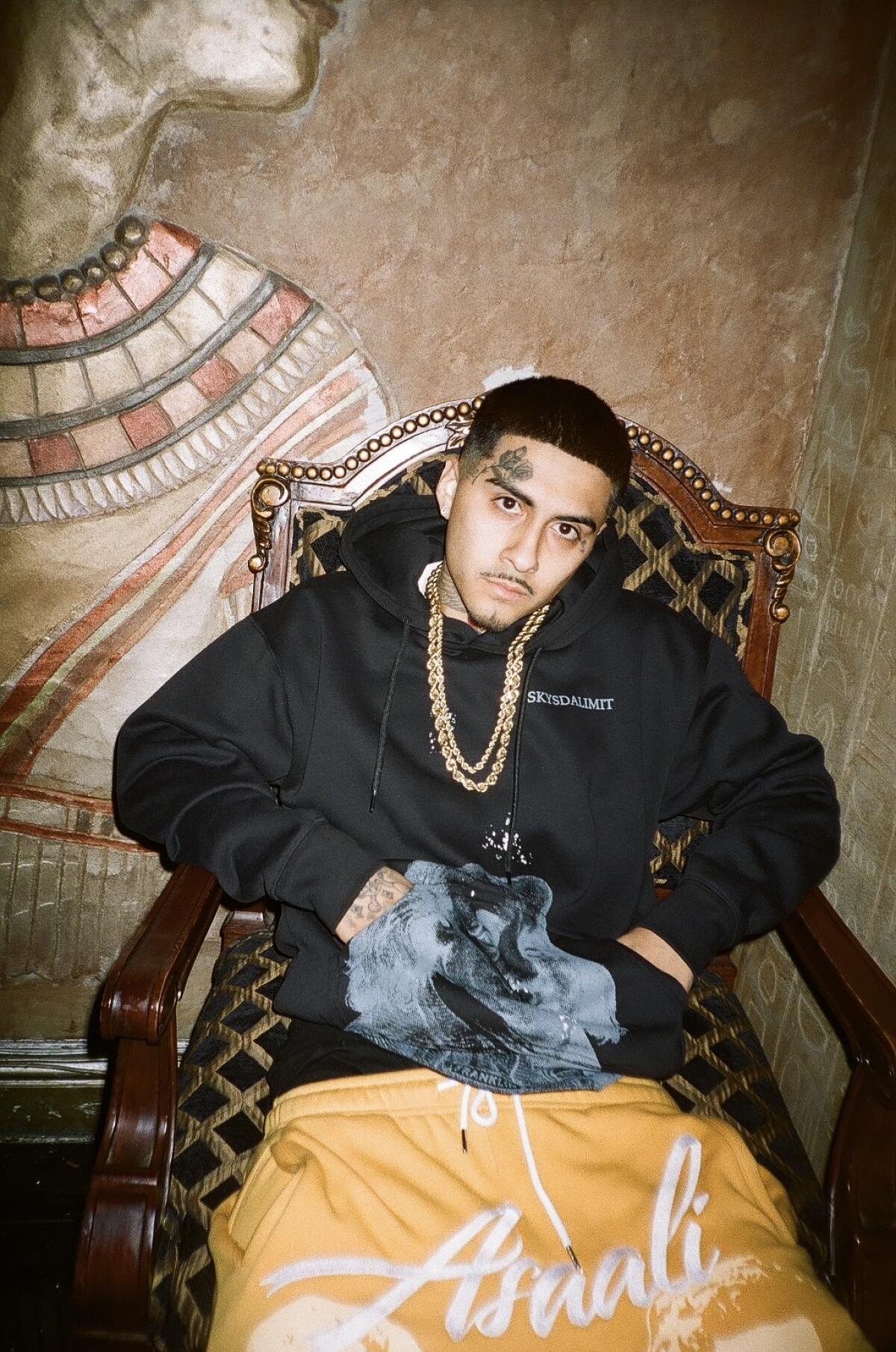

MoneySign Suede Net Worth: Latest 2024 Update

Estimating the financial standing of a specific individual is often a matter of public interest. What is the approximate worth of this entity?

The financial worth of an individual, company, or entity, often expressed in monetary terms, represents the total value of assets. This value can be composed of various factors, including investments, property, income, and other holdings. Assessing net worth can provide insights into financial health, but it should not be interpreted as a sole measure of success or worth. Specific figures for an entity are not readily available to the public in all instances. The amount of publicly available information will vary and it may not always be possible to establish a definitive number.

Knowing a particular entity's financial standing can be important for various reasons. It can provide context for understanding their operations, influence or impact. However, it's crucial to remember that any valuation of this nature is a snapshot in time, as financial situations evolve. The value of such information is dependent upon the subject matter and the context in which it is used.

| Category | Details |

|---|---|

| Information Source | Publicly available information, if applicable, or not applicable, or private |

| Reliability | Estimation dependent on data availability; no definitive number is provided without specific figures |

This discussion provides a general overview of the concept of financial worth. Further exploration into the specific entity would necessitate a focus on the resources and materials available for analysis.

Moneysign Suede Net Worth

Determining the precise financial standing of an entity like Moneysign Suede requires a multifaceted approach. Accurate valuation is challenging, dependent on available data.

- Financial Data

- Asset Valuation

- Revenue Streams

- Investment Portfolio

- Public Information

- Market Trends

- Company Performance

Accurate financial assessments depend on readily available financial reports and verifiable information sources. For instance, a company's revenue stream data will factor into their net worth. Publicly traded companies often provide this information, whereas private entities may not. Understanding the asset valuation process is also critical, and this involves the value of both tangible and intangible assets. Analyzing investment portfolios can further clarify the financial picture. Tracking market trends and company performance gives insights into overall financial strength. A deep understanding of the context within which these factors exist is crucial to evaluating the overall financial health of Moneysign Suede. Without access to definitive information, these data points must be approached with caution, and a nuanced perspective is paramount when analyzing a firm's overall financial health.

1. Financial Data

Financial data forms the cornerstone of any valuation assessment, including estimations of net worth. The availability and reliability of this data directly impact the accuracy of any conclusions drawn about the financial standing of an entity. Understanding the various components of financial data is essential for forming a comprehensive picture of an organization's financial situation and its potential implications.

- Revenue and Income Statements

Revenue and income statements are crucial for understanding the financial performance of an entity. They depict the total income generated and the expenses incurred during a specific period. Analyzing trends in revenue over time can indicate growth or decline, providing insights into the entity's profitability. For a company like Moneysign Suede, revenue figures might reflect sales of products or services and would help to contextualize their financial health. This information allows stakeholders to understand the entity's capacity to generate funds.

- Balance Sheets

Balance sheets provide a snapshot of an entity's financial position at a particular point in time. They detail assets, liabilities, and equity. Understanding the composition of assetswhether they are liquid or fixedis important, as is the entity's ability to meet its financial obligations, represented by liabilities. Analyzing the balance sheet helps assess an entity's financial solvency.

- Cash Flow Statements

Cash flow statements track the movement of cash into and out of an entity. This is vital for evaluating its ability to generate cash, cover operating expenses, and invest in growth opportunities. Analyzing cash flow patterns over time can reveal trends indicative of strength or vulnerability. For Moneysign Suede, cash flow is critical for evaluating operational efficiency and sustainability.

- Financial Ratios

Financial ratios provide a comparative analysis of different financial data elements. These ratios assess various aspects of financial health, such as liquidity, profitability, and solvency. Interpreting these ratios in the context of the entity's industry is essential. Examples include comparing profitability ratios (e.g., profit margins) to industry averages. Analyzing financial ratios can highlight areas of strength or weakness in Moneysign Suede's financial performance.

In conclusion, accessing and analyzing financial data are indispensable elements when attempting to understand or estimate an entity's net worth. By evaluating revenue, balance sheet information, cash flow statements, and financial ratios, a deeper understanding of the firm's financial situation can be achieved. This, in turn, provides a more complete picture of the entitys overall financial status.

2. Asset Valuation

Accurate asset valuation is fundamental to estimating the net worth of any entity, including Moneysign Suede. Determining the fair market value of assets forms the bedrock of a comprehensive financial assessment. The process of evaluating assets involves considering various factors, and the results directly influence the final calculation of net worth. This includes identifying, categorizing, and determining the economic value of the entity's holdings.

- Tangible Asset Valuation

Tangible assets, such as property, equipment, and inventory, are appraised based on their market value. Factors like condition, location, and demand influence this evaluation. For example, a piece of equipment with a high depreciation rate may command a lower price in the current market. The valuation of tangible assets for Moneysign Suede would encompass considerations like the condition and location of any real estate holdings and the quality and quantity of any physical inventory.

- Intangible Asset Valuation

Intangible assets, like intellectual property (patents, trademarks), brand recognition, and customer relationships, introduce complexities to the valuation process. The assessment of these assets often requires specialized methods and estimations. For instance, brand recognition is typically evaluated based on market share, reputation, and historical performance. Moneysign Suede's potential value may include the worth of its brand name, its customer relationships, and any proprietary technologies.

- Market Comparison and Comparable Sales

Market comparison analysis involves evaluating similar assets in the marketplace and their prices. This data-driven approach can serve as a benchmark for valuation. Comparable sales of similar products or services in comparable markets can help determine a fair market value for Moneysign Suede's assets. If comparable companies have recently sold assets or experienced valuation changes, this might inform a relevant evaluation of Moneysign Suede's current worth.

- Discounted Cash Flow Analysis (DCF)

DCF analysis projects future cash flows from an asset and discounts them to their present value, factoring in the time value of money. This method provides a valuation framework based on anticipated future earnings and is often used for businesses. The application of DCF to the assets of Moneysign Suede requires projections of future income streams. This method is not necessarily straightforward in evaluating non-operating or non-generating assets.

Properly evaluating all assets, both tangible and intangible, is crucial for arriving at a reasonable estimate of Moneysign Suede's net worth. Accurate valuation is essential for informed decision-making and strategic planning, particularly for investment strategies, financial reporting, and legal matters. Ultimately, several methods must be employed for accurate and balanced valuation. The reliability of the valuations depends on the quality of the underlying data and the thoroughness of the analysis.

3. Revenue Streams

Revenue streams are a direct determinant of net worth. A robust and diversified revenue stream is a cornerstone of a healthy financial standing, representing the income generated by an entity's operations. The nature and consistency of these revenue streams influence the overall financial strength and sustainability of Moneysign Suede. Higher and more consistent revenue streams typically correlate with a higher net worth, all else being equal. For example, a company generating consistent revenue from multiple, reliable sources is generally better positioned financially than one reliant on a single, volatile revenue stream.

The importance of understanding revenue streams for evaluating net worth extends beyond a simple correlation. Varied revenue sources help stabilize overall financial performance. A company experiencing fluctuations in a single income stream might face significant financial challenges, potentially impacting their ability to invest in growth opportunities or meet their financial obligations. Conversely, a company with diversified revenue sources can withstand market downturns in certain areas and continue to perform, safeguarding its financial stability. Reliable revenue streams also influence borrowing capacity, and lenders often use historical revenue data to assess a company's creditworthiness. For instance, companies with consistently high revenue may be more attractive to investors seeking stable returns, which would ultimately impact the market valuation and, therefore, net worth. Different business models employ varied revenue streams, thus emphasizing the importance of understanding the companys specific operational structure in evaluating financial health.

In conclusion, revenue streams are integral to understanding and assessing the net worth of an entity like Moneysign Suede. A comprehensive analysis of these streams provides insights into an entity's financial stability and its capacity for future growth. While net worth is multifaceted, revenue streams represent a critical component that directly influences financial well-being, impacting valuation, creditworthiness, and ultimately the overall financial health of Moneysign Suede. Understanding this relationship enables more informed financial judgments, strategic planning, and investment decisions.

4. Investment Portfolio

An investment portfolio significantly influences the net worth of an entity like Moneysign Suede. The value and performance of investments held within the portfolio directly impact the overall financial standing. The composition and management of these investments are critical factors, shaping the financial trajectory and influencing the estimated net worth.

- Asset Allocation and Diversification

The strategic allocation of funds across different asset classes (stocks, bonds, real estate, etc.) and diversification of holdings are crucial. A well-diversified portfolio mitigates risk. The investment strategy should align with risk tolerance and financial goals. For instance, a company focusing on long-term growth might have a portfolio with a higher concentration in stocks compared to a company prioritizing stability. Understanding the potential return characteristics of various investment vehicles is paramount in creating a comprehensive portfolio suited to Moneysign Suede's long-term financial strategy and risk appetite.

- Investment Performance and Returns

The performance of investments within the portfolio directly affects the entity's net worth. Positive returns on investments increase the overall value of the portfolio. Conversely, poor performance can diminish net worth. Consistent and substantial returns will contribute to a stronger net worth, while erratic or negative returns will exert downward pressure. A portfolio's historical performance can serve as an indicator of potential future returns, allowing stakeholders to make informed decisions regarding the entity's financial position and future projections. The performance of Moneysign Suede's investment portfolio is a key indicator of the overall financial health and future outlook of the organization.

- Investment Timing and Market Cycles

The timing of investments and the ability to navigate market cycles significantly affect the portfolio's value. Understanding market cycles and making strategic investment decisions during favorable periods can maximize returns. Similarly, a company might benefit from investing in areas that are expected to perform well in the future, reflecting anticipated market trends. Conversely, poor timing and an inability to weather market downturns can negatively impact portfolio value and overall net worth. Investment timing is a critical aspect of portfolio management, requiring careful consideration and adaptation to market conditions.

- Valuation and Assessment of Investments

Accurate and ongoing valuation of investments is crucial for a clear understanding of the portfolio's current value. Investments should be regularly assessed, taking into account changes in market conditions and asset values. Accurate valuation allows for proper reporting and financial planning, helping to ensure a consistent understanding of the overall value and potential return of Moneysign Suede's investment portfolio. Regular valuation updates provide the organization with timely insights into the market's impact on investments and potential adjustments needed to the investment portfolio.

In conclusion, an investment portfolio is an integral component of the overall picture of a company's net worth. The management, allocation, and performance of these investments play a critical role in determining a company's financial health, future growth potential, and overall financial standing. For Moneysign Suede, a meticulously managed investment portfolio will contribute significantly to its financial strength and sustainable growth in the long run. The relationship between these elements is vital for assessing the long-term prospects of Moneysign Suede and its position in the market.

5. Public Information

Public information plays a significant role in understanding the potential net worth of Moneysign Suede, though not definitively determining it. Publicly available data, such as financial filings, press releases, and market analyses, provide context and clues, but a precise calculation requires access to internal data. The availability and accuracy of such information directly influence the reliability of any estimations. For example, a company announcing significant investment gains or partnerships through press releases might suggest a potential increase in net worth. Conversely, news of substantial debt or declining revenue could indicate a potential decrease.

The practical significance of public information in this context lies in its ability to inform broader estimations and analyses. Investors and analysts utilize this information to make informed decisions. Company financial reports, if available, allow for comparisons to industry benchmarks and identify potential trends, which in turn can impact perceived value. However, it's crucial to understand that public information is often a selective and often incomplete representation of the whole picture, thus limiting its capacity for precisely determining the entity's net worth. Public information alone cannot give a full financial assessment of an organization, which necessitates careful and nuanced analysis. For instance, favorable press coverage might raise investor confidence, indirectly affecting market valuation, which can influence perceptions of net worth, but does not directly determine the actual value.

In summary, public information acts as a vital, albeit limited, component in assessing the potential net worth of Moneysign Suede. While access to detailed financial reports and other internal information remains crucial, public data provides important context for analysts and investors. However, a comprehensive understanding of the company's financial position depends on reliable, detailed information, ideally beyond public records. The limitations of solely relying on public data must be acknowledged to avoid erroneous or misleading conclusions about the true financial standing of Moneysign Suede. This limitation underscores the importance of considering public information within a wider context of financial analysis, not as an absolute measure of net worth.

6. Market Trends

Market trends significantly influence the perceived and potential net worth of Moneysign Suede. Understanding these trends is crucial for assessing the company's financial health and future prospects. Fluctuations in market conditions can impact demand for products or services, affecting revenue and ultimately impacting the overall valuation.

- Economic Conditions

Economic downturns or expansions directly affect consumer spending and investment decisions. A period of economic recession may lead to reduced demand for certain products or services, potentially impacting Moneysign Suede's revenue and therefore its valuation. Conversely, a robust economic environment often fosters higher consumer spending, potentially boosting demand for goods and services and, in turn, positively affecting the company's value.

- Industry Trends

Changes in industry trends significantly affect the competitiveness and profitability of companies within that sector. Emerging technologies, shifting consumer preferences, and new regulations can create both opportunities and challenges. The impact on Moneysign Suede depends on the company's adaptability to these trends. For instance, a burgeoning interest in sustainable or eco-friendly products may open up new market segments for environmentally conscious companies, creating opportunities to increase revenue and potentially the perceived value of Moneysign Suede if aligned with the trend. Failure to adapt may result in diminished market share and reduced value.

- Consumer Preferences and Demand

Shifting consumer preferences and emerging needs impact product demand and potentially influence the value proposition of Moneysign Suede's products or services. A company's success often hinges on accurately recognizing and meeting these evolving demands. If Moneysign Suede's products or services resonate well with current consumer preferences, a surge in demand and a positive market response may lead to increased revenue and higher valuation. Conversely, a lack of responsiveness to evolving trends may diminish market share and potentially impact the company's value. Understanding the specific factors influencing consumer demand is critical for strategic planning and product development.

- Technological Advancements

Technological advancements can transform industries and reshape market dynamics. These advancements can either create new opportunities or render existing products or services obsolete. For Moneysign Suede, the adoption of new technologies or the integration of new technologies into products or services can either enhance their value proposition or introduce the risk of obsolescence if not properly adapted. Rapid technological changes, specifically, often require companies to adapt quickly, sometimes presenting significant hurdles or opportunities depending on the firm's response to these advancements.

In summary, market trends are dynamic forces constantly shaping the business landscape. The ability to understand, anticipate, and adapt to these trends is crucial for Moneysign Suede to maintain its competitiveness and potential value. A meticulous analysis of market dynamics, including economic conditions, industry trends, consumer preferences, and technological advancements, directly informs strategic planning and investment decisions. These aspects are critical for assessing the potential and sustainable value of Moneysign Suede in the present and future market.

7. Company Performance

Company performance is a critical factor directly impacting the perceived and potential net worth of Moneysign Suede. Strong, consistent performance typically translates to a higher valuation, while struggling performance can lead to a decrease in perceived worth. This relationship underscores the importance of understanding how various operational aspects influence a company's financial health and subsequent value.

- Revenue Growth and Stability

Consistent revenue growth demonstrates a company's ability to attract and retain customers and efficiently manage operations. Stable revenue indicates a healthy market position and consistent demand for products or services. This stability is a crucial factor in assessing long-term viability and, consequently, the potential for a higher net worth. A company with a history of fluctuating revenue might face greater investor uncertainty, potentially impacting its perceived net worth. For instance, a sudden decline in sales or a dramatic increase in costs could negatively affect a company's valuation.

- Profitability and Efficiency

Profitability, measured by profit margins and return on investment, is a key indicator of a company's operational efficiency and ability to generate returns. High and consistent profitability typically signals strong management and efficient resource allocation. Conversely, low or declining profitability may suggest inefficiencies or challenges in the marketplace. Investors and analysts often scrutinize profitability data when evaluating the potential net worth of a company, as high profitability often translates to a higher valuation.

- Market Share and Competitiveness

Maintaining or increasing market share demonstrates a company's competitive edge in the marketplace. A dominant market position, supported by strong brand recognition and favorable customer perception, often signifies a higher potential for future revenue and profitability. Conversely, a declining market share might indicate a losing battle against competitors, potentially impacting the company's valuation and, thus, its net worth. Success in maintaining market leadership can contribute to a greater investor confidence and a higher estimated net worth for Moneysign Suede.

- Innovation and Adaptability

Innovation and adaptability to market changes are crucial for long-term success. Companies that consistently introduce new products or services, adopt new technologies, and adapt their business strategies to changing market conditions are often positioned for greater growth and higher valuation. This often translates to a higher potential net worth. Conversely, a lack of innovation or resistance to adopting new trends can lead to a decline in market share and perceived value. The pace of innovation and the agility of companies will directly affect their valuation.

In conclusion, company performance, encompassing revenue growth, profitability, market share, and adaptability, directly influences the valuation and potential net worth of Moneysign Suede. A strong, consistent track record in these areas typically suggests a higher potential for growth and increased investor confidence, which contribute to a potentially higher valuation. Conversely, weaknesses in these areas may lead to lower investor confidence and potentially a lower estimated net worth. Understanding these factors is essential for evaluating the financial strength and long-term prospects of Moneysign Suede and, consequently, its net worth.

Frequently Asked Questions about Moneysign Suede Net Worth

This section addresses common inquiries regarding the financial standing of Moneysign Suede. Information presented here is based on publicly available data and analysis, and estimations are not definitive valuations.

Question 1: What is the precise net worth of Moneysign Suede?

A precise net worth figure is not publicly available for Moneysign Suede. Estimating net worth necessitates access to comprehensive financial data, including detailed balance sheets, income statements, and cash flow statements, information which is often not publicly disclosed for private entities.

Question 2: How is net worth typically determined?

Net worth is calculated by assessing total assets (tangible and intangible), subtracting total liabilities. Factors like revenue, profitability, market position, and investment returns influence the overall estimation. Determining a precise figure demands in-depth analysis often unavailable to the public.

Question 3: Why isn't the net worth of Moneysign Suede readily available?

For private entities, detailed financial data is often not publicly disclosed. This is a common practice for businesses that wish to maintain confidentiality regarding their financial status. Publicly available information, if present, offers a limited perspective, necessitating reliance on external analysis rather than a definitive figure.

Question 4: What sources of information can be used to understand Moneysign Suede's financial health?

While a precise net worth figure is unavailable, information on company performance can be gleaned from press releases, financial news articles, industry reports, and potentially regulatory filings (if applicable). However, these sources only provide partial views and do not offer a complete financial picture.

Question 5: How can I stay informed about updates regarding Moneysign Suede's financial status?

Following reputable financial news sources and industry publications that cover Moneysign Suede or the relevant sector can provide insights into any significant developments. However, a definitive net worth figure remains inaccessible without proprietary financial data.

In summary, while a precise net worth figure for Moneysign Suede is unavailable to the public, understanding the factors influencing such estimations, including public information, market trends, and company performance, provides a framework for evaluating the company's financial health. Publicly available data, however, cannot replace internal financial reporting.

This concludes the FAQ section. The subsequent sections will explore the operational and financial factors influencing Moneysign Suede's potential value.

Conclusion Regarding Moneysign Suede's Net Worth

Assessing the precise net worth of Moneysign Suede is complex, requiring access to internal financial data unavailable to the public. This analysis explored various factors influencing a potential valuation, including revenue streams, investment portfolios, market trends, and company performance. The absence of definitive financial reporting necessitates reliance on publicly available data, which, while informative, provides a limited perspective. Consequently, any estimate of net worth must be considered provisional and not a precise representation of the entity's financial standing. The evaluation of market trends, company performance, and asset valuation, though valuable, remains incomplete without complete financial disclosures.

Ultimately, a thorough understanding of Moneysign Suede's financial health demands transparency in financial reporting. While publicly accessible information can offer context, investors and analysts should approach any valuation estimate with caution. Future developments, such as changes in market conditions, company performance, or regulatory actions, may significantly affect perceived value. For comprehensive financial assessment, access to internal financial records is essential. This necessitates a careful interpretation of publicly available information alongside a recognition of inherent limitations. A nuanced understanding of the complexities surrounding net worth estimations is vital for informed decision-making regarding the entity.

Detail Author:

- Name : Modesto Strosin

- Username : thea.monahan

- Email : franecki.marcelina@harber.com

- Birthdate : 1975-06-02

- Address : 6530 Brant Forks Apt. 577 Hermannborough, KY 68848-0085

- Phone : (410) 657-5708

- Company : Schumm, Zieme and Runolfsson

- Job : Stock Broker

- Bio : Fugiat reprehenderit quia enim corrupti alias reprehenderit non. Voluptatem sit ut et non. Corporis veritatis odit error labore ut harum nihil.

Socials

facebook:

- url : https://facebook.com/buckridgem

- username : buckridgem

- bio : Assumenda aut voluptas totam similique in. Eum dicta provident labore est.

- followers : 6753

- following : 2059

tiktok:

- url : https://tiktok.com/@mae2418

- username : mae2418

- bio : Ducimus a molestias repellat aut.

- followers : 6049

- following : 1719