Samsung & Apple Net Worth: 2023 Comparison

How do the financial strengths of Samsung and Apple compare? Understanding the vast wealth of these tech giants provides valuable insights into market trends and competitive landscapes.

The financial resources of Samsung and Apple are significant indicators of their market dominance and influence. Apple, primarily a consumer electronics and services company, and Samsung, a diverse conglomerate encompassing electronics, telecommunications, and more, generate immense revenues. Quantifying these resources through net worth provides a measure of accumulated wealth, reflecting past successes and future potential. This net worth, alongside other financial metrics, offers a lens through which to understand the strength and trajectory of these two global powerhouses.

The scale of these companies' net worth has profound implications. Their financial capacity enables significant investments in research and development, leading to innovation in their respective sectors. It also contributes to the creation of jobs and impacts the global economy. Historically, these companies have exhibited considerable growth, impacting the technological landscape significantly. The consistent high levels of investment and subsequent revenue generation underscore the enduring success and resilience of these corporations, though they are subject to market fluctuations and evolving consumer preferences.

Moving forward, a deeper exploration of the respective financial strategies and market positions of these companies, and how they impact the broader tech industry and consumer experience, is crucial to understanding their ongoing and future influence.

Samsung and Apple Net Worth

Understanding the financial strength of Samsung and Apple provides insights into their market influence and global impact. Analyzing their substantial net worth allows for a deeper understanding of these technology giants.

- Market Dominance

- Revenue Streams

- Investment Strategies

- Product Innovation

- Global Presence

- Brand Recognition

- Profitability

- Stock Performance

These key aspects, when considered together, reveal a multifaceted picture. Market dominance, for instance, is often linked to successful revenue streams and extensive brand recognition. Investment strategies, influencing product innovation, further shape the ongoing competitive landscape. Profitability and stock performance are indicators of market perception and investor confidence. Samsung's diverse product portfolio and global presence illustrate their expansive reach compared to Apple's more focused approach. Ultimately, these factors illuminate the significant financial clout and impact of these two tech powerhouses on the global stage.

1. Market Dominance

Market dominance directly correlates with the net worth of Samsung and Apple. A substantial market share, achieved through sustained product innovation, strong brand recognition, and effective marketing strategies, often translates into significant revenue and profit margins. These robust financial results contribute significantly to the overall net worth of these corporations. Consequently, a company's commanding market position provides a powerful foundation for future growth and investment opportunities. Strong brand recognition, frequently the result of consistent market leadership, allows for premium pricing, leading to enhanced profitability and ultimately, increased net worth. Apple's dominance in the premium smartphone market, for example, facilitates sustained high profit margins, directly bolstering their financial strength.

The significance of market dominance as a component of net worth extends beyond the immediate financial impact. It also indicates the company's ability to attract and retain customers, leading to stronger brand loyalty. This established customer base forms a crucial asset, ensuring continued revenue streams and future growth potential. Samsung, through its vast portfolio of consumer electronics, showcases how market leadership across various product categories, from smartphones to televisions, translates into a substantial net worth. The ability to dominate key market segments enables companies to maintain a competitive edge, leading to continuous innovation and technological advancement. This, in turn, further reinforces their market position and increases their financial value.

In conclusion, market dominance is a critical factor in shaping the net worth of Samsung and Apple. The ability to command a significant portion of the market allows for sustained revenue generation, increased profitability, and significant investment opportunities. This translates into a strong foundation for future growth and overall financial strength. Understanding the intricate connection between market leadership and financial success is essential to appreciate the scale and impact of these two global tech giants.

2. Revenue Streams

Revenue streams are fundamental to the financial health and, consequently, the net worth of companies like Samsung and Apple. Understanding the diverse and substantial revenue sources of these corporations provides crucial insight into their financial strength and sustainability. This analysis examines key revenue streams and their implications.

- Product Sales

A substantial portion of both companies' revenue derives from the sale of tangible products. Samsung, with its broad range of consumer electronicssmartphones, televisions, and appliancesrelies heavily on product sales. Apple, focused primarily on smartphones, tablets, and computers, also generates significant revenue from these physical products. The volume and price points of these products, along with manufacturing efficiencies and supply chain management, all directly affect the overall revenue generated and, thus, the net worth of the companies. Strong product demand and innovation are vital to maintaining revenue from this source.

- Service Revenue

Services are increasingly important revenue streams for both companies. Apple's App Store and related services, including cloud storage, generate substantial recurring revenue. Samsung, too, has integrated services into its ecosystem, including mobile payment systems and cloud solutions, supplementing their product sales. The profitability of these service offerings, along with the ease of access and customer base engagement, significantly contribute to overall revenue and, therefore, the net worth. Recurring revenue models from services increase predictability and long-term financial stability.

- Licensing and Intellectual Property

Licensing agreements and intellectual property (IP) can contribute to revenue, though its significance varies. Samsung, with a broader product portfolio, may have more licensing opportunities across various industries. Apple, owing to its concentration on particular device categories, is less reliant on this revenue stream. The extent of successful licensing strategies and the strength of their IP portfolios plays a significant role in overall income. IP value is a component of company valuation.

- Investment Income

Investment income generated by each corporation, from investments in other companies or financial instruments, has a smaller, but still notable, impact on their revenue. The composition and performance of these investments are crucial to sustained profitability and, consequently, to the total net worth. The management of investment portfolios significantly influences long-term financial sustainability.

These revenue streams, when considered together, reveal the complex nature of how Samsung and Apple generate income. The multifaceted nature of their revenue streams contributes to their overall financial stability and helps sustain their large net worths. Understanding these diverse revenue sources allows for a more nuanced appreciation of their financial power and adaptability to market changes. Ultimately, strong revenue generation across various domains is crucial to the continued growth and substantial net worth of these global technological leaders.

3. Investment Strategies

Investment strategies play a critical role in shaping the net worth of companies like Samsung and Apple. The strategic allocation of capital, influenced by market forecasts, technological advancements, and risk tolerance, directly impacts financial performance and, ultimately, the overall value of the company. Effective investment strategies can amplify returns, potentially accelerating growth and contributing substantially to the net worth of these tech giants. Conversely, poorly conceived or executed strategies can hinder profitability and negatively impact the company's value.

Samsung and Apple employ diverse investment strategies reflecting their distinct corporate structures and market positions. Samsung, as a diversified conglomerate, invests in various sectors beyond its core technology operations. This diversification aims to mitigate risks associated with fluctuations in specific markets and technological advancements. Apple, concentrating primarily on its core technology sectors, tends to prioritize investments in research and development, aiming to cultivate innovative products and maintain its leadership position in the market. Both companies allocate substantial resources to intellectual property, research, and development, with the goal of maintaining and creating future revenue streams, which ultimately strengthens their long-term net worth. Real-world examples include Samsung's investment in semiconductor manufacturing, a key component in its electronics ecosystem, and Apple's ongoing investment in developing self-driving technology, aiming to expand into new markets and generate future revenue streams.

Understanding the investment strategies of companies like Samsung and Apple offers practical value for investors and analysts. The successful implementation of these strategies translates to sustained revenue, growth, and enhanced value for the firm. By analyzing their investment decisions, one can gain valuable insights into potential market trends, emerging technologies, and the financial health of major corporations. Furthermore, understanding the impact of market forces and technological disruptions on investment strategies is essential to comprehending the sustained value of these companies, while also recognizing the potential vulnerabilities inherent in any particular investment strategy. This knowledge provides critical tools for evaluating and understanding the market position of companies and anticipating potential future growth trajectories.

4. Product Innovation

Product innovation is inextricably linked to the substantial net worth of companies like Samsung and Apple. The ability to consistently introduce novel products, functionalities, and user experiences is a crucial driver of revenue, market share, and brand value, ultimately impacting their financial standing. The innovative design and development of new products are essential for maintaining a competitive edge in a dynamic market. Successful product launches frequently translate into increased demand, higher market penetration, and improved profitability.

Consider Samsung's foray into foldable smartphones and innovative display technologies. These groundbreaking products, along with the continuous advancement of features and capabilities in existing product lines, consistently draw consumer interest and contribute significantly to their market presence and net worth. Similarly, Apple's sustained commitment to product design and user experience, exemplified by the iPhone's iterative improvements, has fostered enduring customer loyalty and premium pricing power, further bolstering their substantial net worth. These examples demonstrate the vital role product innovation plays in generating revenue, driving market share growth, and enhancing brand prestige. The continuous pursuit of technological advancements in design, manufacturing, and user-friendliness positions these companies for future market leadership, enhancing their financial performance and net worth.

In conclusion, product innovation is a significant component of the net worth of Samsung and Apple. The consistent development of new and improved products, coupled with the creation of unique user experiences, is essential for maintaining a competitive edge, attracting and retaining consumers, and bolstering profitability. The financial success of these companies hinges on their ability to stay ahead of market trends, ensuring that innovation remains a driving force behind their continued prosperity. Understanding this connection allows for a more comprehensive appreciation of the dynamic interplay between technological advancement, consumer preferences, and corporate financial performance.

5. Global Presence

A company's global presence significantly influences its net worth. The reach and operational efficiency across international markets contribute to revenue streams and brand recognition, factors directly impacting a company's financial health. For corporations like Samsung and Apple, with substantial net worths, the global reach is a critical element in their financial performance.

- Expanded Revenue Streams

Global operations provide access to diverse markets and consumer bases. This access allows for increased revenue streams and reduced reliance on any single geographic region. For Samsung, a global presence across various markets, including emerging economies, expands the potential customer pool, diversifying their product sales and service offerings. Similarly, Apple's global reach allows for consistent product demand across regions, fostering stable revenue and profit growth regardless of localized economic fluctuations.

- Economies of Scale and Cost Reduction

Production in various global locations can leverage economies of scale, allowing for cost reductions in manufacturing and distribution. Samsung's global manufacturing presence, optimizing production in different countries based on cost-effectiveness and resource availability, is a strategic component of their global reach. This approach also benefits Apple, by allowing for production and distribution to occur near consumer markets and reducing transportation costs and time.

- Enhanced Brand Recognition and Market Share

Extensive global marketing campaigns and localized adaptations create a stronger brand presence and foster international consumer loyalty. Samsung, through strategic marketing campaigns tailored to different cultural contexts across the globe, has strengthened its brand identity and expanded market share. This same approach is evident with Apple, which adapts its marketing strategies to resonate with local tastes and cultural nuances, creating an enduring brand image and strengthening their position as a premium brand globally.

- Access to Resources and Talent

Global presence grants access to specialized resources and a wider pool of skilled labor, which fosters innovation and technological advancement. Both companies leverage global expertise and resources for research and development, contributing to the advancement of their respective fields, allowing for continuous innovation and enhancing their global standing. This access to diverse talent pools also bolsters production capabilities and efficiency, further enhancing their financial performance.

In summary, global presence for companies like Samsung and Apple is not just about extending market reach but strategically leveraging opportunities. The diverse markets, economies of scale, resource access, and enhanced brand recognition directly contribute to their robust net worth and sustained success. This global expansion is an essential component of their financial strength, illustrating the interconnectedness of global operations and corporate financial health.

6. Brand Recognition

Brand recognition is a significant driver of a company's net worth, particularly for corporations like Samsung and Apple. Strong brand recognition fosters customer loyalty, enabling premium pricing, increased market share, and ultimately, higher profitability. This, in turn, directly contributes to the overall financial valuation of the company. A recognizable and trusted brand often signals product quality, reliability, and innovation, encouraging consumer preference and sustained revenue streams.

The impact of brand recognition on financial performance is evident in the market success of Samsung and Apple. Both companies have cultivated strong brand identities, associated with technological innovation and high-quality products. Apple's iconic design aesthetic and meticulous attention to user experience contribute to a premium brand image, enabling them to command higher prices for their products. Samsung's global presence and diverse product portfolio, along with aggressive marketing campaigns, solidify their brand recognition and encourage widespread consumer appeal, fostering substantial revenue generation. Strong brand recognition is a tangible asset influencing the perceived value of the company and contributing directly to its financial strength and overall net worth.

Understanding the profound connection between brand recognition and financial success is crucial for both investors and corporate strategists. A strong brand serves as a crucial intangible asset, enhancing a company's value proposition beyond its tangible assets. This translates into higher stock valuations and greater investor confidence. Effective brand management is essential for sustained financial growth and market leadership. Maintaining and enhancing brand recognition necessitates consistent quality, innovation in product development, and targeted marketing strategies that resonate with the target consumer demographic. Ultimately, a well-recognized brand contributes to a company's lasting competitive advantage and its overall net worth.

7. Profitability

Profitability is a fundamental driver of net worth for companies like Samsung and Apple. Consistent profitability generates substantial retained earnings, a crucial component of capital accumulation. This retained capital fuels reinvestment in research and development, expansion into new markets, and the acquisition of other companies, thereby bolstering future growth and, ultimately, escalating net worth. Substantial profits are essential to fund these operations, enabling sustained expansion and market leadership.

The correlation between profitability and net worth is undeniable. Profits directly translate into increased shareholder value and influence on market positioning. Strong quarterly and annual earnings reports, indicating high profitability, often correlate with rising stock prices. This demonstrates investor confidence and anticipation of continued growth. For example, if Samsung or Apple consistently deliver impressive profit margins due to effective cost control and operational efficiency, their net worth tends to expand accordingly, positively impacting the financial performance and future growth prospects of the companies. The reverse is also true; a decline in profitability can signal underlying problems or market shifts, impacting investor confidence and consequently, the net worth of the company. This direct link between financial performance and market perception underlines the practical importance of maintaining consistent profitability.

In conclusion, profitability forms a vital link in the chain of value creation for corporations like Samsung and Apple. Strong profitability, consistently demonstrated over time, is a significant indicator of financial health and a key driver of increasing net worth. This relationship highlights the importance of operational efficiency, market responsiveness, and effective strategic decision-making to sustain both profitability and the overall growth of these multinational corporations. Companies demonstrating sustained profitability, such as Samsung and Apple, effectively demonstrate their capacity for continued growth, maintaining investor confidence and increasing the long-term value of the company.

8. Stock Performance

Stock performance is a direct reflection of market perception regarding a company's value and future prospects. For companies like Samsung and Apple, whose net worth is significantly tied to their stock valuation, understanding this connection is crucial. Stock performance gauges investor confidence in the company's ability to generate profits and maintain a strong market position, directly impacting the overall valuation and, subsequently, the net worth. A detailed examination of stock performance reveals key indicators that contribute to this relationship.

- Stock Price Fluctuations

Stock prices fluctuate based on numerous factors, including market trends, economic conditions, and investor sentiment. Changes in stock price directly correlate to changes in perceived value. Positive news, such as strong financial results or innovative product launches, often results in increased stock prices, boosting a company's net worth. Conversely, negative news, such as financial setbacks or regulatory scrutiny, can lead to stock price declines, potentially impacting net worth. These fluctuations are a dynamic reflection of the market's evolving assessment of a company's future prospects.

- Investor Sentiment and Trading Volume

Investor sentiment, influenced by various factors like market analysis and media coverage, plays a significant role in stock performance. High trading volume, often associated with increased investor interest, can signal strong market confidence. Conversely, low trading volume might indicate investor uncertainty, potentially impacting stock prices. Trends in investor sentiment and trading volume give crucial insights into the market's perception of the company's prospects and its potential impact on the overall net worth.

- Financial Performance Metrics

Companies' financial performance, reflected in key metrics like revenue, earnings, and profitability, directly influences stock performance. Strong financial results often translate into higher stock prices, suggesting a positive outlook for the company's future. Conversely, poor financial performance, such as declining revenues or lower-than-expected earnings, typically results in a decrease in stock price and thus affects the net worth. Close monitoring of these metrics allows for a clearer understanding of the market's reaction to the company's financial performance.

- Comparison to Industry Peers

Analyzing a company's stock performance relative to its industry peers offers valuable context. Superior performance in comparison to competitors often signifies market leadership and can positively affect a company's perceived value and net worth. Conversely, lagging stock performance in comparison to peers might signal challenges or opportunities missed. This competitive analysis provides a relative benchmark for assessing market perception and the company's position within the industry.

Ultimately, stock performance acts as a critical barometer for investor confidence in Samsung and Apple. A positive correlation between stock price and a company's financial results often mirrors the perceived value of the company and, in turn, a growing net worth. Conversely, negative stock performance, particularly if sustained, can reflect declining investor confidence and may impact a company's future valuation and net worth. These indicators underscore the dynamic connection between stock performance and the financial health and market standing of large multinational corporations.

Frequently Asked Questions

This section addresses common inquiries regarding the net worth of Samsung and Apple, providing concise and factual answers to help clarify key aspects of their financial standing.

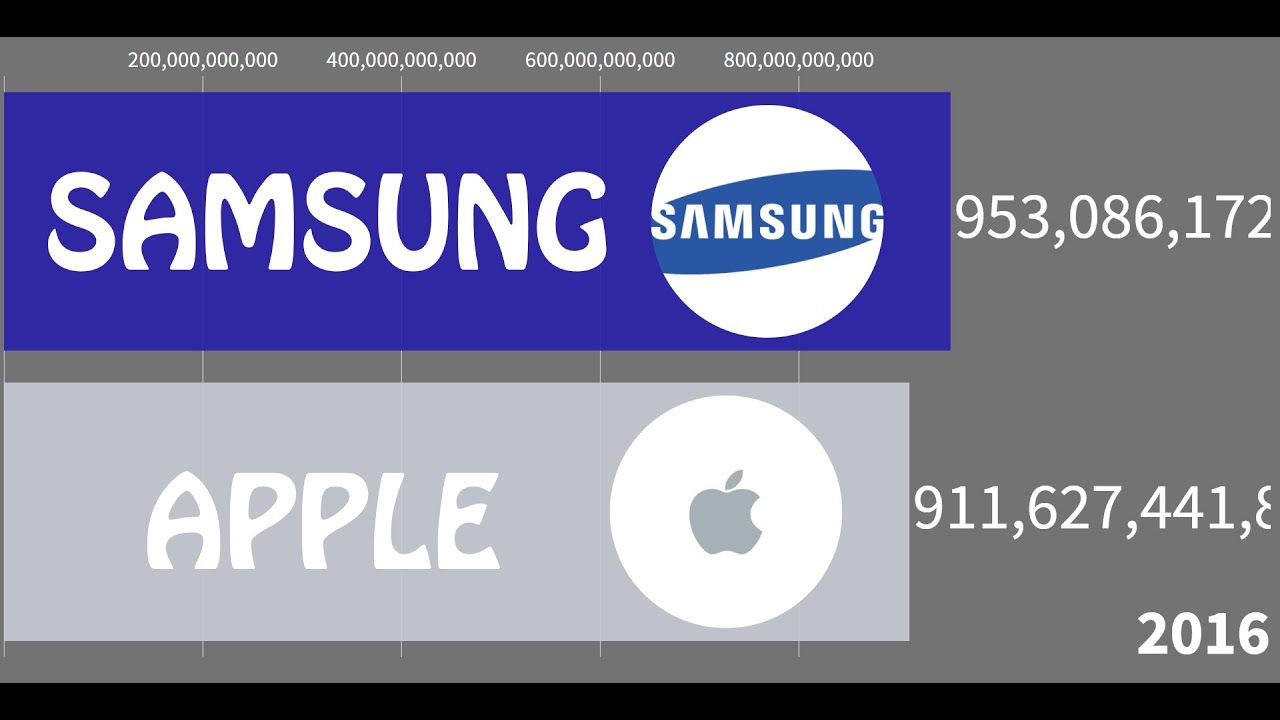

Question 1: What is the current net worth of Samsung and Apple?

Precise figures for net worth fluctuate constantly due to market conditions and reporting periods. Publicly available data offers estimates, but precise figures are often unavailable until official financial reports are released. Therefore, definitive values are difficult to provide in real-time.

Question 2: How is net worth calculated for these companies?

Net worth is typically calculated by subtracting a company's liabilities (debts) from its assets (possessions). This calculation is complex, encompassing various types of assets, including tangible assets (property, equipment), intangible assets (intellectual property, brand value), and financial assets (cash, investments). Precise methodologies and estimations can vary.

Question 3: What factors influence the net worth of Samsung and Apple?

Several factors impact a company's net worth, including revenue generated from products and services, profitability, investment decisions, market share fluctuations, economic conditions, and investor confidence. The success of their product launches, brand recognition, and global presence significantly influence their financial value and net worth.

Question 4: How does Samsung's net worth differ from Apple's?

Samsung is a diversified conglomerate with a broader range of product lines, creating more varied revenue streams. Apple, primarily focused on consumer electronics, particularly smartphones and related services, has a more concentrated business model. Consequently, the revenue and profitability of these two companies are approached differently, ultimately affecting their respective net worths. The impact of each factor differs based on the company.

Question 5: Why is the net worth of these companies important?

The net worth of Samsung and Apple represents a significant measure of their economic influence. It reflects their market dominance, investment capabilities, and long-term financial health. Understanding their net worth provides a valuable perspective on market trends, economic conditions, and the competitive landscapes within the technology sector.

Understanding these factors is crucial for comprehending the scale of these companies and their global impact. Further analysis of specific financial reports and market trends can offer a deeper understanding of the companies' financials.

Conclusion

The analysis of Samsung and Apple's net worth reveals a complex interplay of factors influencing their financial strength and market position. Key determinants, such as market dominance, revenue streams, investment strategies, product innovation, global presence, brand recognition, profitability, and stock performance, all contribute to the overall valuation of these tech giants. The substantial resources generated through these factors facilitate substantial investment in research and development, underpinning future growth and technological advancement. Furthermore, the diverse revenue streams, encompassing product sales, services, and licensing agreements, contribute significantly to overall profitability and sustained financial stability. A global presence amplifies revenue streams, reduces costs, and strengthens brand recognition, further solidifying their financial standing.

Understanding the intricate relationship between these factors and net worth provides critical insights into the dynamics of the global technology sector. The financial strength of these companies underscores the importance of innovation, strategic investment, and adaptability in a competitive landscape. Future analysis of these companies' performance will undoubtedly be crucial for understanding market trends and technological advancements in the broader sector. Tracking financial metrics, analyzing investment strategies, and studying their responses to changing market dynamics will provide a valuable framework for investors and analysts seeking to comprehend the complex forces driving technological advancement and economic growth.

Detail Author:

- Name : Agnes Ruecker

- Username : ansley14

- Email : lorena67@hotmail.com

- Birthdate : 1993-10-11

- Address : 17790 Ernesto Village North Emelia, OR 27567

- Phone : (240) 612-1036

- Company : Rice Inc

- Job : Project Manager

- Bio : Aut aut quia non error quaerat similique totam. Eum asperiores ut rem necessitatibus doloremque autem est. Iusto enim odio laudantium maiores dolor et voluptate. Sed est nemo tempore dignissimos.

Socials

tiktok:

- url : https://tiktok.com/@loyal_xx

- username : loyal_xx

- bio : Itaque ut suscipit et consectetur eos. Repellendus quibusdam non voluptatibus.

- followers : 3116

- following : 91

facebook:

- url : https://facebook.com/loyal.ondricka

- username : loyal.ondricka

- bio : Praesentium neque est saepe animi.

- followers : 4659

- following : 664

linkedin:

- url : https://linkedin.com/in/londricka

- username : londricka

- bio : Dolor reiciendis voluptas eos a.

- followers : 1737

- following : 2596