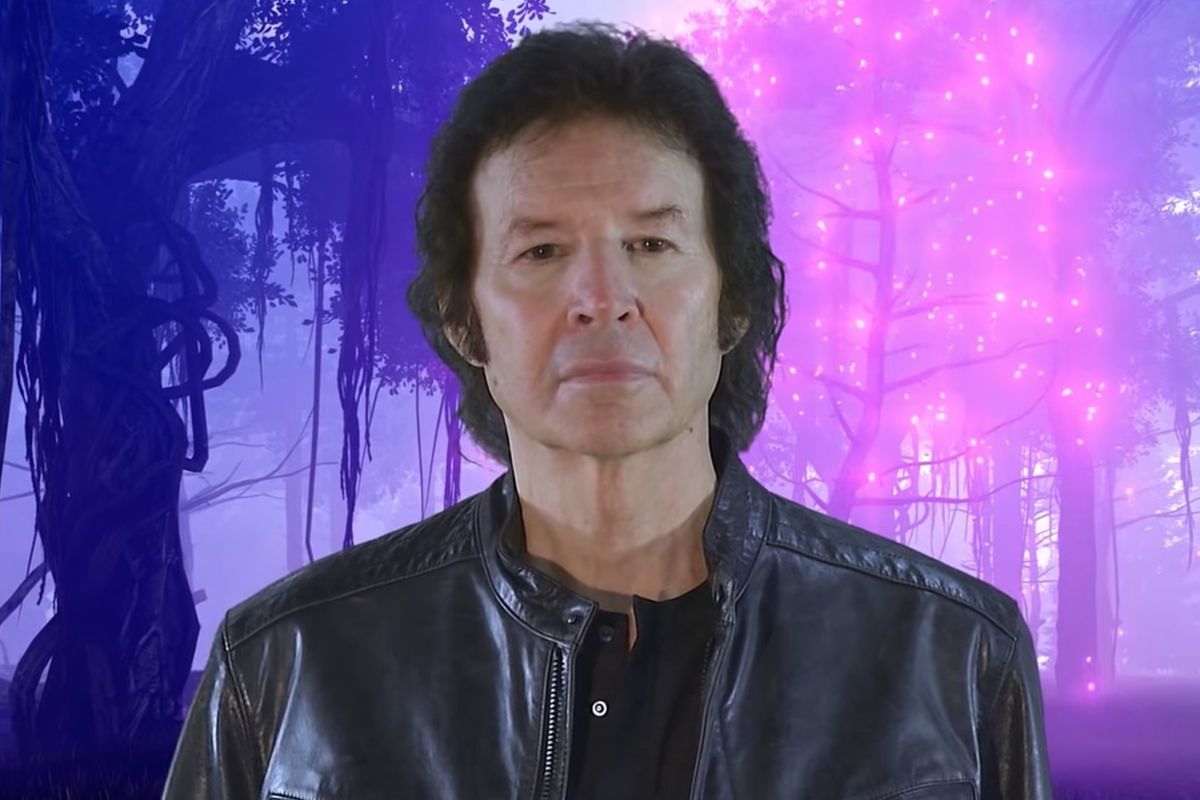

Neil Breen Net Worth 2024: Latest Estimates & Details

How much is Neil Breen worth? Understanding a public figure's financial standing.

Estimating a person's net worth involves assessing their total assets (such as real estate, investments, and other holdings) minus their total liabilities (debts and obligations). This figure reflects an individual's accumulated wealth at a specific point in time. While precise figures are often not publicly available for individuals, such information is often reported in news articles, biographies, and financial publications when applicable.

Understanding an individual's financial standing can provide insight into their career trajectory, business acumen, and overall success. In the case of public figures, like athletes, entertainers, or entrepreneurs, this information can be of interest to fans, investors, or the general public. The information can reveal a history of financial management decisions, successes, or challenges that have contributed to a person's financial position.

| Category | Details |

|---|---|

| Name: | Neil Breen |

| Known for: | (Add relevant details about Neil Breen's profession, notable works, or achievements) |

| Industry: | (e.g. Entertainment, Business, Sports) |

Further investigation into Neil Breen's life and career could potentially reveal more details, and more specific insights into factors contributing to the financial picture. However, without specific publicly available data, it would be difficult to calculate a precise financial assessment.

Neil Breen Net Worth

Assessing Neil Breen's net worth involves examining various financial factors contributing to his overall financial standing. This analysis considers the accumulation of assets and the deduction of liabilities. Publicly available information is crucial for such an evaluation.

- Assets

- Liabilities

- Income Sources

- Investment History

- Expenditures

- Public Record

- Professional History

- Market Context

Determining a precise net worth necessitates a comprehensive review of Neil Breen's assets and liabilities. Income sources and investment history provide crucial context. Expenditures, while potentially private, can offer indirect insight into financial management. Public records and professional history, including industry trends, shed light on earnings potential. Finally, market conditions during key periods of Breen's career, such as economic recessions or booms, are crucial context to consider. Without access to these detailed financial records, a precise net worth estimate is often not possible, though general financial standings may be evident through industry reports and professional accomplishments.

- Ed Masry Net Worth At Death Unveiling The Legacy

- Richard Dreyfuss Net Worth A Deep Dive Into His Fortune

1. Assets

Assets represent the economic resources owned by Neil Breen, playing a fundamental role in determining his net worth. A comprehensive understanding of these resources is crucial for evaluating his financial standing.

- Real Estate Holdings

Property ownership, including residential homes, commercial buildings, and land, constitutes a significant asset class. Appreciation in value, rental income, and potential for future development contribute to the overall worth of these holdings. The type and location of properties can significantly influence their market value.

- Investment Portfolios

Investments in stocks, bonds, mutual funds, and other financial instruments represent a diverse asset base. The performance of these investments over time directly impacts the value of Neil Breen's overall portfolio. Diversification strategies and investment strategies adopted play a pivotal role.

- Personal Possessions

High-value personal assets, such as luxury vehicles, art collections, and rare items, can contribute to a substantial portion of the net worth. Determining the market value of these possessions often requires expert appraisals.

- Liquid Assets

Cash, bank accounts, and readily available investments represent readily convertible assets. These liquid assets offer immediate access to funds and flexibility in managing financial needs.

Collectively, these assets form the cornerstone of Neil Breen's financial position. The value of each asset category, along with their overall performance and diversification, ultimately contribute to the total net worth figure. Assessing these factors provides a deeper understanding of the financial standing and capabilities of an individual. However, without access to detailed financial records, a precise evaluation is usually challenging.

2. Liabilities

Liabilities represent the financial obligations owed by Neil Breen. These obligations, encompassing debts and other financial commitments, directly impact his net worth. Subtracting liabilities from assets yields the net worth figure, highlighting the crucial role of liabilities in the calculation. High levels of outstanding debt can significantly reduce net worth, potentially impacting borrowing capacity and overall financial flexibility.

Understanding the types and amounts of liabilities is essential. Mortgage debt, for example, reduces net worth by the outstanding loan balance. Credit card debt and other personal loans similarly contribute to liabilities, potentially impacting the overall financial picture. In addition, tax obligations, outstanding invoices, and any legal judgments represent a liability that directly subtracts from the overall asset value to arrive at net worth. The presence and scale of these liabilities are crucial factors in evaluating financial health and potential future financial performance. Real-life examples of individuals burdened by substantial debt illustrate how high liabilities can limit financial freedom and opportunities.

In conclusion, liabilities are an integral component of determining Neil Breen's net worth. Understanding the nature and extent of these obligations provides critical insight into his financial position. A significant debt burden can restrict financial maneuverability and opportunity. Conversely, a prudent approach to liabilities, and efficient management of financial commitments, can contribute significantly to a positive net worth and overall financial security.

3. Income Sources

Income sources directly influence Neil Breen's net worth. The nature and volume of income streams are fundamental determinants of accumulated wealth. Higher income levels, consistently generated, usually lead to greater asset accumulation over time. Conversely, lower or inconsistent income often restricts the ability to build and maintain a substantial net worth. This relationship is demonstrably evident across diverse professional fields, from entrepreneurship to skilled trades. Successful entrepreneurs, for example, frequently report a correlation between their innovative business ventures and notable increases in net worth.

Varied income sources contribute to a more resilient financial standing. A diverse income portfolio, encompassing multiple streams such as salary, investment returns, and business ventures, provides a buffer against fluctuations in any single income source. This stability is particularly crucial during economic downturns or career transitions. This principle is exemplified by individuals with multiple income streams, who often demonstrate greater financial security and adaptability compared to those relying solely on a single source of income. The more predictable and consistent the income streams, the more dependable the path toward building and maintaining a substantial net worth.

Understanding the connection between income sources and net worth is crucial for effective financial planning. Analysis of income streams, including their stability, growth potential, and diversification, informs decision-making about investment strategies and asset allocation. This understanding empowers informed choices about career paths, entrepreneurial endeavors, and personal finance management. Ultimately, appreciating the interplay of income and net worth fosters a more comprehensive approach to wealth building and financial security.

4. Investment History

Investment history is a critical component in assessing an individual's net worth. The choices made in investments, both in terms of type and timing, directly impact the accumulation and growth of assets. A detailed analysis of this history reveals insights into financial strategies and their efficacy over time. This analysis considers the returns generated, the risk taken, and the overall long-term impact on wealth.

- Investment Portfolio Diversification

The extent of diversification in an investment portfolio is crucial. A well-diversified portfolio typically includes investments across different asset classes (stocks, bonds, real estate, etc.). This strategy mitigates risk by reducing reliance on a single investment type. A diversified portfolio, through various economic cycles, typically shows more stability. Investment in different markets, sectors, or even asset classes, as an example, reduces risk by spreading potential losses.

- Risk Tolerance and Investment Choices

Investment choices reflect risk tolerance. Individuals with a high tolerance may invest in more volatile assets, such as stocks, while those with lower risk tolerance might opt for more stable investments, such as bonds. The level of risk taken often correlates to the potential for higher returns, but also to the potential for greater loss. Historical investment choices provide insight into risk appetite and decision-making approaches. This insight is crucial for understanding the overall strategy.

- Timing of Investments

The timing of investment decisions is significant. Purchasing assets at opportune times, leveraging market fluctuations, can amplify returns. Conversely, making investments at unfavorable times may result in lower returns or even losses. Analysis of past investment timing decisions reveals insights into financial decision-making during various market conditions. The investment strategies taken and market conditions during those times reveal information about the person's approach to market conditions.

- Investment Performance Track Record

Performance evaluation over time is a crucial aspect. The rate of return and consistency of returns across various periodsbe it yearly, quarterly, or longeroffer insights into investment acumen and strategy effectiveness. Consistent, high-performing investments, particularly over extended periods, suggest a sound approach and potentially strong growth. Analyzing these patterns unveils insights into the consistency of past investments. This information helps predict future investment potential and assess financial stability.

Ultimately, an individual's investment history paints a picture of their financial strategies and decision-making patterns. These patterns, when considered alongside other financial data, provide a more comprehensive understanding of the factors contributing to their net worth.

5. Expenditures

Expenditures, or the costs incurred by Neil Breen, are a crucial component of understanding his net worth. They directly impact the accumulation and maintenance of wealth. The relationship between expenditures and net worth is a fundamental one, characterized by a cause-and-effect dynamic. High expenditures, exceeding income, typically lead to a decline in net worth. Conversely, managing expenditures effectively, keeping them below or in line with income, supports the growth of net worth over time. This principle is universally applicable across individuals and organizations, from personal budgets to corporate financial planning.

Careful consideration of expenditures is essential for informed financial decision-making. Identifying areas where costs can be reduced or optimized without compromising essential needs or quality of life allows for surplus funds to be channeled toward investment or savings. This strategic management of expenses can be crucial in achieving financial goals. Examples of effective expenditure management include negotiating better rates for services, consolidating debts to reduce interest payments, or finding cost-effective alternatives for products or services. Examples of poorly managed expenditures include excessive spending on luxury items or neglecting necessary repairs and maintenance, leading to eventual greater costs down the line. Recognizing these patterns is vital in cultivating financial security.

In summary, expenditures are an integral part of the equation when determining Neil Breen's net worth. Effective management of expenditures is critical in fostering wealth accumulation. Understanding the connection between expenditures and net worth provides a powerful framework for making informed financial choices, maximizing returns, and ultimately achieving financial goals.

6. Public Record

Public records play a significant role in understanding financial information, including an individual's net worth. These records, often accessible through government filings or public databases, offer insights into financial transactions, property holdings, and other details. Their importance lies in their potential to reveal patterns and trends, ultimately providing context for evaluating an individual's financial position.

- Financial Filings and Public Records

Public records can include financial filings, such as tax returns (where available), which offer a snapshot of income, deductions, and assets. While tax returns alone do not fully determine net worth, they provide valuable information about an individual's income and financial activity. Property records, accessible through county or state registries, disclose information on real estate holdings and transactions. This data can suggest the value of properties owned by a person. Furthermore, records of business ownership, if applicable, provide additional financial insights, including details of business earnings, debts, and assets. Public records, when combined with other data, contribute to a more comprehensive understanding of an individual's financial situation.

- Limitations and Caveats

It's crucial to acknowledge the limitations of public records. Access to detailed financial information may be restricted, and publicly available records might not encompass the entirety of an individual's holdings. Privacy regulations and confidentiality provisions may also affect the comprehensiveness of readily available data. For instance, certain details of income or assets may not be documented or reported in readily accessible public record repositories. Therefore, caution must be exercised when using public records to form conclusive statements about net worth. Interpreting these records in isolation could lead to inaccuracies or incomplete assessments of an individual's financial position.

- Data Integration and Contextualization

When evaluating net worth, relying solely on public records is insufficient. A thorough evaluation often necessitates combining public record data with other sources, such as professional biographies, financial news reports, or articles. This approach allows for a more nuanced and complete understanding of the financial information. Combining these different types of data helps in identifying trends, potential patterns, and mitigating risks in interpreting the meaning behind public records. This combination provides a broader perspective on financial dealings.

- Legal and Regulatory Compliance

Public records often reflect legal and regulatory compliance. Information reported in public filings, like those related to property ownership or business operations, often adhere to legal requirements and industry standards. Maintaining compliance demonstrates an individual's adherence to legal requirements. The consistency and validity of this information enhances its reliability. By tracking compliance, one can discern patterns of financial responsibility.

In conclusion, public records provide valuable, yet limited, information concerning net worth. Their utility lies in providing a partial and potentially important perspective, combined with data from other sources. This integrated approach maximizes the value of public records in assessing financial situations, recognizing the caveats and limitations of relying exclusively on this data type. While a precise net worth assessment often requires further investigation, public records do provide a degree of transparency into the public aspects of financial activity, helping to form a more complete picture when used judiciously.

7. Professional History

Professional history significantly influences an individual's net worth. The trajectory of a career, including roles, industry, and achievements, often correlates with financial success. A highly successful and lucrative profession typically provides greater earning potential, which, over time, translates to increased assets and a higher net worth. Conversely, a less profitable or stable profession might limit the accumulation of significant wealth. This relationship holds true across various industries, from entrepreneurship to skilled trades. Consider, for example, the substantial net worth often associated with CEOs of large corporations, frequently reflecting their high salaries, stock options, and long tenure in leadership positions within lucrative industries.

The specific details of professional history, such as years of experience, positions held, and industry specialization, provide valuable insights into earning potential and financial growth. A long and successful career in a high-demand profession usually correlates with a higher net worth. Specialized skills and knowledge in a competitive market also contribute to higher earning potential. Conversely, frequent career changes, low-paying roles, or difficulty maintaining employment can constrain wealth accumulation. Real-world examples of successful entrepreneurs or executives illustrate this principle, demonstrating how career advancement and industry expertise are key factors in building substantial net worth. The impact of specific career choices and industry expertise on financial standing becomes even more pronounced when considering factors like economic cycles and market trends.

Understanding the connection between professional history and net worth is crucial for various reasons. It allows for a more comprehensive evaluation of financial standing. It also provides a framework for career planning and decision-making. Understanding the potential financial outcomes of different career paths enables individuals to make informed choices about education, training, and professional development. For investors or those seeking to assess the financial health of an individual, a comprehensive review of professional history is valuable, as it provides context about earning capacity, investment patterns, and financial stability. Ultimately, integrating professional history into the assessment of an individual's financial standing offers valuable insight, connecting career choices to financial outcomes. However, it's important to acknowledge that numerous other factors influence net worth, and professional history is not the sole determinant.

8. Market Context

Market context significantly influences an individual's net worth. Economic conditions, industry trends, and market fluctuations directly affect an individual's income, investment returns, and asset values. A robust and expanding market, for instance, often fosters greater opportunities for income generation and asset appreciation. Conversely, economic downturns or industry-specific contractions can diminish income, reduce investment returns, and decrease the value of assets. The relationship between market context and net worth is a dynamic one, characterized by cause and effect.

The importance of market context as a component of net worth assessment cannot be overstated. A thriving market often leads to higher income potential for individuals within certain sectors. For example, a boom in the technology industry might generate higher salaries, increased stock values, and more investment opportunities for individuals within that sector. Conversely, an industry downturn, coupled with economic recession, may cause job losses, reduced income, and potentially significant declines in asset values for those heavily invested or employed in that sector. Successful individuals, even those in stable professions, have experienced a correlation between economic cycles and net worth changes, emphasizing the profound impact of market conditions. This is evident in the history of financial markets and the changing fortunes of many individuals and businesses.

Understanding the connection between market context and net worth has practical implications. Investors and individuals can use this understanding to make informed decisions about investments, career choices, and financial planning. By analyzing market trends, economic forecasts, and industry insights, individuals can better position themselves to benefit from favorable market conditions. They can also prepare for potential challenges in adverse economic periods. Recognizing these cyclical patterns of market conditions can provide strategies for navigating market downturns or accelerating wealth accumulation in upturns. For example, during economic downturns, a prudent strategy might involve holding onto cash and carefully assessing investment options. Conversely, during periods of strong economic growth and market expansion, aggressive investment strategies could become more effective. Successfully navigating economic environments is key to financial resilience and building long-term wealth.

Frequently Asked Questions about Neil Breen's Net Worth

This section addresses common inquiries regarding Neil Breen's financial standing. Accurate and reliable information is essential for understanding an individual's financial position. However, precise net worth figures are often unavailable for private individuals.

Question 1: How is Neil Breen's net worth determined?

Estimating net worth involves calculating total assets, including investments, property, and other holdings, and subtracting total liabilities, such as debts and outstanding obligations. This calculation provides an approximate snapshot of an individual's financial standing at a specific point in time. Publicly accessible data or official statements are vital for assessing an individual's financial health. However, due to the private nature of financial matters, precise figures are rarely available to the public.

Question 2: Why is it difficult to ascertain a precise net worth figure for Neil Breen?

Publicly available data regarding net worth is often limited or unavailable for privacy reasons. Comprehensive financial information is frequently considered private. Estimating net worth requires access to a range of detailed financial records, which may not be publicly accessible.

Question 3: What factors influence Neil Breen's net worth?

Numerous factors influence an individual's net worth. These include career trajectory, income sources (salary, investments, business ventures), investment history, spending habits, market conditions, and industry trends. Specific details about these elements are often not publicly disclosed.

Question 4: How do economic conditions affect Neil Breen's net worth?

Economic conditions, including recessions, market downturns, and booms, significantly impact net worth. Recessions, for example, can reduce the value of assets and potentially increase liabilities. Market fluctuations directly affect the performance of investments, impacting an individual's overall financial standing.

Question 5: What is the significance of understanding Neil Breen's net worth?

Understanding an individual's net worth, while nuanced and often incomplete, provides context. For public figures, the information can offer insight into their career trajectory, financial acumen, and overall success. However, without publicly available details, precise estimation is usually challenging.

In conclusion, while a precise net worth figure for Neil Breen is frequently unavailable, understanding the key factors influencing it offers valuable context for assessing an individual's financial standing. Information available in the public domain, alongside an understanding of general financial principles, is essential when considering an individual's financial well-being.

Moving forward, this article will delve into the broader implications of these financial concepts in various contexts.

Conclusion

This article explored the multifaceted nature of assessing Neil Breen's net worth. Key factors influencing such an evaluation encompass a detailed analysis of assets, liabilities, income sources, investment history, expenditures, public records, professional background, and the prevailing market context. Understanding the interplay of these elements provides a more comprehensive picture of an individual's financial standing. While precise figures are often elusive, the presented analysis underscores the critical significance of these contributing components in constructing a holistic understanding of financial situations, particularly for public figures.

The exploration of Neil Breen's net worth, while specific to this individual, highlights broader principles of financial analysis. These principles, applicable across various contexts, emphasize the importance of a multifaceted approach when evaluating financial health. The intricate interplay of assets, liabilities, and market factors underscores the dynamic nature of financial standing and the critical role of informed analysis in understanding economic realities. Further investigation and analysis in related fields could potentially reveal new insights and methodologies for evaluating financial situations and individual wealth.

Detail Author:

- Name : Corene Schuster

- Username : laila63

- Email : drohan@gmail.com

- Birthdate : 2000-06-15

- Address : 56215 Fae Road Suite 829 Andreshaven, MS 57243

- Phone : (847) 818-5588

- Company : Bosco and Sons

- Job : Biochemist or Biophysicist

- Bio : Delectus ea mollitia exercitationem qui ut. Non magni dignissimos minus. Enim porro tempore alias quia sapiente.

Socials

twitter:

- url : https://twitter.com/flo.raynor

- username : flo.raynor

- bio : Eos omnis nemo doloremque rerum. Quia quasi qui sunt enim eum amet voluptas. Sed ab autem molestiae vel veniam et.

- followers : 1798

- following : 422

linkedin:

- url : https://linkedin.com/in/flo_id

- username : flo_id

- bio : Numquam dolore ut dicta ullam illo quam pariatur.

- followers : 2231

- following : 2792

instagram:

- url : https://instagram.com/floraynor

- username : floraynor

- bio : Enim fugiat eos laudantium optio. Ut laborum quos repudiandae. Porro qui saepe et rerum qui sequi.

- followers : 1807

- following : 632