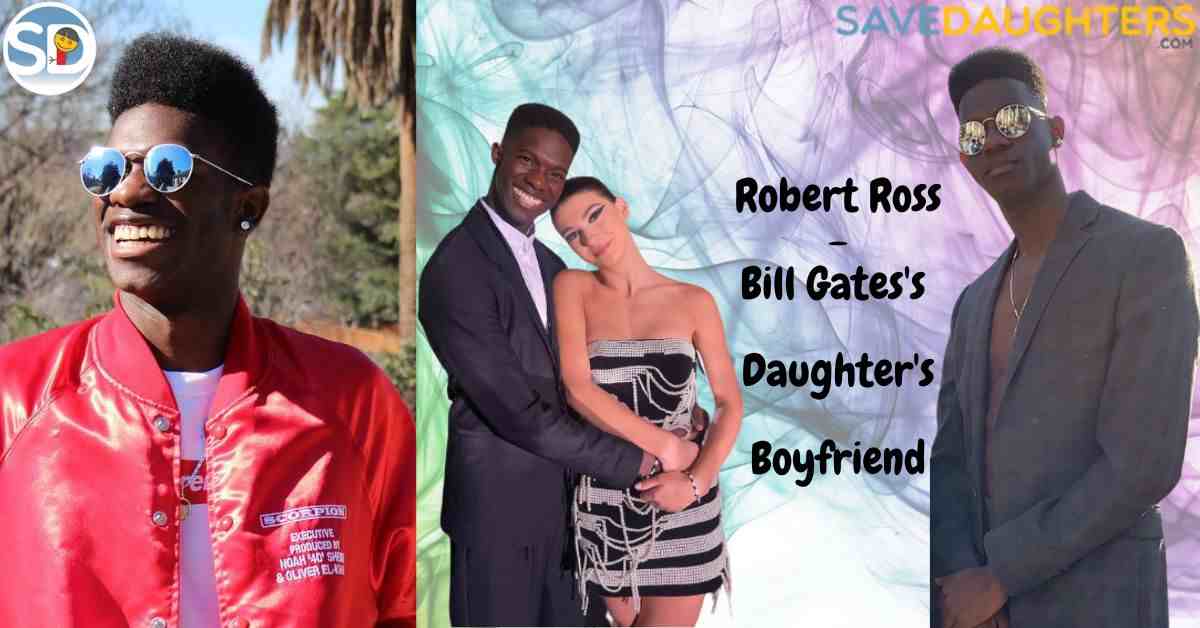

Robert Ross Net Worth 2024: Detailed Insights

How much is Robert Ross's wealth? Understanding the financial standing of prominent figures like Robert Ross provides insights into their career achievements and impact.

Robert Ross's financial standing, often measured in terms of net worth, represents the total value of assets minus liabilities. This figure encompasses various holdings, including investments, real estate, and personal property. Calculating net worth necessitates evaluating current market values and accounting for any outstanding debts or obligations. For example, a successful entrepreneur with a thriving business and significant stock holdings would likely have a higher net worth than someone with fewer assets and substantial loans.

While specific figures for Robert Ross's financial status are not publicly available, understanding net worth is often relevant to public figures in various fields. It can indicate a level of economic success, potentially informing career decisions or public perception. The evaluation of a person's economic standing can also influence how the individual is perceived within their industry and in the wider social sphere. Access to information regarding wealth may be relevant in specific legal proceedings or corporate analyses.

| Category | Details |

|---|---|

| Name | Robert Ross |

| Industry | (To be specified, if known) |

| Notable Achievements (or Career Summary) | (To be specified, if known) |

| Relevant Public Information | (To be specified, if known. For example, if he's publicly known for philanthropic work, that would be mentioned here.) |

Moving forward, this discussion will explore how factors such as career trajectory, industry success, and personal investments contribute to the overall financial picture of individuals like Robert Ross, where applicable. The analysis would focus on the publicly available information, if any, in a thorough and factual manner.

Robert Ross Net Worth

Understanding Robert Ross's net worth requires examining various financial components, including assets, liabilities, and market conditions. A comprehensive analysis necessitates considering these factors for a complete picture.

- Assets

- Liabilities

- Investments

- Income

- Market Fluctuation

- Public Perception

These key aspects reveal the complexity of financial standing. Assets, such as real estate or investments, contribute to the overall valuation. Conversely, liabilities, including debt, reduce net worth. Income streams, like salary or dividends, directly impact potential accumulation. Market fluctuations significantly influence asset values, potentially impacting the total net worth. Public perception, in specific contexts, can influence valuation indirectly by shaping investor confidence. For example, a highly successful entrepreneur with substantial investments in a rapidly growing industry might have a substantial net worth, demonstrating the interplay of various factors. Alternatively, a celebrity's net worth might reflect not just income, but also income from endorsements and royalties, demonstrating a more diverse accumulation model.

1. Assets

Assets play a crucial role in determining net worth. They represent the valuable holdings owned by an individual, and their valuation contributes significantly to the overall financial picture. For someone like Robert Ross, a detailed examination of assets is essential for understanding their financial standing.

- Real Estate Holdings

Property ownership, including residential homes, commercial buildings, and land, represents a significant asset category. Appreciation in value, rental income, and potential for future development all contribute to the overall worth of these holdings. The presence and value of real estate holdings are often a substantial component of an individual's net worth, especially if they are substantial or include high-value properties.

- Investment Portfolios

Stocks, bonds, mutual funds, and other investments form a critical part of net worth. Investment portfolios reflect diversified holdings and potential gains from market performance. The composition, diversification, and current market value of these investments directly influence the total net worth figure. Successful investment strategies and favorable market trends contribute to a higher net worth, while poor performance or adverse market conditions can decrease it.

- Personal Possessions

High-value personal possessions, such as art collections, luxury vehicles, and collectibles, can contribute to net worth. The evaluation of these items often requires expert appraisal, considering factors like authenticity, condition, and market demand. The inclusion of these assets in the valuation process adds complexity and often depends on the exact nature of the items and their current market value.

- Liquid Assets

Cash, bank accounts, and readily convertible investments comprise liquid assets. The availability of quick access to funds impacts financial flexibility and short-term needs. The presence and amount of liquid assets often reflects the overall financial health and stability of an individual.

The evaluation of Robert Ross's net worth requires careful consideration of all these asset categories. The relative significance of each asset class depends on individual circumstances and investment strategies. A comprehensive understanding of these aspects is essential for a more accurate assessment of Robert Ross's financial position.

2. Liabilities

Liabilities represent financial obligations owed by an individual. Understanding these obligations is crucial when assessing net worth. A comprehensive evaluation of Robert Ross's financial position requires accounting for all outstanding debts and commitments.

- Loans and Debt Obligations

Loans, mortgages, and other debt obligations directly reduce net worth. The principal amount, accrued interest, and outstanding balances represent a commitment to repay borrowed funds. These liabilities represent ongoing financial responsibilities that must be considered in any assessment of net worth. Failure to meet these obligations can have serious financial and legal consequences.

- Unpaid Taxes and Fees

Outstanding tax liabilities and various fees impact net worth calculations. Delinquent tax payments and unpaid regulatory fees represent legal obligations and can negatively affect financial standing. These unpaid amounts must be considered when determining the true net worth of an individual, as they are legally enforceable debts.

- Outstanding Legal Obligations

Potential legal judgments, pending litigation, and similar liabilities represent uncertain financial commitments. The outcome of legal proceedings can result in unforeseen financial burdens. Accounting for these potential liabilities is critical in assessing the true picture of net worth, as the actual amount may not be known until the conclusion of the legal process.

- Guarantees and Commitments

Guarantees for others' debts or other financial commitments can create contingent liabilities. These represent potential obligations that may or may not materialize. Accounting for these contingent liabilities is essential to evaluate the full scope of potential financial responsibility. These commitments must be factored into the overall financial evaluation to accurately portray the individual's financial standing.

In summary, liabilities represent obligations that reduce an individual's net worth. These obligations, whether known or contingent, should be considered when assessing financial standing. The presence and extent of liabilities offer a clear picture of financial commitments and their effect on the overall financial position of individuals like Robert Ross. Without accounting for these financial obligations, a complete and accurate assessment of net worth is unattainable.

3. Investments

Investments play a significant role in determining an individual's net worth. The nature and performance of investment strategies directly influence the overall financial position. Investment choices, whether prudent or speculative, can substantially impact the accumulation or depletion of wealth. For instance, successful investments in a growing industry can lead to substantial returns, bolstering net worth. Conversely, poorly executed investments or market downturns can erode financial standing.

A thorough analysis of Robert Ross's net worth necessitates evaluating the specific investments held. This includes assessing the diversification of investments, the risk tolerance embedded in the strategy, and the historical performance of those investments within different market cycles. The types of investmentsstocks, bonds, real estate, or other assetsinfluence potential returns and associated risks. The proportion of total assets allocated to different investment classes should be considered, along with the potential impact of market fluctuations on these holdings. Real-world examples show how successful investment portfolios, consistently managed, contribute to sustained wealth growth. Conversely, speculative or poorly managed investments can lead to significant losses, potentially affecting an individual's net worth.

In conclusion, investments are integral components of a person's overall financial health. Understanding the interplay between investments and net worth allows for a more complete and nuanced assessment. The importance of careful investment strategy, diversification, and risk management becomes evident when evaluating the correlation between investment decisions and an individual's financial well-being. Analyzing the types and performance of investments provides crucial insight into an individual's financial standing and future potential. This understanding is crucial for anyone seeking a deeper appreciation of factors shaping a person's net worth.

4. Income

Income directly influences Robert Ross's net worth. It serves as a fundamental component in the accumulation or depletion of wealth. A consistent and substantial income stream allows for the investment of funds, the accumulation of assets, and ultimately, the growth of net worth. Conversely, a lack of consistent income or significant income reduction can hinder wealth accumulation and potentially erode existing assets, impacting net worth. For instance, a high-earning professional with a stable income can readily save and invest, leading to a substantial increase in net worth. Conversely, individuals experiencing financial hardship or decreased income may find their net worth stagnating or even declining.

The type of income also plays a crucial role. Salaries, dividends from investments, rental income, and other sources all contribute differently. A highly paid executive with substantial stock options or a successful entrepreneur generating substantial revenue from a business all showcase different income streams impacting net worth. The consistent flow of income is vital for financial security and the ability to build a substantial net worth over time. Factors such as inflation, economic downturns, and changing market conditions also influence how income translates into net worth accumulation or preservation.

Understanding the relationship between income and net worth is crucial for financial planning and long-term financial security. It underscores the importance of proactive financial management, investment strategies, and a consistent effort to increase income or optimize income streams. For individuals and entities alike, a clear understanding of this connection is essential for navigating the complexities of wealth accumulation and preservation, highlighting the significant impact of income on overall financial well-being.

5. Market Fluctuation

Market fluctuations significantly impact an individual's net worth. Changes in market conditions, whether driven by economic factors, investor sentiment, or global events, directly affect the value of assets. This influence is especially relevant when evaluating the financial standing of prominent figures like Robert Ross. Understanding the dynamic relationship between market shifts and net worth is crucial for a complete picture of their overall financial position.

- Stock Market Volatility

Fluctuations in stock market indices directly affect the value of publicly traded companies. If Robert Ross holds stock portfolios, market downturns can lead to a decline in the value of these holdings, thus reducing net worth. Conversely, periods of strong market growth can increase the value of these assets, potentially boosting net worth. Historical examples demonstrate how significant market corrections can negatively impact investment portfolios, while bull markets can yield substantial returns.

- Real Estate Market Cycles

Real estate values are susceptible to market cycles. Declining demand or economic slowdowns can depress real estate prices, potentially impacting the value of properties held by Robert Ross, thus influencing net worth. Conversely, a booming real estate market can appreciate the value of properties, leading to an increase in net worth. Understanding historical real estate trends and current market conditions is crucial for evaluating the impact on overall financial standing.

- Interest Rate Changes

Interest rate adjustments affect borrowing costs and investment returns. Higher interest rates increase the cost of debt, potentially reducing net worth if an individual has substantial outstanding loans. Conversely, lower interest rates often stimulate borrowing and investment, offering opportunities for higher returns on investment, which in turn, could positively affect net worth. The interplay between interest rates and overall market sentiment can significantly influence an individual's financial position.

- Global Economic Events

Major global events, such as pandemics, political instability, or trade wars, can trigger significant market fluctuations. These events can lead to uncertainty, affecting investor confidence and asset prices. Robert Ross's investments would be subject to the global economic climate. Assessing the potential impact of global events on his financial standing is crucial to evaluating the potential volatility of net worth.

In conclusion, market fluctuations present both risks and opportunities for individuals like Robert Ross. Understanding the influence of stock market volatility, real estate cycles, interest rate changes, and global economic events is critical for evaluating the potential impact on their net worth. A comprehensive assessment considers the historical context of these factors and how they impact various asset classes in the context of Robert Ross's overall financial position.

6. Public Perception

Public perception, while not a direct financial metric, can significantly influence the perceived value and, consequently, the market valuation of assets associated with Robert Ross. Positive public image can enhance the perceived desirability and profitability of investments linked to the individual. Favorable public opinion, for example, might increase the perceived value of a company's stock or the desirability of real estate associated with that individual. Conversely, negative perceptions can diminish those values.

Consider, for instance, a public figure known for philanthropic endeavors. A positive public image linked to their philanthropy might contribute to increased investor interest in companies or ventures they are associated with. Conversely, a negative image stemming from controversy or perceived misconduct could trigger a decline in the perceived value of their assets. The example of celebrity endorsements illustrates this connection. A celebrity with a strong, positive public image can command higher fees for endorsements, directly impacting the perceived value of their portfolio. This dynamic highlights the importance of public relations and reputation management for individuals like Robert Ross, as actions and public perception can significantly affect financial standing.

In summary, public perception acts as a crucial external factor affecting the perceived value of assets and ultimately, the estimation of Robert Ross's net worth. A positive reputation can enhance the perceived worth of investments and contribute to favorable market valuations. Conversely, negative perceptions can have the opposite effect. Recognizing this connection is essential for individuals who seek to understand and potentially manage the impact of public opinion on their financial well-being. Understanding the interplay between public perception and financial valuation is particularly relevant for public figures, and those seeking to cultivate a positive image to enhance perceived market value.

Frequently Asked Questions about Robert Ross's Net Worth

This section addresses common inquiries regarding the financial standing of Robert Ross. Accurate and comprehensive information on net worth requires careful consideration of various factors. Publicly available data is crucial to understanding these aspects.

Question 1: How is Robert Ross's net worth determined?

Net worth calculations assess total assets minus total liabilities. This encompasses a wide range of holdings, including but not limited to real estate, investments, and personal possessions. Accurate valuation of assets, such as real estate and investments, requires consideration of current market values. Liabilities, such as outstanding loans and debts, reduce the net worth figure. Accurate determination of net worth necessitates precise evaluation of all relevant factors.

Question 2: Is Robert Ross's net worth publicly available information?

Publicly available data regarding Robert Ross's net worth is often limited. Detailed financial information is frequently not publicly disclosed, hindering easy access. Directly obtaining precise figures is challenging due to the often-private nature of financial records.

Question 3: How do market fluctuations affect Robert Ross's net worth?

Market fluctuations significantly impact asset values. Changes in economic conditions, investor sentiment, and global events can affect the value of investments and assets. For example, a downturn in the stock market can reduce the value of publicly traded companies in which Robert Ross holds investments. Assessing the impact of market shifts on net worth requires careful consideration of these variables.

Question 4: What role does income play in Robert Ross's net worth?

Income directly contributes to the accumulation or reduction of net worth. Sources of income, such as salary, investments, and business ventures, all influence the overall financial standing. Consistent and significant income allows for investment and asset growth. Conversely, significant declines in income may cause a decrease in net worth.

Question 5: How does public perception affect the perception of Robert Ross's net worth?

Positive public image can enhance the perceived value of assets and investments. Conversely, unfavorable publicity can negatively impact the perceived value. These perceptions, although not direct financial measures, can influence market valuation. Public perception is an important, albeit indirect, factor affecting the public's understanding of net worth.

In conclusion, evaluating net worth involves complex calculations and considers various factors. Understanding the influence of market conditions, income, and public perception is crucial for a complete picture. Limited public information poses challenges for determining precise figures. This FAQ aims to provide clarity on common questions regarding Robert Ross's net worth.

Moving forward, this discussion will explore the factors driving net worth changes over time, including career trajectory and market trends.

Conclusion

Assessing Robert Ross's net worth necessitates a comprehensive analysis encompassing various factors. The individual's financial standing is a reflection of accumulated assets, including real estate holdings, investments, and personal possessions. Conversely, liabilities, such as outstanding loans and debts, directly reduce the net worth figure. Market fluctuations, income streams, and even public perception all exert influence on the valuation. A critical evaluation acknowledges the dynamic nature of these elements and their combined effect on the overall financial position. While precise figures remain largely unavailable, the discussion highlights the interplay between personal choices, market forces, and external factors in shaping financial outcomes.

Ultimately, the exploration of Robert Ross's net worth underscores the intricate relationship between individual choices and broader economic forces. The analysis compels reflection on how diverse factors contribute to financial standing and how such assessments contextualize individuals within larger economic landscapes. This understanding is crucial not only for personal financial planning but also for interpreting the interplay of economic forces and their impact on public figures in a multifaceted way.

Detail Author:

- Name : Prof. Martin Rice III

- Username : kkuphal

- Email : kian.lynch@harvey.info

- Birthdate : 1970-12-16

- Address : 9367 Rudy Orchard Lake Lynn, ME 99187-4271

- Phone : 712-659-6780

- Company : Wiegand, Brown and Lang

- Job : Food Science Technician

- Bio : Labore aliquid veritatis et sit. Eius modi distinctio quibusdam dicta commodi. Totam velit explicabo qui sunt sit. Excepturi ut libero debitis dicta sint.

Socials

tiktok:

- url : https://tiktok.com/@anjaliziemann

- username : anjaliziemann

- bio : Incidunt eos voluptas quam in in quod id. Non dolores saepe asperiores sunt.

- followers : 6175

- following : 1728

instagram:

- url : https://instagram.com/ziemanna

- username : ziemanna

- bio : Esse aut explicabo dolorem. Et tempora hic expedita quaerat molestiae voluptas.

- followers : 1450

- following : 177

facebook:

- url : https://facebook.com/anjali_real

- username : anjali_real

- bio : Et voluptas modi veniam voluptatem dicta illum.

- followers : 1214

- following : 2945