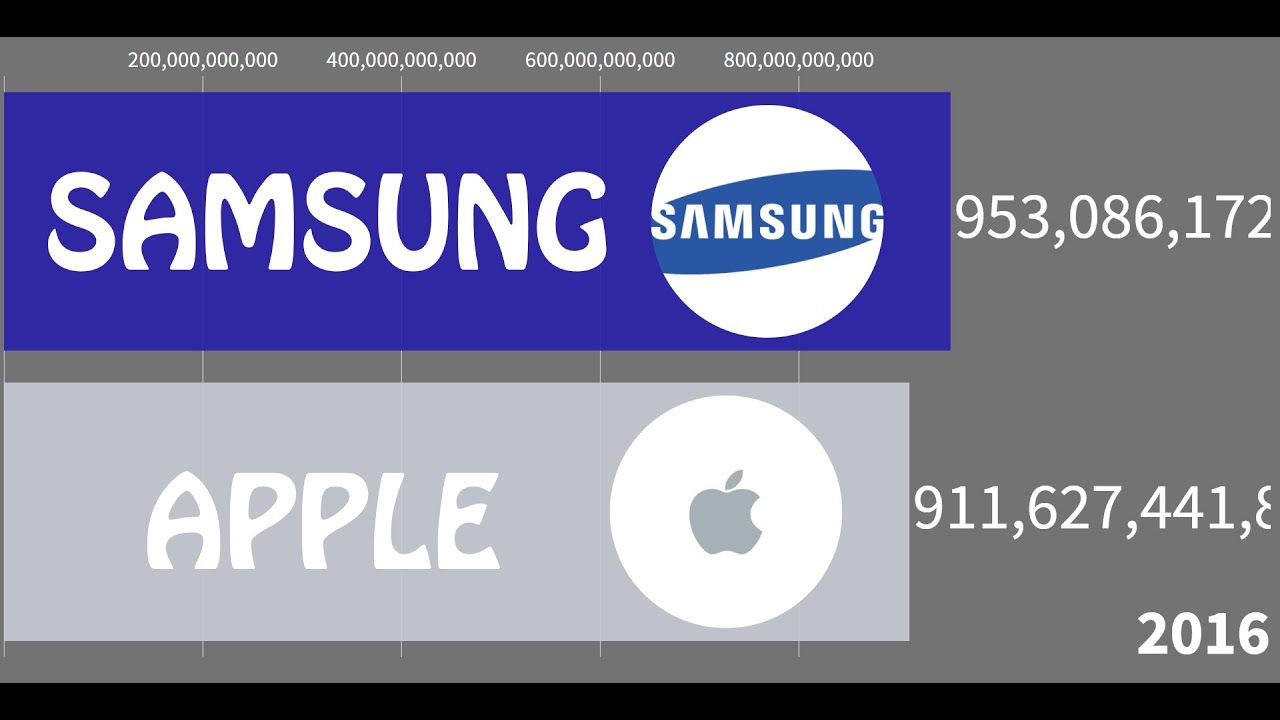

Apple Vs. Samsung Net Worth: 2023 Comparison

How do Apple and Samsung's financial standings compare? Understanding the monumental financial weight of these tech giants reveals crucial insights into their market dominance and future potential.

A company's net worth, in a financial context, represents its total assets minus its total liabilities. For Apple and Samsung, this figure reflects the overall value of their assets, including cash, investments, intellectual property (like patents and trademarks), and physical assets (factories, stores), less any outstanding debts or obligations. Publicly available data, including stock prices, reported earnings, and financial statements, can be used to estimate this value. Note that the exact calculation can vary based on the methodology used and the specifics of reporting. It's critical to distinguish between market capitalization (a stock market measure) and net worth, as they differ in their fundamental components and how they are derived.

Analyzing the financial strength of Apple and Samsung is essential for investors and industry observers. A high net worth signifies a company's strong financial position, its capacity for innovation, and its resilience during economic fluctuations. It provides insight into market influence and brand recognition, both factors critical in the competitive tech landscape. Historical trends in the net worth of these companies show a dynamic relationship to global economic conditions, product success, and market share. The financial well-being of these companies affects not only their own sustainability but also influences the economies of the countries where they operate. Tracking this metric provides insights into long-term sustainability and overall industry performance.

Moving forward, we can explore the intricate dynamics shaping Apple and Samsung's profitability. Factors impacting their performance include global economic conditions, consumer trends, and emerging technologies. We will examine these factors and delve into recent strategic moves that could impact their financial health in the coming years.

Net Worth of Apple and Samsung

Assessing the financial strength of Apple and Samsung is crucial for understanding their market influence and future prospects. Analyzing their net worth reveals key aspects impacting their stability and competitiveness.

- Market capitalization

- Revenue generation

- Profitability

- Asset valuation

- Debt levels

- Stock performance

- Brand recognition

- Innovation capacity

These aspects intertwine to paint a comprehensive picture of the companies' financial health. Market capitalization reflects investor confidence; high revenue signifies strong market presence and profitability showcases efficiency. Asset valuation considers tangible and intangible assets, while debt levels impact financial flexibility. Stock performance gauges investor sentiment, brand recognition underscores market appeal, and innovation capacity anticipates future growth. Apple's sustained high stock performance and record revenue, paired with Samsung's strong global presence and diverse product portfolio, illustrate the interplay of these elements. Understanding these aspects is vital for assessing their relative positions in the technological landscape, forecasting future trends, and making informed investment decisions.

1. Market Capitalization

Market capitalization, a crucial metric for evaluating the financial health of publicly traded companies like Apple and Samsung, differs from net worth. While net worth represents the overall value of a company's assets minus liabilities, market capitalization reflects the aggregate value of its outstanding shares in the stock market. Understanding the connection between these two figures provides insights into investor sentiment, market perception, and the overall financial strength of these tech giants.

- Relationship to Stock Prices

Market capitalization directly correlates with the current share price of a company's stock multiplied by the total number of outstanding shares. Fluctuations in stock prices drive changes in market capitalization. Positive investor sentiment, driven by news regarding product launches, financial performance, or industry trends, typically results in rising stock prices and, consequently, a higher market capitalization. Conversely, negative news, economic downturns, or competitive pressures can lead to declines in stock prices and a lower market capitalization.

- Reflection of Investor Confidence

Market capitalization serves as a gauge of investor confidence in a company's future prospects. A higher market capitalization suggests that investors believe the company holds significant potential for growth and profitability. This confidence is often based on various factors, such as the quality of a company's products, its market position, and its management team. The perceived value and expectations for future performance of Apple and Samsung, as reflected by stock prices, directly affect their market capitalization.

- Comparison with Net Worth

Crucially, market capitalization does not precisely equal net worth. Market capitalization focuses solely on the stock market's valuation of a company, while net worth encompasses all assets and liabilities. Differences arise because market capitalization primarily considers a company's future earning potential as perceived by investors, potentially diverging from the company's current assets and liabilities. This divergence highlights the role of expectations and projections in market valuation, which can be significant for companies like Apple and Samsung, with complex portfolios and significant future potential.

- Influence on Financial Health Perception

While not a direct measure of overall financial health, a company's market capitalization significantly influences the general perception of its financial health. A high market capitalization suggests substantial investor interest, potentially indicating a positive trajectory for the company. However, this metric should be interpreted cautiously alongside other financial indicators. A strong market capitalization should complement, not replace, a deep understanding of a company's actual financial position.

In conclusion, market capitalization acts as a crucial indicator of investor sentiment and perceived future potential. Understanding its limitations, particularly concerning its disconnect with a company's complete net worth, is vital for a complete assessment. A high market cap, combined with strong financial performance and positive market trends, suggests a healthy future for companies like Apple and Samsung, while a stagnating or declining market capitalization might signal uncertainty or potential issues.

2. Revenue Generation

Revenue generation is a fundamental component of a company's financial health, directly impacting its net worth. For corporations like Apple and Samsung, understanding how revenue is generated, its growth patterns, and its stability provides critical insights into their overall financial standing. Profitability, a key driver of net worth accumulation, is intrinsically tied to revenue streams.

- Product Portfolio Diversity and Market Penetration

The breadth and depth of product offerings significantly influence revenue. Companies with diverse product lines, such as Apple's encompassing smartphones, computers, and accessories, or Samsung's range from electronics to consumer appliances, are better positioned to weather market fluctuations. Successful market penetration through effective branding and marketing strategies further contributes to consistent revenue generation, creating a more stable financial foundation.

- Price Elasticity and Market Positioning

The pricing strategy and market positioning of products directly impact revenue. A company with strategic pricing models, capitalizing on market demand and competitor analysis, can maximize revenue. Positioning products at various price points, targeting different customer segments, allows for diversification of revenue streams and adaptability to economic shifts. The impact on net worth stems from a stable and growing revenue stream, enabling consistent profit generation.

- Operational Efficiency and Cost Management

Efficient operations and meticulous cost management are crucial to maximizing profitability from generated revenue. Optimizing production processes, streamlining supply chains, and minimizing overhead expenditures allow for higher profit margins. For companies like Apple and Samsung, efficient operations translate into higher returns on sales, thus boosting net worth. Cost-effective operations are integral to sustainable revenue growth and enhancement of the overall financial position.

- Global Reach and Market Expansion

Companies with a substantial global presence and ongoing market expansion initiatives can significantly enhance revenue. Exploring new markets and penetrating existing markets effectively creates new revenue streams. For companies like Apple and Samsung, a wider geographical reach broadens their revenue base, contributing to the growth and strength of their financial portfolio. This global strategy can be crucial in maintaining or improving net worth in an evolving economic landscape.

In summary, Apple and Samsung's revenue generation strategies are deeply intertwined with their net worth. Consistent, growing revenue from a diversified product portfolio, strategic pricing, and operational efficiency fuels profitability and contributes to an overall strong financial position. Companies succeeding in these areas demonstrate a sustainable financial advantage and a stronger likelihood of continued growth in net worth. These detailed aspects form the foundation for future evaluation of their overall financial standing and performance against market benchmarks.

3. Profitability

Profitability is a direct driver of a company's net worth. Higher profitability translates to greater accumulated wealth over time. For companies like Apple and Samsung, consistent profitability is essential for bolstering net worth and ensuring long-term financial stability. The ability to generate profit from operations directly increases the value of assets and reduces liabilities, thereby enhancing the overall net worth. This connection is not simply theoretical; it's a demonstrable economic principle.

The relationship between profitability and net worth is multifaceted. Profitability, a core component of a company's financial health, acts as a primary engine for accumulating wealth. A company consistently generating significant profits can reinvest these earnings into expanding its operations, acquiring new assets, or returning capital to shareholders. These actions strengthen the company's financial position and contribute directly to rising net worth. Conversely, consistently low or negative profitability reduces the available capital for reinvestment, hindering growth and potentially decreasing net worth. For example, a company like Apple, consistently profitable, can use these earnings for research and development, expanding facilities, or returning capital to shareholdersall activities contributing to a stronger financial foundation and increased net worth. Conversely, a period of reduced profitability for Samsung could limit investment in new product lines or research initiatives, potentially impacting future net worth growth.

Understanding the connection between profitability and net worth is crucial for assessing a company's long-term financial health. A consistent track record of profitability demonstrates a company's capacity to generate returns and reinvest for future growth. This understanding allows investors to assess the financial strength of companies like Apple and Samsung, evaluating their potential for future value creation. Analyzing profitability trends alongside other financial metrics provides a more comprehensive understanding of a company's financial position, enabling informed decisions. Ultimately, maintaining and improving profitability is paramount for companies seeking to enhance their net worth and secure a strong financial future.

4. Asset Valuation

Asset valuation is integral to determining the net worth of companies like Apple and Samsung. Accurate valuation of a company's assets forms the bedrock of its overall financial standing. Assets, encompassing tangible items like property and equipment, and intangible assets such as intellectual property and brand recognition, contribute directly to a company's net worth. A precise assessment of these assets is crucial for understanding the overall financial strength and potential for growth of these corporations. For example, a significant increase in the value of Apple's patents related to its mobile operating system or Samsung's advanced semiconductor technology directly influences their respective net worth figures. Similarly, fluctuations in the value of Apple's retail stores or Samsung's manufacturing facilities directly impact their asset valuation and subsequent effect on their net worth.

The valuation process itself can be complex. Intangible assets, like brand reputation and intellectual property, often present unique valuation challenges. Sophisticated methodologies, incorporating market research, comparable analysis, and expert opinions, are typically employed. For example, Apple's brand strength, cultivated through years of consistent innovation and product design, influences the market's perception of its products and, thus, their value. Furthermore, the valuation of intellectual property, like patents and trademarks, is crucial in understanding a company's future revenue potential and innovation capacity. The accurate valuation of these assets, particularly in the tech industry, is essential to accurately reflect the company's overall worth and future financial trajectory. This understanding is essential not only for investors but also for the companies themselves in strategic decision-making concerning investments, acquisitions, and potential mergers.

In conclusion, asset valuation is a critical component of calculating a company's net worth. Accurate valuation of both tangible and intangible assets is essential for a comprehensive understanding of a company's financial position. The valuation process, particularly for intangible assets, can be complex, requiring specialized knowledge and methodologies. A clear understanding of these valuation principles allows for a more informed evaluation of a company's overall financial health, enabling investors and stakeholders to make more informed decisions and gain insight into the company's strategic direction. The valuation methodologies, including discounted cash flow analysis and comparable company analysis, are crucial tools for assessing the future potential and financial stability of firms like Apple and Samsung in a competitive market environment.

5. Debt Levels

Debt levels are a critical component in assessing the financial health and ultimately, the net worth of companies like Apple and Samsung. A prudent management of debt is essential for maintaining financial stability and maximizing shareholder value. Understanding how these tech giants manage debt is crucial for evaluating their long-term viability and potential for growth. High debt levels can potentially limit a company's flexibility and hinder its ability to respond to market changes. Conversely, low debt levels often signify a stronger financial position and greater resilience.

- Impact on Financial Flexibility

High levels of debt can significantly constrain a company's financial flexibility. Debt obligations, including interest payments and principal repayments, require significant cash flow allocation. This can reduce available capital for crucial investments in research and development, expansion projects, or acquisitions. A constrained financial position may make it harder for a company to adapt to market shifts or capitalize on emerging opportunities. For example, if a company faces an unexpected downturn or a surge in demand, limited financial flexibility can hinder its response, impacting its ability to secure funding for necessary adjustments. This constraint directly affects the long-term potential and, ultimately, the net worth of Apple and Samsung.

- Influence on Profitability

Debt levels can impact profitability. Interest payments on outstanding debt represent a significant expense. High interest rates on debt can diminish the net profit margins of a company, reducing potential returns and potentially affecting its overall financial performance. This reduced profitability can hinder the accumulation of capital for investments, thereby slowing the growth of net worth. For example, a substantial increase in debt obligations might necessitate cuts in research spending, slowing down innovation and future revenue streams. The pressure to service debt obligations might force operational efficiencies to be curtailed, affecting profitability further.

- Risk and Credit Ratings

Significant debt levels elevate risk for investors and creditors. Companies with substantial debt loads are often perceived as riskier investments. This increased risk can lead to a decline in credit ratings. Lower credit ratings translate into higher borrowing costs, making it more expensive for the company to raise additional funds in the future. This cost increase acts as a hindrance to future expansion or acquisitions, limiting the potential for growth in net worth. Credit rating agencies assess factors including debt levels, profitability, and cash flow when assigning ratings. Companies with lower ratings may find their borrowing options limited or costly, affecting their strategic options and long-term net worth.

- Comparison and Context

A comparison of debt levels between similar companies in the same industry (or even between Apple and Samsung) provides context. Analyzing the debt-to-equity ratios and the overall debt structure provides insights into the approach each company uses to fund its operations. A company's debt level, considered in relation to industry benchmarks and its own historical performance, contributes to the overall assessment of its financial health and potential for net worth growth. Differences in debt levels, if not justifiable by operational differences, can signal discrepancies in financial strategy and their respective implications on potential net worth growth.

Ultimately, the management of debt levels is a significant factor in the determination of the net worth of Apple and Samsung. The impact of debt on financial flexibility, profitability, and risk perception demonstrates the importance of prudent financial management in building and maintaining long-term financial strength and creating a substantial and stable net worth.

6. Stock Performance

Stock performance serves as a critical barometer for evaluating the perceived market value and financial health of publicly traded companies like Apple and Samsung. Fluctuations in stock prices directly reflect investor sentiment and expectations regarding future profitability, growth, and overall financial strength. This dynamic relationship is crucial for understanding the connection between stock performance and a company's net worth.

- Investor Sentiment and Market Perception

Stock prices are a direct reflection of investor sentiment. Positive news, strong financial reports, or innovative product launches often lead to increased investor confidence, driving up stock prices. Conversely, negative news, concerns about market trends, or competitive pressures can decrease investor confidence and lead to falling stock prices. This direct correlation between stock performance and perceived value forms a significant link to a company's net worth. For instance, a sustained period of rising stock prices signals investor confidence in Apple's continued growth and financial health, bolstering its perceived net worth. Similarly, a decline in Samsung's stock price may indicate concerns about its future financial performance and impact its net worth perception in the market.

- Market Capitalization and Value Representation

Stock performance is intrinsically linked to market capitalization, a key component of a company's overall value. A company's market capitalization is determined by multiplying its current stock price by the number of outstanding shares. Strong stock performance tends to increase market capitalization, suggesting greater perceived value and a potentially higher net worth for the company. Conversely, poor stock performance decreases market capitalization, signaling a decreased market valuation and potentially a lower net worth perception, even if underlying assets haven't changed significantly.

- Influence on Investment Decisions

Stock performance is a major factor in investment decisions. Investors closely monitor stock prices to assess risk and potential returns. High stock performance often attracts further investment, reinforcing the perceived value and potentially leading to a higher net worth. The opposite holds true: poor stock performance can deter investment, potentially impacting a company's access to capital and potentially hindering net worth growth. This investment behavior is particularly relevant for companies like Apple and Samsung, given their significant market capitalization and influence within the tech industry.

- Short-Term Versus Long-Term Implications

Stock performance should be analyzed within both short-term and long-term contexts. Short-term fluctuations can be driven by temporary factors such as market sentiment or company-specific events. However, long-term trends in stock performance provide a more reliable measure of a company's overall financial health and growth potential. Over time, consistent positive stock performance reflects investor confidence in a company's ability to generate sustained revenue and profits, which translates to a higher net worth valuation.

In conclusion, stock performance is a key indicator reflecting market perception of a company's value and potential, directly affecting investors' views on net worth. While short-term fluctuations can occur, sustained positive performance generally signals a healthy financial position, contributing to a positive outlook on the company's net worth. Understanding this connection helps investors make informed decisions and assess the long-term financial health of companies like Apple and Samsung.

7. Brand Recognition

Brand recognition plays a significant role in the net worth of companies like Apple and Samsung. A strong brand, built on consistent quality, innovative products, and a positive image, fosters consumer loyalty, leading to increased demand, higher sales, and ultimately, a greater market valuation. This positive perception translates into a premium price for products, which directly impacts revenue and profit margins. Strong brand recognition can also influence investor confidence, driving up stock prices and increasing market capitalization, a crucial component of net worth.

For Apple, its iconic brand, associated with sleek design, user-friendly technology, and a strong ecosystem of products, generates significant brand loyalty. This translates to higher prices for iPhones, MacBooks, and other Apple products. The strong brand also attracts premium pricing for accessories, creating a significant revenue stream beyond core product sales. Samsung, with a brand built on affordability, functionality, and a wide product range, commands a large market share in diverse sectors. Its wide product line, including smartphones, electronics, and appliances, allows for a broader customer base, underpinning overall revenue and market value. Both companies invest heavily in maintaining and enhancing their brand image through marketing and advertising, recognizing its direct correlation with market success and financial performance.

The practical significance of understanding the connection between brand recognition and net worth is profound. Investors utilize brand strength as a key indicator of long-term value and financial stability. Companies with strong brands are often considered less susceptible to market fluctuations and better positioned for sustained growth. Analyzing brand recognition and its impact on revenue streams, pricing strategies, and investor confidence enables a more comprehensive assessment of a company's overall financial health and potential for future net worth appreciation. Furthermore, the inherent value embedded in strong brands, beyond simple financial metrics, demonstrates the crucial role of intangible assets in driving long-term success and impacting the net worth of prominent tech corporations.

8. Innovation Capacity

Innovation capacity significantly influences the net worth of companies like Apple and Samsung. A firm's ability to consistently introduce novel products and services directly impacts its market share, pricing power, and overall financial performance. This capacity for innovation is not merely about introducing new features but also about creating entirely new markets and redefining consumer expectations.

- Product Differentiation and Market Leadership

A strong innovation capacity allows companies to create products and services that stand out from competitors. This differentiation is key to establishing market leadership and commanding premium prices. Apple's innovative design language and user-friendly interfaces, along with its consistent evolution of core products, demonstrate this. Likewise, Samsung's diverse product lines, encompassing electronics, consumer appliances, and mobile devices, showcase adaptability and ongoing innovation across various sectors. This differentiation enhances market share and profitability, contributing directly to increased net worth.

- Long-Term Value Creation

Innovation is not just about short-term gains but about building long-term value. Continuous investment in research and development (R&D) and design, as seen in Apple and Samsung's investments, fuels innovation that leads to sustained growth and a more valuable enterprise. The ability to anticipate future market needs and create products to meet them provides a competitive edge, leading to a higher valuation of the company's assets and ultimately influencing net worth over the long term.

- Attracting and Retaining Talent

A reputation for innovation attracts top talent in design, engineering, and related fields. Apple and Samsung, known for their robust R&D departments and innovative culture, create an attractive working environment for leading minds. This talent pool fuels further innovation, which translates into superior products and an elevated market position, leading to a greater valuation of the company as a whole and its net worth.

- Customer Loyalty and Brand Premium

Innovation fosters customer loyalty. Customers are willing to pay a premium for products known for their groundbreaking designs, functionalities, and technological advancements. The brand premium generated by Apple and Samsung's innovative products translates directly into higher revenue and profit margins. This is a significant driver of the overall value proposition and directly influences the company's net worth. Each innovative cycle reinforces the brand's perceived value, further elevating consumer demand and market price.

In summary, innovation capacity is not just a desirable trait; it is a critical factor driving the net worth of companies like Apple and Samsung. The ability to consistently introduce innovative products and services fuels sustained growth, attracts top talent, builds brand loyalty, and ultimately translates into a stronger financial position and greater market valuation, significantly impacting the companies' overall net worth.

Frequently Asked Questions about Apple and Samsung Net Worth

This section addresses common inquiries regarding the financial standing of Apple and Samsung, focusing on factors influencing their net worth. Understanding these aspects provides a more comprehensive perspective on the financial health and market positioning of these tech giants.

Question 1: What is the precise meaning of "net worth," and how does it differ from market capitalization?

Net worth represents the total assets of a company, less its liabilities. It encompasses all owned assets, including cash, investments, property, and intellectual property, minus all outstanding debts. Market capitalization, on the other hand, reflects the aggregate value of a company's publicly traded shares, calculated by multiplying the current share price by the number of outstanding shares. These are distinct metrics; while related, they do not offer identical views of a company's financial status. Market capitalization gauges investor perception of future potential, while net worth represents the company's overall financial standing at a specific point in time.

Question 2: How do revenue streams influence the net worth of Apple and Samsung?

Consistent and substantial revenue generation is fundamental. Diversified revenue streams, such as from various product lines and services, create resilience to market fluctuations. Companies achieving strong revenue growth tend to accumulate more capital, which can be reinvested or used to reduce debt, contributing significantly to a rise in net worth. Conversely, declining revenue might indicate difficulties, potentially impacting future net worth.

Question 3: What role does profitability play in shaping the net worth of these companies?

Profitability directly influences a company's ability to build its net worth. High profitability allows for reinvestment in operations, research and development, and potentially dividend payments, all contributing to increased capital and enhanced net worth. Consistent profitability indicates a company's strength and potential for long-term value creation. Conversely, losses or low profitability can diminish a company's resources and negatively impact its net worth.

Question 4: How do debt levels and asset valuation impact a company's overall net worth?

Debt levels directly affect financial flexibility and risk perception. High debt levels can strain resources, limiting investment opportunities and potentially impacting profitability. Asset valuation, encompassing tangible and intangible assets, significantly determines net worth. Accurate valuations, particularly of intangible assets like brand recognition and intellectual property, are crucial for an accurate reflection of a company's overall worth.

Question 5: How does stock performance relate to the perceived net worth of these corporations?

Stock performance reflects investor confidence and the market's perception of a company's future. Strong stock performance often correlates with increased market capitalization and a higher perceived net worth. Factors affecting stock performance include financial performance, market trends, and investor sentiment. It's important to note that stock price volatility can temporarily affect the perceived net worth, but long-term trends are more indicative of a company's fundamental strength.

Understanding the interplay of these factors provides a more nuanced understanding of the financial position and future potential of companies such as Apple and Samsung.

The next section will explore the specific financial strategies and performance metrics employed by these companies.

Conclusion

The analysis of Apple and Samsung's net worth reveals a complex interplay of factors. Market capitalization, a crucial reflection of investor confidence, demonstrates the significant influence of perceived future performance. Strong revenue generation, stemming from diverse product portfolios and efficient operations, directly fuels profitability and subsequent net worth accumulation. Strategic management of debt levels is crucial for financial flexibility and minimizing risk. Asset valuation, encompassing tangible and intangible assets, significantly contributes to the overall worth, particularly in industries marked by rapid technological advancement. Brand recognition, a vital intangible asset, contributes to pricing power and sustained market presence. The consistent drive for innovation, underpinning product differentiation and customer loyalty, forms an essential engine for long-term growth and enhancing net worth. Stock performance serves as a crucial indicator of investor sentiment and market perception of a company's financial health and future potential, reflecting the dynamic relationship between market forces and a company's financial standing. Considering these interconnected factors, a holistic understanding of a company's financial strength surpasses a narrow focus on any single metric. Consequently, an accurate assessment of Apple and Samsung's net worth requires careful evaluation of the multifaceted financial landscape within which these companies operate.

Further exploration into the specific financial strategies, performance metrics, and market trends of these corporations, alongside rigorous analysis of their evolving competitive landscape, provides a more profound comprehension of the complex variables driving the net worth of Apple and Samsung. Investors and industry observers should continuously evaluate these factors, along with emerging market dynamics and technological advancements, to assess the future trajectory of these major tech players within the global economy. The ongoing analysis of this evolving context is crucial for informed decision-making in investment strategies and for understanding the dynamics of the tech industry.

Detail Author:

- Name : Edmund Schuster

- Username : doris31

- Email : blang@hotmail.com

- Birthdate : 1974-03-26

- Address : 738 Abshire Course Port Delores, NV 45375-5459

- Phone : 260.568.5068

- Company : Lindgren-Macejkovic

- Job : Food Preparation

- Bio : Voluptatibus nisi aut et et repudiandae. Eaque eum placeat ullam hic alias. Tempore nemo totam non eaque occaecati labore est illum.

Socials

tiktok:

- url : https://tiktok.com/@cyril8965

- username : cyril8965

- bio : Eligendi deleniti voluptatibus sunt at iste. Qui et et nisi dolores laudantium.

- followers : 2847

- following : 2472

twitter:

- url : https://twitter.com/cyril2669

- username : cyril2669

- bio : Facilis at sunt ut dolor ad fugit optio rerum. Aut deserunt qui est possimus. Optio adipisci eos nihil dignissimos aut. Laboriosam et quo ut.

- followers : 113

- following : 770

facebook:

- url : https://facebook.com/cyril6621

- username : cyril6621

- bio : Laboriosam vel et quam assumenda eveniet eaque.

- followers : 996

- following : 957

linkedin:

- url : https://linkedin.com/in/pagacc

- username : pagacc

- bio : Est ut explicabo modi et maiores.

- followers : 2835

- following : 1901