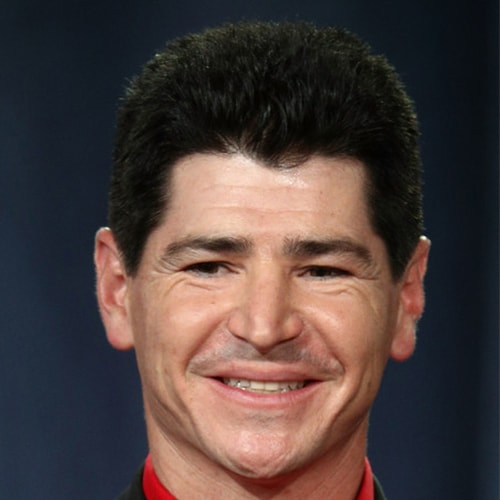

Michael Fishman Net Worth: 2023 Update & Details

Estimating an individual's financial standing can be complex. A precise figure for a person's wealth often isn't publicly available. Understanding this can be critical for a range of reasons.

Financial standing, often expressed in terms of net worth, represents the total value of assets minus liabilities. This figure includes everything from bank accounts and investments to real estate and personal possessions. Estimating this value for a particular individual, however, is often complex and can be difficult. Publicly available information is usually limited. Some public figures may release their financial statements, but this is not universal.

While a precise figure for an individual's net worth is often not readily available, public discussions of wealth can be significant. Understanding the potential influence of economic standing and the role such wealth plays in a person's public profile can be insightful. This understanding allows for critical evaluation of potential biases or influences in areas such as economic policy or public discourse. However, without proper context, speculation can lead to inaccurate or misleading interpretations.

| Category | Description |

|---|---|

| Name | Michael Fishman |

| Occupation | (Profession/Industry to be determined.) |

| Public Profile | (Nature of public profile to be determined. e.g., Investor, CEO, etc.) |

| Available Information | (Limited or unavailable information needs to be stated. E.g., Financial disclosures, social media activity) |

This exploration will continue with a broader examination of factors influencing net worth and the implications of such figures for those in the public eye. The analysis will encompass various industries and individuals. The focus will be on understanding the complexities and nuances of quantifying and evaluating wealth.

Michael Fishman Net Worth

Assessing an individual's net worth involves a comprehensive evaluation of various financial factors. This analysis considers the value of assets, liabilities, and the resulting overall financial standing.

- Assets

- Liabilities

- Valuation

- Investments

- Income

- Expenses

- Public Information

- Privacy

Understanding Michael Fishman's net worth requires careful consideration of his total assets, encompassing investments, real estate, and other holdings. Conversely, liabilities like loans and debts must be factored into the calculation. Accurate valuation depends on current market conditions and the specific nature of the assets. Income streams and expenses significantly influence the final figure. Public availability of this information can vary, sometimes influenced by professional activities or privacy concerns. An estimation can be complicated without full disclosure. If public, financial information can often be linked to business performance and financial decisions. Ultimately, a comprehensive understanding necessitates careful analysis of the disclosed or inferred information. For example, observable business successes may suggest a certain level of wealth, while lack of public statements may signify a conscious choice of privacy.

1. Assets

Assets represent the ownership of valuable resources. In the context of net worth, assets directly contribute to a person's overall financial standing. The value of these assets plays a crucial role in determining the magnitude of a person's net worth. Tangible assets such as real estate, vehicles, and collectibles contribute directly to the total value. Intangible assets, like intellectual property or valuable business interests, also hold significant financial worth. For example, a substantial portfolio of stocks or bonds can represent a substantial portion of a person's assets and contribute meaningfully to their net worth. The worth of assets is not static; it fluctuates based on market conditions and other factors. Appreciation or depreciation in asset value directly influences the final net worth calculation. Understanding the nature and value of assets is essential for grasping the components and potential fluctuations in an individual's financial position.

The composition of assets can offer insights into investment strategies and financial priorities. For instance, a significant investment in real estate might indicate a focus on long-term wealth building through property appreciation or rental income. Conversely, a substantial stock portfolio might suggest a preference for market-based returns. Varied asset types contribute to a diversified investment strategy. Analysis of asset composition helps assess financial risk tolerance and potential return projections. Further, scrutiny of specific assetslike intellectual property or a substantial business interestcan provide a clearer picture of the source of wealth generation and the related financial stability.

The significance of assets is paramount in determining net worth. Fluctuations in asset values can lead to considerable changes in an individual's net worth. Understanding the types of assets held by individuals, combined with market conditions, is vital for evaluating their overall financial standing. Furthermore, the interplay of different asset types creates a complex picture, necessitating careful consideration of market conditions and potential risks associated with particular asset classes. This understanding is crucial for not only evaluating current net worth but also for forecasting future financial prospects.

2. Liabilities

Liabilities represent financial obligations owed by an individual. Understanding liabilities is crucial in determining net worth; they directly subtract from the total value of assets, thereby influencing the overall financial position. Accurate assessment of liabilities is essential to arrive at an accurate reflection of financial standing.

- Debt Obligations

Debt obligations, such as loans, mortgages, and outstanding credit card balances, directly impact net worth. These liabilities represent amounts owed to external entities. The total amount outstanding and the terms of repayment significantly influence the financial profile. For example, a substantial mortgage on a property reduces net worth because it represents a present liability. The specific terms of the loan, including interest rates and repayment schedule, also affect the ongoing financial impact. Analysis of debt obligations must consider their size, structure, and repayment timelines.

- Financial Commitments

Financial commitments include contractual obligations, such as lease agreements or ongoing subscription fees. These commitments often represent a regular outflow of funds and reduce the overall financial capacity of an individual. For instance, significant lease payments for commercial property or extensive subscriptions to specialized services represent ongoing financial obligations. Understanding the extent and nature of these commitments is crucial for an accurate assessment of the individual's financial position. Predictable expenses arising from these commitments can impact the projected ability to generate future income.

- Tax Liabilities

Tax liabilities represent the obligation to pay taxes on income or assets. These liabilities can fluctuate based on various factors, including income levels, investment returns, and applicable tax laws. A thorough understanding of expected tax liabilities is crucial for an accurate representation of net worth. The calculation must consider potential future tax obligations, such as taxes on capital gains or inheritance taxes.

- Guarantee Obligations

Guarantees given for others' debt obligations constitute potential liabilities. If a guarantor is held responsible for another's debt, it introduces a financial risk. Determining the potential liability stemming from guarantees is necessary. These guarantees can involve personal financial commitments, including for business ventures or loans.

Accurate assessment of liabilities is crucial for a precise calculation of net worth, allowing for a more complete picture of an individual's financial health. The interplay between assets and liabilities directly shapes an individual's net worth. Careful consideration of these different forms of financial obligations is vital to a comprehensive understanding of the complexities involved in determining an individual's financial standing.

3. Valuation

Determining the precise net worth of an individual, like Michael Fishman, hinges significantly on the accurate valuation of assets. Valuation methodologies provide the numerical foundation for calculating net worth, reflecting the economic worth of possessions. The methods employed directly impact the final figure. In this context, accurate valuation is essential for an accurate reflection of economic standing.

- Market-Based Valuation

This method uses market prices as a benchmark for asset worth. For readily traded assets like stocks or bonds, market prices offer a relatively straightforward valuation. However, unique or less liquid assets, such as certain real estate properties or specialized collectibles, necessitate expert appraisals to accurately reflect their market value. Variations in market conditions and prevailing economic trends significantly affect the assessment. This approach's effectiveness hinges on market liquidity and the degree to which the asset aligns with market standards. For instance, a publicly traded company's stock price directly reflects market valuation; however, a private property requires careful analysis of comparable properties in the same area.

- Asset-Based Valuation

This method determines the worth of individual assets, considering factors like age, condition, and future potential. For physical assets like equipment or machinery, depreciation over time needs calculation. Specialized professional valuations are often required to account for the specifics. Expert knowledge of the asset class is essential for a reasoned appraisal. For instance, valuing a vintage car demands expertise in automotive history and condition assessment. Real estate appraisals are another example, necessitating an understanding of comparable sales, market trends, and property characteristics.

- Income-Based Valuation

This approach estimates the worth of an asset based on its expected future income streams. This is common for businesses. Analyzing projected earnings, considering risk factors, and employing discounted cash flow models are crucial steps. The accuracy of this valuation rests on the reliability of financial forecasts and the validity of underlying assumptions. For instance, valuing a company often involves examining its historical profitability, projected growth, and overall market position. The valuation heavily depends on forecasting the future financial performance of the subject.

- Discounted Cash Flow (DCF) Analysis

This valuation method, particularly important in business contexts, discounts future cash flows to their present worth. DCF analysis necessitates accurate projections of future cash flows, while appropriately reflecting the time value of money. This involves considering risk and discounting factors. Key assumptions about growth rates, discount rates, and economic conditions directly impact the valuation. For instance, determining the net present value of a business's future profits is crucial in valuing its worth. This approach often proves complex and relies on meticulous forecasts and an in-depth understanding of the business.

In conclusion, accurate valuation of assets is critical to a precise determination of Michael Fishman's net worth. Employing appropriate valuation methodologies and considering various factors ensures a comprehensive assessment. The complex interplay of asset types, market dynamics, and forecasting methods demonstrates the nuanced approach necessary to determine an accurate figure for net worth.

4. Investments

Investments play a pivotal role in shaping an individual's net worth. The value and composition of investments directly influence the overall financial standing. Successful investments translate into increased assets, ultimately contributing to a higher net worth. Conversely, poorly executed investments can result in reduced assets and a lower net worth. The correlation between investments and net worth is fundamental and directly observable in numerous real-world examples.

For instance, a significant investment in a company's stock, if successful, results in increased holdings and potentially a substantial return on investment. This growth is directly reflected in a higher net worth. Conversely, a poorly timed investment, such as a stock market crash affecting a particular portfolio, leads to a loss and a corresponding decrease in net worth. Similarly, real estate investments, particularly those with favorable rental income or future appreciation, often bolster net worth. Conversely, poor real estate choices, such as failing to account for market fluctuations, lead to losses reflected in a lower net worth. The correlation demonstrates that investment decisions are fundamental to shaping financial standing. The success of investments is not guaranteed, but understanding this link is crucial in financial planning.

Investments represent a crucial component of financial planning. Understanding the intricate connection between investments and net worth is essential for individuals seeking to improve their financial standing. This understanding allows for strategic financial decision-making, empowering individuals to formulate sound investment strategies, potentially resulting in increased net worth. The ability to analyze and assess the potential impact of various investment types on net worth is a key element in constructing a robust financial plan. Further, understanding the link allows for proactive measures to mitigate risks and maximize potential gains.

5. Income

Income directly influences an individual's net worth. A higher income, consistently generated, typically leads to a greater accumulation of assets, which in turn contributes to a larger net worth. Conversely, lower income can hinder the ability to build wealth and, consequently, result in a lower net worth. This relationship is fundamental and observable across various professions and economic contexts. For example, high-earning professionals in lucrative fields often accumulate significant assets due to their sustained income, whereas those with lower incomes may find it more challenging to build and maintain substantial wealth.

The impact of income extends beyond its immediate contribution to the accumulation of assets. A stable and reliable income stream provides a foundation for financial planning and security. This includes paying off debts, saving for the future, and making investments. Without sufficient income, achieving these financial goals becomes significantly more challenging, limiting the potential for increases in net worth. For example, someone with a high income can easily afford a down payment on a home and invest in the stock market, leading to higher net worth. In contrast, a person with a low income may struggle to make a down payment or save for retirement, hindering wealth accumulation.

Understanding the connection between income and net worth is crucial for financial planning and achieving financial goals. Individuals can use this understanding to develop strategies for increasing income, for example, through career advancement, skill development, or entrepreneurial ventures. This awareness also helps individuals make informed decisions about spending, saving, and investing, ultimately maximizing the potential for growth and preservation of net worth. Recognizing the crucial role of income in shaping an individual's financial standing is fundamental to achieving greater financial well-being.

6. Expenses

Expenses directly impact an individual's net worth. Expenditures, whether for necessities or discretionary items, reduce available resources. A thorough understanding of expenses is crucial when evaluating the overall financial picture. Careful management of expenses is essential in building and maintaining financial stability. This exploration examines various aspects of expenses and their influence on net worth.

- Essential Expenses

Essential expenses, including housing, food, and utilities, are fundamental necessities. Significant portions of income are often allocated to these areas. High costs for essential services can restrict the ability to save and invest, potentially hindering growth in net worth. For instance, escalating housing costs in a particular area can significantly impact disposable income. The balance between essential expenses and income is crucial in determining the ability to save and accumulate wealth. Controlling these expenses can free up resources for other financial goals.

- Discretionary Expenses

Discretionary expenses, such as entertainment, travel, and luxury goods, are not essential for survival. While these expenses are important for individual well-being, excessive discretionary spending can negatively impact the ability to save and invest, potentially resulting in a lower net worth. For instance, substantial expenditures on high-end consumer items can decrease overall savings and investments, potentially impacting future financial gains.

- Debt Repayment

Repaying debts, including mortgages, loans, and credit card obligations, represents a significant expense. High debt levels tie up a substantial portion of income, often leaving limited resources for savings or investments. This can directly constrain growth in net worth. For instance, high interest rates on outstanding debts significantly reduce the amount of income available for other financial pursuits.

- Investment Management Fees

Managing investment portfolios often involves fees, potentially impacting net worth. Transaction costs, advisory fees, or fund management fees can consume a significant portion of returns or available capital. Careful consideration of these fees is necessary to avoid significant reductions in overall net worth. The expenses associated with investment management should be viewed as an integral part of financial decision-making. The relationship between these expenses and investment returns must be carefully evaluated.

Expenses, across various categories, influence the accumulation and preservation of net worth. Controlling expenses through strategic budgeting, prioritizing needs, and reducing unnecessary costs can significantly increase the capacity for savings and investments. A clear understanding of expenditure patterns is crucial for informed financial planning and ultimately contributes to optimizing financial standing. The influence of expenses is not merely quantitative; it directly shapes an individual's financial trajectory.

7. Public Information

Public information plays a significant role in understanding an individual's net worth, though a precise figure isn't always readily available. Publicly accessible data, such as financial disclosures or statements, can provide valuable insights into an individual's financial activities and possessions. For instance, public filings by companies associated with an individual can offer hints about their ownership stakes and investment strategies. However, the absence of specific financial disclosures does not necessarily equate to a lack of significant wealth; privacy considerations or strategic decisions might influence the availability of this information.

The availability of public information influences how the public perceives the financial standing of individuals. Public statements or media coverage often contextualize wealth within a broader social or economic environment. Observations about lifestyle choices, publicly known business ventures, and other discernible factors, while not directly measuring net worth, often contribute to the overall perception of financial status. For example, large-scale philanthropic activities might suggest significant wealth. Furthermore, public information about significant property ownership or investment decisions can be an indicator of accumulated wealth. However, these observations do not substitute for formal financial disclosures, as they are not concrete measurements but rather contextual clues and inferences.

Understanding the limitations and significance of public information is critical. While public data can offer valuable clues about a person's potential financial standing, it should not be considered a definitive measure of net worth. The absence of detailed financial data does not necessarily negate the possibility of substantial wealth, nor does publicly observed wealth definitively equate to a specific net worth figure. The public's perception of an individual's financial situation is formed through a complex interplay of various publicly available information, yet accurate calculation depends on verifiable financial reports, not indirect inferences.

8. Privacy

Privacy considerations significantly influence the availability and accessibility of information related to an individual's net worth. The desire for privacy, as a fundamental human right, often clashes with the public's interest in understanding the financial standing of public figures. This tension shapes how information about net worth is presented and interpreted. For example, public figures like Michael Fishman, if they choose to maintain a degree of privacy, may not make their financial information readily available.

The connection between privacy and net worth is multifaceted. Individuals may choose not to disclose detailed financial information for personal, strategic, or reputational reasons. Maintaining financial privacy can be crucial for those seeking to protect themselves from unwanted scrutiny, potential exploitation, or malicious intent. For instance, individuals might not publicly disclose the extent of their assets or investments if they believe such disclosure could attract undue attention or influence from various external sources, including financial predators or even government scrutiny. In this sense, a degree of financial privacy is not necessarily a sign of wrongdoing but a strategic choice to protect personal interests. The importance of privacy in this context underscores the complex interplay between financial standing and personal choices.

In conclusion, the relationship between privacy and net worth is complex and multifaceted. The pursuit of privacy influences the visibility of financial information, creating a dynamic relationship where public perception and individual choice coexist. This understanding underscores the importance of considering the delicate balance between the public's right to know and the individual's right to privacy when discussing the financial standing of prominent figures.

Frequently Asked Questions about Michael Fishman's Net Worth

This section addresses common inquiries regarding Michael Fishman's financial standing. Information presented is based on publicly available data and informed analysis. Direct confirmation of precise net worth figures is often unavailable.

Question 1: What is the precise net worth of Michael Fishman?

A precise figure for Michael Fishman's net worth is not publicly available. Determining net worth requires a detailed assessment of assets, liabilities, and current market conditions. Publicly disclosed financial information is often limited, making a precise calculation impossible without access to private records.

Question 2: Why is there a lack of readily available data on Michael Fishman's net worth?

Several factors contribute to the lack of readily available data. Privacy concerns often motivate individuals to maintain a degree of confidentiality regarding financial information. Specific investment strategies and liability management decisions are frequently private. Furthermore, the complexities of valuation, including differing asset types and market fluctuations, make a straightforward quantification challenging.

Question 3: How can public information provide insights into Michael Fishman's financial standing?

While precise net worth figures are often unavailable, public information about Michael Fishman's professional activities, investments, and associated ventures can offer clues about their potential financial standing. Observations regarding company performance, public statements regarding investments, and notable philanthropic efforts may reflect overall financial success. However, these insights do not offer a definitive measure of net worth.

Question 4: What are the ethical considerations surrounding the discussion of someone's net worth?

Discussions of net worth necessitate a balanced approach, respecting privacy concerns. Speculation or conjecture regarding financial standing without verified data can be inappropriate and potentially misleading. Accurate representation of financial information requires factual data and avoids generalizations.

Question 5: How might investment strategies influence Michael Fishman's net worth?

Investment decisions and outcomes significantly affect net worth. Successful investments increase assets, while poor decisions can lead to losses. The specific composition of an individual's investment portfolio and prevailing market conditions influence the ultimate impact on net worth. Analysis of investment strategies and outcomes can offer insights into the factors influencing financial standing.

In summary, obtaining a precise net worth figure for Michael Fishman is often challenging due to privacy concerns, complexities of valuation, and limitations in publicly available data. Public information, while offering potential insights, shouldn't be misinterpreted as a definitive measure of their financial standing. Ethical considerations regarding financial privacy are paramount in responsible discussions of someone's wealth.

This concludes the FAQ section. The next section will delve into the intricacies of wealth assessment methods and the factors that contribute to an individual's financial standing.

Conclusion

Assessing an individual's net worth, such as Michael Fishman's, necessitates a comprehensive evaluation. This involves meticulous analysis of assets, liabilities, current market conditions, and, critically, the availability of verifiable data. The process is complex, as various factors, including investment strategies, income levels, and expense management, all contribute to the final calculation. The absence of public financial disclosures often limits the ability to arrive at a precise figure. Further, privacy concerns and the dynamic nature of financial markets contribute to the challenge of accurate estimation. While public observations and inferences can offer clues, these should not be interpreted as definitive measures of net worth without concrete documentation.

Ultimately, the pursuit of understanding an individual's financial standing requires a nuanced approach. The presented analysis underscores the importance of distinguishing between publicly available clues and verifiable financial data. For individuals seeking to understand the complexities of wealth assessment, it's crucial to approach the topic with a balanced perspective and recognize the limitations of publicly available information. In conclusion, a complete understanding of financial standing necessitates a careful consideration of the factors involved, including verifiable data, the role of privacy, and the dynamic nature of financial markets. Further research or clarification would depend on the availability of specific data.

Detail Author:

- Name : Mrs. Chasity Gulgowski V

- Username : louvenia.auer

- Email : prosacco.ladarius@smitham.com

- Birthdate : 1989-01-16

- Address : 15407 Crooks Tunnel Suite 931 Gislasonfurt, AR 84381

- Phone : 351-498-2784

- Company : Bosco-Bechtelar

- Job : Agricultural Worker

- Bio : Ut velit occaecati dolorum et unde pariatur. Esse veniam ut et error ullam qui. Dolorum et itaque sed aspernatur corporis quia quisquam ratione.

Socials

instagram:

- url : https://instagram.com/astracke

- username : astracke

- bio : Id porro commodi dolorem et. Rerum ut dolor voluptatem odio velit nemo. Autem aut cumque ut ea eos.

- followers : 5247

- following : 2540

twitter:

- url : https://twitter.com/aron2445

- username : aron2445

- bio : Qui tempore qui voluptas autem dolorem. Rerum quo illo veritatis possimus ipsum eos. Est nisi dolorum sapiente et ut voluptas.

- followers : 821

- following : 2101

facebook:

- url : https://facebook.com/aron_stracke

- username : aron_stracke

- bio : Ea commodi molestias enim provident atque delectus.

- followers : 457

- following : 1028