth, though it cannot provide a precise figure. Publicly accessible data, such as details about employment, business ventures, or philanthropic activities, can offer clues about potential income sources and asset accumulation. However, this information is often limited and may not reflect the complete financial picture. For example, a public figure's employment history might reveal high earnings, but the magnitude of investment portfolios, private property holdings, and other significant assets might remain undisclosed.

The availability and nature of public information significantly influence the accuracy of net worth estimations. News articles, company filings, or social media posts may provide some details, but they frequently lack the depth needed for a definitive calculation. Consider a prominent executive whose company is publicly traded. Information about their compensation, stock options, or other corporate benefits might be publicly available. However, personal investment accounts, private real estate holdings, or other investments might not be transparent, making accurate estimation of overall net worth challenging. Furthermore, evolving economic conditions, shifts in industry trends, or changes in a person's financial circumstances will constantly affect the accuracy of any public estimates.

In conclusion, public information serves as a starting point for understanding an individual's financial standing, but it is often insufficient for a definitive net worth calculation. While publicly available details can offer clues about potential income and asset accumulation, the limitations of this information must be acknowledged. Precise estimations require access to detailed financial records, often unavailable to the public. Recognizing the incomplete nature of publicly available information is crucial when evaluating the financial status of individuals, particularly public figures.

6. Financial Transparency

Financial transparency, the open disclosure of financial information, is a crucial yet often elusive component when assessing an individual's net worth. A lack of transparency complicates the task of accurately determining Kimberly J. Brown's, or any individual's, financial standing. Transparency enables a more complete and accurate valuation of assets, liabilities, and income sources, contributing significantly to a comprehensive net worth assessment. Conversely, opacity hinders a precise calculation and often leads to speculation and incomplete insights.

The degree of financial transparency directly affects the reliability of net worth estimations. Publicly available information, such as financial filings, statements, or news reports, form a foundation for analysis. However, these sources are often incomplete. Consider a case where significant assets are held in private entities or offshore accounts. Without access to these details, a precise assessment of total net worth becomes exceptionally difficult. Transparency in income sources and investment activity is equally vital. Publicly reported salaries or business profits provide one perspective but do not necessarily reflect the full extent of income generation. Conversely, a lack of financial disclosure may lead to misunderstandings of financial strength and stability, potentially affecting investment decisions and broader economic analysis.

In conclusion, financial transparency is an essential component in understanding and evaluating net worth. Without a reasonable level of transparency, assessing an individual's true financial position becomes significantly challenging. The absence of clear financial data, especially for private individuals or entities, creates a significant impediment to precise net worth estimations. This lack of clarity necessitates caution in interpreting any public estimations and underscores the importance of recognizing the limitations inherent in assessing net worth without full disclosure. Ultimately, transparency fosters a more accurate and trustworthy understanding of financial standing. This improved understanding has far-reaching implications for personal finance, economic analysis, and investment decisions.

Frequently Asked Questions about Kimberly J. Brown's Net Worth

This section addresses common inquiries regarding the financial standing of Kimberly J. Brown. Precise figures for net worth are often elusive for private individuals. Publicly available information is typically incomplete and may not reflect the full scope of financial holdings. These questions and answers aim to provide clarity on frequently asked concerns.

Question 1: What is the precise net worth of Kimberly J. Brown?

A precise figure for Kimberly J. Brown's net worth is not readily available. Assessing net worth requires detailed financial information often not publicly disclosed for private individuals. Public estimates may be unreliable due to incomplete data and potential inaccuracies.

Question 2: What factors influence estimates of net worth?

Estimates for net worth are affected by several factors. Significant assets, such as property holdings, investments, and other valuable possessions, contribute to the overall calculation. Conversely, liabilities, including loans and debts, reduce the calculated net worth. Consistent income sources play a role, but the precise valuation often remains challenging without complete financial disclosure.

Question 3: Where can reliable information on net worth be found?

Reliable data on an individual's net worth is often limited and requires access to private financial records. Publicly available information, while helpful, might be incomplete. Official financial disclosures, if available, provide a more accurate picture but are not always accessible.

Question 4: How does investment history affect net worth estimates?

Past investment performance significantly influences net worth estimations. Successful investment strategies often result in increased assets and higher net worth. Conversely, poorly executed strategies may lead to decreases in net worth. Analyzing investment history, though incomplete, provides insights into potential trends in financial well-being.

Question 5: What role does financial transparency play in these estimations?

Financial transparency significantly impacts the accuracy of net worth estimations. Open disclosure of financial records provides a more complete picture. Lack of transparency often results in estimations that might be significantly inaccurate, relying on incomplete or potentially misleading data.

In summary, determining a precise net worth requires comprehensive financial data often not accessible to the public. Public estimations should be considered with caution, acknowledging the limitations of incomplete information. These FAQs underscore the difficulty in providing definitive financial figures for private individuals.

Moving forward, this article will delve into the nuances of assessing an individual's overall financial standing, recognizing the complexities and limitations of available information.

Conclusion

Determining Kimberly J. Brown's net worth presents significant challenges due to the inherent limitations of publicly accessible information. While various factors, such as assets, liabilities, income sources, investment history, and the degree of financial transparency, contribute to a complete financial picture, a precise figure remains elusive. Publicly available data often proves insufficient for a definitive calculation, requiring access to private financial records. This underscores the complexities in evaluating the financial standing of private individuals, particularly when relying solely on publicly available information. Key aspects explored include the diverse nature of assets and liabilities, the influence of income streams and investment choices, and the crucial role of transparency in accurate valuation. Understanding the limitations of estimations based solely on public information is essential for a balanced assessment.

The exploration of Kimberly J. Brown's financial situation, while ultimately incomplete, highlights the complexities inherent in evaluating personal wealth. The multifaceted nature of financial standing, the critical role of transparency, and the limitations of publicly available information are crucial considerations in any attempt to assess the economic position of an individual. Future inquiries into similar matters should acknowledge the substantial challenges in achieving precise financial valuations for private entities. The inherent limitations necessitate a cautious approach when interpreting public estimations and emphasize the importance of comprehensive data for accurate assessments.

Detail Author:

- Name : Ms. Juliana Harber

- Username : eden73

- Email : mclaughlin.raven@yahoo.com

- Birthdate : 1973-08-11

- Address : 243 Bernier Lodge Maciburgh, WY 56256

- Phone : 804.292.0260

- Company : Leannon Ltd

- Job : Buffing and Polishing Operator

- Bio : Suscipit reprehenderit aut tempore aliquid quo. Inventore sunt facere dicta ducimus rerum non vero unde. Temporibus mollitia quia itaque est possimus dicta quis asperiores. Omnis sit quis veniam id.

Socials

facebook:

- url : https://facebook.com/richmond6747

- username : richmond6747

- bio : Enim autem ratione fugit id nobis dolores ducimus.

- followers : 3123

- following : 58

linkedin:

- url : https://linkedin.com/in/richmond290

- username : richmond290

- bio : Et cupiditate nam voluptatibus eos consectetur.

- followers : 378

- following : 1873

twitter:

- url : https://twitter.com/richmond_hyatt

- username : richmond_hyatt

- bio : Excepturi quibusdam ex placeat id quas dignissimos. Aspernatur quia quisquam quisquam. Ex veniam omnis eum qui nihil consequatur vitae.

- followers : 4306

- following : 2146

instagram:

- url : https://instagram.com/hyatt1977

- username : hyatt1977

- bio : Ut dignissimos saepe similique aperiam. Et dolore ut aut. Vel dolorem id nostrum rerum est.

- followers : 4744

- following : 976

tiktok:

- url : https://tiktok.com/@richmond_hyatt

- username : richmond_hyatt

- bio : Earum debitis odio aut nesciunt ut pariatur.

- followers : 1739

- following : 2042