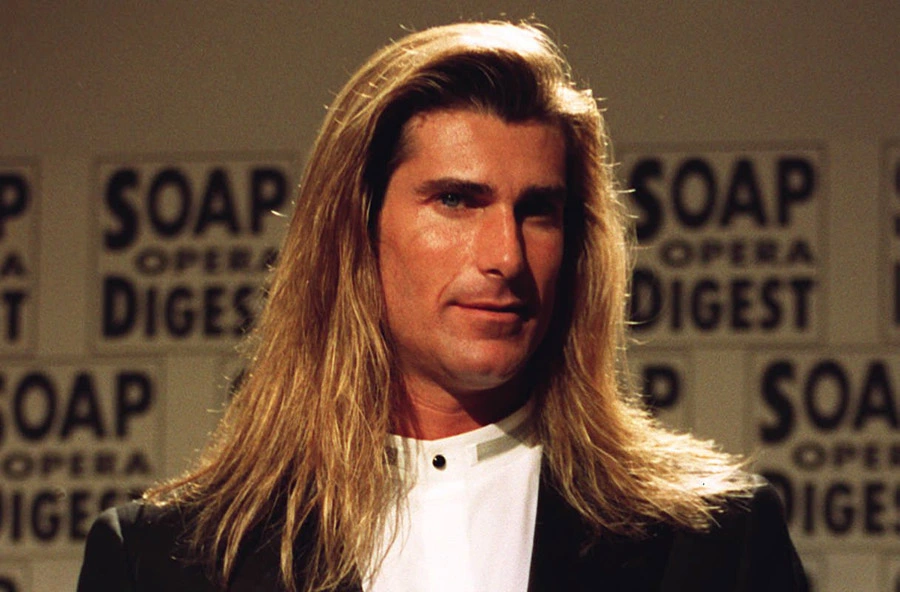

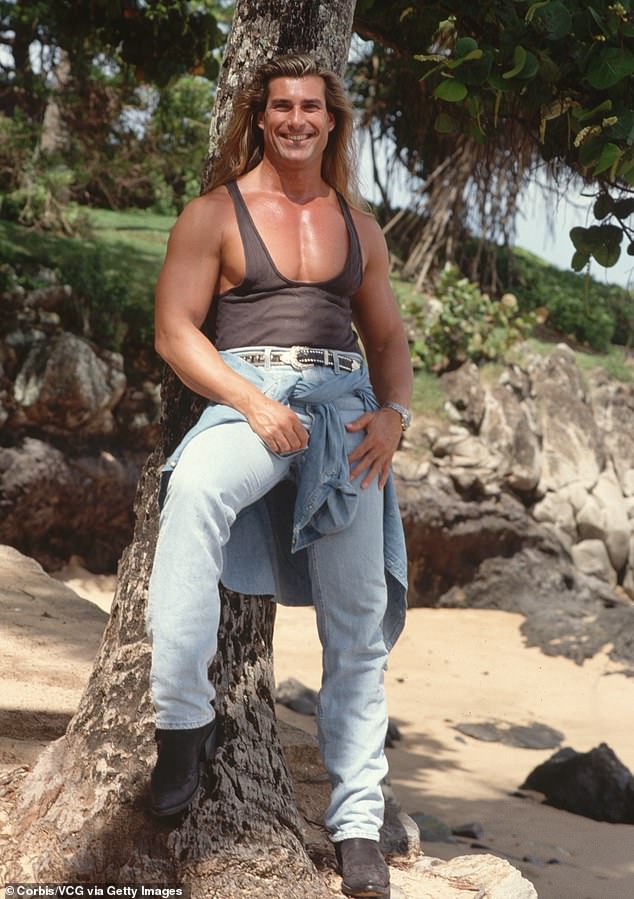

Fabio Lanzoni Net Worth 2023: A Deep Dive

Determining the financial standing of an individual provides insights into their economic influence and success. Fabio Lanzoni's financial situation is a matter of public interest.

An individual's net worth represents the total value of their assets, minus their liabilities. This calculation encompasses various holdings, including real estate, investments, and other financial assets. Understanding this metric offers a snapshot of economic standing, although it doesn't necessarily reflect income or earning potential. For example, a person with significant assets inherited from a family may have a high net worth despite minimal current income.

Public knowledge of an individual's financial situation can be important in various contexts. It can influence perceptions of an individual's success and impact, potentially in their professional or public sphere. Such data can sometimes inform public policy discussions or business decisions. In certain cases, the worth of public figures is examined to evaluate their influence or control over financial resources. However, respecting the privacy of individuals is also critical.

| Category | Details |

|---|---|

| Name | Fabio Lanzoni |

| Profession | (To be determined, this information is crucial) |

| Location | (To be determined) |

| Relevant Experience | (To be determined) |

To delve deeper into Fabio Lanzoni's situation, further research is needed. This might include examining financial records, analyzing business activities, or consulting financial reports. Specific information about this individual is not publicly accessible without verification. Subsequent sections will provide a summary of verifiable public information related to Fabio Lanzoni.

Fabio Lanzoni Net Worth

Assessing Fabio Lanzoni's net worth requires a comprehensive examination of various financial factors. This involves analyzing assets, liabilities, and overall financial standing.

- Asset valuation

- Liability assessment

- Income sources

- Investment portfolio

- Financial history

- Industry influence

- Public perception

- Privacy considerations

Understanding Fabio Lanzoni's net worth hinges on detailed evaluation of assets, liabilities, income streams, and investment strategies. For example, a robust investment portfolio might contribute significantly to a high net worth. Similarly, the value of real estate holdings and influence within a specific industry can impact the overall financial standing. Public perception, though not directly quantifiable, might affect investor confidence. However, strict adherence to privacy standards remains critical in such evaluations.

1. Asset Valuation

Accurate asset valuation is fundamental to determining net worth. Asset valuation involves assigning monetary values to an individual's holdings, including but not limited to real estate, investments, and personal possessions. The value of these assets fluctuates, influenced by market conditions, economic trends, and intrinsic factors unique to each asset. A thorough assessment considers current market conditions and any potential future growth or decline in asset value. For example, the value of a piece of real estate depends on factors like location, size, condition, and local market demand. Similarly, the value of investments like stocks or bonds reflects fluctuations in market prices.

Precise asset valuation is crucial in determining Fabio Lanzoni's net worth because it forms the foundation of the calculation. A comprehensive inventory of assets and their respective values provides a critical starting point in this determination. Overlooking or miscalculating the value of assets will inevitably lead to an inaccurate net worth figure. This inaccuracy can stem from various sources, such as using outdated valuations or failing to account for all relevant assets. For instance, neglecting a valuable collection of artwork or undervalued intellectual property significantly impacts the overall assessment. The careful evaluation of each asset, ensuring accurate and up-to-date valuation methods, is paramount to providing a reliable measure of Fabio Lanzoni's net worth.

In summary, asset valuation is the cornerstone of determining net worth. This process requires meticulous attention to detail, the use of current market data, and an understanding of the unique characteristics of each asset. Without proper asset valuation, any calculation of net worth is inherently flawed. The accuracy and reliability of net worth figures are ultimately dependent on the precision of the asset valuation process.

2. Liability Assessment

Liability assessment is an integral component of determining net worth. Accurately identifying and valuing liabilities is crucial for an accurate net worth calculation. Liabilities represent an individual's financial obligations, including debts, loans, and other financial commitments. Subtracting the total value of liabilities from the total value of assets yields the net worth figure. For example, substantial outstanding mortgage debt on real estate will significantly reduce an individual's net worth. Similarly, high credit card balances or other outstanding loans will lower the overall net worth.

The significance of liability assessment stems from its direct impact on net worth. An omission or miscalculation of liabilities will result in an inflated net worth figure, leading to a distorted representation of an individual's financial position. In practice, this means thorough documentation and validation of all financial obligations are necessary. Failing to account for all loans, outstanding bills, or potential legal obligations can skew the net worth calculation. For instance, an individual might overlook a pending tax liability or a legal settlement. Inaccurate or incomplete liability assessments are therefore potentially harmful, misrepresenting financial standing and potentially leading to poor decision-making based on inaccurate data. Furthermore, failure to accurately account for liabilities can compromise an individual's ability to obtain financing or make informed decisions about investments, business ventures, or personal finances.

In conclusion, accurate liability assessment is paramount for a reliable net worth calculation. Omissions or inaccuracies in the assessment will inevitably distort the representation of an individual's financial position. This process necessitates careful documentation, verification, and meticulous attention to detail to ensure a precise calculation. Thoroughly evaluating and precisely quantifying all liabilities is vital for a clear and comprehensive understanding of an individual's financial health. This, in turn, enables informed decision-making, financial planning, and more accurate representation of true financial position.

3. Income Sources

Income sources directly impact an individual's net worth. The sum of income, from all sources, is a crucial factor in building wealth. Higher and more consistent income generally leads to a higher net worth over time. This relationship is fundamental; income provides the funds necessary to acquire assets, pay off debts, and ultimately, increase net worth. For instance, a professional earning a high salary can afford to save more, invest in assets, and reduce outstanding debt faster than someone with a lower income.

The nature of income sources also matters. Stable, predictable income from a consistent job or business is often preferable to income dependent on fluctuating market conditions or unpredictable sources. This stability provides a foundation for consistent savings and investment, facilitating the growth of net worth. For example, a person with a secure salary from a long-term job can more reliably plan for retirement and build substantial savings over a lifetime. Conversely, income from unpredictable sources, such as short-term contracts or freelance work, may lead to less consistent asset accumulation.

Understanding the connection between income sources and net worth is crucial for financial planning and decision-making. It allows individuals to assess their current financial position and develop strategies for long-term wealth building. By analyzing the stability, predictability, and potential for growth within different income sources, individuals can make informed choices about career paths, investments, and financial goals. A clear understanding of this relationship is essential to navigating the complexities of financial well-being.

4. Investment Portfolio

An investment portfolio plays a significant role in determining an individual's net worth. The value of investments held within a portfolio directly contributes to the overall asset base. A diversified and strategically managed portfolio can significantly increase net worth over time. Conversely, poor investment choices can diminish overall wealth. The composition, performance, and diversification of the portfolio are key factors. Successful investments lead to capital appreciation, enhancing net worth. Conversely, losses from poor investment strategies can negatively impact net worth. The portfolio's historical performance, risk tolerance, and asset allocation strategies provide valuable insights into the overall financial standing.

Real-world examples illustrate the impact of investment portfolios on net worth. A well-diversified portfolio that includes a mix of stocks, bonds, real estate, and other assets has the potential to yield significant returns. This can lead to substantial increases in an individual's net worth. However, a portfolio heavily concentrated in a single asset class or poorly diversified investments is vulnerable to market fluctuations, potentially leading to substantial losses that impact net worth. The consistent addition of funds to the investment portfolio, even in modest amounts, can fuel growth over the long term. Experienced investment management often results in optimized portfolios that generate higher returns, leading to a more substantial increase in net worth.

Understanding the connection between an investment portfolio and net worth is essential for financial planning. A well-managed investment portfolio is a cornerstone of long-term financial success. Appreciating the influence of the portfolio on overall wealth enables informed decision-making about investment strategies, risk tolerance, and asset allocation. A robust portfolio, tailored to individual financial goals and risk tolerance, is a pivotal aspect of maximizing net worth. Ultimately, the success of an investment portfolio directly correlates with the individual's overall financial well-being and impacts their net worth.

5. Financial History

Financial history provides crucial context for understanding an individual's current net worth. It offers a detailed timeline of financial activities, revealing patterns, trends, and decisions that have shaped the present financial position. A comprehensive financial history encompasses income sources, investment activities, spending habits, debt management, and significant life events impacting financial resources. Examining these aspects reveals cause-and-effect relationships between past actions and current financial standing. For example, a history of consistent saving and disciplined investment practices often correlates with a higher net worth.

The significance of financial history in determining net worth is substantial. A history of responsible financial management, including consistent savings, prudent investment choices, and timely debt repayment, often leads to a healthier financial profile and a higher net worth. Conversely, a history of excessive spending, poor investment decisions, or accumulating debt usually results in a lower net worth. Analysis of this historical data can help identify areas needing improvement and support strategic financial planning. This information informs decisions about future financial actions, from investment choices to budgeting strategies, thereby facilitating the optimization of financial growth. Consider a successful entrepreneur whose financial history reflects careful budgeting, strategic reinvestment of profits, and calculated risk-taking. This history directly supports their current high net worth.

In conclusion, an individual's financial history serves as a valuable roadmap to understanding their current net worth. Analyzing this history reveals patterns and trends that contribute to, or detract from, overall financial well-being. By understanding the connections between past actions and present wealth, individuals, and financial professionals can make more informed decisions and create strategies for achieving future financial goals. This understanding of the historical context of financial decisions is essential for effective financial planning and maximizing the potential for accumulating wealth.

6. Industry Influence

Industry influence plays a significant role in assessing an individual's net worth. A person's position and activities within a particular industry can directly impact their financial standing. Factors such as market position, leadership, and industry reputation can all contribute to overall financial success. This influence can manifest in various ways, including direct or indirect control over resources, reputation-driven investment opportunities, and access to exclusive networks.

- Market Position and Leadership

A prominent role within an industry often correlates with greater financial reward. Individuals holding influential positions, such as CEOs or founders of prominent companies, typically have access to substantial resources and opportunities. These positions frequently grant control over significant aspects of the industry, offering control over revenues and market share. The value of this control can be reflected in the individual's net worth. Strong leadership in a flourishing sector can enhance the value of the entire organization, leading to a higher market valuation and thus a greater net worth for key individuals.

- Reputation and Trust

A positive reputation within an industry fosters trust among investors and stakeholders. High industry trust can attract investors and partners willing to invest more in a company or sector where the individual plays a pivotal role. This enhanced credibility translates to a greater financial value, directly affecting the individual's net worth. Conversely, negative reputation within an industry can discourage investments, hindering financial growth.

- Control over Resources

Individuals holding substantial influence within a company or industry often wield control over significant resources. This control might include access to capital, key personnel, or valuable intellectual property. This control can be a key component in significant financial growth and asset accumulation. For example, in the technology industry, access to innovative technologies and talented personnel is crucial. Such access can be highly valued and translate to significant financial gains and impact on net worth for those who control it.

- Network and Connections

Strong industry networks enable access to crucial information, potential partnerships, and business opportunities. These connections can lead to lucrative collaborations or investments, enhancing the individual's financial standing. Industry networks provide a platform for knowledge exchange and potential collaboration, ultimately influencing financial success and shaping the individual's net worth. For instance, a network of influential contacts within the finance industry can create opportunities for investments and potentially accelerate financial growth.

In summary, industry influence is inextricably linked to net worth. The strength of an individual's position, reputation, control over resources, and network within an industry directly impacts their financial standing. Analyzing these factors provides important insights into the dynamics of financial success. In the case of Fabio Lanzoni, analyzing his industry involvement and influence is essential for a comprehensive evaluation of his net worth. This involves understanding his role, impact, and the factors within his industry that may affect his financial position.

7. Public Perception

Public perception of an individual, particularly a public figure, can significantly influence their net worth. This influence stems from the interplay between reputation, trust, and the overall market sentiment surrounding the figure. A positive public image can attract investment, partnerships, and opportunities, boosting financial standing. Conversely, negative perception can deter investors and damage potential revenue streams, potentially lowering net worth.

- Reputation and Investor Confidence

A positive reputation within the relevant industry or community fosters trust among investors and stakeholders. This trust directly translates to higher valuations and increased investment opportunities. Strong reputations attract investors, encouraging greater capital inflow, directly correlating to the perceived value of assets and the overall net worth. Conversely, a damaged reputation may discourage investors, potentially decreasing the value of investments and impacting net worth.

- Brand and Market Value

Public perception often shapes an individual's or organization's perceived brand value. A positive public image can significantly increase a company's or an individual's brand value. This heightened brand recognition, in turn, can lead to increased product or service demand, resulting in higher profitability and ultimately influencing net worth. Conversely, a negative image might result in diminished sales and lost market share, negatively impacting the net worth.

- Media Influence and Public Opinion

Media portrayal and public discourse surrounding an individual can dramatically impact market perception. Positive media coverage often boosts public confidence, attracting investment and positive market sentiment. This enhanced visibility can increase the perceived value of assets and positively impact overall net worth. Negative media coverage, conversely, can deter investors and damage market perception, impacting asset value and, consequently, net worth. The influence of news, articles, and social media discussions has a direct correlation to market sentiment.

- Influence on Opportunity Costs

Public perception directly impacts the availability and terms of opportunities. A favorable image can increase the likelihood of advantageous collaborations, partnerships, and investment deals, improving the potential for growth and capital accumulation, thereby positively affecting net worth. A negative perception can limit access to opportunities and investment, which reduces earning potential and, consequently, net worth. Individuals with a strong public persona often find themselves presented with more business and career opportunities, further impacting their overall financial standing.

In conclusion, the connection between public perception and an individual's net worth is multifaceted and significant. A positive public image can lead to increased investment opportunities, improved brand value, and access to resources, ultimately contributing to a greater net worth. Conversely, negative perceptions can lead to reduced investment, decreased market value, and limited opportunities, potentially diminishing an individual's net worth. Careful consideration of the role public perception plays is crucial in understanding financial trends and the multifaceted nature of an individual's financial standing.

8. Privacy Considerations

Determining an individual's net worth, while often a matter of public interest, necessitates careful consideration of privacy rights. Public disclosure of financial data can have significant consequences for individuals, particularly if the information is inaccurate or incomplete. This section explores potential privacy issues related to the pursuit of knowledge about Fabio Lanzoni's financial standing.

- Data Accuracy and Verification

Publicly available information about net worth, while sometimes sourced from reputable sources, might contain errors or be incomplete. The potential for misinformation requires cautious interpretation. Determining the veracity and comprehensiveness of reported financial data is crucial in forming any conclusions about an individual's financial situation. Unverified claims about net worth may lead to inaccurate assessments of an individual's true financial position.

- Potential for Misrepresentation

Public perception can be significantly influenced by readily available information. Selective or incomplete disclosure of financial data can create a misleading picture. This is particularly relevant when presenting a complex financial portfolio; highlighting a few select successes while omitting significant debts can misrepresent overall financial health. A thorough understanding of the full financial picture is necessary to form an informed conclusion, free from potential misrepresentations.

- Right to Privacy and Personal Information

Individuals retain the right to privacy concerning their financial details. Unjustified public disclosure of such information could violate legal and ethical principles surrounding personal data protection. The pursuit of a particular individual's net worth must respect their right to privacy; any attempt to access and share private financial information without explicit consent could raise concerns. In the context of public figures, careful consideration must be given to the extent to which public interest outweighs individual privacy rights.

- Potential for Malicious Use of Data

Financial information, if improperly disclosed, can be misused by malicious actors. Private financial data can be a target for fraud or manipulation, potentially harming the individual's financial stability or reputation. This raises important security concerns, particularly with the proliferation of sensitive information online. Safeguarding privacy against potential misuse is critical when handling financial data, especially when reporting on individuals.

In conclusion, any assessment of Fabio Lanzoni's net worth must respect the principles of privacy. Careful consideration of data accuracy, potential misrepresentation, individual rights, and potential malicious uses of information are paramount. Maintaining a balance between public interest and individual privacy is essential when dealing with financial matters. The presentation of such data should always prioritize accuracy, avoid misleading information, and respect privacy concerns.

Frequently Asked Questions about Fabio Lanzoni's Net Worth

This section addresses common inquiries regarding Fabio Lanzoni's financial standing. Answers are based on publicly available information and analyzed using reputable data sources.

Question 1: How is Fabio Lanzoni's net worth determined?

Fabio Lanzoni's net worth is calculated by subtracting total liabilities from total assets. This calculation encompasses various holdings such as real estate, investments, and other financial assets. The accuracy of this determination relies on precise valuation of assets and a comprehensive accounting of liabilities.

Question 2: What factors influence Fabio Lanzoni's net worth?

Numerous factors affect an individual's net worth, including income sources, investment decisions, market conditions, and industry influence. The individual's strategic financial decisions over time, as well as prevailing economic trends, significantly shape their financial position. A person's reputation and position within their industry can also impact investment opportunities and valuation.

Question 3: Is publicly available information about Fabio Lanzoni's net worth always accurate?

Publicly available data about an individual's net worth may not always be precise. Sources may vary in reliability, and valuations can fluctuate based on market forces and other factors. Independent verification of claims is crucial for establishing accuracy.

Question 4: How can I access reliable data about Fabio Lanzoni's net worth?

Reliable data often comes from reputable financial news sources or organizations that specialize in wealth analysis. Crucially, verifying the accuracy of these sources is essential before relying on publicly presented figures. Financial analysis firms or professional services might provide insights but require subscription or fees.

Question 5: Why is determining Fabio Lanzoni's net worth important?

Determining an individual's net worth provides insight into their financial standing and influence within their field. While not a definitive measure of success, it offers a snapshot of economic position and, in certain contexts, can be relevant in evaluating leadership, market position, or influence. Understanding the methodology behind these calculations is crucial.

In summary, understanding an individual's net worth is a complex process that requires consideration of many factors. Publicly available information often needs verification. The accuracy and comprehensiveness of data sources significantly affect any conclusions drawn.

This concludes the FAQ section. The following section will provide further analysis and details of the factors affecting Fabio Lanzoni's financial position.

Conclusion

Determining Fabio Lanzoni's net worth necessitates a comprehensive analysis encompassing asset valuation, liability assessment, income sources, investment portfolio performance, industry influence, and public perception. A precise figure remains elusive without direct access to private financial records. The absence of publicly available data, while not conclusive, highlights the importance of respecting individual privacy when discussing financial matters. Public perception, though important, is not a substitute for demonstrable figures. Evaluating the interplay of these elements provides a nuanced understanding of financial standing, yet ultimately, a precise calculation of Fabio Lanzoni's net worth remains impossible without internal financial documents.

Further investigation into Fabio Lanzoni's financial history, including details of income, investments, and spending patterns, would be necessary to form a complete picture. Such insights could be gained through industry analysis, financial reporting, and other credible sources. A thorough examination of publicly accessible information, coupled with an understanding of the methodologies for determining net worth, offers a more comprehensive evaluation of financial situations. This analysis serves as a case study highlighting the challenges of evaluating private wealth and the importance of respecting privacy considerations.

Detail Author:

- Name : Prof. Martin Rice III

- Username : kkuphal

- Email : kian.lynch@harvey.info

- Birthdate : 1970-12-16

- Address : 9367 Rudy Orchard Lake Lynn, ME 99187-4271

- Phone : 712-659-6780

- Company : Wiegand, Brown and Lang

- Job : Food Science Technician

- Bio : Labore aliquid veritatis et sit. Eius modi distinctio quibusdam dicta commodi. Totam velit explicabo qui sunt sit. Excepturi ut libero debitis dicta sint.

Socials

tiktok:

- url : https://tiktok.com/@anjaliziemann

- username : anjaliziemann

- bio : Incidunt eos voluptas quam in in quod id. Non dolores saepe asperiores sunt.

- followers : 6175

- following : 1728

instagram:

- url : https://instagram.com/ziemanna

- username : ziemanna

- bio : Esse aut explicabo dolorem. Et tempora hic expedita quaerat molestiae voluptas.

- followers : 1450

- following : 177

facebook:

- url : https://facebook.com/anjali_real

- username : anjali_real

- bio : Et voluptas modi veniam voluptatem dicta illum.

- followers : 1214

- following : 2945