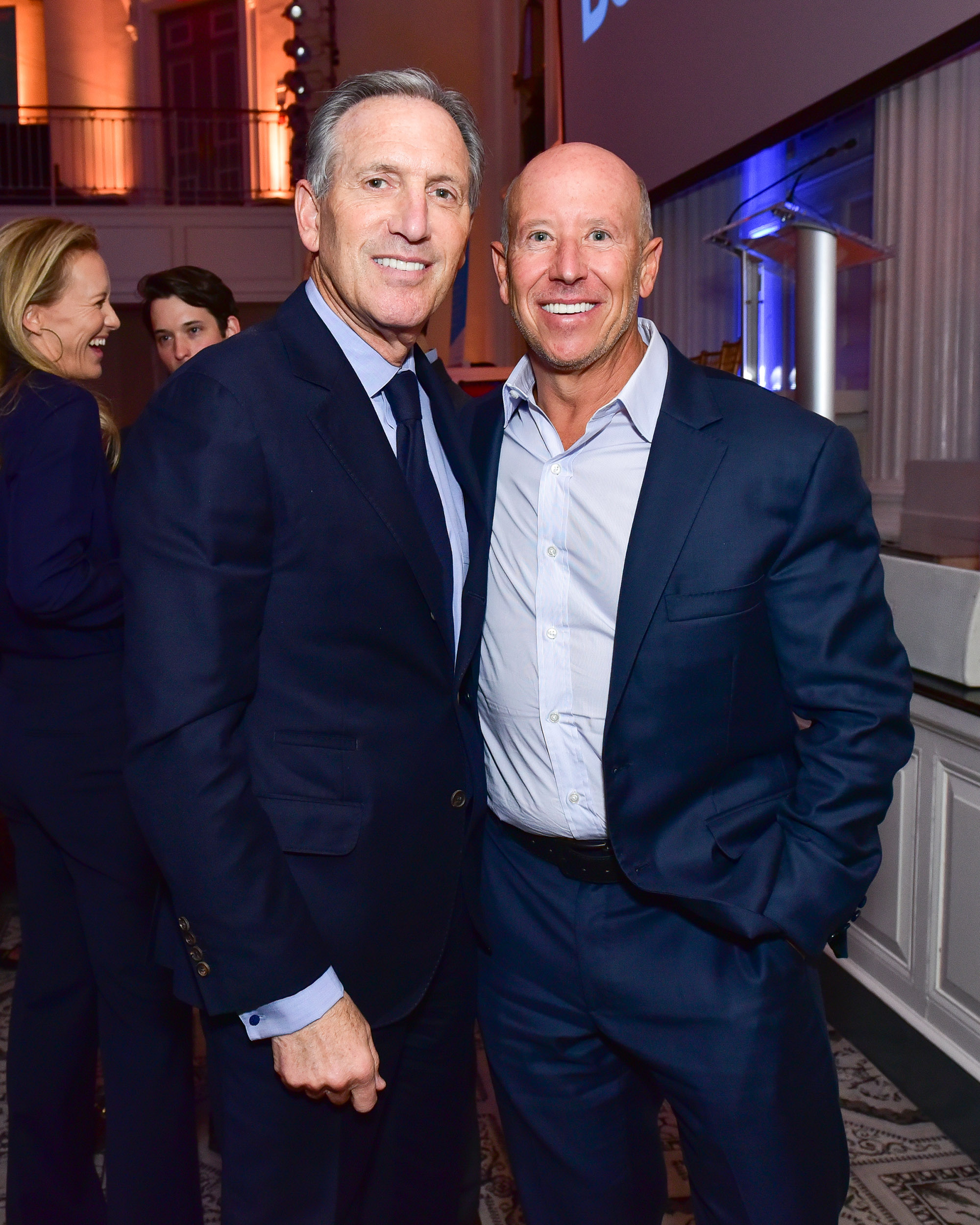

Barry Sternlicht Net Worth 2023: A Deep Dive

How much is Barry Sternlicht's wealth? Understanding the significant impact of a real estate mogul's fortune.

Barry Sternlicht's financial standing reflects his success in the real estate industry. His net worth, a calculation of assets minus liabilities, represents a culmination of investments, property holdings, and earnings. It's a measure of financial strength and a significant indicator of an individual's influence within the real estate market. For example, a high net worth often correlates with a substantial portfolio of properties and the ability to command high-profile transactions.

Understanding Sternlicht's financial profile provides insight into the dynamics of the real estate market and the factors contributing to success in this sector. His accumulation of wealth, whether from acquisitions, developments, or other ventures, sheds light on the complexities of wealth creation. Analysis of his financial standing can also illuminate the strategies and trends that drive growth in the industry. Such financial information helps establish perspectives on individual success and market performance.

- Patti Labelle Net Worth A Deep Dive Into Her Fortune

- Trayce Thompson Salary 2024 Latest Earnings Details

| Category | Details |

|---|---|

| Name | Barry Sternlicht |

| Profession | Real Estate Mogul, Investor |

| Notable Achievements (or Company/s) | President and CEO of Starwood Capital Group |

| Known For | Acquisitions and development of large real estate projects. |

Further exploration of Sternlicht's career path, investment strategies, and major transactions can offer valuable insights into the broader real estate market and the principles driving wealth accumulation within it. This includes understanding how certain market conditions or industry changes influence the growth and value of his holdings, and how his strategies compare to others in the field.

Barry Sternlicht Net Worth

Barry Sternlicht's net worth provides a window into his substantial influence and success within the real estate sector. Understanding the components of this figure is crucial to comprehending the factors driving his financial position.

- Investment Strategies

- Property Portfolio

- Market Fluctuations

- Business Acumen

- Earnings

- Asset Valuation

Sternlicht's investment strategies, including shrewd acquisitions and development ventures, are a major driver of his substantial net worth. His property portfolio, encompassing a diverse range of high-value assets, reflects market awareness and a strong understanding of real estate trends. Market fluctuations influence valuations and the overall worth of such portfolios. Sternlicht's business acumen, strategic decision-making, and leadership contribute significantly to his financial standing. Earnings from business activities and asset management further contribute to the overall value. Accurate asset valuation procedures are fundamental for assessing true net worth, accounting for potential risks and opportunities.

1. Investment Strategies

Investment strategies are fundamental to understanding Barry Sternlicht's substantial net worth. They represent the core principles and methodologies behind the accumulation of wealth. Successful investment strategies involve identifying profitable opportunities, managing risk effectively, and leveraging market trends. For Sternlicht, likely strategies would include property acquisition, development, and asset management. Careful consideration of potential market fluctuations and economic conditions is crucial. A well-defined strategy, diligently implemented, can significantly impact the overall net worth.

The effectiveness of investment strategies directly affects the value of assets held. Successful strategies generate higher returns, leading to increased net worth. Conversely, poor or ill-conceived strategies may result in financial losses and a decline in net worth. Real-life examples of successful investment strategies, demonstrated by Sternlicht's career trajectory, highlight the importance of market analysis, due diligence, and risk mitigation. These strategies, applied consistently over time, contribute to a substantial and sustainable net worth. The specific details of these strategies, while not publicly available in full, likely encompass aspects such as: identifying under-valued properties; understanding the dynamics of a particular real estate market; managing and financing large projects; and navigating financial markets to leverage favorable conditions. Understanding these strategies is vital for any investor hoping to build significant wealth.

In conclusion, investment strategies are not merely a component of a large net worth but are the very engine driving it. The interplay between investment decisions, market conditions, and asset management shapes Sternlicht's financial standing. Analyzing these strategies, drawing parallels to other successful real estate investors, and studying market trends provides valuable insight for aspiring investors, highlighting the importance of strategic planning for long-term financial success. Successful investment strategies are vital for any investor, but especially in the demanding, dynamic world of high-value real estate investment.

2. Property Portfolio

A significant property portfolio is intrinsically linked to Barry Sternlicht's net worth. The value and diversity of this portfolio directly influence his overall financial standing. A robust portfolio, encompassing strategically chosen properties, often represents a substantial portion of total assets. The nature and scale of this portfolio play a pivotal role in determining the magnitude of his net worth.

- Location and Type of Properties

The geographical location and type of properties within the portfolio are critical. Premium locations, high-demand sectors, and properties with strong rental potential or future development prospects contribute significantly to overall value. Sternlicht's experience likely suggests a preference for properties with high yield and appreciation potential, which contribute directly to net worth growth.

- Acquisition and Development Strategies

The methods of acquiring and developing properties impact the portfolio's value and consequently, Sternlicht's net worth. Strategic acquisitions of existing buildings or land, alongside effective development plans for new projects, illustrate expertise in generating returns. These actions directly translate into increasing asset value and bolstering net worth.

- Portfolio Diversification

Diversification within the property portfolio is a crucial element. A varied portfolio lessens risk by distributing investments across different sectors, locations, and property types. This diversification strategy is essential in managing market fluctuations and ensuring overall stability and long-term growth of net worth.

- Market Conditions and Valuation

External market conditions and valuation methods significantly affect the overall value of the property portfolio. Changes in the marketeconomic fluctuations, shifts in demand, or altering interest ratescan cause the portfolio's worth to fluctuate. Accurate valuations, updated frequently, are essential for a precise assessment of net worth and for ensuring realistic projections regarding future gains.

Ultimately, the size and nature of Barry Sternlicht's property portfolio are inextricably linked to his net worth. A well-managed portfolio, strategically diversified and adaptable to market changes, generally leads to a strong and growing financial position. The specifics of his portfolio are not publicly available in full, but the general principles above highlight the essential connection between property investments and his overall net worth. The impact of his portfolio on his financial standing is undeniable and central to his success in the real estate sector.

3. Market Fluctuations

Market fluctuations are a critical element impacting Barry Sternlicht's net worth. The value of real estate assets, a substantial component of his holdings, is intrinsically tied to market dynamics. Understanding how these fluctuations influence investment returns and asset valuations is essential for assessing the overall impact on Sternlicht's financial position.

- Interest Rate Changes

Changes in interest rates directly affect borrowing costs and, consequently, the cost of acquiring and developing properties. Higher interest rates typically reduce the affordability of real estate projects, potentially impacting the profitability of new ventures and the valuation of existing assets. Conversely, lower rates can stimulate demand and increase the value of investments.

- Economic Downturns

Periods of economic downturn often lead to reduced consumer spending and investment activity, including in real estate. Decreased demand can result in lower property prices and decreased rental income, impacting the overall value of a portfolio and Sternlicht's net worth. Conversely, recovery periods can see an upswing in investment and renewed confidence, increasing the value of his holdings.

- Supply and Demand Imbalances

Fluctuations in the supply and demand dynamics for real estate in specific markets significantly impact property values. Increased demand relative to supply typically drives up prices, favorably affecting net worth. Conversely, oversupply relative to demand can lead to depressed market values and negatively influence the returns on investments, thus reducing Sternlicht's net worth.

- Government Regulations and Policies

Government policies regarding real estate development, zoning, and taxation can substantially influence market dynamics and property values. Changes in these regulations can significantly impact investment returns and potentially affect the valuation and overall value of holdings, impacting Sternlicht's net worth. Examples might include changes to building codes, tax incentives, or restrictions on new construction.

In conclusion, market fluctuations are a continuous factor influencing Barry Sternlicht's net worth. The interplay between these diverse factorsinterest rates, economic cycles, supply and demand, and governmental policiesshapes the performance of his real estate investments and directly impacts the valuation of his holdings. Navigating these fluctuations requires a keen understanding of market trends and a responsive investment strategy. Without this awareness, the net worth is susceptible to volatility and unpredictable outcomes.

4. Business Acumen

Business acumen, encompassing a deep understanding of market dynamics, financial strategies, and effective management, directly correlates with Barry Sternlicht's net worth. It's not simply about possessing capital but about deploying it strategically. A keen understanding of real estate markets, regulatory environments, and financial instruments is crucial for success. Strong business acumen allows Sternlicht to identify profitable opportunities, mitigate risks, and maximize returns on investments, all factors contributing significantly to the growth of his net worth.

Sternlicht's ability to recognize emerging trends, anticipate market shifts, and adapt investment strategies accordingly illustrates the significance of business acumen. This involves assessing the potential value of a property, anticipating changes in demand, and leveraging economic conditions. Real-life examples include successful acquisitions, shrewd financing decisions, and timely divestments. Such astute financial and business decisions, driven by strong business acumen, amplify investment returns and ultimately contribute to the overall increase in his net worth. Effective risk management strategies, honed by business acumen, are vital when navigating the complexities of real estate investments, particularly those on a large scale.

In conclusion, business acumen serves as a cornerstone in the pursuit of financial success, particularly in the real estate sector. Without a profound understanding of market forces and effective financial strategies, a substantial net worth remains elusive. For individuals seeking to replicate Sternlicht's success, focusing on honing business acumen, encompassing an in-depth understanding of financial and market dynamics, effective decision-making under pressure, and strategic resource allocation is essential. Understanding this connection provides invaluable insight into the factors driving substantial wealth creation, particularly in the complex and often unpredictable real estate market.

5. Earnings

Earnings represent a critical component in the calculation of Barry Sternlicht's net worth. Directly impacting his financial standing, earnings from various sources are crucial for understanding the accumulation and maintenance of his wealth. This section explores the key facets of earnings and their relationship to overall net worth.

- Salaries and Compensation

Salaries and other forms of compensation from employment are direct sources of income. For figures like Sternlicht, potentially significant salaries from executive positions, management roles, or advisory positions contribute directly to annual earnings and impact the overall financial picture. These earnings are part of the total income calculation and contribute to the overall net worth.

- Investment Income

Earnings from investments, such as dividends, interest on accounts, or capital gains from asset sales, are an essential aspect of Sternlicht's earnings. The substantial scale of his investment portfolio likely generates substantial income streams, further boosting the overall revenue and consequently impacting the net worth.

- Real Estate Income

Income generated from real estate holdings, encompassing rental income, property appreciation, and revenue from development projects, plays a significant role. These income streams directly reflect performance in the real estate market and represent a vital portion of the total income contributing to the net worth.

- Other Business Revenue Streams

Other business activities, including ventures or partnerships, may produce additional income streams. The specifics of these activities can vary, with earnings depending on the nature and success of the venture. Such additional revenue streams often contribute to the overall financial picture and potentially impact the net worth.

The various income streams described contribute to a comprehensive understanding of Sternlicht's financial situation. Analyzing these earnings is crucial for assessing the overall health of his business ventures and the consistency of his wealth accumulation. Consistent and substantial earnings from multiple sources are often associated with a steady increase and substantial net worth, especially in the long term. Understanding these different income components paints a complete picture of his total revenue and its contribution to the overall financial profile. Earnings therefore provide a significant measure of the sustained success of the individual's business ventures and financial acumen.

6. Asset Valuation

Accurate asset valuation is fundamental to determining Barry Sternlicht's net worth. The process of determining the fair market value of assetsparticularly real estatedirectly influences the calculation of his overall financial standing. A precise assessment of his holdings is crucial, as fluctuating market conditions and changing valuations can significantly impact the reported net worth. In essence, the accuracy and methodology of asset valuation directly shape the understanding of Sternlicht's financial health and success.

Several factors influence the valuation of assets in Sternlicht's portfolio. Location, condition, size, and type of property are all critical factors. Future development potential and anticipated rental income are also considered. Moreover, market trends, economic indicators, and comparable sales data in similar locations play a crucial role in determining the value. For example, a prime location in a thriving urban center might command a higher valuation than a comparable property in a less developed area. Similarly, renovations, upgrades, and unique features can significantly elevate the value of a property. Sophisticated valuation methods, often employed by real estate professionals, consider these factors and market conditions in a comprehensive manner. A critical component of this is understanding the potential market risk associated with certain assets and locations. The accuracy of valuation directly affects the precision of the net worth calculation and any associated projections of financial growth.

Understanding the relationship between asset valuation and net worth is crucial for both investors and financial analysts. Precise valuations provide a reliable basis for assessing the financial health of individuals and businesses, allowing for informed investment decisions. For Barry Sternlicht and others in the real estate industry, accurate valuations of assets are fundamental for financial reporting, tax considerations, and strategic decision-making. Challenges in valuation, such as volatile markets or incomplete information, can create inaccuracies and distort the true representation of net worth. Ultimately, reliable asset valuation provides a clear picture of financial position and serves as a crucial building block for future planning and strategic investment. This understanding is essential for evaluating the success and stability of individuals and entities within the real estate and investment realms.

Frequently Asked Questions about Barry Sternlicht's Net Worth

This section addresses common inquiries regarding Barry Sternlicht's financial standing. These questions and answers provide a concise overview of relevant aspects related to his wealth and success in the real estate industry.

Question 1: What is the primary source of Barry Sternlicht's wealth?

Sternlicht's wealth primarily stems from his extensive career in real estate. His success in large-scale property acquisitions, developments, and asset management within the industry forms the core of his financial foundation.

Question 2: How does market fluctuation impact his net worth?

Market fluctuations, encompassing factors like interest rates, economic downturns, and supply-demand imbalances, directly affect the value of real estate assets. These changes can influence Sternlicht's net worth positively or negatively, depending on the specific market conditions and his strategic response.

Question 3: What role does his investment strategy play in determining his net worth?

Sternlicht's investment strategy, encompassing risk assessment, market analysis, and property selection, significantly influences the growth and stability of his net worth. Successful strategies often yield higher returns and greater financial security.

Question 4: How is the valuation of his assets calculated, and what factors influence this?

Accurate asset valuation, encompassing factors such as property location, condition, market trends, and comparable sales, is essential in determining Sternlicht's net worth. The methodology and accuracy of this valuation process directly impact the reported figure.

Question 5: Does his compensation package affect his net worth calculation?

Yes, compensation from employment, investment income, and revenue generated from real estate holdings all contribute to the total income calculation, thus influencing the overall net worth. The diverse sources of revenue contribute to a comprehensive understanding of Sternlicht's financial status.

In summary, Barry Sternlicht's net worth reflects a complex interplay of factors. Market conditions, investment strategies, asset valuation, and compensation all contribute to the overall financial picture. Understanding these elements provides a clearer comprehension of the nuances associated with his wealth and the industry in which he operates.

This concludes the FAQ section. The subsequent section will delve deeper into the specific strategies employed by Sternlicht in the realm of real estate investment.

Conclusion

Barry Sternlicht's net worth serves as a compelling illustration of success within the complex realm of real estate investment. The factors contributing to this substantial figure encompass a multifaceted approach. Strategic investment strategies, coupled with a discerning eye for market trends and a robust portfolio of high-value properties, have been instrumental in the accumulation of his wealth. The crucial role of accurate asset valuation and the consistent generation of earnings from various sources further solidify his financial standing. Moreover, the ability to adapt to market fluctuations, a critical aspect in the real estate industry, underscores the importance of calculated risk-management strategies for long-term financial stability. Ultimately, Sternlicht's financial success reflects a combination of astute business acumen, market savvy, and the effective management of substantial resources.

The exploration of Sternlicht's financial profile provides valuable insights into the dynamics of the real estate market. His trajectory underscores the significant interplay between market forces, investment strategies, and the potential for substantial wealth creation within the sector. Furthermore, the analysis highlights the importance of continuous adaptation and the need for effective risk management when navigating the complexities of such large-scale investments. Understanding these elements provides a framework for evaluating the performance of real estate portfolios and formulating effective investment strategies.

Detail Author:

- Name : Enos Schuppe

- Username : suzanne93

- Email : ghammes@hotmail.com

- Birthdate : 1999-02-26

- Address : 1578 Mertz Land Suite 730 West Otilia, NY 42479-7927

- Phone : 1-458-839-4252

- Company : Murphy PLC

- Job : Veterinary Assistant OR Laboratory Animal Caretaker

- Bio : Nemo dolores soluta voluptate nihil at. Velit ex numquam iure aut sunt voluptas voluptatem. Nesciunt reprehenderit aut fuga molestiae consectetur eius ducimus. Et nam sit et quas voluptatum sit.

Socials

facebook:

- url : https://facebook.com/corine6079

- username : corine6079

- bio : Distinctio repudiandae dolor recusandae enim error aut minus ipsa.

- followers : 459

- following : 2961

tiktok:

- url : https://tiktok.com/@corine.kutch

- username : corine.kutch

- bio : Corrupti enim rerum eos consequatur adipisci officia.

- followers : 5994

- following : 817

twitter:

- url : https://twitter.com/corine_kutch

- username : corine_kutch

- bio : Dolores dolores iusto earum nostrum dolor. In vero nisi architecto. Quidem ab est eveniet fugit aut pariatur praesentium. Asperiores quos et ipsa rerum.

- followers : 4890

- following : 1621