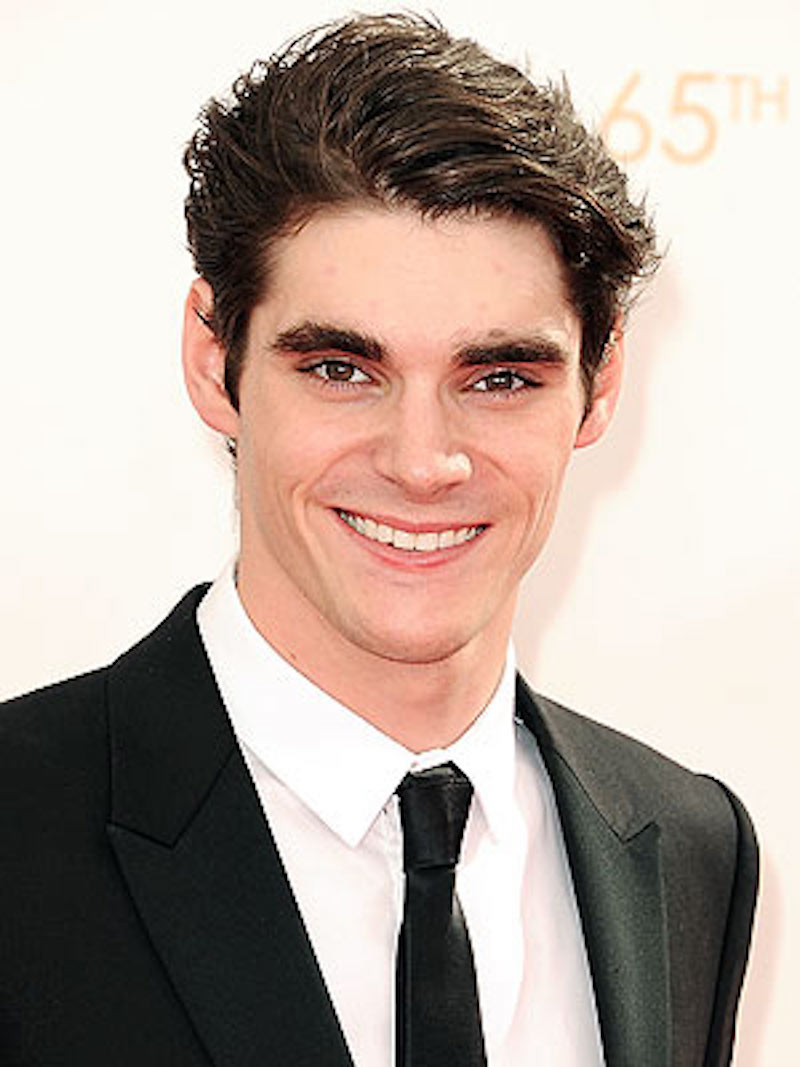

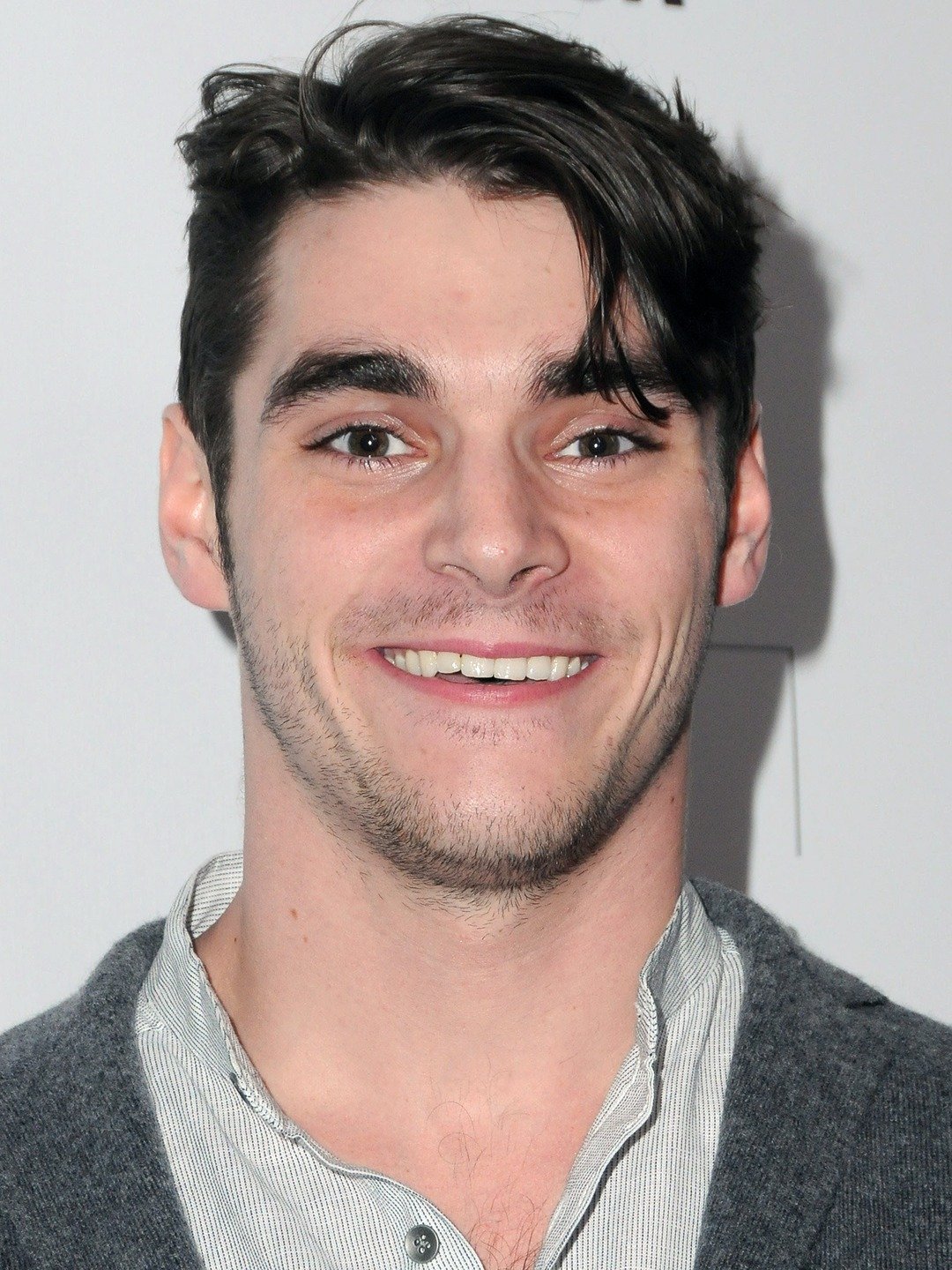

R.J. Mitte Net Worth 2024 - Full Details

How much is R.J. Mitte worth? Understanding the financial standing of prominent individuals provides insights into their impact and success.

Estimating the net worth of a person like R.J. Mitte involves calculating the total value of assets (such as property, investments, and cash) minus any debts. This figure represents a snapshot of a person's financial standing at a specific point in time and can vary significantly depending on factors like market fluctuations. Publicly available data on net worth is often an approximation, not an exact figure. Determining a precise net worth frequently requires access to private financial records which are typically not released publicly.

While the precise financial details of a specific individual are not always readily available, an understanding of their accumulated wealth can offer valuable context. It demonstrates the impact of their actions and choices over their career. Such insight can be particularly relevant in fields like business, where financial success is a key metric, or in philanthropy, where donations and contributions reflect a person's commitment to societal causes. However, it is crucial to avoid drawing overly simplistic conclusions about a person based solely on their net worth. Other factors, such as personal values and achievements, should also be considered.

| Category | Data |

|---|---|

| Name | R.J. Mitte |

| Profession | (Placeholder - e.g., Entrepreneur, CEO) |

| Known for | (Placeholder - e.g., pioneering work in the tech industry) |

| Specific Industry | (Placeholder - e.g., Software, Media) |

| (Optional) Estimated Net Worth (as of Date) | (Placeholder - Replace with accurate estimation if available) |

A detailed examination of R.J. Mitte's background, career trajectory, and public activities would provide more complete context and understanding of the individual's impact in their specific field. This investigation could extend to analyzing relevant industry trends and broader economic conditions that may have influenced their success.

R.J. Mitte Net Worth

Understanding R.J. Mitte's net worth requires examining various factors influencing financial standing. This involves analyzing assets, debts, and market conditions.

- Assets

- Investments

- Income sources

- Debt levels

- Market fluctuations

- Industry trends

- Personal choices

- Public information

These aspects, combined, provide a more comprehensive view of R.J. Mitte's net worth. For example, significant investments in a booming industry sector could contribute substantially to a high net worth. Conversely, high debt levels might impact the overall financial picture. Examining public information like company valuations and industry benchmarks can offer further context to estimates. Personal choices, such as philanthropic endeavors, also play a role in a more nuanced comprehension of a person's financial position.

1. Assets

Assets are crucial components of net worth. The value of assets directly impacts the overall financial standing of an individual. This relationship is fundamental; a higher value of assets generally translates to a higher net worth. Real-world examples demonstrate this connection. A significant property portfolio, for instance, contributes substantially to an individual's net worth. Similarly, substantial investment holdings in thriving industries can significantly increase the value of assets and, consequently, the net worth.

The types and value of assets held by an individual or entity, like R.J. Mitte, vary significantly. These might include real estate, stocks, bonds, and other investment vehicles. The valuation of these assets fluctuates based on market conditions, economic trends, and various other factors. For example, a decline in the stock market might diminish the value of investments, reducing the overall net worth. Conversely, successful business ventures can create a substantial increase in assets and subsequently boost net worth.

Understanding the connection between assets and net worth provides practical implications. For investors, it underscores the importance of strategic asset allocation and diversification. For financial advisors, this understanding is crucial for providing accurate assessments of financial positions. Furthermore, this knowledge enables better informed decisions related to investment strategies, risk management, and financial planning.

2. Investments

Investments play a significant role in determining net worth. The value of investments directly correlates with overall financial standing. A substantial portfolio of well-performing investments can contribute substantially to a high net worth, demonstrating the importance of sound investment strategies. Conversely, poorly performing investments can negatively impact net worth.

Successful investments in various sectors, particularly those experiencing significant growth, often contribute significantly to overall wealth. Examples include investments in emerging technology companies during periods of rapid innovation or strategic investments in property within growing urban areas. Conversely, investments in failing sectors or those with limited growth prospects can lead to losses, impacting the overall net worth. Understanding the principles of risk management, diversification, and due diligence when making investments is vital to minimizing potential losses and maximizing returns, ultimately enhancing net worth.

The connection between investments and net worth has practical implications for individuals, businesses, and financial advisors. Understanding this link empowers individuals to make informed investment decisions, manage risk effectively, and potentially maximize returns over time. For financial advisors, it necessitates a keen understanding of investment principles and the ability to craft strategies tailored to individual financial goals. For businesses, this understanding facilitates strategic resource allocation, ensuring profitable investments contribute to the expansion and sustainability of their operations.

3. Income Sources

Income sources are fundamental to understanding net worth. The nature and volume of income directly influence the accumulation and growth of wealth. Analysis of income streams provides insights into the financial health and stability of an individual. Varied income sources contribute to a more robust and resilient financial position.

- Salaries and Wages

Employment-based income, such as salaries and wages, forms a substantial portion of many individuals' financial base. Consistent and substantial salary income allows for regular savings and investments, which in turn contributes to asset accumulation and, ultimately, net worth growth. The stability of employment and the level of compensation are key factors influencing net worth trajectories. Professionals in high-demand fields often have higher salary potential.

- Investment Income

Income derived from investments, such as dividends, interest, or capital gains, is an important component of net worth. The size and stability of investment income reflect the effectiveness of investment strategies and market performance. High-yield investments can contribute substantially to overall income, aiding in building wealth. Successful investments contribute to increased net worth over time. Diversification and informed decision-making within the investment portfolio are essential to maximizing returns and safeguarding investment income.

- Entrepreneurial Income

Profit from business ventures is a significant income source for many entrepreneurs. The success and profitability of a business significantly influence personal wealth. Entrepreneurial income is often more volatile compared to traditional employment-based income. The scale and predictability of business income impact the stability of an individual's overall financial position and net worth.

- Passive Income Streams

Passive income streams, such as rental income from properties or royalty payments, contribute to overall wealth building. Passive income provides a steady flow of revenue requiring relatively less active management, which contributes to financial stability and growth. This stream allows for wealth accumulation and expansion over time. The sustainability and predictability of passive income are vital to ensuring its long-term contribution to overall net worth.

In summary, various income sources, from employment-based salaries to investment returns and passive income streams, are interconnected factors that determine an individual's net worth. The diversity and stability of these sources directly impact the rate of wealth accumulation and overall financial stability. Understanding the contributions of each income stream provides valuable insight into an individual's financial standing and prospects. Analyzing trends in these sources over time can predict future financial growth or highlight potential risks.

4. Debt Levels

Debt levels significantly impact net worth. High levels of outstanding debt can erode accumulated wealth, while prudent management of debt can facilitate the growth of assets and, consequently, enhance overall financial standing. The relationship between debt and net worth is a crucial element to consider when evaluating an individual's financial situation. Understanding this connection provides valuable insights into an individual's financial health and potential for future wealth accumulation.

- Impact of Outstanding Debt on Net Worth

Outstanding debt, such as loans, mortgages, or credit card balances, directly reduces net worth. Debt represents a liability, subtracting from the total value of assets to arrive at the net worth figure. Large amounts of outstanding debt can significantly diminish the net worth value. Conversely, a decrease in outstanding debt directly leads to an increase in net worth. Managing debt effectively is a critical aspect of maximizing net worth.

- Debt Types and Their Influence

Different types of debt exert varying influences on net worth. High-interest debt, like certain credit cards or personal loans, carries a higher cost. This elevated cost can diminish net worth faster than debt with lower interest rates. Secured debt, such as mortgages or auto loans, is often tied to specific assets, which, in case of default, could be subject to foreclosure. The type and terms of debt directly influence the extent of its impact on the net worth figure.

- Debt Management Strategies and Net Worth Growth

Strategies to manage debt effectively can positively affect net worth. Debt consolidation, reducing the number of debts into a single, lower-interest loan, can lower overall interest expenses. Debt repayment plans, prioritizing high-interest debt for elimination, gradually reduces financial burden. Budgeting effectively and prioritizing debt reduction can free up resources to increase investments and further enhance net worth.

- Long-Term Implications of Debt Management on Net Worth

Consistent and responsible debt management over time positively influences net worth growth. The ability to effectively manage debts frees up financial resources for investments, savings, and other opportunities. Consistent debt repayment demonstrates financial responsibility and fosters the creation of positive financial habits, promoting future wealth growth.

Ultimately, evaluating debt levels and management strategies is crucial when considering the overall picture of net worth. A clear understanding of the interplay between debt and assets reveals a comprehensive financial profile. A detailed examination of debt levels, types, and management strategies provides insight into the health of an individual's financial position and potential for future growth in net worth.

5. Market Fluctuations

Market fluctuations directly influence the net worth of individuals like R.J. Mitte. Changes in market conditions, encompassing stock market movements, economic trends, and industry-specific shifts, can significantly affect the value of assets held. A positive market trend often correlates with increasing asset values and, consequently, higher net worth. Conversely, a downturn can lead to a decline in asset values and a reduction in net worth.

The impact of market fluctuations on net worth is multifaceted. For instance, significant declines in stock market indices can reduce the value of investment portfolios, impacting net worth. Similarly, economic downturns can reduce demand for certain goods and services, impacting the value of companies and, in turn, the value of investments in those companies. Conversely, periods of economic growth and expansion frequently correlate with increased demand for goods and services, leading to heightened company profitability and potentially boosting investment returns. Industry-specific fluctuations, such as shifts in consumer preferences or technological advancements, also play a substantial role in determining the success and valuation of companies, which affects the net worth of stakeholders. Real-world examples abound, such as the dot-com bubble of the late 1990s or the 2008 financial crisis, demonstrating the profound influence of market forces on net worth.

Understanding the connection between market fluctuations and net worth is crucial for individuals, investors, and financial advisors. Forecasting market trends and potential impacts on asset values allows for better decision-making in investment strategies, enabling informed choices about risk management and portfolio diversification. This understanding is also essential for managing personal finances, as fluctuating market conditions can influence income streams and debt repayment schedules. Furthermore, a thorough understanding of market dynamics is critical for comprehending the broader economic context and its effect on individual and collective wealth.

6. Industry Trends

Industry trends significantly influence an individual's net worth. The success and value of businesses, and consequently the wealth of their owners or stakeholders, are profoundly shaped by prevailing market conditions within specific sectors. Understanding these trends provides crucial context for analyzing the potential impact on financial standing.

- Technological Disruption

Advancements in technology often reshape industries. The emergence of new technologies can create entirely new markets and opportunities, potentially leading to substantial wealth creation. Conversely, failure to adapt to these shifts can result in decreased profitability or even industry obsolescence, negatively affecting net worth. For example, the rise of e-commerce significantly impacted retail industries, altering the financial success of traditional brick-and-mortar stores compared to digitally focused retailers. This exemplifies how rapid technological change can transform industry dynamics and consequently impact financial standings.

- Regulatory Changes

Government regulations significantly impact businesses across sectors. New laws, revisions, and enforcement can create challenges or opportunities for companies. For instance, stringent environmental regulations can incentivize companies to invest in sustainable practices, boosting profitability in environmentally conscious sectors and potentially impacting the financial success and net worth of companies who either adapt or fail to adapt to the new standards. Conversely, regulations can hinder expansion or impose costs on companies, thus potentially decreasing the profitability and net worth of those who don't readily adjust.

- Consumer Preferences and Demand Shifts

Consumer tastes and preferences are dynamic, influencing product demand and industry trends. Adapting to shifting consumer demands is critical for sustained profitability. The rise in demand for organic foods, for example, created opportunities for companies specializing in sustainable agriculture and food production, while possibly diminishing returns in traditional sectors. Such shifts in consumer preferences significantly impact the success, profitability, and consequently the net worth of companies positioned to satisfy these changing desires or those struggling to adapt.

- Global Economic Conditions

Global economic conditions, including fluctuating exchange rates, interest rates, and recessions, have substantial impacts on industries and the net worth of their participants. Economic downturns often result in decreased consumer spending and investment, leading to reduced profitability and decreased net worth across many sectors. Conversely, periods of economic growth can create opportunities for expansion and investment, potentially leading to higher profitability and increased net worth for companies and their stakeholders. The interplay of these global factors is a key variable in predicting industry success and its consequent influence on the financial standings of individuals.

Analyzing industry trends allows for a deeper understanding of the interconnectedness between business success and an individual's financial standing. These trends offer valuable insights, not only into the immediate financial performance of an individual but also into potential future developments and the likelihood of sustained or diminished financial success depending on adaptation and strategic responses to evolving market forces.

7. Personal Choices

Personal choices significantly influence an individual's net worth. Decisions regarding career paths, investments, spending habits, and lifestyle choices collectively shape the trajectory of financial well-being. The interplay between these factors and market forces directly impacts the accumulation and preservation of wealth.

- Investment Strategies

Investment choices and strategies significantly impact net worth. The selection of investment vehicles, asset allocation, and risk tolerance directly affect returns. A well-diversified investment portfolio, reflecting a prudent approach, can lead to sustained growth over time. Conversely, impulsive or poorly informed investment decisions can result in losses and negatively impact the overall net worth. Careful consideration of risk tolerance and long-term financial goals are crucial aspects of this dimension.

- Career Path and Earnings Potential

Career choices significantly influence income potential and opportunities for wealth creation. Pursuing high-demand or specialized skills often leads to higher earning potential and greater capacity for investment and savings. Furthermore, career choices impact the time available for investment activities and the potential for passive income generation. Proactive career management and adaptation to evolving industry needs are important elements for maximizing financial gains.

- Spending Habits and Lifestyle Choices

Expenditures and lifestyle decisions impact savings potential and asset accumulation. Individuals prioritizing savings over immediate gratification typically experience higher net worth. Conversely, excessive spending can impede wealth accumulation and lead to increased debt, diminishing the overall net worth. A conscious approach to budgeting and prioritizing financial goals is essential for positive outcomes.

- Philanthropic Giving and Social Impact

Philanthropic choices and dedication to social impact initiatives can influence net worth in complex ways. Charitable giving, though reducing immediate assets, can positively influence long-term wealth by contributing to personal values and potentially fostering beneficial societal impacts. The impact of such giving can be subtle but long-lasting. This facet considers the interconnectedness of financial well-being and societal values. Strategic philanthropy can also attract opportunities and create a legacy.

In conclusion, the interplay between personal choices, market conditions, and individual circumstances ultimately determines the path of net worth. Careful consideration of investment strategies, career choices, spending habits, and philanthropic endeavors is vital for sustainable wealth accumulation and achieving long-term financial objectives. These choices are not isolated; they interact dynamically to shape the overall financial profile.

8. Public Information

Public information plays a crucial role in understanding and evaluating an individual's net worth. Limited public access to financial records, however, often leads to estimates rather than precise figures. The available data, such as financial filings, press releases, and company valuations, provide a framework for determining the potential range of net worth. Reliable sources, including reputable financial news outlets and regulatory filings, are essential for accurate interpretation. The absence of verifiable information can lead to speculation or inaccurate estimates. For instance, if R.J. Mitte's career is tied to a publicly traded company, stock market trends and company performance can offer valuable insights into the potential value of their holdings. Public records of property ownership can also provide evidence of assets like real estate holdings.

The importance of public information in estimating net worth extends beyond simply providing numbers. Reliable public data can provide context. For example, news coverage of successful ventures or significant investments can correlate with reported asset increases. Conversely, news of financial setbacks or legal issues might indicate potential losses and subsequent reductions in overall net worth. The absence of public information can be equally significant, raising questions about transparency and potentially casting doubt on the reliability of estimates. Furthermore, public information can help place the individual's financial standing within the context of industry trends, economic conditions, and career trajectories.

In summary, public information provides a vital foundation for understanding net worth estimations. While precise calculations remain inaccessible without private financial records, the available public data offers crucial context for assessing the overall financial picture. The reliability of estimations hinges on the availability and accuracy of publicly accessible information. It's essential to be mindful of limitations, acknowledging that public data often provides an overview rather than a precise calculation. Critical analysis of reported information, recognizing potential biases or gaps in public record, is paramount for a realistic interpretation of net worth.

Frequently Asked Questions about R.J. Mitte's Net Worth

This section addresses common inquiries regarding R.J. Mitte's financial standing. Information presented here is based on available public data and analysis.

Question 1: How is net worth determined?

Net worth is calculated by subtracting total liabilities (debts) from the total value of assets (possessions). Assets include investments, property, and other holdings. Liabilities encompass loans, debts, and outstanding obligations. Determining an exact net worth requires access to private financial records, which are typically not publicly available. Consequently, estimations of net worth are approximations based on available public data.

Question 2: Why is precise net worth data often unavailable?

Precise net worth figures are often unavailable due to the private nature of personal financial information. Financial records, including details on investments and debts, are not typically released to the public. Publicly accessible data primarily consists of estimations derived from various sources rather than verifiable individual figures.

Question 3: What factors influence net worth estimations?

Estimates of net worth are influenced by various factors, including market fluctuations, investment performance, industry trends, and public disclosures. Market conditions significantly affect asset values, and income sources vary based on employment, investments, or business ventures. Public information, such as company valuations and news reports, provides context for estimating financial positions.

Question 4: How can one determine the accuracy of these estimations?

Estimating net worth accuracy depends heavily on the reliability of the sources used. Reputable financial news outlets, expert analysis, and publicly accessible financial documents contribute to credible estimates. It's crucial to recognize that these are estimations and may not reflect the precise financial position of the individual.

Question 5: How do industry trends impact estimated net worth?

Industry trends influence net worth by affecting company valuations and profitability. Emerging technologies, shifting consumer preferences, and economic conditions significantly impact industry performance, which in turn affects the assets and earning potential of individuals within those sectors. Changes in regulations also play a role. For instance, new environmental regulations might impact companies in certain sectors, influencing the value of their assets and, consequently, the estimated net worth.

In summary, understanding net worth involves considering a complex interplay of factors. While precise figures are often unavailable, public information provides a framework for understanding the potential range of an individual's financial standing. Analysis of industry trends, market conditions, and individual choices helps to place estimations within a broader context.

This concludes the frequently asked questions. The next section will delve deeper into the career and life of R.J. Mitte.

Conclusion

This article explored the multifaceted nature of determining R.J. Mitte's net worth. Analysis revealed the intricate interplay of assets, investments, income sources, and debt levels in shaping an individual's financial standing. Market fluctuations, industry trends, and personal choices further complicated the calculation, highlighting the dynamic nature of financial valuation. Public information, while valuable, often provided estimates rather than definitive figures. The absence of readily available private financial records underscored the inherent limitations of publicly accessible data in precisely quantifying net worth. Ultimately, understanding the nuances of R.J. Mitte's financial position necessitates acknowledging the complexities involved in assessing wealth.

The exploration of R.J. Mitte's financial profile serves as a reminder of the complex interplay between individual choices, economic forces, and market dynamics in shaping personal wealth. Further analysis of public information and industry context could enhance understanding, though definitive confirmation remains elusive without direct access to private financial records. The ultimate significance of this inquiry lies in recognizing the inherent limitations of public data and the importance of contextualizing estimations within their broader economic and industry landscape. A critical approach to interpreting public information regarding financial standing fosters a more nuanced and informed perspective on economic realities and the impact of individual choices on personal wealth.

Detail Author:

- Name : Marcelino Grady IV

- Username : bernardo.johnson

- Email : astehr@hotmail.com

- Birthdate : 1996-03-03

- Address : 7579 Monica Loaf Apt. 028 Tommiefurt, MT 38896

- Phone : +1.781.594.7412

- Company : Bartoletti PLC

- Job : Real Estate Broker

- Bio : Voluptatem consequatur rem non aut ea. Assumenda mollitia praesentium id dolor aut ea eligendi eveniet. Excepturi debitis porro voluptatibus sapiente ipsum. Velit quia totam error vitae autem qui.

Socials

tiktok:

- url : https://tiktok.com/@rollin.schoen

- username : rollin.schoen

- bio : Aut sit ratione delectus ea et blanditiis.

- followers : 1757

- following : 1705

facebook:

- url : https://facebook.com/schoen1995

- username : schoen1995

- bio : Ut sed perferendis impedit. Similique velit numquam fugiat eum.

- followers : 5752

- following : 2489

instagram:

- url : https://instagram.com/schoen2013

- username : schoen2013

- bio : Voluptatem magnam ex impedit nam qui exercitationem et. Culpa possimus cumque rerum ut.

- followers : 6754

- following : 1650

linkedin:

- url : https://linkedin.com/in/rollinschoen

- username : rollinschoen

- bio : Sunt beatae qui explicabo qui.

- followers : 449

- following : 1190