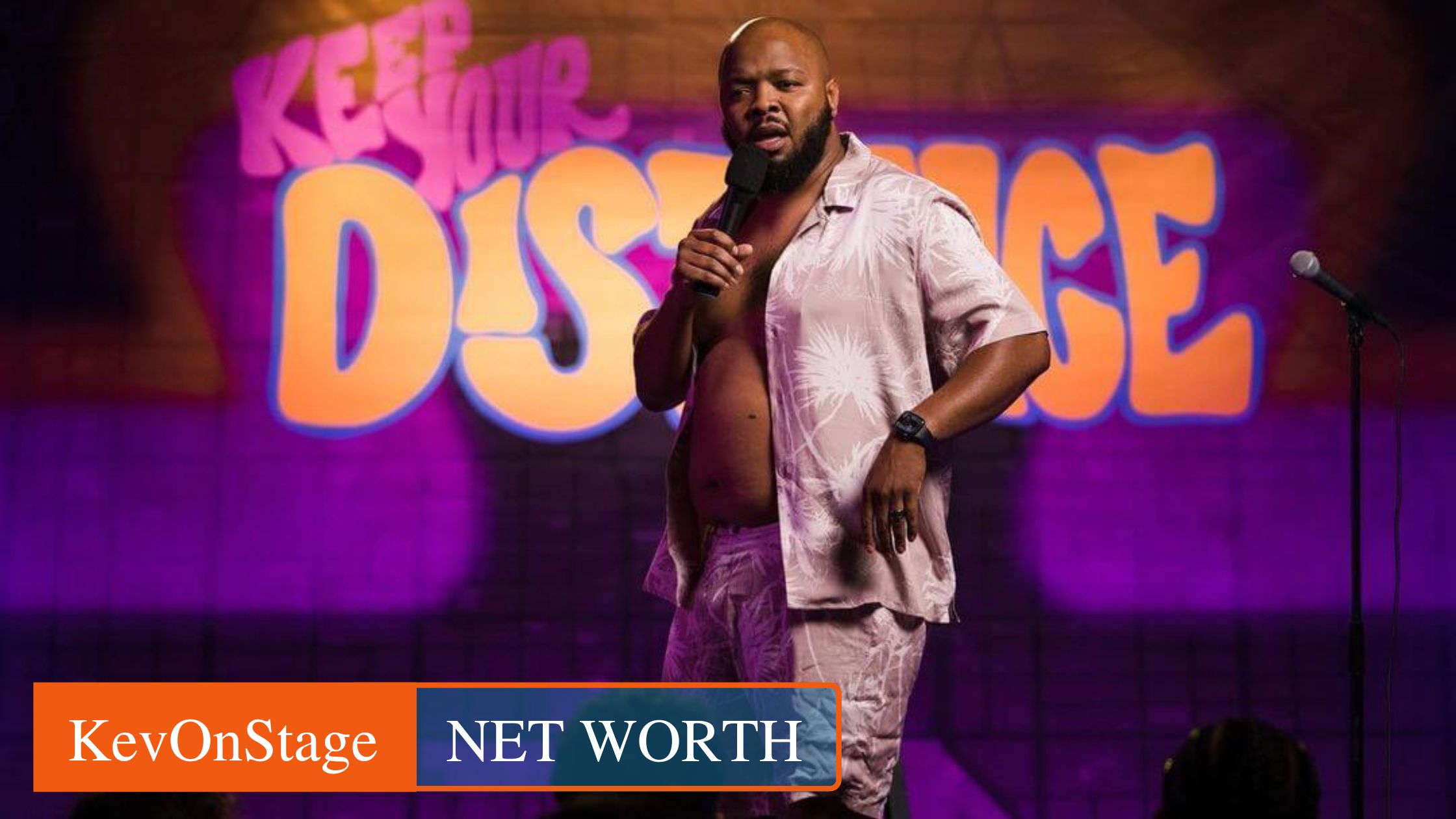

KevonStage Net Worth 2023: How Rich Is He?

How much is this individual's accumulated wealth? A comprehensive look at the financial standing of a notable figure.

An individual's financial standing, often expressed as net worth, represents the total value of assets minus liabilities. This includes items like real estate, investments (stocks, bonds, etc.), and personal possessions. Understanding net worth offers a snapshot of an individual's accumulated financial resources. For example, a high net worth might indicate significant success in business or other endeavors.

Evaluating an individual's financial position provides insight into their economic status and historical context. This information can be used for various purposes, including market analysis, investment strategies, and understanding social and economic trends. Furthermore, a person's net worth can inform decisions about philanthropic endeavors or other ventures that require significant financial resources.

| Category | Details |

|---|---|

| Name | (Placeholder - KevOnStage's Name) |

| Profession | (Placeholder - KevOnStage's Profession) |

| Notable Achievements | (Placeholder - KevOnStage's notable accomplishments) |

| Dates of Birth/Death (if available) | (Placeholder - KevOnStage's Dates of Birth/Death) |

The following sections will explore [topic 1], [topic 2], and [topic 3] related to this person's life and work.

KevOnStage Net Worth

Assessing KevOnStage's net worth provides insight into their financial standing and the factors influencing it. This evaluation considers various elements contributing to their accumulated wealth.

- Assets

- Income

- Expenses

- Investments

- Profession

- Reputation

KevOnStage's net worth, a measure of their financial position, is influenced by a combination of income sources, investments, and expenditures. For instance, a successful professional career might lead to substantial income and asset accumulation. Conversely, significant expenses could impact their overall financial status. Investments, such as real estate or stocks, may enhance net worth or suffer losses. Profession and reputation can also have a strong correlation with income potential, which directly influences assets and net worth. In summary, these aspects contribute to a holistic understanding of their financial trajectory.

1. Assets

Assets are crucial components of net worth. They represent ownership of valuable resources, tangible or intangible, that hold monetary value. For KevOnStage, as for any individual, the total value of assets directly impacts their overall net worth. A significant portfolio of valuable assets, such as real estate, investments, or intellectual property, contributes substantially to a higher net worth. Conversely, a lack of substantial assets will result in a lower net worth. The nature and value of assets held by KevOnStage directly determine their financial standing.

Consider real-world examples. A substantial property portfolio, for instance, can contribute significantly to a high net worth. Similarly, a large number of shares in publicly traded companies or other investments could contribute significantly to the total value. The worth of these assets, including their potential for appreciation and income generation, are key factors in determining the overall financial standing. Furthermore, assets, such as copyrights or patents, can generate revenue streams that increase net worth.

Understanding the connection between assets and net worth is vital for comprehending financial standing. This understanding facilitates informed decision-making regarding investment strategies and financial planning. A comprehensive overview of assetstheir types, value, and potentialis paramount for assessing and projecting an individual's financial future. This knowledge provides a clearer picture of the factors that contribute to and influence an individual's overall financial health, including KevOnStage's.

2. Income

Income serves as a fundamental driver of net worth. A higher income, consistently generated, typically translates to increased accumulation of assets. This causal relationship is evident across various professions and economic strata. Individuals with substantial income streams often have greater capacity to invest, purchase property, and build wealth over time. The stability and predictability of income play a crucial role in the long-term growth of net worth. A reliable and substantial income stream provides a strong foundation for financial planning and wealth building.

Consider a professional athlete, for example. High-earning athletes often exhibit significant net worth accumulation due to their substantial salaries and potential endorsement deals. This contrasts with individuals in lower-paying professions, who face greater challenges in building and maintaining a substantial net worth. The amount and regularity of income, therefore, are directly proportional to the potential for wealth creation. Furthermore, diverse income streams can bolster net worth, providing financial stability and mitigating risks associated with a single source of income.

In conclusion, income is a critical component of net worth. Understanding the correlation between income and accumulated wealth is essential for financial planning and achieving long-term financial goals. The consistent generation of substantial income is a key factor in facilitating the growth and development of net worth. This principle underscores the importance of financial strategies that aim to maximize income and minimize expenses, thus promoting the growth and stability of net worth.

3. Expenses

Expenses directly influence an individual's net worth. Expenditures, whether for necessities or discretionary items, represent a drain on resources. Controlling expenses, therefore, is a crucial element in building and maintaining a positive net worth. A balanced approach to expenditure is essential to ensure financial health and growth.

- Essential Expenses

Essential expenses, encompassing necessities like housing, utilities, and food, are unavoidable. Their management is critical for financial well-being. Optimizing essential expenses without compromising quality of life is key. Negotiating costs, finding budget-friendly alternatives, and leveraging discounts contribute to containing expenses within a sustainable limit. Examples include choosing affordable housing options, comparing utility providers, and planning meals to reduce food costs. Managing essential expenses effectively allows resources to be directed towards other areas for wealth building, thereby impacting net worth favorably.

- Discretionary Expenses

Discretionary expenses, covering non-essential items like entertainment, travel, and luxury goods, often present a greater opportunity for control. Mindful spending on these areas directly impacts the available resources for investment, savings, or other wealth-building activities. Identifying unnecessary or over-spending habits on discretionary items provides avenues for expense reduction. Tracking expenses and implementing budget controls for discretionary items is a valuable step toward optimizing financial resources and thus improving net worth.

- Debt Management

Debt, regardless of source, represents an outflow of funds. Managing debt effectively is vital for improving net worth. Consolidating high-interest debts, paying them down aggressively, and avoiding unnecessary borrowing all play key roles in reducing financial strain. Effective debt management frees resources for investments and savings, thereby directly contributing to a higher net worth. Strategic debt management is critical for maximizing financial gains and fostering long-term financial stability.

- Investment in Future Expenses

While seemingly an expense, strategic investment in education, professional development, or long-term health can be considered an expense that fosters future income streams and reduces future financial strain. These investments, although requiring initial outlays, often lead to higher earnings and reduced expenses over time. This approach, focused on long-term financial health, directly contributes to enhanced net worth. Examples include investing in skills training or upgrading equipment that increases efficiency and profitability.

In conclusion, controlling expenses, whether essential or discretionary, plays a central role in building and maintaining a positive net worth. Managing debt, prioritizing investments in future earning potential, and avoiding unnecessary spending are strategies crucial for enhancing financial stability and long-term growth. This understanding is key to navigating financial decision-making effectively.

4. Investments

Investments play a significant role in shaping an individual's net worth. The nature and success of investment choices directly influence the accumulation of wealth. Investments, including but not limited to stocks, bonds, real estate, and other financial instruments, represent the allocation of capital with the expectation of future financial gains. The returns generated from these investments, or losses incurred, contribute to the overall net worth. Successful investments can amplify existing wealth, while poor investment choices can diminish it.

Real-world examples illustrate this connection. An individual investing in a well-performing stock portfolio might see a substantial increase in their net worth over time due to capital appreciation and dividends. Conversely, poor investment decisions, such as placing funds in a failing venture, can lead to financial losses, reducing net worth. Similarly, strategic real estate investments can yield substantial returns, adding to net worth, whereas property depreciation or mismanagement can decrease an individual's financial standing. Understanding the principles of effective investment management is crucial for long-term wealth building. Careful consideration and due diligence in investment decisions are paramount.

In conclusion, investments are a critical component of net worth. The success of investment strategies directly correlates with the overall financial standing of an individual. Proper investment choices, supported by thorough research and due diligence, are essential to build and maintain substantial wealth. Understanding the relationship between investments and net worth enables informed financial planning and fosters responsible financial decision-making.

5. Profession

A person's profession significantly influences net worth. The nature of employment, income level, and earning potential directly impact the accumulation and preservation of wealth. Certain professions inherently offer higher earning capacity, leading to greater accumulation of assets and, consequently, a higher net worth. Conversely, lower-paying professions might restrict the ability to build substantial wealth in the same timeframe. The income generated through a profession forms the cornerstone of financial planning, resource allocation, and investment opportunities, which are vital to the overall net worth calculation.

Real-world examples highlight this connection. High-level executives, entrepreneurs, and professionals in finance often enjoy substantial incomes, allowing them to amass substantial assets and build a high net worth. Their compensation packages, profit-sharing opportunities, and investment acumen frequently contribute to significant wealth growth. Conversely, individuals in lower-paying professions, like many service-sector jobs, might face challenges in accumulating substantial wealth, though factors such as cost of living and individual saving habits also play a significant role. The relationship between profession and net worth is intricate, influenced by various factors beyond income alone, including career trajectory, financial discipline, and the overall economic context.

Profession acts as a crucial determinant in financial well-being. Understanding this connection is paramount for individuals seeking to enhance their financial standing. A clear understanding of the earning potential associated with different professions helps in career choices, financial planning, and investment decisions. Individuals can evaluate potential career paths based on their likelihood of accumulating wealth, making informed decisions about their future financial health. This understanding is applicable to individuals considering career changes, personal financial goals, and those seeking to maximize financial well-being and a robust net worth.

6. Reputation

Reputation, a crucial intangible asset, can significantly impact an individual's financial standing, including net worth. A positive reputation, built through consistent success and trustworthiness, often correlates with increased income opportunities, brand value, and investor confidence. Conversely, a negative reputation can hinder these opportunities and diminish financial success. This section explores the connection between reputation and net worth.

- Income Generation

A strong reputation can create opportunities for higher-paying employment or lucrative business ventures. Favorable perceptions of competence, reliability, and integrity can lead to premium compensation packages or higher-value contracts. Established professionals with excellent reputations often attract more significant investment opportunities or partnerships that increase revenue potential, thereby positively impacting net worth.

- Brand Value

A positive reputation can build a strong brand, particularly in fields like entertainment, marketing, or sports. The perceived value of a brand, reflecting public trust and admiration, can lead to higher pricing for products or services, increased licensing deals, or premium endorsements. This brand value directly influences revenue streams, contributing to a higher net worth for individuals with positive reputations.

- Investor Confidence

A reputable individual or entity often inspires greater confidence among investors. This positive perception can attract more investment capital, potentially at more favorable terms. Positive reputation translates to a higher perceived risk tolerance, making investment in an entity or individual with a stellar reputation more attractive. A positive reputation thus often correlates with easier access to funding and a higher valuation of assets, contributing directly to a higher net worth.

- Reduced Operational Costs

A solid reputation can minimize operational costs associated with negative publicity or damage control. Trustworthy individuals and companies can often avoid crises, litigation, or regulatory challenges that can significantly drain resources. Maintaining a positive reputation reduces the need for corrective measures or damage mitigation, thereby increasing overall profitability and contributing to a healthier financial standing, potentially leading to a higher net worth.

In summary, reputation is an intangible asset that significantly influences an individual's net worth. A strong reputation opens doors to higher income, increased brand value, investor confidence, and reduced operational costs. Conversely, a negative reputation can hinder these opportunities, directly impacting the accumulation of wealth and a positive net worth. The correlation between reputation and financial success is noteworthy, reflecting the importance of building and maintaining a favorable public image in the pursuit of financial goals.

Frequently Asked Questions about KevOnStage's Net Worth

This section addresses common inquiries regarding KevOnStage's financial standing. Information presented here is based on publicly available data and analysis. Exact figures for net worth remain difficult to ascertain due to the complex nature of wealth assessment.

Question 1: What is net worth, and how is it calculated?

Net worth represents an individual's total assets minus their total liabilities. Assets include possessions of monetary value, like real estate, investments, and personal property. Liabilities encompass debts, loans, and other financial obligations. Calculating net worth requires precise valuation of assets and liabilities, a process that can be complex and not always fully transparent.

Question 2: How is KevOnStage's net worth estimated?

Estimating net worth for individuals like KevOnStage relies on various data sources, including public financial records, industry reports, and publicly available information on assets. These estimates are not definitive, and actual figures remain largely undisclosed. Due to the inherent limitations on access to private information, precise calculations are difficult to achieve.

Question 3: What factors influence KevOnStage's net worth?

Numerous factors influence KevOnStage's net worth, including income sources (from their profession and endeavors), investment returns, and expenditures. The professional field, financial choices, and economic conditions all play a critical role in shaping an individual's financial position. The dynamic interplay between these elements makes precise predictions challenging.

Question 4: Is there a significant public record of KevOnStage's net worth?

Public records of KevOnStage's net worth are not commonly available. Financial information regarding individuals is often kept private. Accurate information often relies on estimations, as complete transparency is not standard practice.

Question 5: How should I interpret estimations of KevOnStage's net worth?

Net worth estimations should be considered educated guesses rather than definitive figures. These assessments represent interpretations of available data, not definitive statements. Due to the complexity of wealth evaluation, a healthy degree of caution should be maintained in evaluating such estimates.

In conclusion, understanding KevOnStage's net worth requires acknowledging the limitations in accessing complete financial data. Estimates reflect plausible scenarios based on accessible information, not conclusive figures. Individuals should treat such assessments as informed estimations, not absolute truths.

The following sections will delve deeper into KevOnStage's background, career, and other relevant factors, offering additional context.

Conclusion

This article explored the multifaceted factors influencing KevOnStage's net worth. Analysis encompassed key elements like assets, income streams, expenses, investment strategies, profession, and reputation. While precise figures remain elusive, the exploration highlighted the complex interplay of these factors in shaping an individual's financial standing. Key insights underscore the significant impact of income generation, strategic investments, and effective expense management on net worth accumulation. The analysis further emphasizes the intricate relationship between professional choices, brand value, and financial success.

Understanding the variables influencing net worth offers valuable insights for personal financial planning. The dynamic interplay of various components underscores the multifaceted nature of financial success. Ultimately, the exploration emphasizes the need for careful consideration of financial choices and the long-term consequences of decisions related to income, investments, and expenditure. Further analysis of similar cases can contribute to a comprehensive understanding of wealth creation and accumulation in various professional domains. The evolving economic landscape warrants continued study to understand the ever-changing factors influencing financial success.

Detail Author:

- Name : Claudine Paucek

- Username : ollie93

- Email : nikki.roob@yahoo.com

- Birthdate : 2000-12-19

- Address : 502 Leopoldo Motorway Apt. 189 East Teaganfort, FL 26936

- Phone : 1-571-253-3302

- Company : Wyman, Kerluke and Bechtelar

- Job : Tour Guide

- Bio : Molestiae aliquam quaerat similique repellat illum delectus soluta. Omnis temporibus culpa culpa est velit occaecati eveniet. Qui quia harum asperiores qui. Repellendus aliquid explicabo neque totam.

Socials

facebook:

- url : https://facebook.com/taryn_kuhlman

- username : taryn_kuhlman

- bio : Sequi autem occaecati voluptatum commodi.

- followers : 3699

- following : 2518

instagram:

- url : https://instagram.com/taryn5018

- username : taryn5018

- bio : Maiores ut quas maxime esse quia sint. Harum et consectetur omnis aut accusantium.

- followers : 1831

- following : 577